TODAY’S MAZE

Happy Wednesday! Last time we showed that Europe is split between Parcel lockers and pickup points. This time we show that Europe’s parcel wars are heating up…. and that InPost is building the continent’s largest locker network, turning convenience into a billion-parcel advantage.

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 MAZE STORY

InPost’s Billion-Parcel Empire 📦

InPost is rewriting Europe’s logistics playbook. The company’s latest 2025 data shows an unstoppable rise from a Polish upstart to a continental force. Its expansion blends scale, tech, and consumer loyalty across three major markets. The story is one of compound growth, relentless execution, and a simple promise: speed and convenience at every door—or locker.

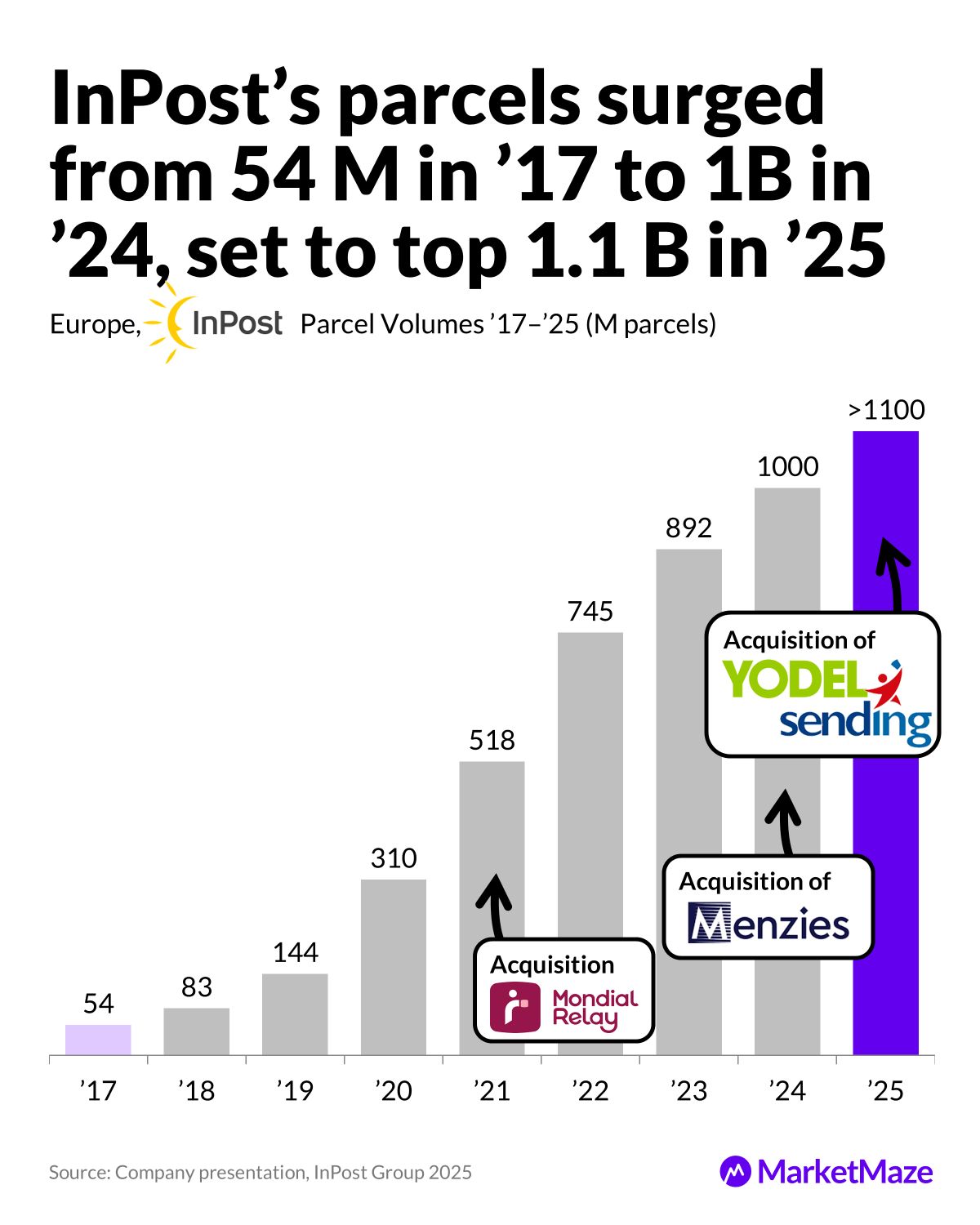

Growth Surge 🚀

InPost’s parcel volumes exploded from 54 million in 2017 to nearly 1 billion in 2024, on track to exceed 1.1 billion in 2025. Strategic takeovers like Mondial Relay, Menzies, and Yodel accelerated the shift from a national to a European network. Each acquisition opened a new market and cut last-mile costs. The curve is exponential—proof that scale in parcel logistics is now a data and density game.

