Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

Welcome back! Beauty’s moving from the counter to the cloud, B2B buyers have swapped lanyards for Google, and Amazon just stretched Prime Day longer than a Marvel movie marathon. Buckle up—here’s the signal amid the noise.

Sorry for late send out… but as promised, we just wrapped our retail media white paper. Two months of research, charts, rewrites, and late-night coffee. Worth it.

If you want to actually understand how retail media works—and what it means for advertisers and marketplaces… this is probably the best resource on the internet.

Check it out here 👉 Retail Media Importance for Marketplaces

INSIGHTS🧠

🧴 The Next Era of Beauty is Digital

💎 Search > Trade Shows in B2B

🛒 Prime Day’s New Era: 93 Hours Long

🤖 Amazon’s AI Stack Crushes Everyone

📦 China’s €27B eCom Tsunami Hits EU

NEWS📖

🇬🇧 Temu targets 50 % UK‑to‑UK orders by 2025

🇺🇸 Prime Day racks up $24 B in four days

🇨🇦 Shein brings semi‑managed marketplace to Canada & GCC

🇸🇪 H&M and Mango roll out AI fashion twins

🇺🇸 U.S. online grocery tops $9.8 B in June

🇨🇳 Alibaba’s Super Saturday hits 80 M one‑day orders

+ 15 other handpicked news from the last week you need to know 🔥

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

The Next Era of Beauty is Digital 🧴

Beauty is hitting refresh. According to McKinsey's "State of Fashion: Beauty" 2025 report, the $441B global beauty industry is shifting online, chasing volume, and led by a surprising hero: fragrance. Based on global consumer surveys and exec interviews, this data snapshot shows where growth is really coming from. Spoiler: it’s not markups.

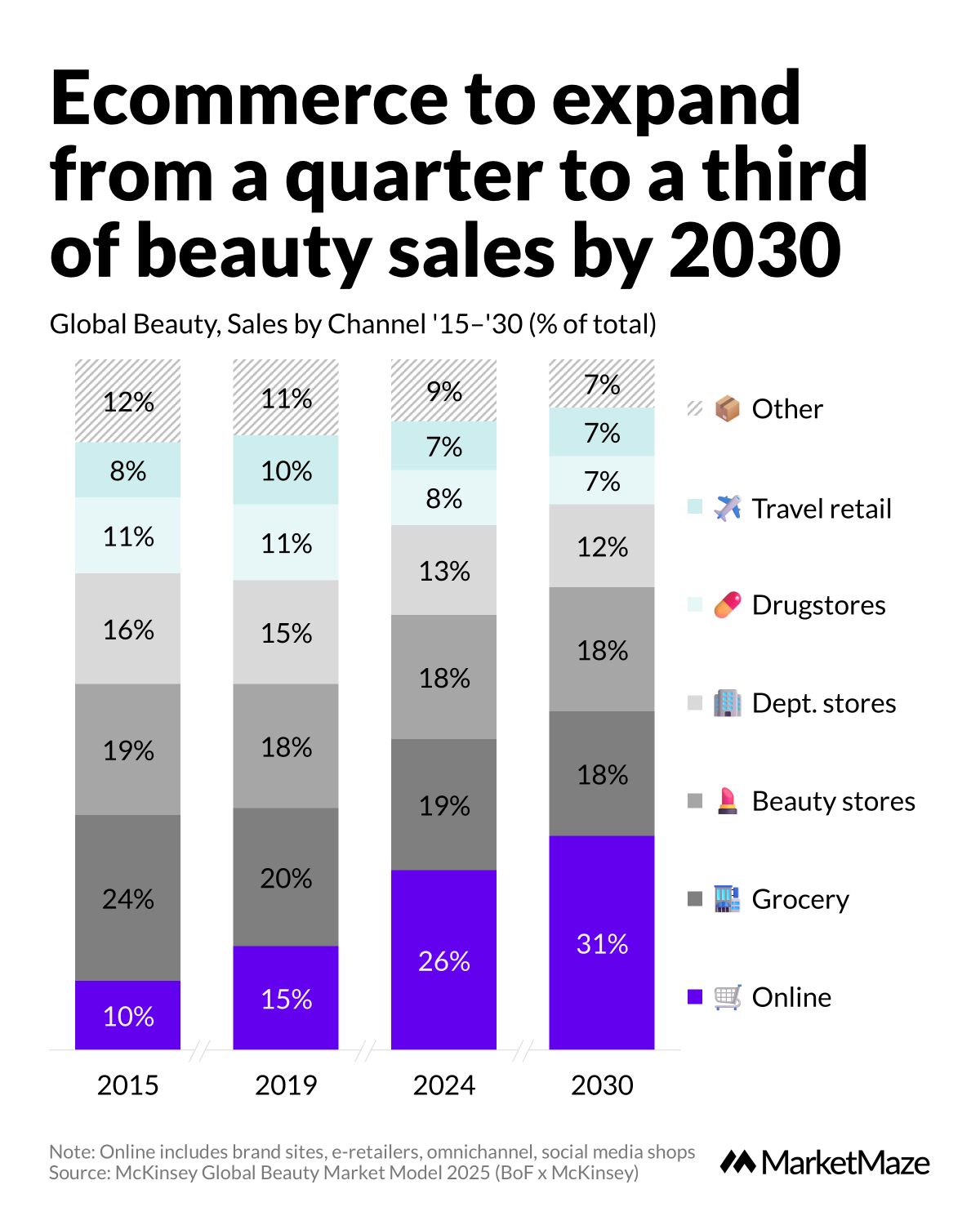

Ecomm takes the mirror selfie 🛒

E-commerce will grow from 10% of beauty sales in 2015 to 31% by 2030. In 2024, it already hits 26%. Physical stores—department, drugstores, even beauty boutiques—are steadily losing ground. Marketplaces, social, and brand DTC are the new frontline. The message? Your next moisturizer might come with a Prime logo.

