The Maze: Shoppers are rewriting the playbook as year-end sales turn into global smart-spending rituals. Consumers compare harder, plan earlier, and lean on GenAI to cut through the noise. Despite price pressure and uncertainty, intent to buy rises and spending shifts toward essentials and strategic splurges.

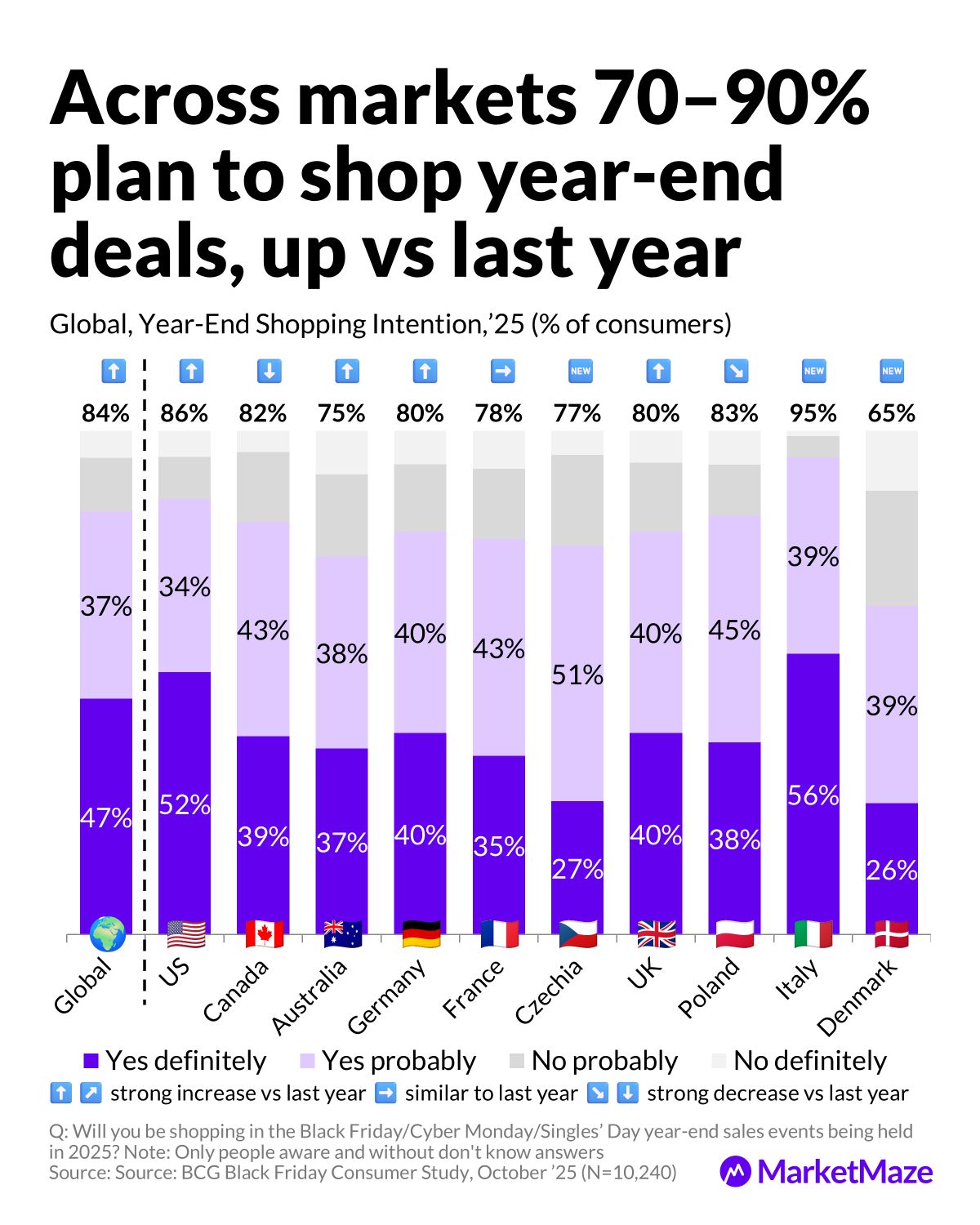

Across markets, 70–90% plan to shop year-end deals, led by Italy 95% and the US 86%; intent rises even as cautious sentiment persists.

