The Maze: Economic anxiety is no longer abstract. Workers across regions now link their personal job security to global forces they cannot control. A large, multi-country survey of employees shows fear rising faster than confidence, and trust failing to keep up.

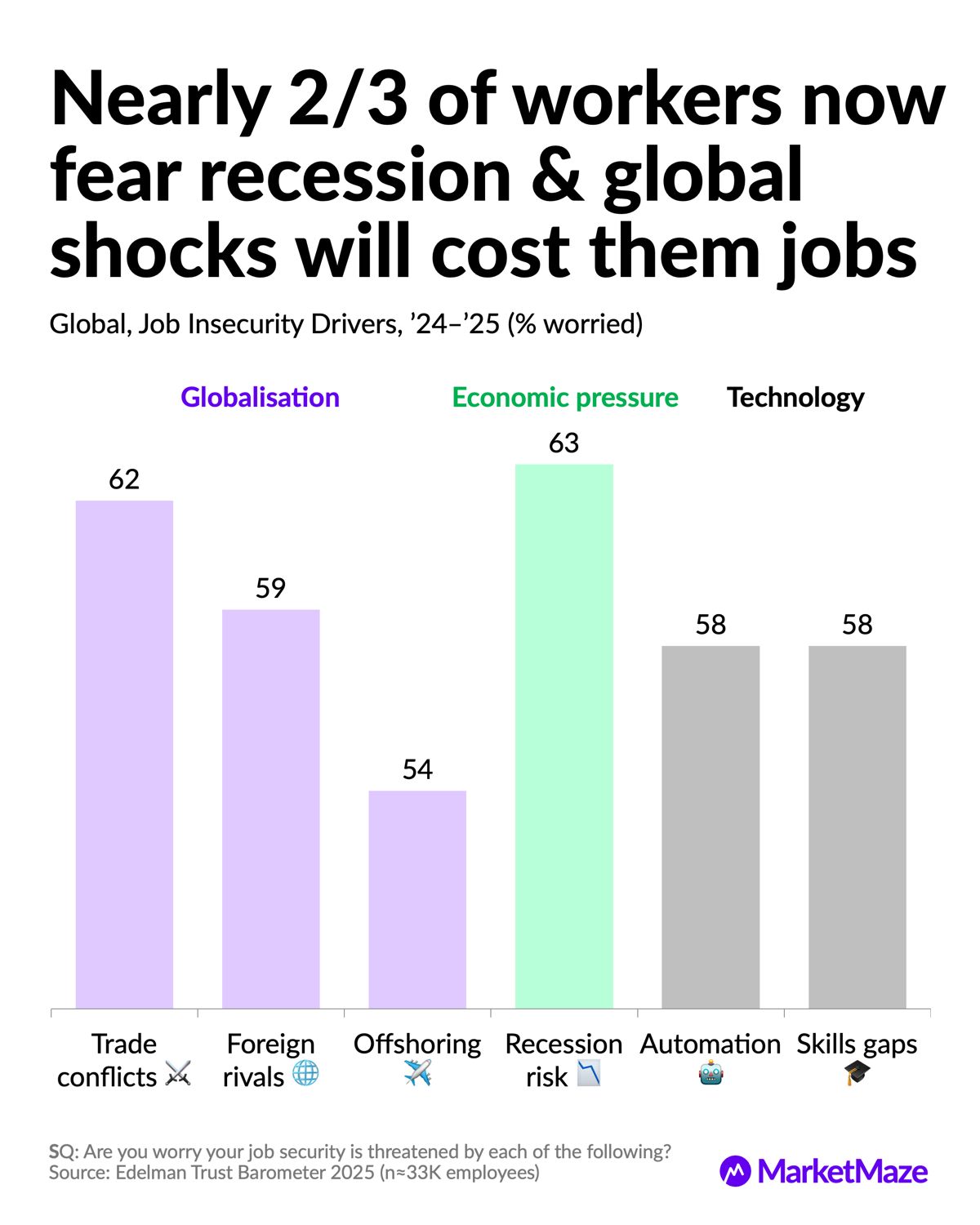

Nearly 63% of workers fear recession risk will threaten their jobs, beating automation and skills gaps at 58%, showing macro fear now outweighs tech fear.