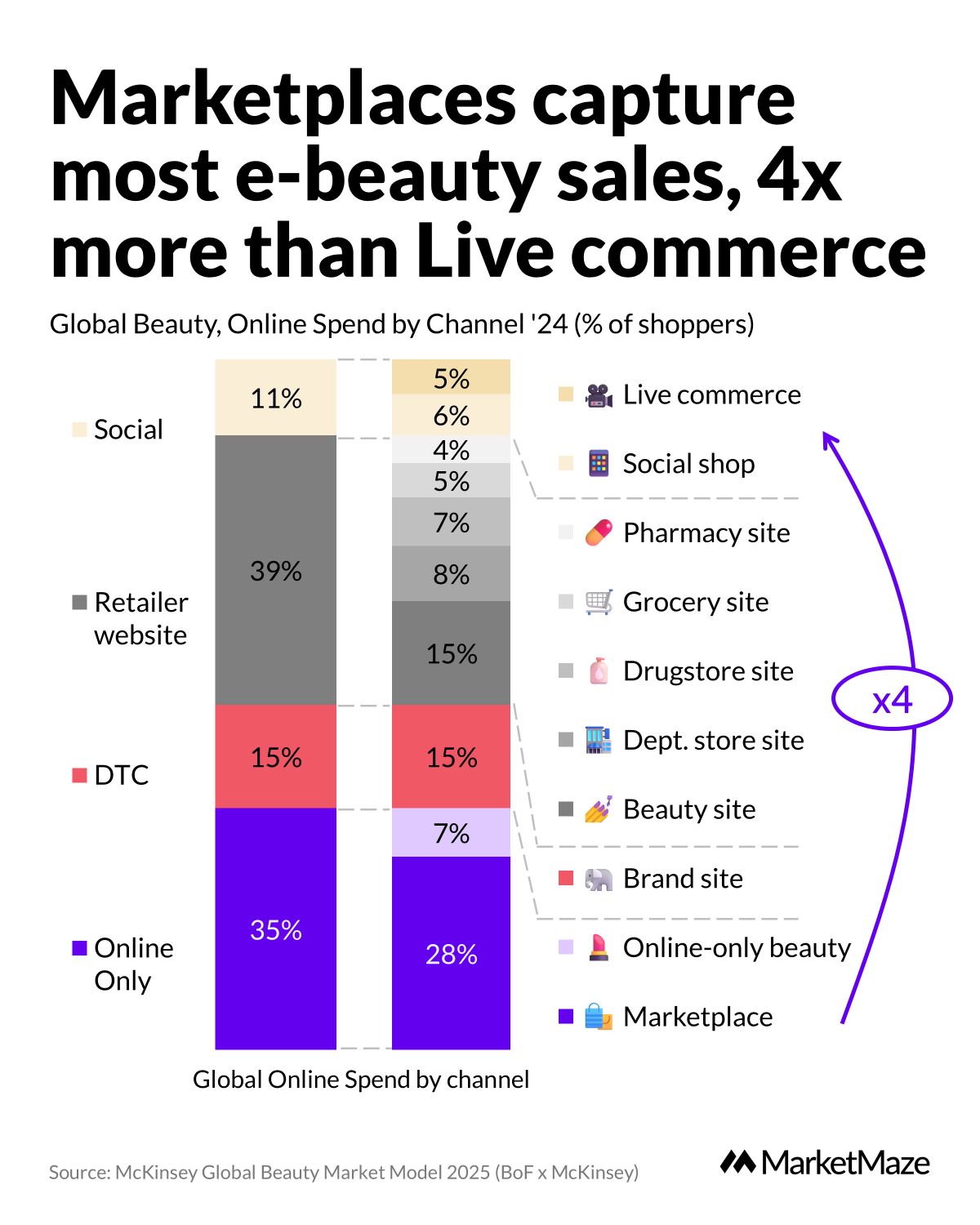

Amazon outmuscles TikTok 🥊

In 2024, Amazon-style marketplaces take 28% of all global online beauty spend. That's 4x more than Live commerce (5%) and miles ahead of Social Shops (6%). Even traditional beauty sites and brand.com lag behind. Consumers want convenience, price, and delivery speed - TikTok may win hearts, but Amazon wins carts.