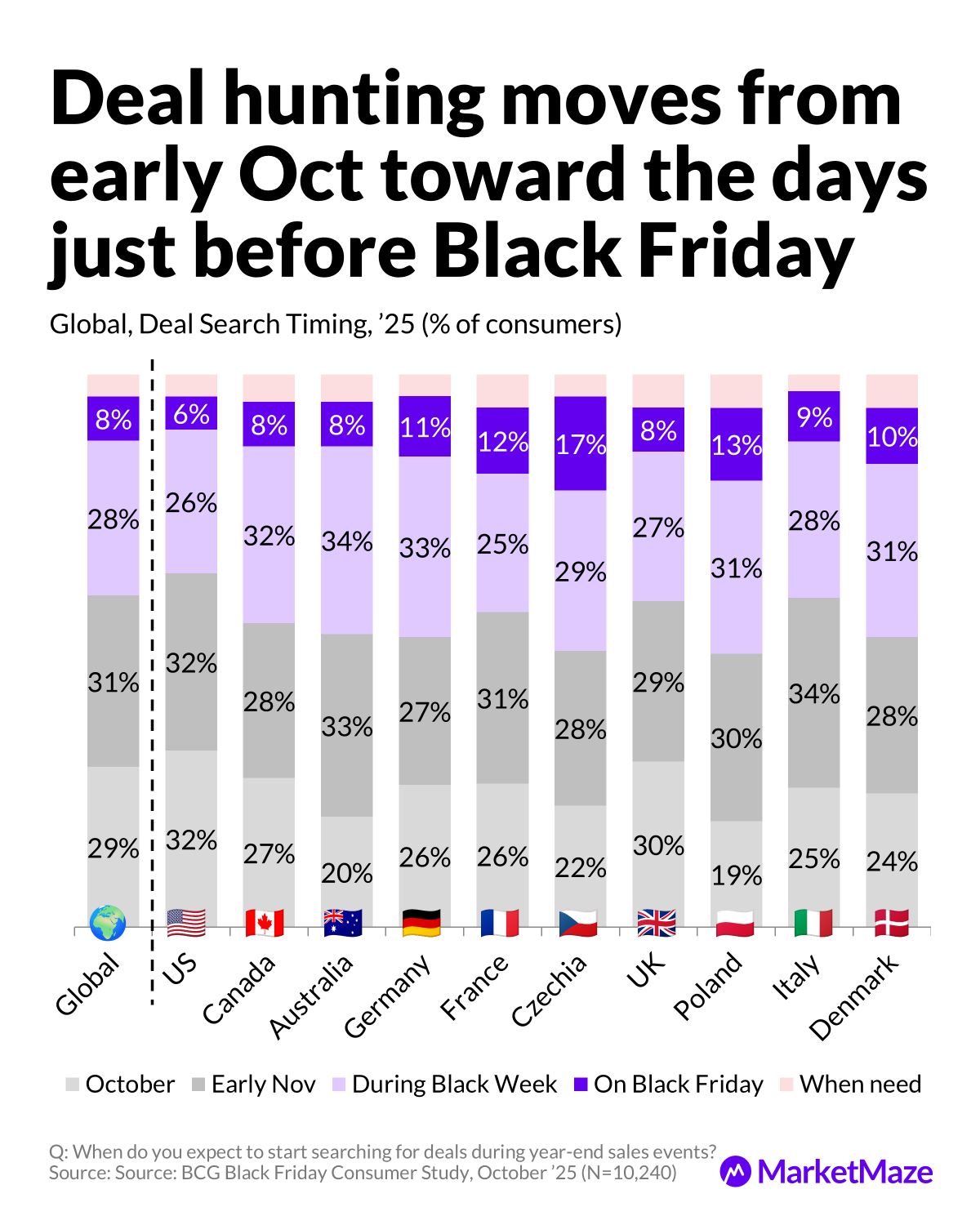

Deal hunting moves later, with 28% searching only days before Black Friday, up as shoppers wait for bigger discounts.

