TODAY’S MAZE

Happy Thursday! InPost just signaled that Europe’s delivery game is about to change, and this time the challenger isn’t a marketplace at all. Fresh off a major UK partnership with eBay and a bruising legal fight with Allegro, the company is moving from locker operator to full-stack commerce player. 2026 will bring its own AI-powered marketplace, built around the idea that delivery — not the front-end shop window — will decide who wins the next era of ecommerce.

The moves line up into a clear pattern: deeper integration with global marketplaces, rapid expansion across Europe, and a growing belief that whoever controls the last mile controls the customer.

In today’s MarketMaze focus:

InPost’s Big Europe Play

Global Fashion Slowdown

Google’s AI Try-On Expands Global Reach

Two Shelves Emerging

JD.com Captures European Retail Giant

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: InPost’s new partnership with eBay in the UK is more than a logistics milestone. It signals a strategic shift toward becoming Europe’s commerce infrastructure layer, powered by lockers, data and soon its own marketplace. While the company fights Allegro at home and scales rapidly across Europe, it is also preparing to launch an AI-powered marketplace in early 2026, aiming to control not just the last mile but the full buyer–seller journey. The message is clear: delivery is the moat, and everything else becomes a replaceable interface.

At the end of 2025 InPost integrated its 12 000 UK lockers and PUDO points into eBay’s checkout, giving millions of users instant access to out-of-home delivery and accelerating UK parcel growth that already reached 89.4 million in the first half of the year.

At home InPost is in arbitration with Allegro, seeking more than PLN 2.3 billion after alleging that the marketplace steered buyers toward its own logistics network, a dispute that reflects how controlling delivery has become the key strategic lever in ecommerce.

Internationally InPost is assembling a pan-European network through Yodel in the UK and Sending in Spain, while preparing to launch its own AI marketplace in early 2026 that could automate listing, fulfilment and returns directly into its locker network.

Why it matters: If InPost and Allegro ever aligned instead of colliding, they could resemble a European version of Amazon, where the marketplace and logistics backbone move as one. InPost’s bet is that in an AI-first commerce world the marketplace front end becomes interchangeable, but delivery remains the defensible asset. The eBay partnership shows what happens when that backbone plugs directly into the transaction layer.