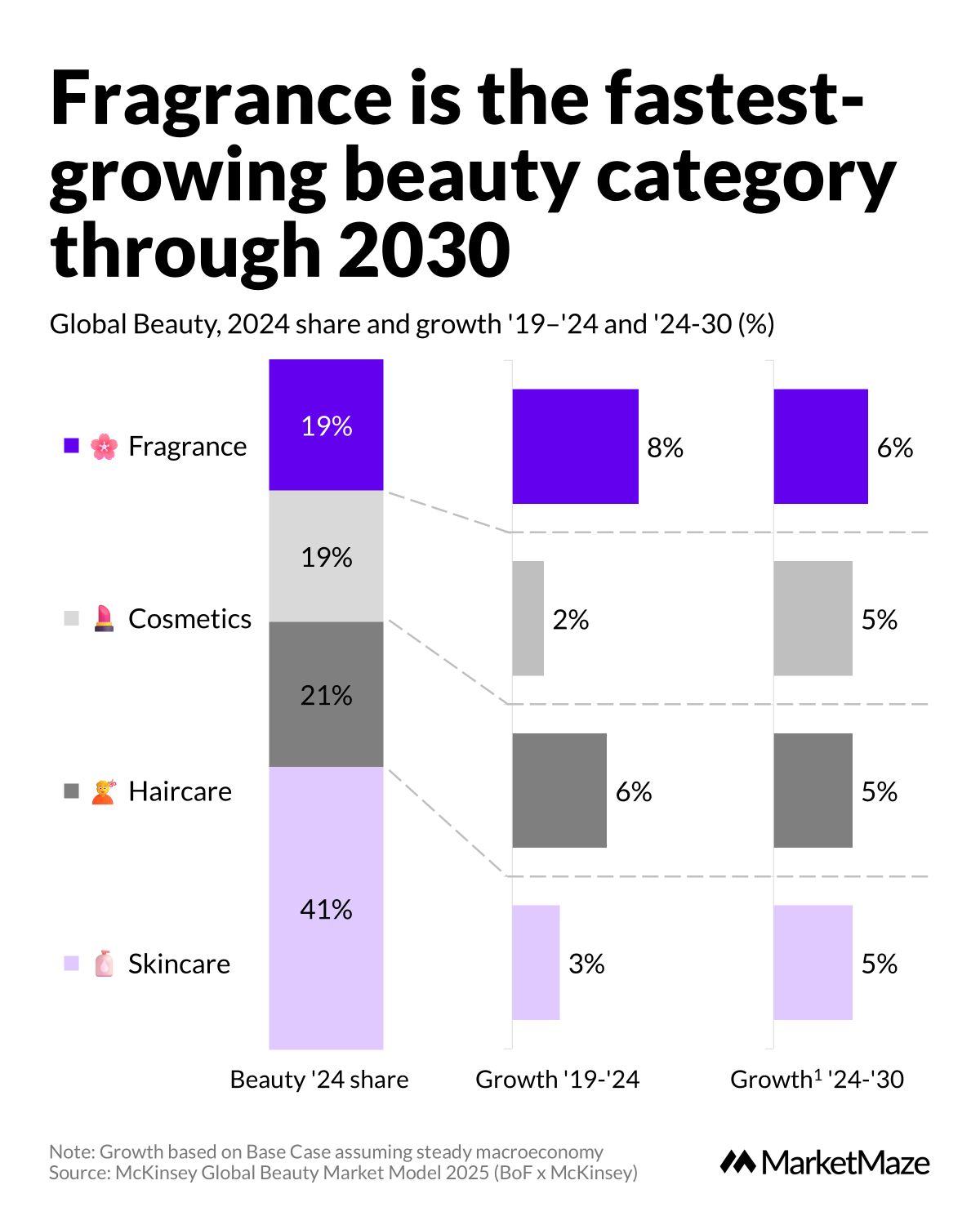

Fragrance smells like ROI 🌸

Fragrance is no longer just a luxury impulse buy. It’s the fastest-growing category in beauty: 8% CAGR from 2019–2024 and projected 6% more to 2030. That outpaces skincare (5%), haircare (5%), and makeup (5%). Thanks to Gen-Z, niche brands, and TikTok virality, fragrance is now a high-growth asset class.