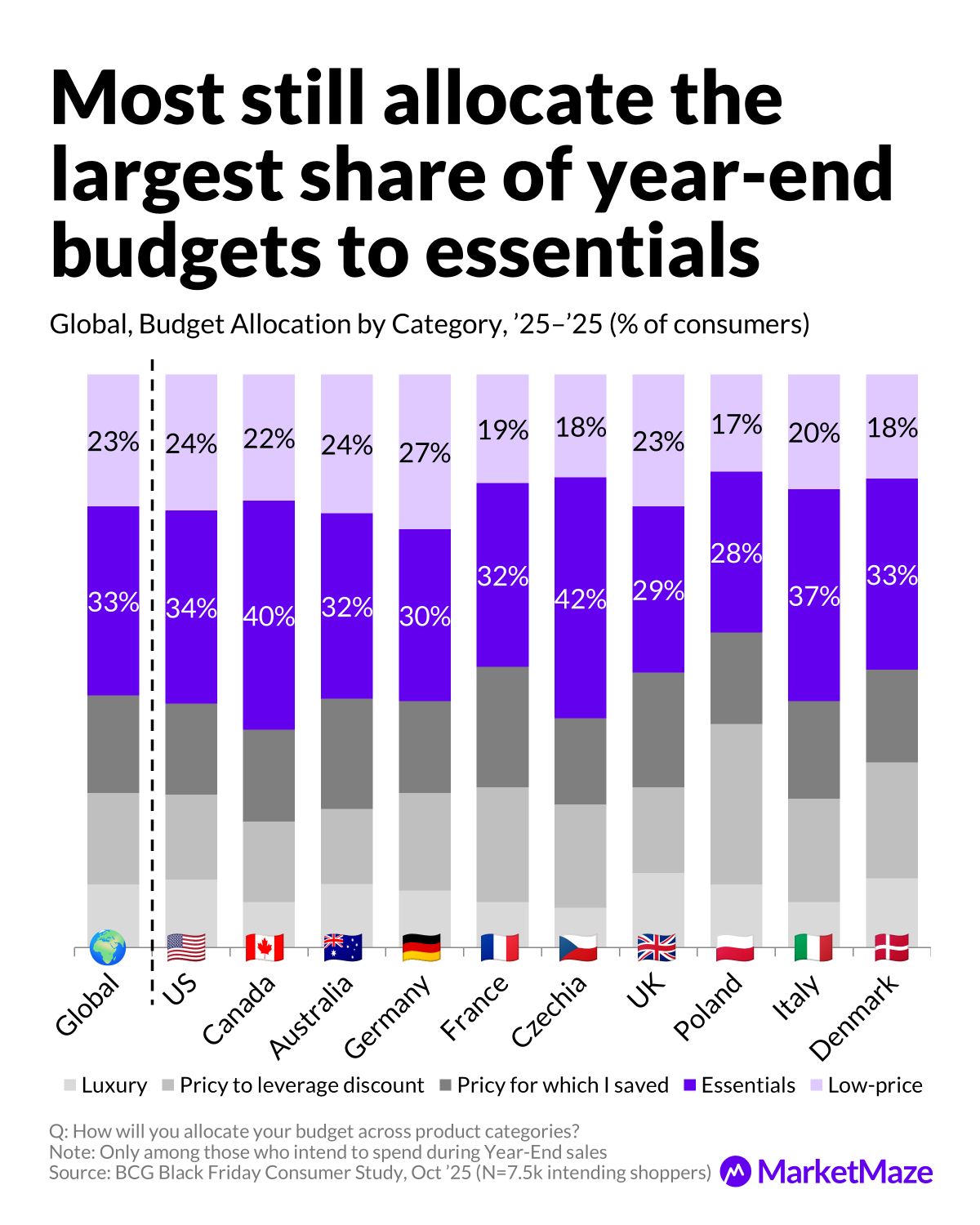

Essentials still dominate budgets globally at 56%, but higher-priced discretionary items gain traction as confidence inches back.

