TODAY’S MAZE

Happy Tuesday! Elon Musk is taking compute to orbit. A massive merger between SpaceX and xAI aims to build data centers in space to bypass energy limits.

It’s a bold bet on solar-powered satellites to fuel future AI demands. But will off-planet infrastructure actually solve the on-ground power crisis?

In today’s MarketMaze focus:

SpaceX buys xAI

Saks leaves Amazon

FedEx debuts AI tools

TikTok’s older shopper surge

Walmart outpaces Amazon growth

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Elon Musk has officially acquired xAI through SpaceX, forming a $1.25 trillion entity dedicated to building solar-powered orbital data centers that bypass Earth's growing energy limitations.

SpaceX filed for FCC approval to launch up to one million satellites designed to function as orbital data centers, a move intended to process massive AI workloads without draining local power grids.

The deal values the combined "innovation engine" at approximately $1.25 trillion, merging Starlink’s connectivity infrastructure with the model training capabilities of xAI and the distribution reach of X.

Musk claims that harnessing near-constant solar energy in space will become the lowest cost way to generate compute within three years, eliminating the operational constraints of terrestrial facilities.

Why it matters: Off-planet infrastructure represents a radical pivot to solve the AI energy crisis, potentially ensuring that the backend compute powering future commerce tools remains scalable and affordable.

If off-planet data centers significantly lower AI compute costs, where do you expect the biggest impact on digital commerce in the next five years?

- 🛒 Price-Led Sellers (high-volume sellers using AI to compress margins further)

- 🧠 Brand-Led Sellers (brands investing in personalization and content at scale)

- 📦 Logistics Players (operators optimizing routing, forecasting, and automation)

- 📢 Marketing Services (agencies scaling creative, targeting, and testing)

- 🧰 Commerce Platforms (marketplaces and software providers embedding AI by default)

☝️ Vote to see results!

FROM OUR PARTNERS

The best marketing ideas come from marketers who live it.

That’s what this newsletter delivers.

The Marketing Millennials is a look inside what’s working right now for other marketers. No theory. No fluff. Just real insights and ideas you can actually use—from marketers who’ve been there, done that, and are sharing the playbook.

Every newsletter is written by Daniel Murray, a marketer obsessed with what goes into great marketing. Expect fresh takes, hot topics, and the kind of stuff you’ll want to steal for your next campaign.

Because marketing shouldn’t feel like guesswork. And you shouldn’t have to dig for the good stuff.

MAZE STORY

The Maze: Saks Global is winding down its Amazon storefront to refocus on its own digital channels. The split follows rising tensions after Amazon opposed the retailer's bankruptcy plans, signaling a strategic retreat from the marketplace model.

Amazon provided $475 million to help finalize the 2024 Neiman Marcus acquisition, an arrangement where Saks agreed to sell products via the tech giant's platform.

Sources indicate the marketplace concept saw limited brand participation, prompting the retailer to prioritize driving traffic directly to its proprietary e-commerce site where growth opportunities appear stronger.

Amazon argued the new financing proposals put its equity at risk, though the company maintains its broader luxury strategy remains intact despite the Saks exit.

Why it matters: This divorce underscores the inherent friction between exclusive luxury curation and mass-market platform scale. Brands often find that maintaining equity requires controlling the customer experience rather than delegating it to aggregators.

FROM OUR PARTNERS

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

MAZE STORY

The Maze: FedEx debut two new AI-powered tools, Tracking+ and Returns+, designed to let retailers keep customers within their own branded apps for delivery updates rather than redirecting them to third-party carrier sites.

Developed in collaboration with parcelLab, the white-labeled features embed directly into merchant channels to automate responses for common “Where is my order?” inquiries.

Keeping traffic on-site converts at over 3% while personalized return experiences drive three times more repeat purchases compared to generic carrier pages.

This push for retention comes as 2025-2026 holiday returns exceeded 10% globally, forcing merchants to prioritize the post-purchase experience to protect margins.

Why it matters: Logistics providers are evolving from simple movers into digital experience platforms that help brands own the customer relationship. Transforming the post-purchase phase from a cost center into a retention engine creates a critical competitive advantage.