FROM OUR PARTNERS

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

MAZE DEEP DIVE

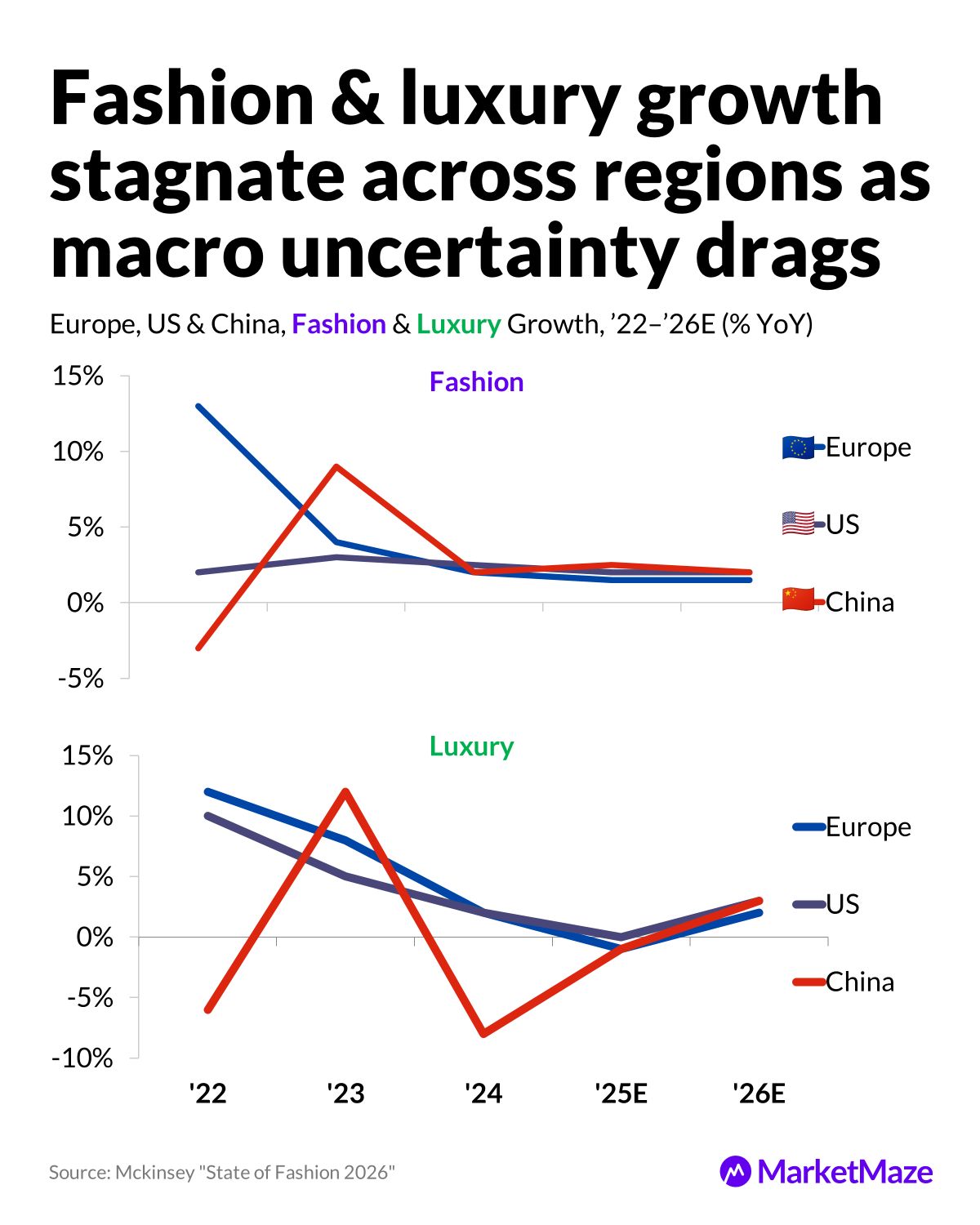

The Maze: The global fashion engine is cooling as macro uncertainty pushes consumers toward caution and brands toward pricing power. Forecasts reveal shrinking volume, uneven price moves and widening gaps between regions and categories. Across markets, leaders brace for another slow year shaped by tariffs, inflation pressure and shifting demand.

Europe, US and China all slide toward low single digit fashion growth by 26E, with China swinging from 12 percent luxury growth in 23 to negative in 24 before stabilising.

Global executives expect higher prices and softer volumes in 26 as 53 percent plan price hikes above 1 percent and only 36 percent expect stronger unit growth.

Tariffs hit sourcing markets hard with China and Vietnam responsible for 14 billion dollars of the 27 billion dollar duty impact and smaller hubs adding another 13 billion dollars.

Brands shift production and raise prices to absorb tariff costs as 55 percent opt for price increases and more than one third move sourcing to lower duty markets.

Jewellery overtakes all categories with 4.1 percent volume growth through 28E while clothing and footwear stay near 1 percent and other accessories contract on price.

Asia Pacific grows its jewellery share from 63 percent to 65 percent by 28E as China and India dominate global demand while Europe and North America stagnate.

Why it matters: The industry is entering a long cycle where pricing, efficiency and sourcing strategy beat top line expansion. Brands that adjust supply chains, protect margins and align with shifting regional demand will outperform. Those slow to pivot will get squeezed by costs they cannot pass on and consumers they cannot win back.

MAZE STORY

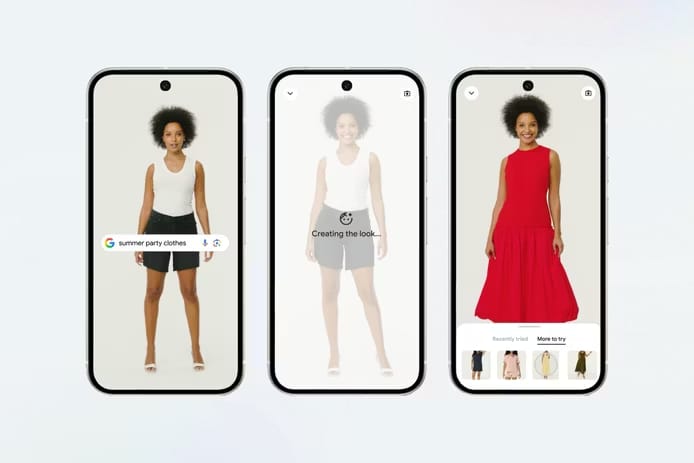

Google virtual try-on tool Credits: Google

The Maze: Google expanded its AI-powered virtual try-on tool for apparel to the UK and India, leveraging its custom fashion model to let shoppers visualize items on themselves across the massive 50-billion listing Shopping Graph. This move enables consumers to make more confident purchase decisions ahead of the festive season.

Shoppers simply upload a full-length photo and then the feature generates an image showing how garments, including tops, dresses, and shoes, appear on their unique body shape.