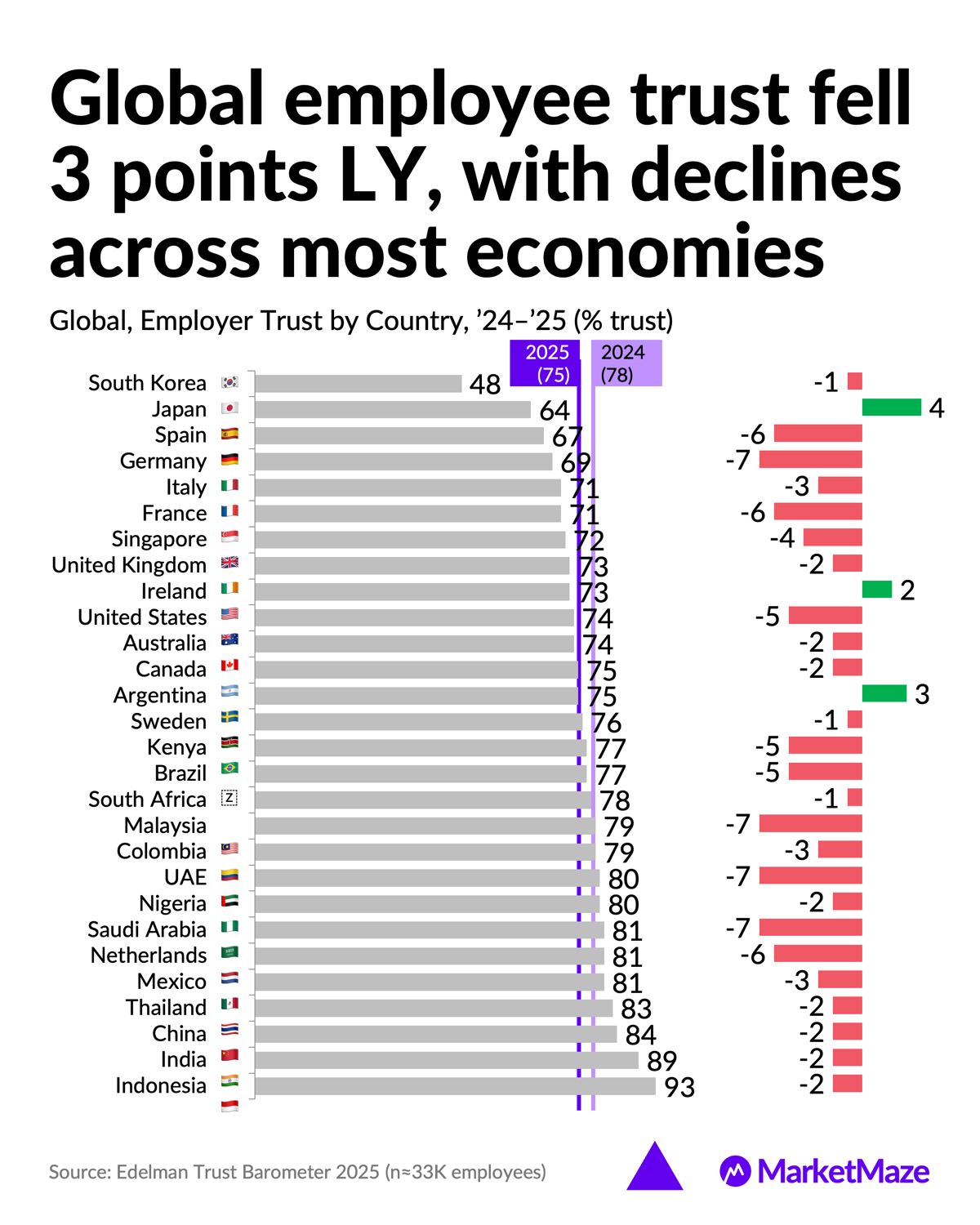

Global employee trust fell 3 p.p. YoY, with declines across most large economies, including Germany -7, France -6, and the US -5.