DATA TREASURE

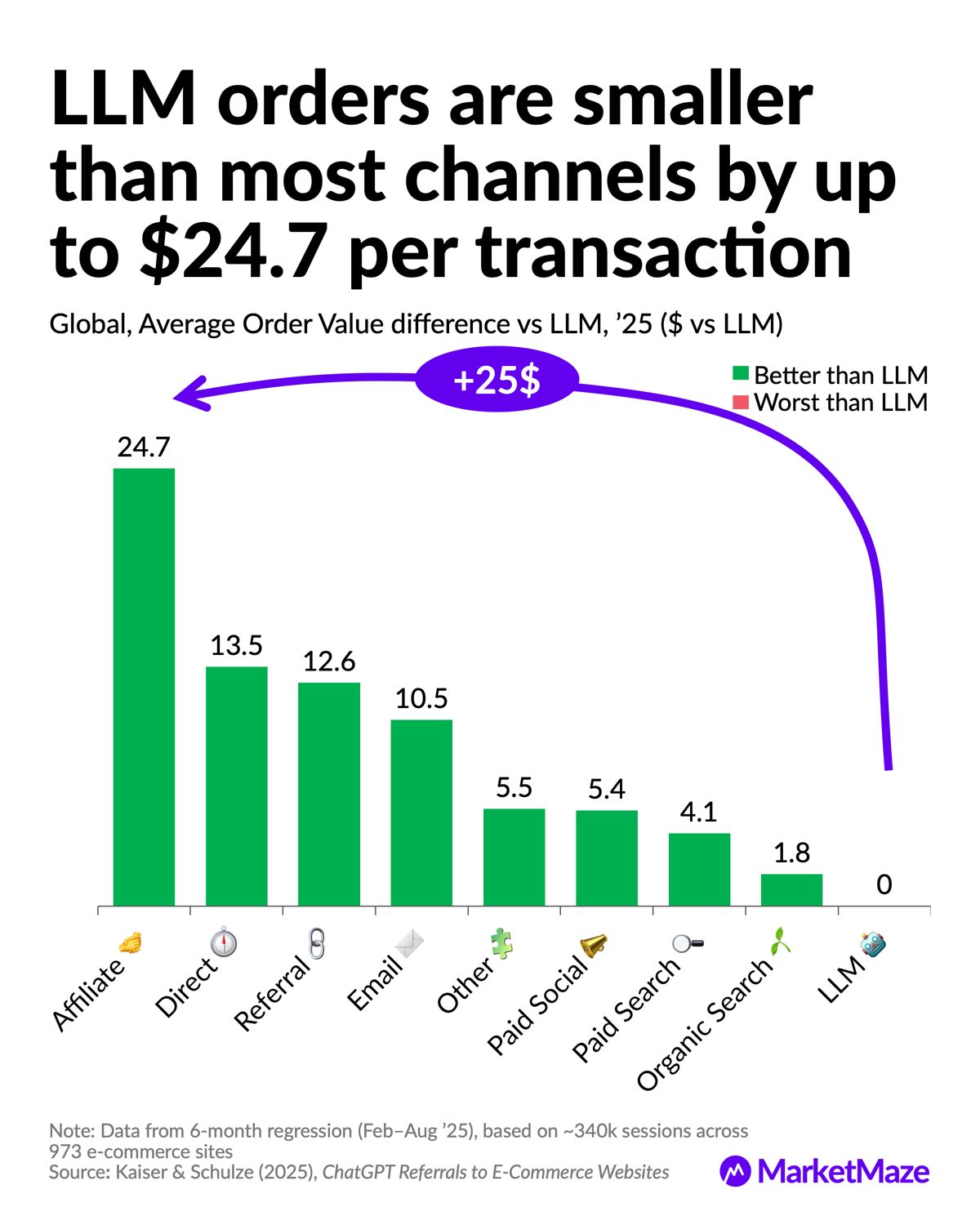

The Maze: LLM referrals reshape ecommerce traffic quality. A 6-month global regression across ~340k sessions shows AI traffic converts better than paid social, but underperforms intent channels on depth, spend, and exploration.

Conversion index vs LLM shows affiliate at 186%, paid search at 145%, email at 132%, while paid social collapses to 47%, confirming LLM beats interruption traffic but trails intent-led channels

AOV vs LLM reveals a sharp gap, with affiliate +$24.7, direct +$13.5, referral +$12.6, while LLM anchors at $0 and paid social barely clears +$5

Engagement metrics split sharply as LLM sessions are shorter, shallower, yet bounce less than most channels except paid and organic search

Why it matters: Ecommerce growth now depends on traffic quality, not volume. LLMs deliver efficient intent capture but weak monetization. Brands must design funnels where AI drives entry, and owned channels drive value.