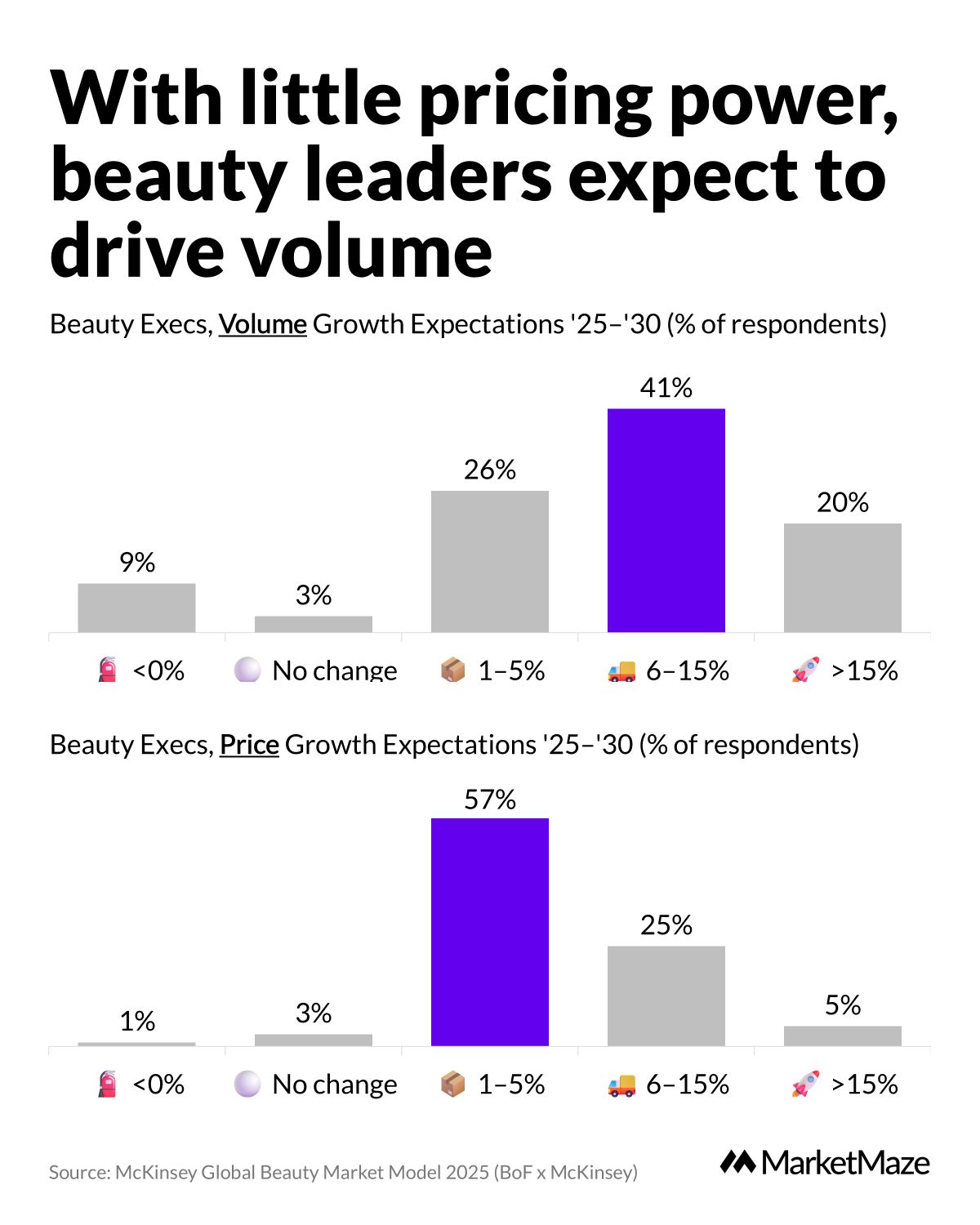

Volume is the new pricing strategy 📦

Beauty execs are done betting on price hikes. 41% expect volume growth of 6–15% per year through 2030. Just 5% expect prices to rise more than 15%. The majority? Counting on 1–5% increases at best. In a price-sensitive market, brands know the winning play is pushing units, not pushing prices.

From our partners

Your boss will think you’re a genius

You’re optimizing for growth. You need ecom tactics that actually work. Not mushy strategies.

Go-to-Millions is the ecommerce growth newsletter from Ari Murray, packed with tactical insights, smart creative, and marketing that drives revenue.

Every issue is built for operators: clear, punchy, and grounded in what’s working, from product strategy to paid media to conversion lifts.

Subscribe free and get your next growth unlock delivered weekly.

