TODAY’S MAZE

Happy Tuesday! Temu has hit a hard regulatory wall in Türkiye, officially pausing cross-border shipments following a surprise government inspection.

The sudden pivot to local inventory raises a critical question: is the era of frictionless direct-from-China logistics finally coming to an end?

In today’s MarketMaze focus:

Temu halts cross-border sales

OpenAI pitches premium ads

Investor blocks JD.com expansion

Social commerce outpaces retail

Circular fashion becomes mandatory

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Temu has suspended cross-border sales in Türkiye following a surprise inspection by the nation's Competition Authority. The marketplace now restricts Turkish consumers to purchasing goods exclusively from domestic sellers.

Regulators visited Temu’s Istanbul office last week, prompting the platform to immediately limit inventory to local retailers to address compliance concerns.

The pivot anticipates the February 1 elimination of simplified customs clearance for items valued under 30 euros.

Local probes discovered toxic substances in imported goods, fueling a push from domestic ecommerce organizations for stricter regulations.

Why it matters: This rapid localization proves that aggressive regulatory scrutiny successfully forces global marketplaces to dismantle their direct-from-China logistics models. National governments are closing tax loopholes and raising safety standards to shield domestic merchants from cheap imports.

For global marketplaces operating in Europe and emerging markets, what is the most realistic response to stricter import rules like those applied to Temu in Türkiye?

- 🌍 Full localization (country-by-country seller onboarding and local inventory)

- 🔄 Hybrid model (local sellers plus limited compliant cross-border assortment)

- 📉 Market exit (withdrawing from smaller or high-friction countries)

- 🤝 Partner reliance (working through local distributors or incumbents)

- ⏳ Regulatory delay (slowing growth while lobbying and adapting processes)

FROM OUR PARTNERS

Stop Duplicates & Amazon Resellers Before They Strike

Protect your brand from repeat offenders. KeepCart detects and blocks shoppers who create duplicate accounts to exploit discounts or resell on Amazon — catching them by email, IP, and address matching before they hurt your bottom line.

Join DTC brands like Blueland and Prep SOS who’ve reclaimed their margin with KeepCart.

MAZE STORY

The Maze: OpenAI is aggressively pitching ChatGPT inventory at a premium $60 CPM, forcing advertisers to weigh high entry costs against limited visibility into attribution and performance tracking.

This pricing strategy demands fees roughly three times higher than Meta’s standard rates, effectively positioning the chatbot interface as a luxury media channel rather than a volume play.

Early comparisons suggest the ad product lacks the granular targeting capabilities of mature platforms, offering basic impression counts instead of the deep telemetry buyers typically expect.

Advertisers buying in now are essentially paying a "discovery tax" to access high-intent users, prioritizing brand adjacency to AI innovation over immediate efficiency or proven ROI.

Why it matters: Search is evolving into a premium media network. Platforms are leveraging their control over the next major interface to dictate expensive terms before building the measurement infrastructure brands usually require.

FROM OUR PARTNERS

Know what works before you spend.

Discover what drives conversions for your competitors with Gethookd. Access 38M+ proven Facebook ads and use AI to create high-performing campaigns in minutes — not days.

MAZE STORY

The Maze: Czech billionaire Daniel Kretinsky initiates a friendly takeover of Fnac Darty to secure 50% ownership. This strategic move aims to prevent Chinese ecommerce giant JD.com from gaining control through its stake in Ceconomy.

Kretinsky informed the board last Friday of his intention to launch a friendly public takeover bid targeting 50% of the retailer's capital.

Fnac Darty’s leadership unanimously welcomed the bid in a press release, signaling alignment to protect the company's independence.

This move prevents JD.com from using its stake in Ceconomy to gain strategic influence over the electronics retailer's operations.

Why it matters: Legacy European retailers are aggressively fortifying defenses to retain local control against Asian ecommerce expansion. Securing majority ownership prevents global giants from leveraging minority stakes into broader market dominance.

DATA TREASURE

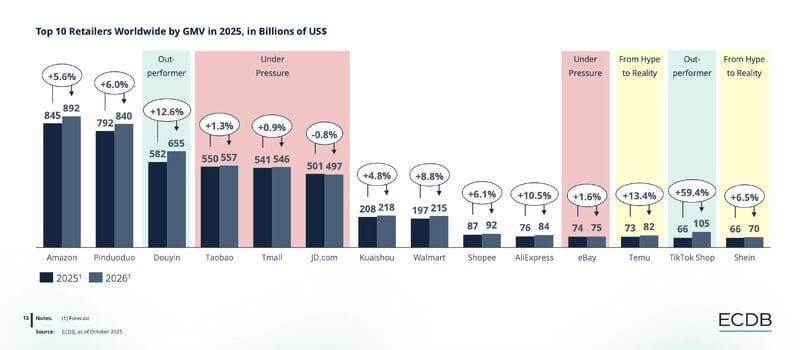

The Maze: Retail is shifting from search to feed. Entertainment-driven shopping is scaling faster than price-led disruption, and it is changing who wins online.

Douyin and TikTok Shop combined are forecast to reach ~$760B GMV next year, growing about 17%, with TikTok Shop alone expanding near 59%.

Ultra-cheap players slow sharply, with growth falling into low double or single digits, as tariffs, regulation, and customer fatigue expose fragile acquisition models.

Shoppers leaving “cheapest wins” platforms increasingly choose good value mid-tier retailers, while social commerce wins on discovery, impulse, and speed.

Why it matters: Attention is now the storefront. Brands that cannot sell through content risk becoming invisible, even if their prices stay competitive.