DATA TREASURE

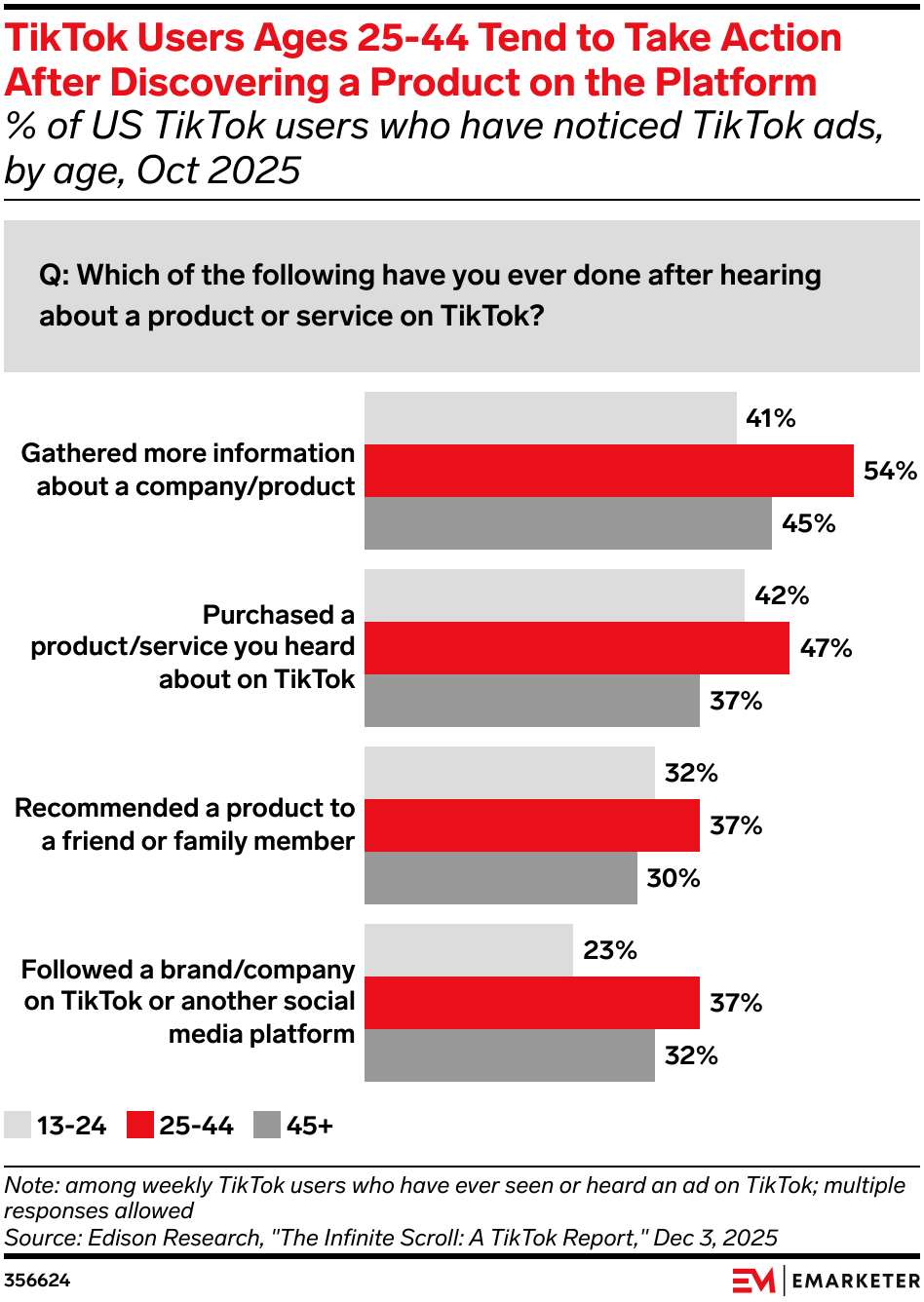

The Maze: TikTok is no longer a teen toy. Users aged 25–44 are the platform’s most powerful shoppers, moving from discovery to purchase at scale.

Over half of users 25–44 research products after TikTok exposure, and nearly half complete a purchase.

This group outperforms both younger and older users on buying, recommending, and following brands.

TikTok increasingly acts as a mid funnel engine, not just an awareness feed.

Why it matters: Ecommerce brands should treat TikTok like a performance channel for adults with money, not just a branding playground.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Amazon confirmed its 'Just Walk Out' tech will survive in third-party venues, relying on phone or card entry instead while dropping palm scanning.

🇺🇸 Walmart reported double-digit growth for its paid membership program in January, signaling the retailer is successfully chipping away at Prime's dominance.

🇺🇸 Amazon opened its advertising APIs to AI agents in a new beta, connecting LLMs like Claude and ChatGPT directly to ad workflows.

🇳🇱 Bol launched an external 3PL network, opening its fulfillment infrastructure to third-party logistics partners and moving beyond a closed ecosystem.

🌍 US & India struck a deal to slash reciprocal tariffs to 18%, potentially easing cross-border costs for merchants sourcing from or selling to India.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team