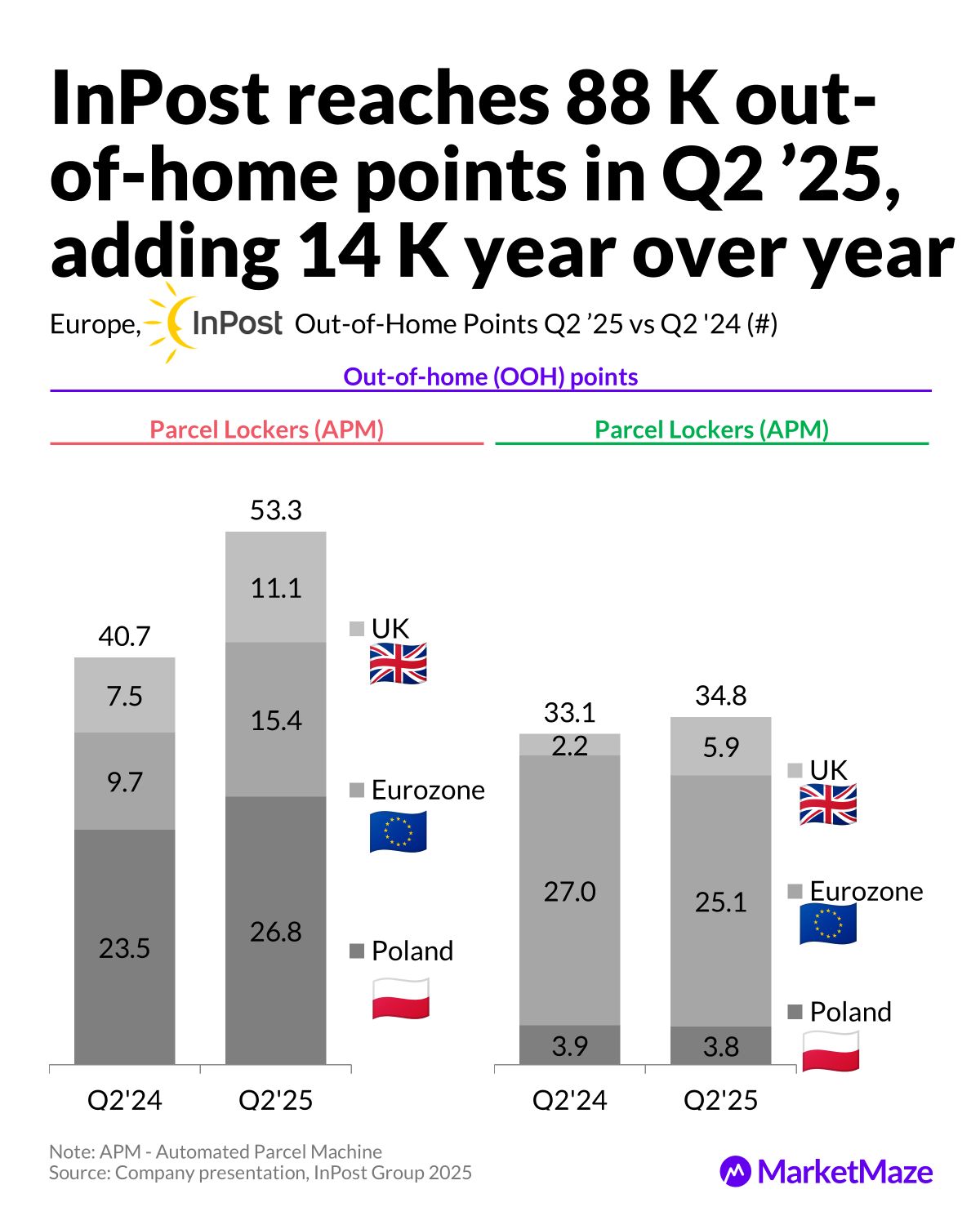

Network Boom 🌍

In Q2 2025, InPost reached 88,000 out-of-home points, adding 14,000 in just a year. The network now includes 53,000 parcel lockers and 35,000 pickup points across Europe. The UK and Eurozone drove most of the growth, while Poland remained steady at 27,000 lockers. With 14,000 new sites in a single year, InPost’s reach now rivals that of traditional national carriers.