💎 Data Treasure

Search > Trade Shows in B2B🧠

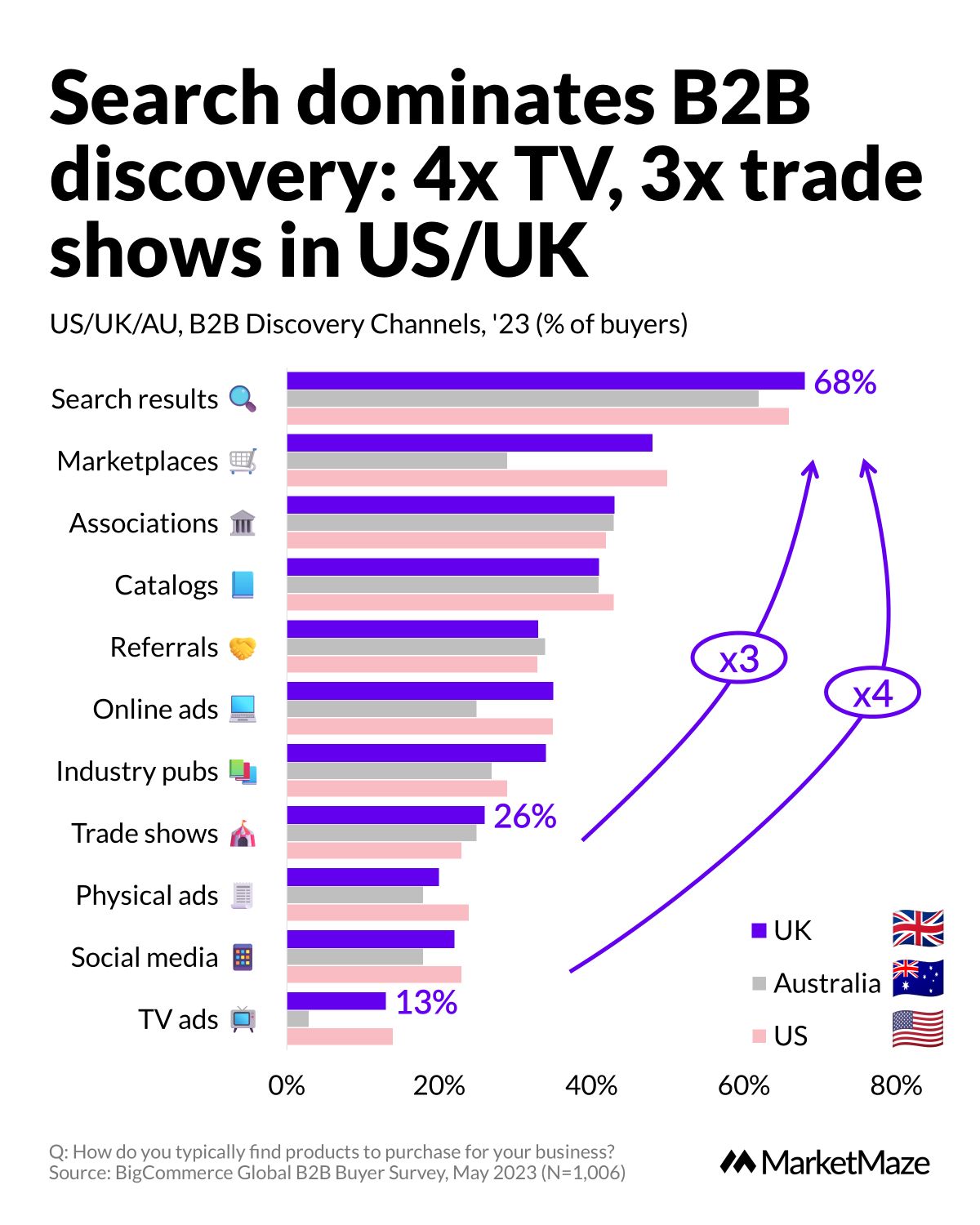

B2B buying has left the convention center and gone digital. According to BigCommerce's Global B2B Buyer Survey (May 2023, N=1,006 buyers across US, UK, AU), the way B2B buyers discover and purchase products has fundamentally shifted. Search dominates discovery. Supplier websites beat social media 4x. If you're not online, you're invisible.

Search beats trade shows by 3x 🔍

Search is the #1 discovery channel in all three markets—used by 68% in the UK, 66% in the US, and 62% in Australia. That’s 4x more than TV ads and 3x more than trade shows. Online marketplaces (like Amazon Business) rank second, while catalogs still matter—especially in AU. Social media, TV, and even trade shows? Fading fast. B2B buyers think like consumers—Google first, decide fast.

Supplier websites win the checkout 🛒

When it comes to actual purchasing, supplier websites and apps are where the money lands—used by 75% of US buyers, 73% in the UK, and a whopping 77% in Australia. That’s 1.5x more than B2B marketplaces and 3x more than social channels. Even in-store and rep-led sales lag behind. In 2025, if your site isn’t fast, clear, and mobile-friendly, you’re losing deals before they even start.

From our partners

Premium Marketing. 0% Effort, Real Results.

Automatically increase revenue and be a leader in your industry with your very own, custom-built A.I. that creates and manages only the highest-quality of content.

Here’s what you get:

Automatic Revenue Growth: Attract new leads and drive more business, hands-free.

Done-for-You Content: World-class posts created and published daily across every social platform.

Google Ranking Boost: Stay at the top of search results with SEO-optimized updates.

Custom-Built for You: Every word, image, and post tailored to your brand, no cookie-cutter templates.

Zero Time Required: You stay in control, but Lightpost does all the work. Approve, tweak, or just watch the results roll in.

Perfect for anyone who wants to lead their industry and save hours every week. Ready to see what effortless marketing looks like?

👀 Outside the Maze

🛒 Prime Day’s New Era: 93 Hours Long 😮

Sherwood breaks down Amazon’s 2025 Prime Day, now a 93-hour behemoth. The sale's gone from 24 hours in 2015 to nearly 4 days, expanding globally as it chases more wallet share. The visual highlights just how far Amazon’s promotion machine has scaled. 👉 Sherwood

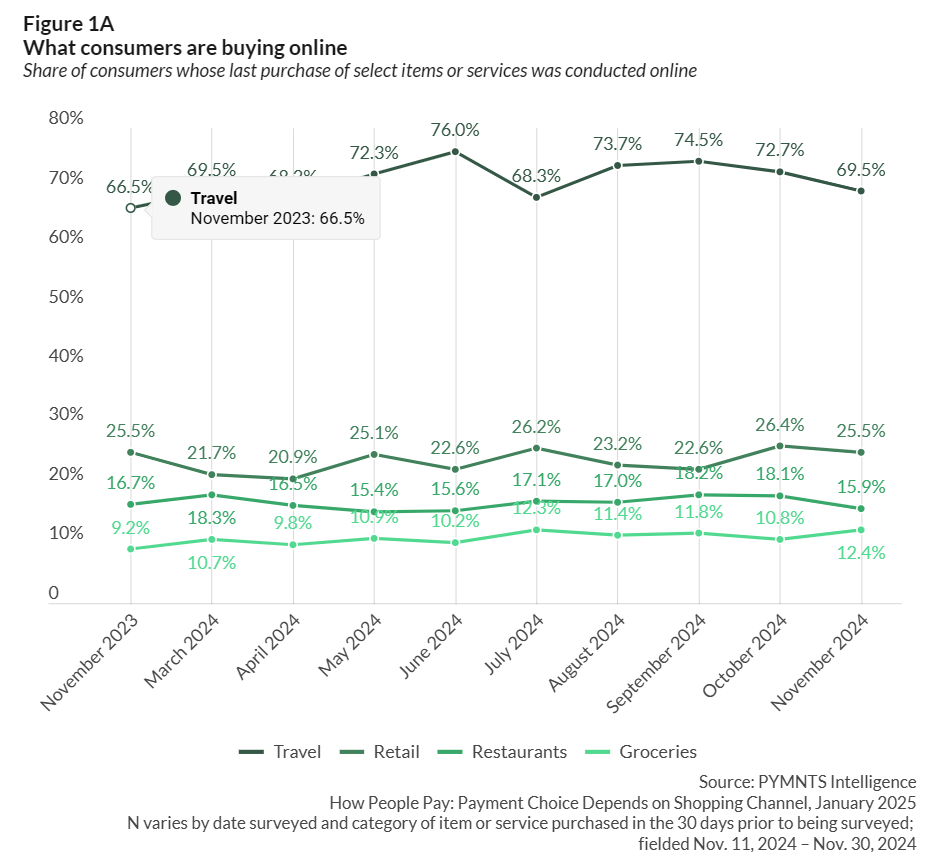

👵👨💻 Who Shops Online and What They Buy

PYMNTS Intelligence explores how consumers across generations spend online. Travel dominates, with 76% booking digitally by mid-2024. Retail, groceries, and restaurant orders lag, barely crossing 25%. Gen Z? Still prefers food delivery over online grocery carts.👉 PYMNTS