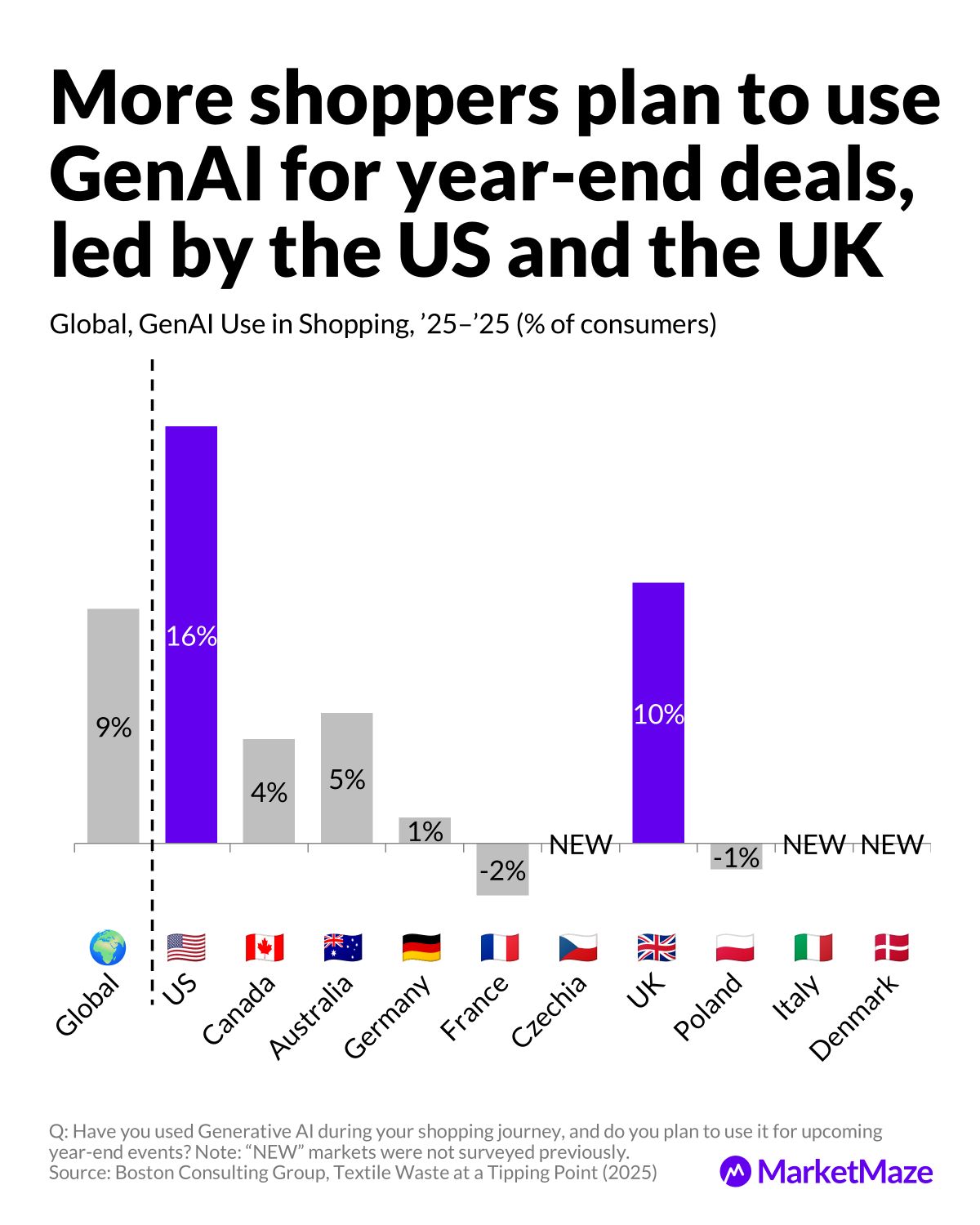

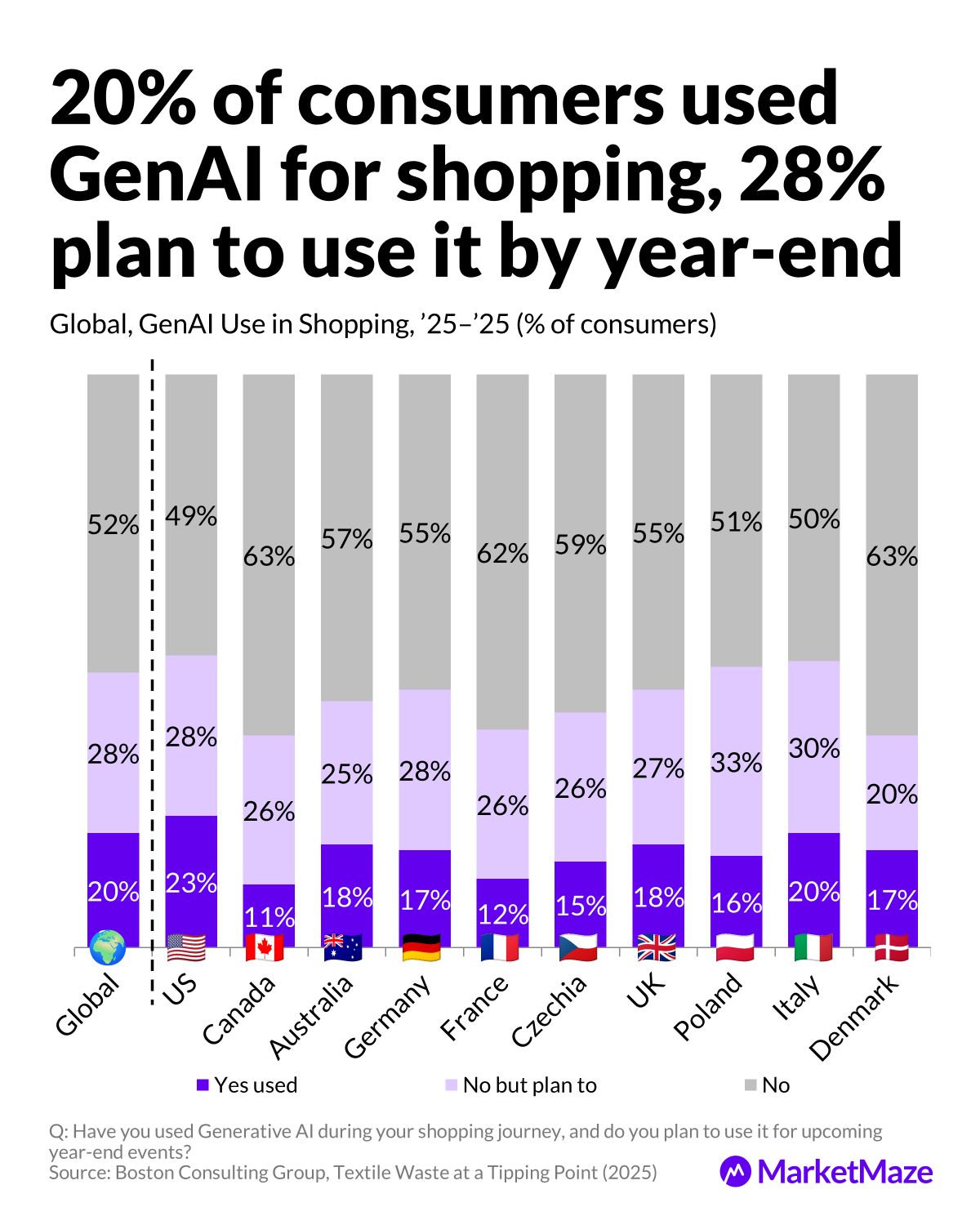

GenAI use jumps 9pp YoY, with 48% using or planning to use AI for research, price checks, and deal-hunting; the US leads with 51%.