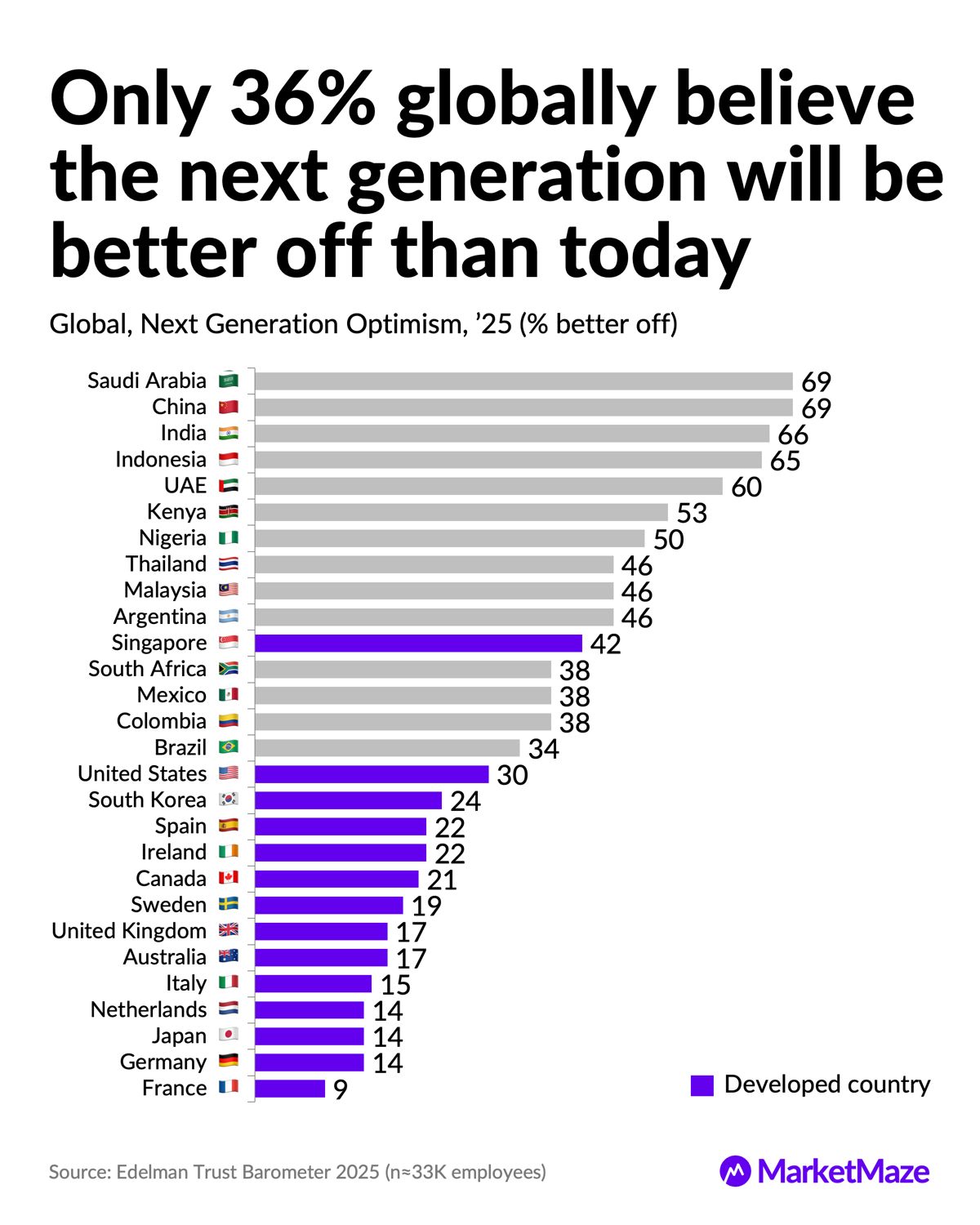

Only 36% globally believe the next generation will be better off, with optimism collapsing below 20% in France, Germany, Japan, and the UK.