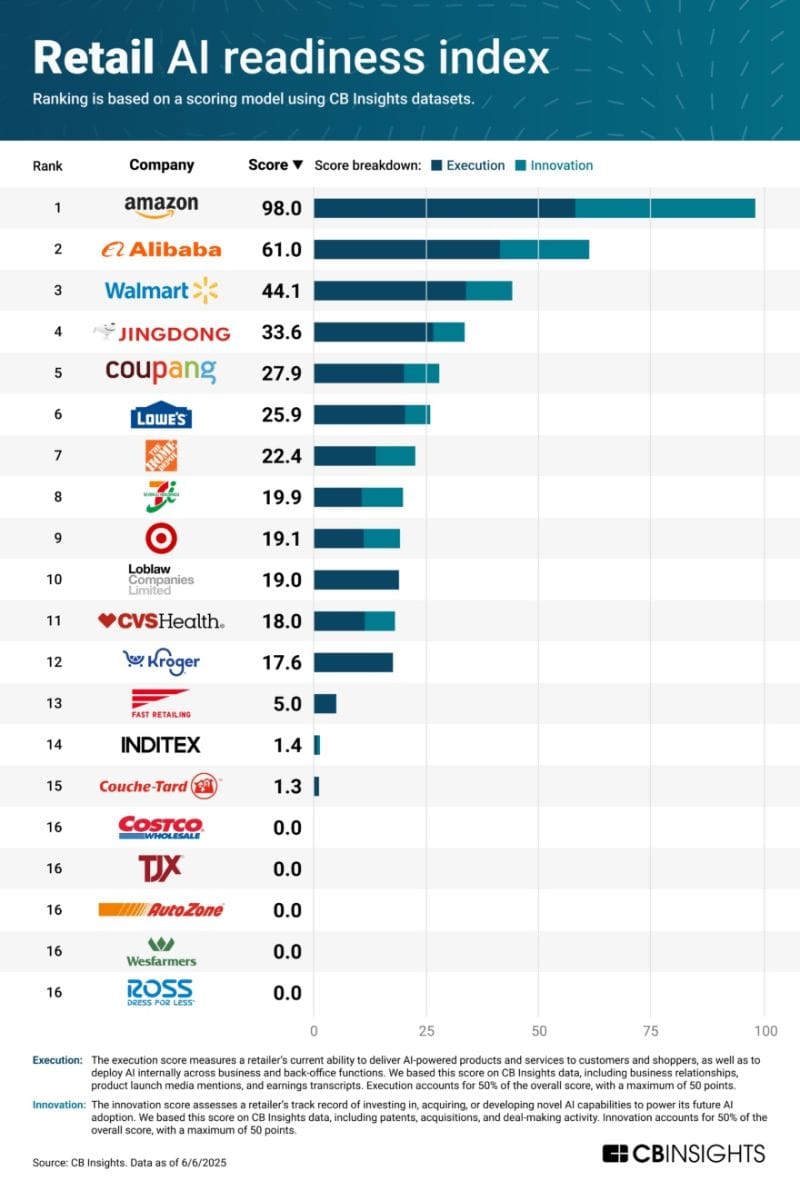

🤖 Amazon’s AI Stack Crushes Everyone

CB Insights’ AI Readiness Index shows Amazon (98 pts) and Alibaba (61) sprinting ahead. Amazon built its AI backbone—Bedrock, Nova LLMs, Anthropic stake, and in-house chips. Alibaba rides Qwen and open-source video models. Everyone else? Playing catch-up or renting from Google/OpenAI.👉 LinkedIn