Younger shoppers adopt fastest, but GenAI spreads across Gen X and Boomers too, showing it is no longer niche.

Consumers increasingly expect clear, fair deals around 30%, rejecting gimmicks and demanding transparency.

Why it matters: Year-end events are now global battlegrounds where value decides loyalty and visibility equals revenue. AI-driven discovery reshapes how consumers search, compare, and buy. Retailers that communicate clearly, show real value, and win the early digital interface pull ahead in a market where trust

🛒 SHOPPER INTENT

Shoppers commit strongly to year-end deals

Year-end events have become smart-spending rituals, and intent climbs across all major markets. Italy reaches 95 % and the US hits 86 %, showing that even in cautious times shoppers still show up for value.

→ Italy leads at 95 % with 56 % saying they will definitely shop

→ The US reaches 86 %, combining 52 % definite shoppers with strong confidence

→ Germany, France and Czechia remain high potential segments with mixed momentum

Shoppers are not spending blindly. They are choosing where value is real and ignoring noise. This sets the stage for tighter competition over attention and trust.

⏰ DEAL TIMING

Deal hunting moves closer to the event

Planning starts early for many, but momentum shifts toward last-minute searches. A growing share of consumers wait until Black Week or even the day itself to compare prices and spot deeper discounts.

→ Early November searches account for 32 % in the US and 34 % in Canada

→ Black Week spikes in markets like Australia 33 % and Germany 27 %

→ Black Friday day searches jump to 17 % in Czechia and 13 % in Poland

The window to influence shoppers is compressing. Visibility and real-time pricing matter more as consumers delay commitment until the best offer appears.

📦 BUDGET SHIFT

Essentials dominate but high-value items rise

Consumers still allocate most year-end budgets to essentials, yet discretionary spending returns as confidence improves. Essentials hold the top share, but pricier categories gain ground as shoppers look for meaningful deals.

→ Essentials reach 33–42 % across major markets, peaking in Czechia at 42 %

→ High-priced items to leverage discounts hit 40 % in Canada and 37 % in Italy

→ Luxury stays low at around 20 % globally but rises slightly in high-income markets

People remain value-conscious but are ready to stretch for quality when the discount feels real. Smart splurging replaces impulsive buying.

🤖 GENAI MOMENTUM

US and UK lead in AI-driven shopping

GenAI becomes a mainstream shopping assistant. Adoption accelerates rapidly, especially in the US and UK, where shoppers rely on AI to compare products, find deals and reduce decision fatigue.

→ GenAI intent jumps 16pp in the US and 10pp in the UK

→ France is the only major market showing a slight drop at minus 2pp

→ Germany lags with only 1pp growth as adoption matures slowly

AI is becoming the new search engine for buying decisions. Retailers whose data is invisible to AI lose shelf space before the shopper even sees a product.

🧠 GENAI ADOPTION

20% used GenAI and 28% will use it by year-end

GenAI shifts from experimental to essential. One in five consumers already used it and more than one in four plan to use it for year-end shopping. Younger groups lead but older generations are catching up fast.

→ US reaches 23 % usage and 28 % planning to use

→ Canada hits 26 % planning to use despite lower current use

→ Italy posts a combined 50 % planning and active usage

This is the tipping point where AI becomes part of the everyday shopping journey. Retailers that adapt fast will shape how consumers discover and decide.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team