Discover how retail media is reshaping digital advertising.

Retail media is quietly transforming digital advertising, and it’s bigger than most realize. In this MarketMaze white paper, we unpack the latest trends shaping retail media—from how top retailers and advertisers view its value, to what actually works compared to search and social ads. You’ll get a clear look at why retail media is so effective, and how it’s changing the financial landscape for the world’s biggest marketplaces.

If you want to understand where digital advertising is heading, this is the place to start.

🌀 Key points

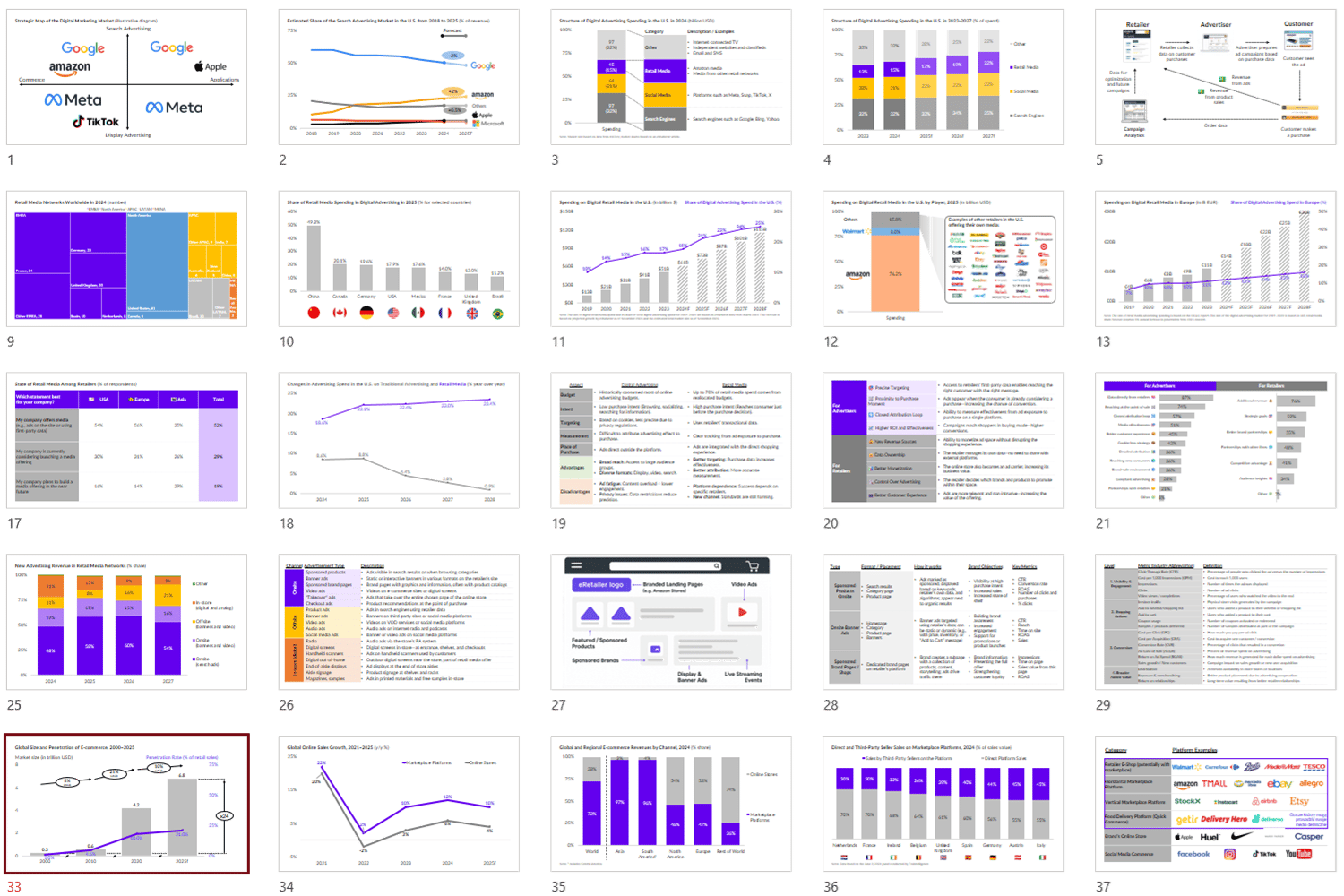

Retail media is set to claim 20%+ of digital ad budgets by 2028—growth you can’t ignore.

30–65% of marketplace profits now come from retail media. It’s your core profit driver.

Onsite ads deliver the bulk of revenue; offsite and in-store are important but secondary.

Amazon, Walmart, and Instacart set the stage for retail media strategy and innovation.

Data-driven, point-of-purchase ads win on ROI—every marketer should take notice.

Fragmentation and Amazon’s scale are the biggest challenges—and biggest opportunities.

💎 Data Gem

🚀 Why Retail Media Now?

Retail media isn’t just another trend—it's the tectonic shift reshaping digital advertising. By 2028, one out of every five dollars spent on digital ads will flow through retail media, with platforms like Amazon and Allegro taking the lion’s share. The big story? Retailers aren’t just selling products; they’re selling the shelf itself, and every brand is scrambling to buy the best real estate.

💡 Retail Media’s Edge

Forget banners lost on social or search. Retail media means reaching people where intent—and wallets—are highest: at the moment of purchase. Onsite ads now account for over 80% of spending, with targeting powered by first-party data and real shopping behaviors, not cookies or guesswork. The results speak: Walmart Connect boasts a return on ad spend (ROAS) of 7.5, crushing the 2.8 you get on Facebook.

💰 The Financial Engine of Marketplaces

Here’s what should keep every CFO up at night: retail media isn’t just incremental revenue—it’s the profit center. At Instacart, retail media delivers a staggering 65% of total EBITDA, and even for giants like Walmart and Allegro, it’s now a pillar of financial stability. Average gross margins hit 60–80%, compared to the razor-thin margins of traditional retail. If you want to stay ahead of your competitors, you need to read this report and see where the market is going next.

📋 What’s Inside?

60 no fluff pages with 50+ stunning graphics covering:

Basics: How retail media works and why it’s growing fast

Benchmarks: Latest global and European market data and forecasts

Formats: Ad types, effectiveness, and KPIs that matter most

Case Studies: Amazon, Walmart, Allegro, Instacart—deep dives and lessons

Financials: Margins, profit drivers, and strategic takeaways

Challenges: What’s blocking brands, and how top players overcome barriers

👤 Who Is This For?

Marketplace leaders, brands, advertisers

Retail strategists, analysts, investors

Agencies and tech providers in e-commerce

🏅 Why Trust MarketMaze?

Independent, data-driven analysis

Original research plus curated industry sources

Written by Artur Stańczuk, experienced e-commerce strategist

🎓 Found this insightful?

📩 Get free weekly insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports with detailed sources and links

📘 Understand marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

📖 White Paper download

Free for MarketMaze+ members

Amazon kindle format and pricing coming soon!

Link to download: Only for MarketMaze+ subscribers