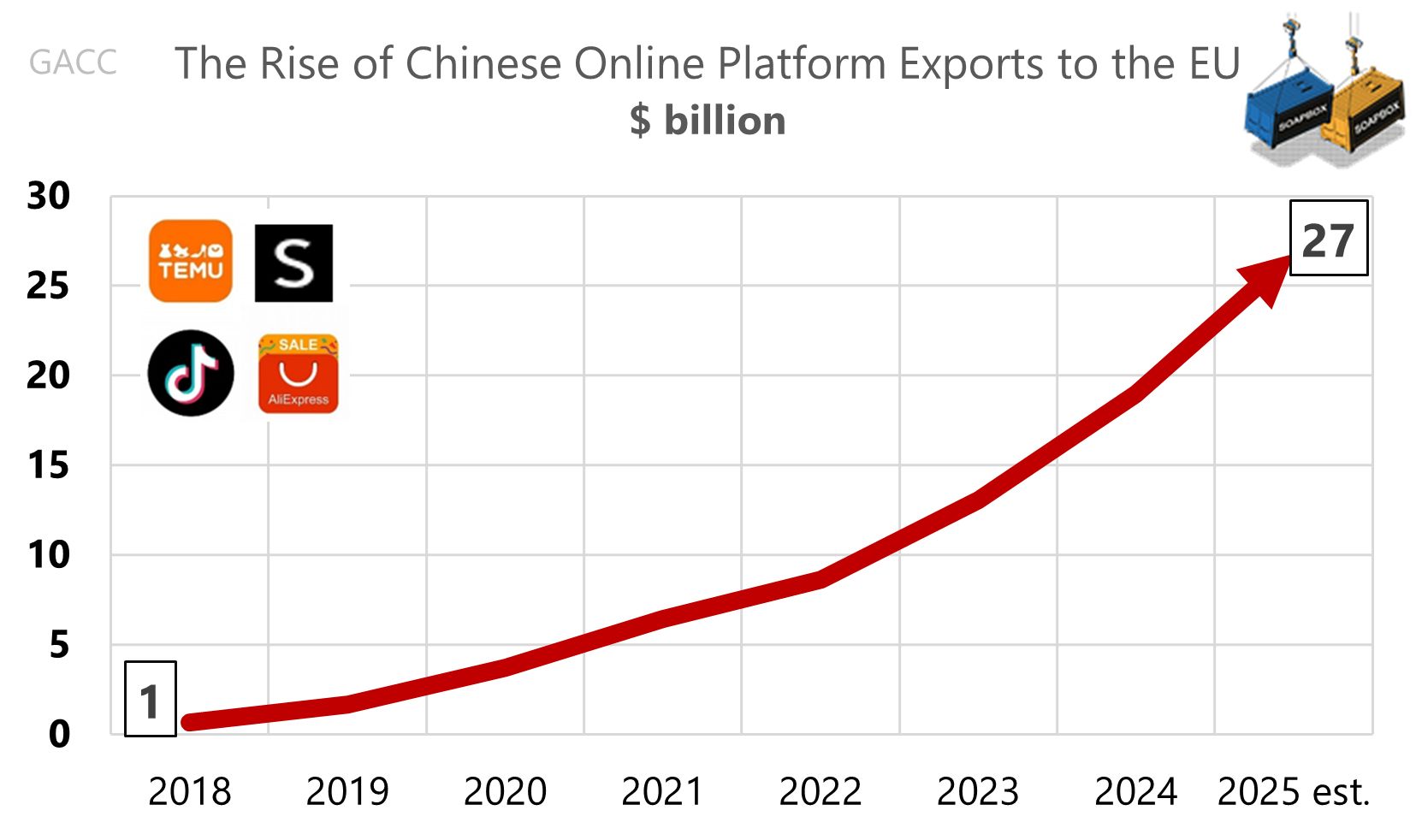

📦 China’s €27B eCom Tsunami Hits EU

Soapbox breaks down Chinese marketplace exports to the EU, up from $1B in 2018 to $27B in 2025. TEMU, TikTok Shop, Shein, and AliExpress are bulldozing traditional European supply chains. It’s a volume game now—and China’s winning it.👉 Soapbox

📶 EU Teens Live Online (and So Do You)

Eurostat reports 96% of EU youth now use the internet daily. In 2011 it was 77%. Older generations are catching up too—rising from 55% to 88%. Digital commerce isn’t the future. It’s the baseline.👉 Eurostat

📰 Maze Briefing

🛒 Mass merchant platforms

🇬🇧 Temu sets 50% UK orders to be local-to-local 2025. Temu wants half of UK orders sourced, stored, and delivered inside Britain by 31 Dec 2025, cutting lead times to under 72 h and letting SMEs export to 90+ markets. Execs say the shift could add “hundreds of millions of pounds” and lift UK GMV toward £4 bn. 👉 ChannelX

🇺🇸 OpenAI adds checkout, eyes slice of ChatGPT sales. OpenAI will embed a Shopify cart inside ChatGPT in Q4, charge merchants 2-5 %, and bet 0.2 % of 1.8 bn monthly visits convert into multi-billion sales. Pilots with Instacart, Mercari and Fanatics seek to offset a $5 bn 2024 loss and push revenue run-rate past $10 bn. 👉 PYMNTS

🇺🇸 Prime Day hits $24bn; US gen-AI traffic up 3300%+. Adobe says Americans spent $24.1 bn online during the 8-11 Jul Prime window, 70 % over 2024, with 53 % on mobile and BNPL at 8 %. Gen-AI deal bots spiked traffic 3,300 %, pushing the week’s e-commerce run-rate to $42 bn as apparel slid 24 % and electronics 23 %. 👉 TechCrunch

🇺🇸 Walmart revamps to lure high-income US web buyers. Logo tweaks and “Who knew?” ads with $600 saunas lifted online sales 22 % and raised $100k+ households to 30 % of revenue. A 500 m-SKU marketplace, one-hour delivery, NY Fashion Week pop-ups and a $2.3 bn Vizio buy anchor the wealthy push. 👉 Modern Retail

🇺🇸 Walmart axes hundreds of market coordination roles in US. A 16 Jul memo scraps coordinator jobs and merges training academies, following 1,500 tech and ad cuts in May; analysts see $60-80 m savings. Staff can seek coaching roles as the 1.6 m-strong workforce braces for tariff-driven price hikes. 👉 CNBC

🇮🇩 Tokopedia-TikTok merger stalls; 2,500 jobs cut ID. TikTok Shop Indonesia axed half its staff, traffic dropped 40 %, and payouts slowed, leaving the unit 20 % shy of a $14 bn 2025 GMV goal. An antitrust probe looms while ByteDance touts a $1.8 bn SME fund amid a hiring freeze. 👉 Rest of World