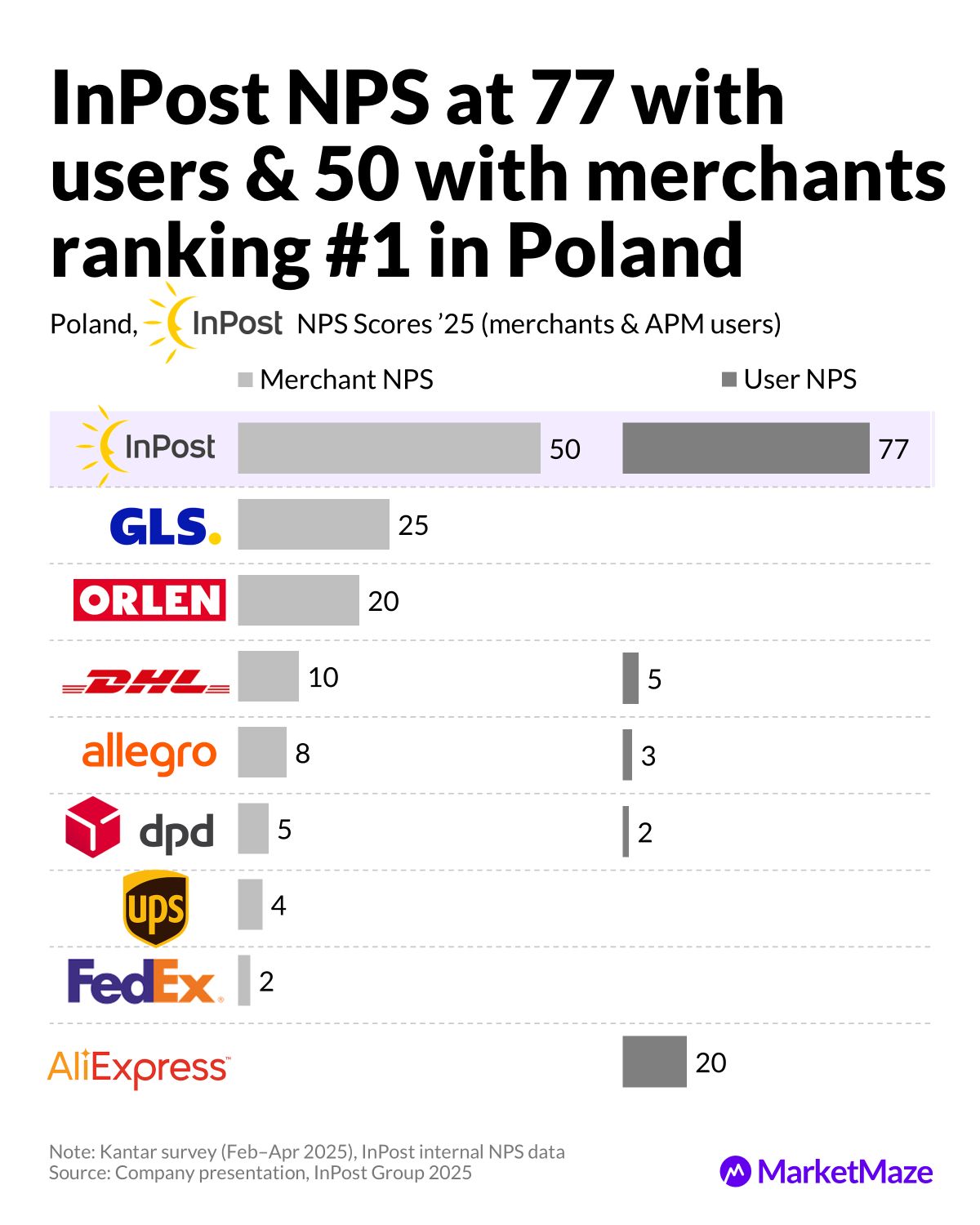

Loyalty Edge 💛

Customer satisfaction fuels InPost’s dominance. It scored NPS 77 with users and 50 with merchants, ranking first in Poland. Over 14.6 million app users—70% of all locker customers—generate 80% of volume. No other delivery app in Europe has that kind of engagement. InPost turned convenience into loyalty and loyalty into a competitive moat.