DATA TREASURE

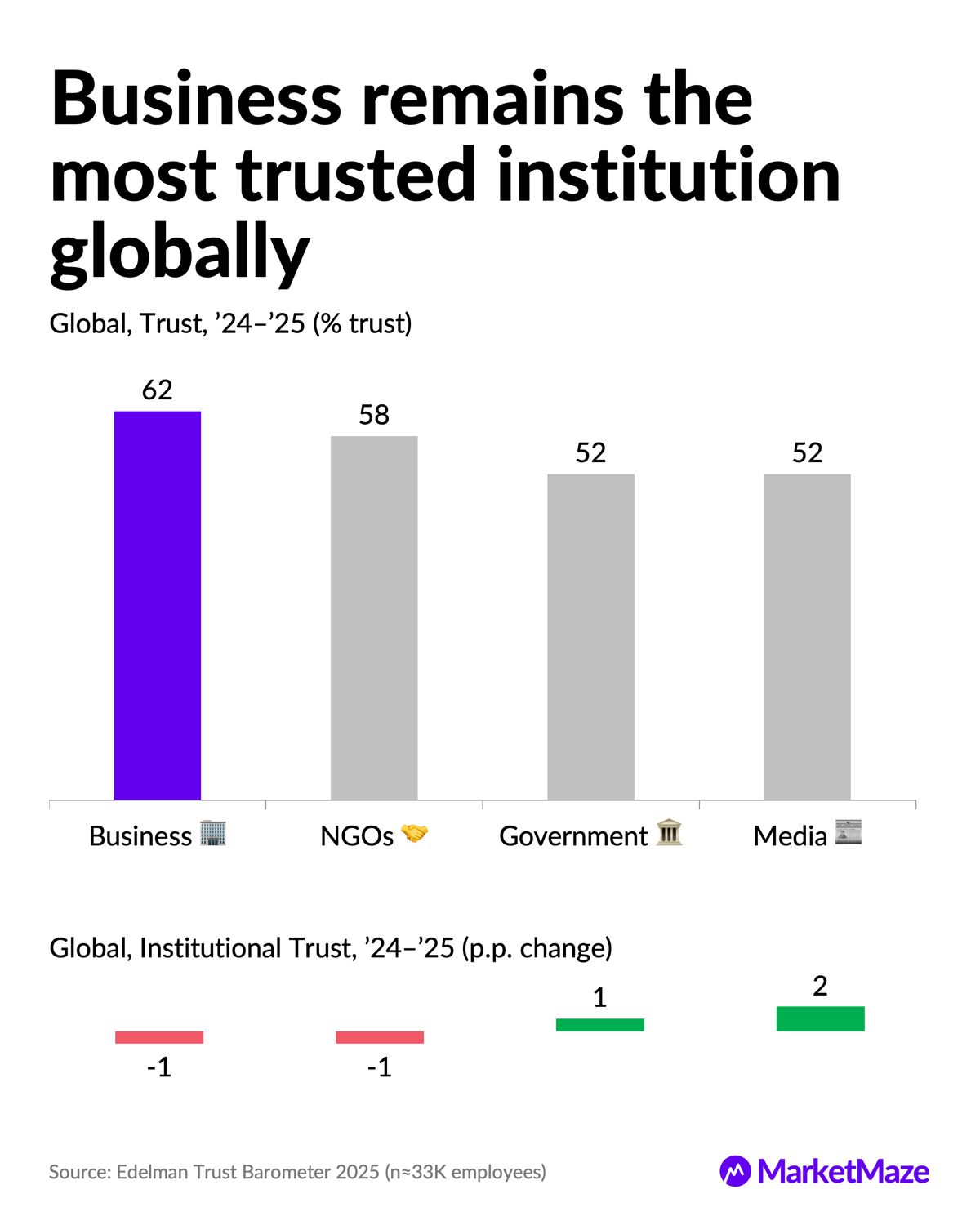

The Maze: Economic anxiety is no longer abstract. Workers across regions now link their personal job security to global forces they cannot control. A large, multi-country survey of employees shows fear rising faster than confidence, and trust failing to keep up.

Nearly 63% of workers fear recession risk will threaten their jobs, beating automation and skills gaps at 58%, showing macro fear now outweighs tech fear.

Global employee trust fell 3 p.p. YoY, with declines across most large economies, including Germany -7, France -6, and the US -5.

Only 36% globally believe the next generation will be better off, with optimism collapsing below 20% in France, Germany, Japan, and the UK.

Business remains the most trusted institution at 62%, but trust fell in most countries and business is trusted in only 15 of 28 markets.

Why it matters: When workers fear macro shocks, trust erodes before unemployment rises. For ecommerce, platforms, and global brands, confidence now depends less on growth stories and more on stability, pricing, and jobs.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇩🇪 Germany saw online retail spending grow 3.2% to €83.1 billion last year, outperforming forecasts despite broader economic stagnation.

🇬🇧 UK Retailers blame rising energy bills and national insurance hikes for a 1.5% jump in food prices, signaling continued inflationary pressure.

🇸🇪 Ikea rolled out in Sweden a dedicated digital marketplace for second-hand products, expanding its circular economy platform to five markets.

🇺🇸 Pinterest released its 2026 Marketing Moments Guide, revealing that consumers now begin researching major seasonal events months earlier than traditional ad windows.

🇺🇸 Amazon updated its cashierless tech with RFID-enabled checkout lanes designed specifically for temporary retail settings like festivals and pop-up stores.

🇳🇱 Bol launched AI-powered visual search, allowing shoppers to find products using images for better conversion.

🇺🇸 FedEx & UPS warned of severe service disruptions across the US as Winter Storm Fern impacts key air cargo hubs.

🇪🇸 Just Eat partnered with Brico Depôt in Spain to diversify beyond food by offering home delivery of DIY and home improvement products.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team