🇩🇪 eBay launches GDPR-ready Store Newsletter tool in EU. Sellers get one templated email every two weeks; pilots saw 12 % click-through and 4 % sales lifts. Abuse risks fines up to 6 % of turnover; AI copy and live-deal pulls land before Q4. 👉 Onlinehändler News

🇺🇸 BLCK to launch 24/7 shop TV with low price pledge. Launching in October on Roku, Fire TV, Apple TV and Google TV, BLCK promises prices 10 % below any online listing and chases $350 m GMV in year one. Sixty brands paid $15k plus 8 % commission; ShipBob covers 95 % of ZIPs with 2-day delivery. 👉 PR Newswire

👗 Fashion, Home & Beauty Ecommerce

🇪🇪 Zalando taps Omniva for Baltic last-mile overhaul. Deal makes state-owned courier Omniva sole carrier for Zalando in Estonia, Latvia and Lithuania for four years. Adds Saturday delivery, label-free returns and helps launch Lounge; Zalando Q1 2025 revenue €2.42 bn, up 7.9 %, with 4.5 m new shoppers. 👉 Retail Tech Innovation Hub

🇨🇦 Shein extends semi-managed plan to Canada and GCC. Shein pushes its semi-managed marketplace into Canada and the Gulf, letting sellers keep assortment but place stock locally while Shein handles fulfilment. Model now spans nine sites; Canada e-commerce is forecast at US$111 bn by 2027, while GCC online retail grows 15 % CAGR toward US$50 bn. 👉 BY56

🇬🇧 ASOS plugs Celonis in to read orders in real time. ASOS wires Celonis process mining across containers, DCs, carrier KPIs and returns, giving a live view from purchase order to doorstep. Supply-chain chief Laurence Moore says early wins cut delays and cost-per-order after FY 2024 logistics ran at 8.1 % of sales. 👉 Supply Chain Dive

🇬🇧 Vinted renews Evri deal, grows UK out-of-home net. Vinted extends its UK pact with Evri through 2029, giving 8 m users 11 k ParcelShops and lockers, set to hit 25 k by 2030 via a £50 m push. Parcel volumes have doubled since 2021; this phase trials reusable packaging to ride Britain’s pre-loved boom. 👉 Parcel & Postal Technology International

🇸🇪 H&M and Mango launch AI twins and chat style tool. H&M’s July denim ads use AI-generated model twins, cutting shoot costs and CO₂, while Mango’s ‘Mango Stylist’ chatbot serves outfit ideas in 10 countries. The duo joins Levi’s and Adidas in taking consumer-facing AI mainstream. 👉 Fashion Network

🇩🇪 Flaconi and Nuvei add payments in five EU markets. Berlin-based flaconi plugs Nuvei’s optimisation suite into Denmark, Sweden, Finland, Czech Republic and Italy through one API. CTO Sven Rosemann says higher conversion aided a 30 % revenue jump in 2024; more local payment options are next. 👉 The Fintech Times

🇪🇸 Inditex puts €18m into Theker Robotics seed round. Zara owner Inditex joins Kibo and Leadwind in a €18 m seed for Theker Robotics to bring adaptive robots to logistics and recycling lines. Cash will triple staff and pilot units in Inditex DCs as chair Marta Ortega doubles automation capex. 👉 Retail Detail

🇺🇸 Nike AI exec Jason Loveland exits in tech shakeup. Nike’s AI chief Jason Loveland resigns after leading athlete analytics and generative-design tools; move follows the June exit of virtual-studios VP Ron Faris and undisclosed tech layoffs. Analysts say departures cloud Nike’s metaverse and AI plans. 👉 Retail Dive

🍔 eGrocery & Food Delivery

🇺🇸 US e-grocery sales hit $9.8bn record in June 2025. Delivery climbed 29% to $3.8 bn, pickup 25% to $4.3 bn and ship-to-home 33% to $1.7 bn, lifting online grocery 27.6% YoY. One in four supermarket e-shoppers also bought at Walmart, a 4-point jump Mark Fairhurst calls “a wake-up call” as pickup loses share two years running. 👉 Grocery Dive

🇨🇳 China instant retail to exceed ¥2tr by 2030 goals. Alibaba and Meituan now move 80 m and 150 m instant-delivery orders daily, fueling a ¥650bn market in 2023, up 28.9% YoY. Turnover could exceed ¥2 tr by 2030, yet analysts say rider gaps and supply-chain speed, not discounts, will decide the winners. 👉 China Daily

🇩🇪 Lieferando to axe 2k couriers, shift to gig works. Lieferando will cut 2,000 of 10,000 German riders and shift 30% of cities to subcontractors already used by Uber Eats and Wolt. MD Lennard Neubauer cites speed needs; unions warn of ‘pseudo-self-employment’ as another 20% of staff join the gig ranks. 👉 Interia via MSN

🇮🇳 Swiggy lifts protein menu to 30 Indian cities now. The ‘High Protein’ tag now lists 500,000 dishes from 35,000 restaurants across 30 cities after a pilot clicked by 1.8 m users. Swiggy says protein orders rose 52% YoY and higher margins fund perks like 3.886 m ESOP shares worth ₹150 cr and the ₹99 Store in 175 cities. 👉 YourStory

🇺🇸 Etsy spell trade booms with $5-$50k magic rituals. Thousands of ‘Etsy witches’ list digital altar pics, selling spells from $5 charms to $50,000 pacts. Top seller Avatara has 11,000 orders, WitchTok tops 30 bn views and a $2 bn US metaphysical market lets some sellers earn four-figure monthly incomes. 👉 KTLA

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team