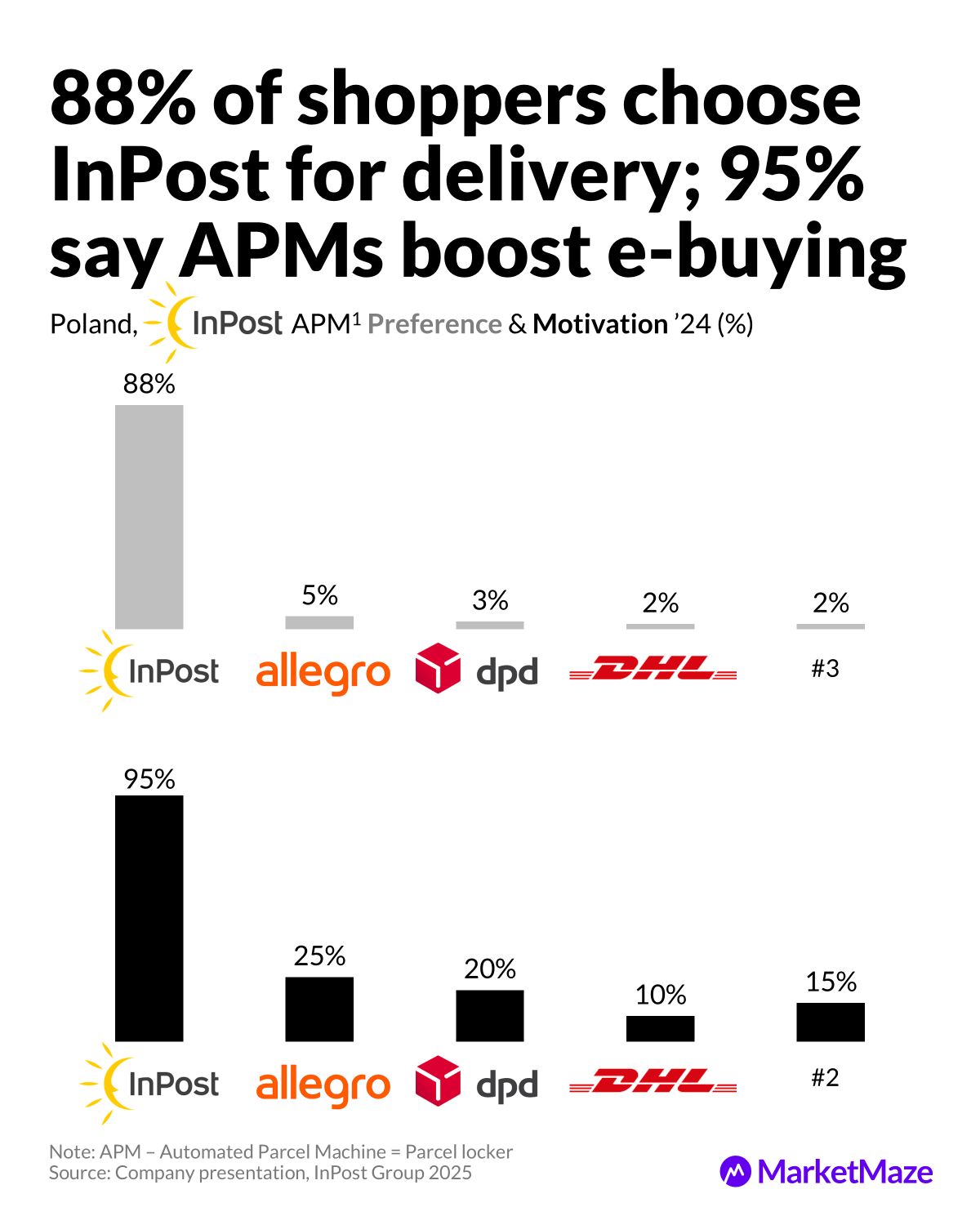

Conversion Engine 💡

In Poland, 88% of shoppers choose InPost for delivery and 95% say lockers motivate them to buy. This isn’t about shipping—it’s about conversion. When consumers see an InPost option at checkout, they click buy. That’s not brand love. That’s habit reinforced by reliability, speed, and proximity. InPost turned parcel collection into retail’s most underrated growth lever.

Editable Slides & source links:

🔒 Available for MarketMaze+

📣 FROM OUR PARTNERS

Stop wasting time on endless drafts. The world’s fastest-growing brands use a simpler creative loop:

1️⃣ Generate high-converting ad visuals from product shots — no designers needed.

2️⃣ Turn static photos into video ads in seconds.

3️⃣ Score each creative with predictive AI trained on 450+ data points before launch.

From AI Stock Images and Fashion Photoshoots, to Video Generators and Compliance Checkers, AdCreative.ai helps you create, test, and launch polished campaigns at scale — without creative teams or costly shoots.

Join 5,000+ businesses automating their ad production.

Get visuals that sell — not just look good.

🌀 MAZE STORY

InPost’s European Takeover 🌍

InPost is turning parcel lockers into Europe’s next logistics empire. The company’s 2025 data shows a network spreading across the continent, eating into legacy carriers’ turf. With bold acquisitions and relentless rollout, InPost now rivals national postal services. The company’s edge lies in density, speed, and a near-perfect mix of convenience and technology.