The underlying custom AI model for fashion understands human anatomy and simulates how fabrics like cotton and wool fold, stretch, and drape across various body types.

In the US market, where the tool previously launched, 70% of users confirmed the virtual try-on experience made shopping more fun, driving a new visual and social commerce behavior.

Why it matters: This AI expansion fundamentally changes how consumers shop for apparel online, making it easier to reduce the guesswork around fit and appearance. Ecommerce executives must recognize that visual confidence tools are now table stakes for increasing conversion rates and cutting down costly return volume, which directly impacts GMV.

FROM OUR PARTNERS

Stop wasting time on endless drafts. The world’s fastest-growing brands use a simpler creative loop:

1️⃣ Generate high-converting ad visuals from product shots — no designers needed.

2️⃣ Turn static photos into video ads in seconds.

3️⃣ Score each creative with predictive AI trained on 450+ data points before launch.

From AI Stock Images and Fashion Photoshoots, to Video Generators and Compliance Checkers, AdCreative.ai helps you create, test, and launch polished campaigns at scale — without creative teams or costly shoots.

Join 5,000+ businesses automating their ad production.

Get visuals that sell — not just look good.

DATA TREASURE

The Maze: Rufus is rewriting Amazon discovery. Profitero+ finds that only 22 percent of page-1 search products also appear in Rufus answers, proving that AI is running a different selection logic than the search algorithm. At the same time 36 percent of Rufus picks are nowhere on page 1, showing how AI elevates products that search ignores. This is the start of a split digital shelf where rank and relevance no longer move together.

• In Sept–Oct 2025 analysts reviewed 4,991 products across 87 prompts and found that high-ranking search winners frequently failed to appear in Rufus, revealing how conversational AI filters more aggressively for context and intent than for rank stability.

• Rufus recommendations surfaced challenger brands by matching shopper language around use cases, showing that relevance signals like reviews and feature clarity now matter more than search keyword structure.

• Amazon is investing in AI formats like Lens Live and Smart Buy, signalling a shift toward curated decision engines that favor content quality and intent fit over traditional listing optimization.

Why it matters: Rufus breaks the link between ranking power and AI visibility. Brands must optimize for SEO to stay seen and for GEO to stay chosen. The next phase of ecommerce will reward products that answer real shopper intent, not just those engineered to win page-1 search.

MAZE STORY

The Maze: Chinese e-commerce titan JD.com successfully secured majority control of CECONOMY, the parent company of European electronics heavyweights MediaMarkt and Saturn, cementing a massive push into the EU retail landscape to accelerate the retailer's digital transformation. This €2.2 billion deal enables JD.com to infuse its leading technology and logistics infrastructure into CECONOMY’s existing 1,000+ store footprint.

JD.com secured 59.8% of CECONOMY shares after the voluntary public takeover offer, raising its total stake with partner Convergenta to 85.2% ownership.

The transaction affects CECONOMY’s operations across 11 European countries, which generated a substantial €22.4 billion in sales during fiscal year 2023/24, underscoring the scale of this acquisition of stake in CECONOMY.

This move aligns with broader Chinese investment patterns by combining JD.com's technology and supply chain expertise with CECONOMY's deep physical retail presence.

Why it matters: This partnership fundamentally changes the competitive pressure on existing European electronics marketplaces by injecting sophisticated Chinese logistics and supply chain optimization. Ecommerce leaders should watch closely to see how JD.com successfully blends its technological agility with CECONOMY's deep physical retail presence across 11 key European markets.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇺🇸 Walmart Marketplace achieved a new single-day conversion record on Black Friday, driven by strong customer demand for unique Marketplace finds and essential holiday items.

🇩🇪 Hugo Boss shares fell after the German fashion house warned that sales and profit would decline sharply next year, signaling a turbulent phase as the company begins a major strategic reset.

🌍 Demand for retail real estate rebounded significantly in Q3, driven primarily by discount retailers expanding their physical footprints as cautious consumers prioritize value purchases.

BRIEFING

📣Everything else in Ecommerce ecosystem

🇺🇸 New data shows that Google's AI Mode sends traffic on 69% of transactional search queries, contradicting fears of click suppression, as Google expands tests making AI Overviews the default UX.

🇺🇸 MrBeast’s company is developing a two-sided marketplace designed to efficiently match creators with Fortune 1,000 brand marketers looking to access the global creator influencer economy.

🇺🇸 Former Google CEO Eric Schmidt argued that AI is currently under-hyped because the largest future gains lie in automating the costly, repetitive 'boring' backbone of corporate operations, including logistics, billing, and inventory management.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team