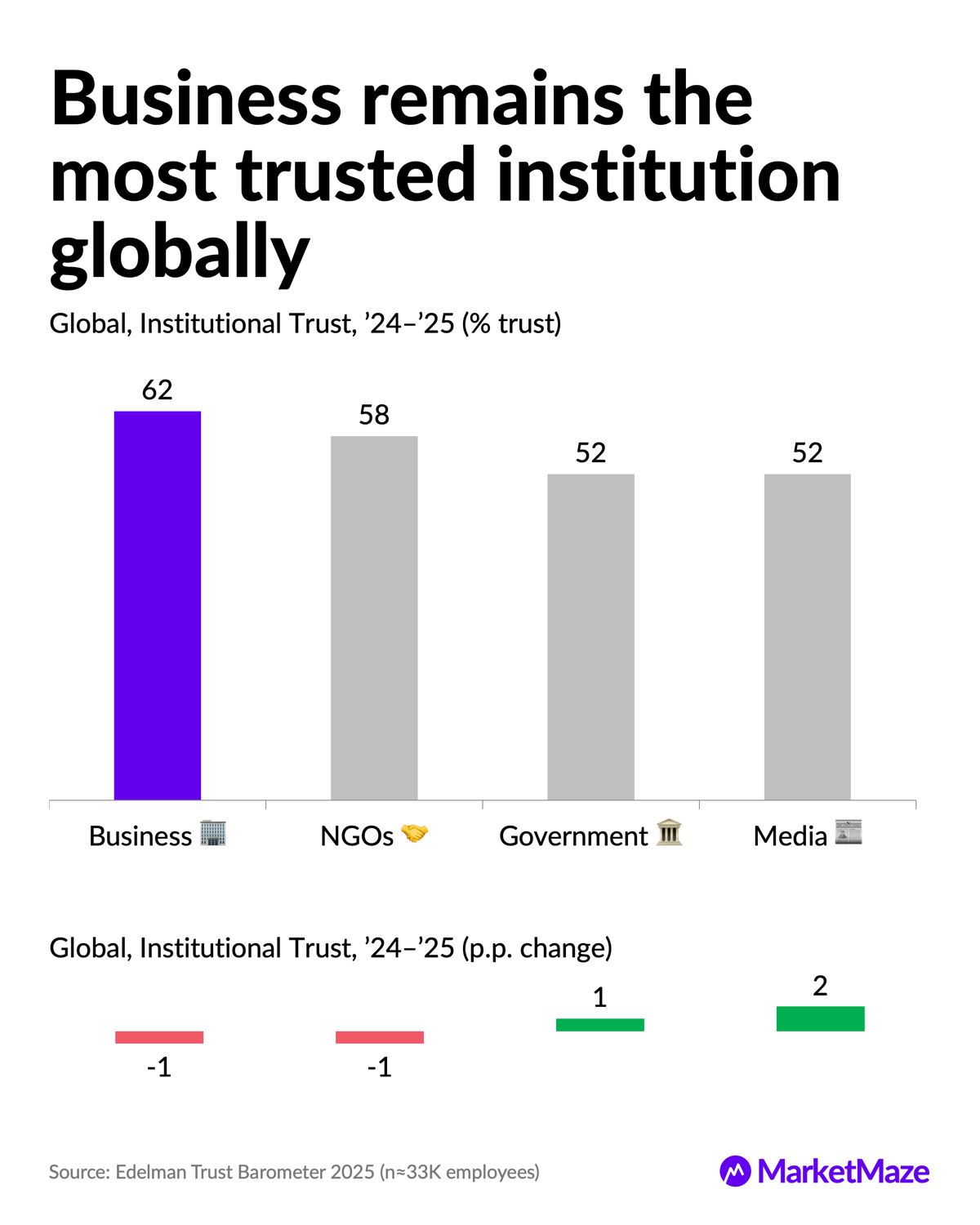

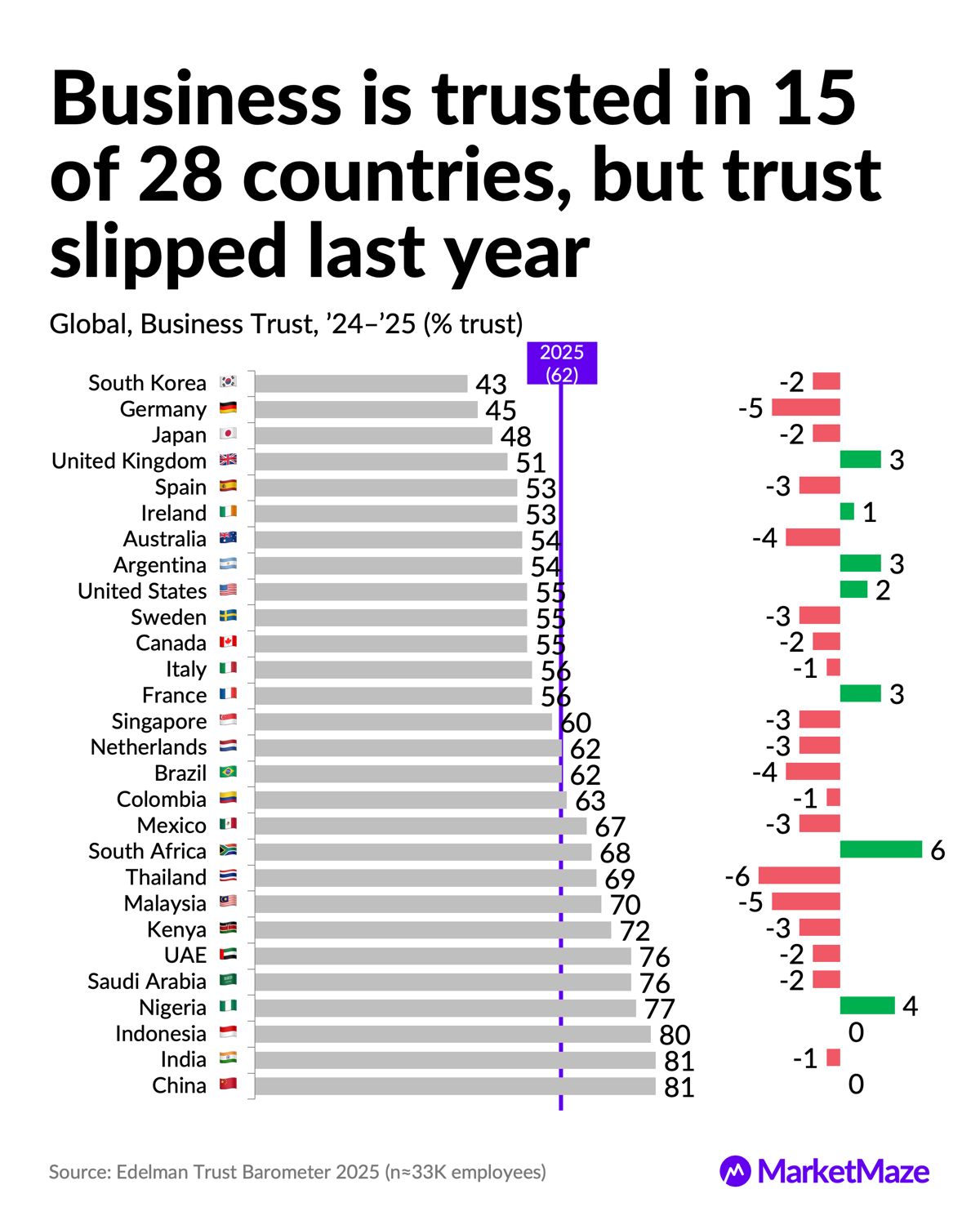

Business remains the most trusted institution at 62%, but trust fell in most countries and business is trusted in only 15 of 28 markets.

Why it matters: When workers fear macro shocks, trust erodes before unemployment rises. For ecommerce, platforms, and global brands, confidence now depends less on growth stories and more on stability, pricing, and jobs.

🌍 Global Fears

Recession beats automation as top job anxiety

Workers no longer fear robots first. They fear recessions and global shocks wiping out demand. This marks a shift from tech disruption narratives to macro survival mode, with globalization and geopolitics driving insecurity.

63% cite recession risk as a job threat, higher than automation at 58%, showing fear has moved from skills to cycles.

Trade conflicts worry 62% of workers, while foreign rivals (59%) and offshoring (54%) signal sustained globalization anxiety.

Technology fears plateaued, suggesting workers now see AI as inevitable but economic downturns as existential.

Job insecurity is no longer about learning faster. It is about whether demand will exist at all. That sets the emotional backdrop for every other trust metric that follows.

📉 Trust Slips

Employee trust fell almost everywhere last year

Trust in employers dropped even before layoffs surged. That is a warning sign. Employees are pricing future risk into today’s confidence, not reacting to past cuts.

Global trust fell 3 p.p. YoY, with steep drops in Germany -7, Italy -3, France -6, and Spain -6.

The US fell 5 p.p., landing at 74%, despite strong labor markets and wage growth.

Only a few markets gained trust, including Japan +4 and Argentina +3, mostly from low starting points.