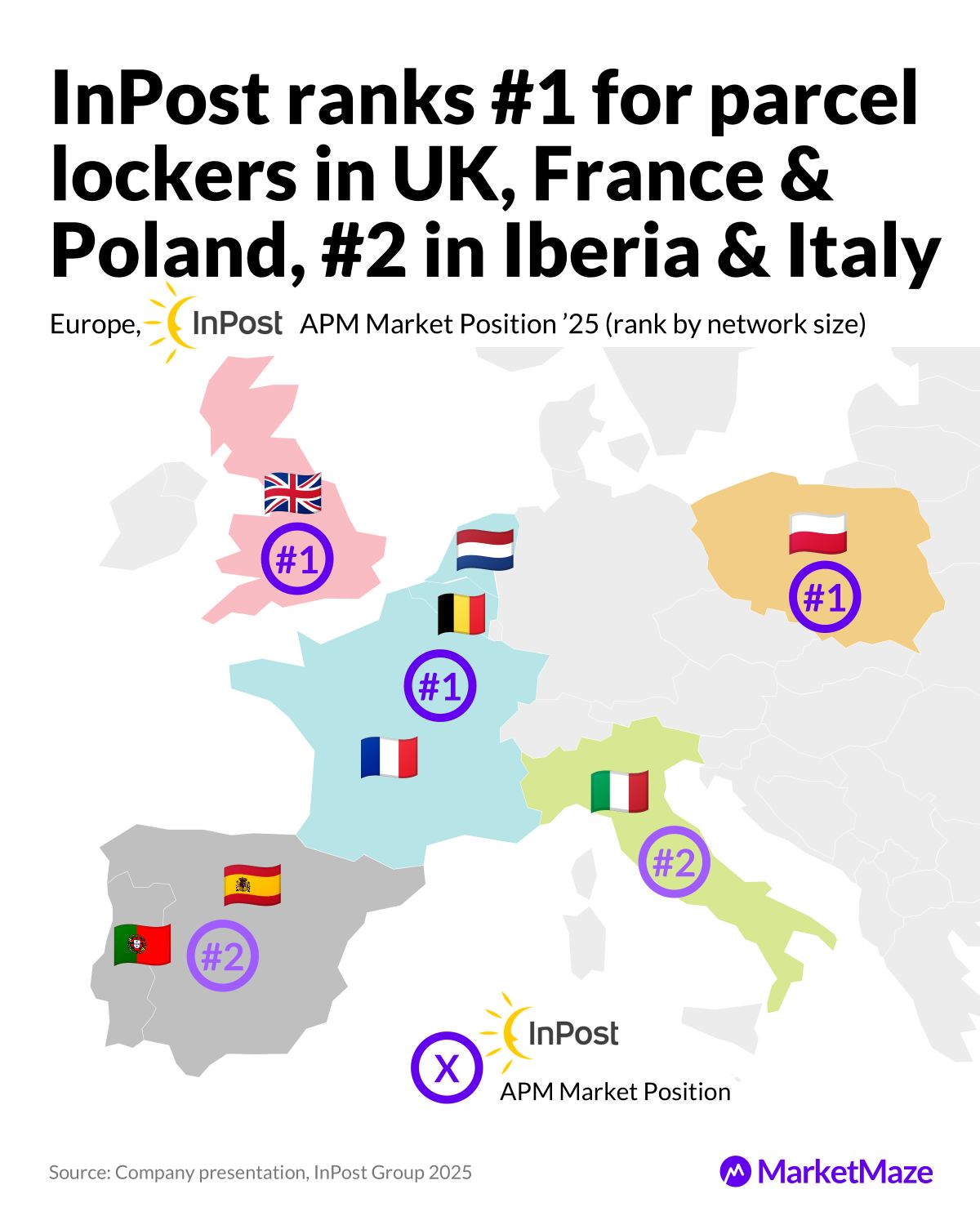

Locker Leadership 🏆

InPost now ranks #1 for parcel lockers in the UK, France, and Poland, and #2 in Italy and Iberia. Its locker footprint stretches from Manchester to Madrid, covering markets once dominated by incumbents like DPD and Mondial Relay. This network gives InPost unmatched access to over 500 million consumers across Europe. The shift signals that out-of-home delivery is no longer a niche—it is the backbone of modern e-commerce logistics.

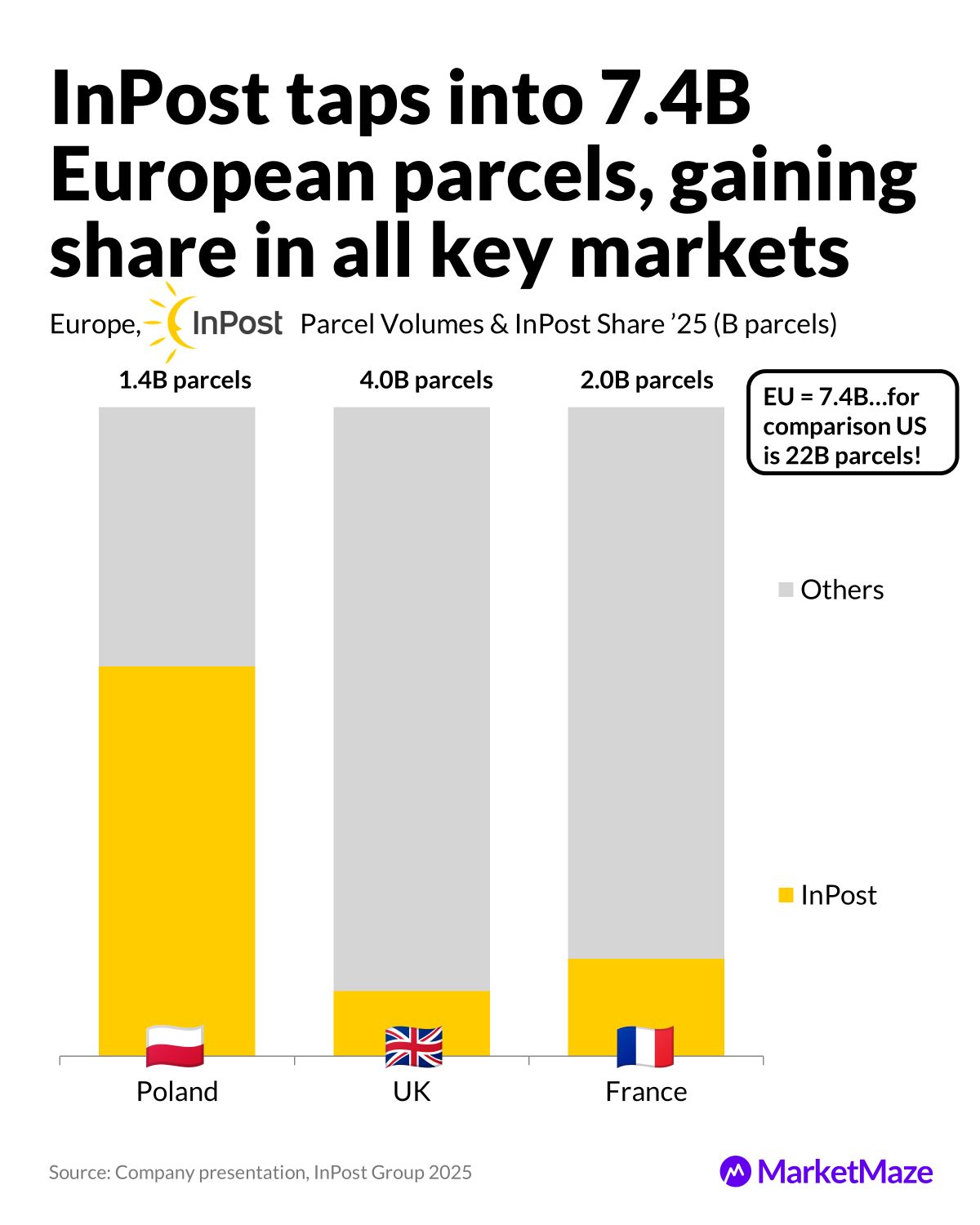

Parcel Power 💪

Europe ships around 7.4 billion parcels a year, with InPost capturing an ever-growing slice of that pie. It owns roughly 60% of Poland’s market, 10% in the UK, and 15% in France, moving about 1.5 billion parcels annually. For context, the US moves 22 billion parcels, showing Europe’s room for growth. InPost’s focus on locker-first delivery positions it perfectly for that expansion wave.

Outpacing Markets 🚀

InPost is growing faster than e-commerce itself. In 2025, its parcel volume rose 6% in Poland, 10% in the Eurozone, and a staggering 177% in the UK against flat or shrinking markets. The company’s model scales with adoption—every new locker lowers costs and raises usage. InPost isn’t just riding the e-commerce curve; it’s building the infrastructure that powers it.

Editable slides and source links: 🔒 Available for MarketMaze+

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

🧠 RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

Before you go, we’d love your feedback on today’s Maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team