Trust is behaving like a leading indicator. It breaks before the balance sheet does, not after.

🧠 Future Doubts

Optimism collapses in developed economies

Belief in progress has fractured along development lines. Emerging markets still see momentum. Rich countries see stagnation, debt, and shrinking upside.

Only 36% globally believe the next generation will be better off than today.

France sits at 9%, Germany 14%, Japan 14%, the UK 17%, and the US 30%.

China and India remain above 65%, reflecting growth, demographics, and state driven investment narratives.

When people stop believing the future improves, consumption shifts from growth to protection. That changes how markets behave.

🏢 Institutional Trust

Business leads but the margin is shrinking

Business still outranks governments and media on trust, but the advantage is thinning. Leadership without momentum is fragile.

Business trust stands at 62%, ahead of NGOs 58%, government 52%, and media 52%.

Trust in business fell -1 p.p., while government gained +1 and media +2, narrowing the gap.

Business is trusted in just 15 of 28 countries, mainly emerging markets tied to job creation.

Business now carries institutional expectations without institutional protection. That is a risky place to stand.

🌐 Uneven Map

Trust is high where growth is visible

Geography explains more than ideology. Trust follows jobs, wages, and momentum, not slogans.

China and India both exceed 80% trust in business, alongside Indonesia, Nigeria, Saudi Arabia, and the UAE.

Germany 45%, South Korea 43%, and Japan 48% reflect high scrutiny, aging populations, and slower growth.

Europe clusters near neutral trust, while emerging markets dominate the top half.

Trust rises where opportunity feels tangible. It falls where the system feels saturated.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team