The Maze: LLM referrals reshape ecommerce traffic quality. A 6-month global regression across ~340k sessions shows AI traffic converts better than paid social, but underperforms intent channels on depth, spend, and exploration.

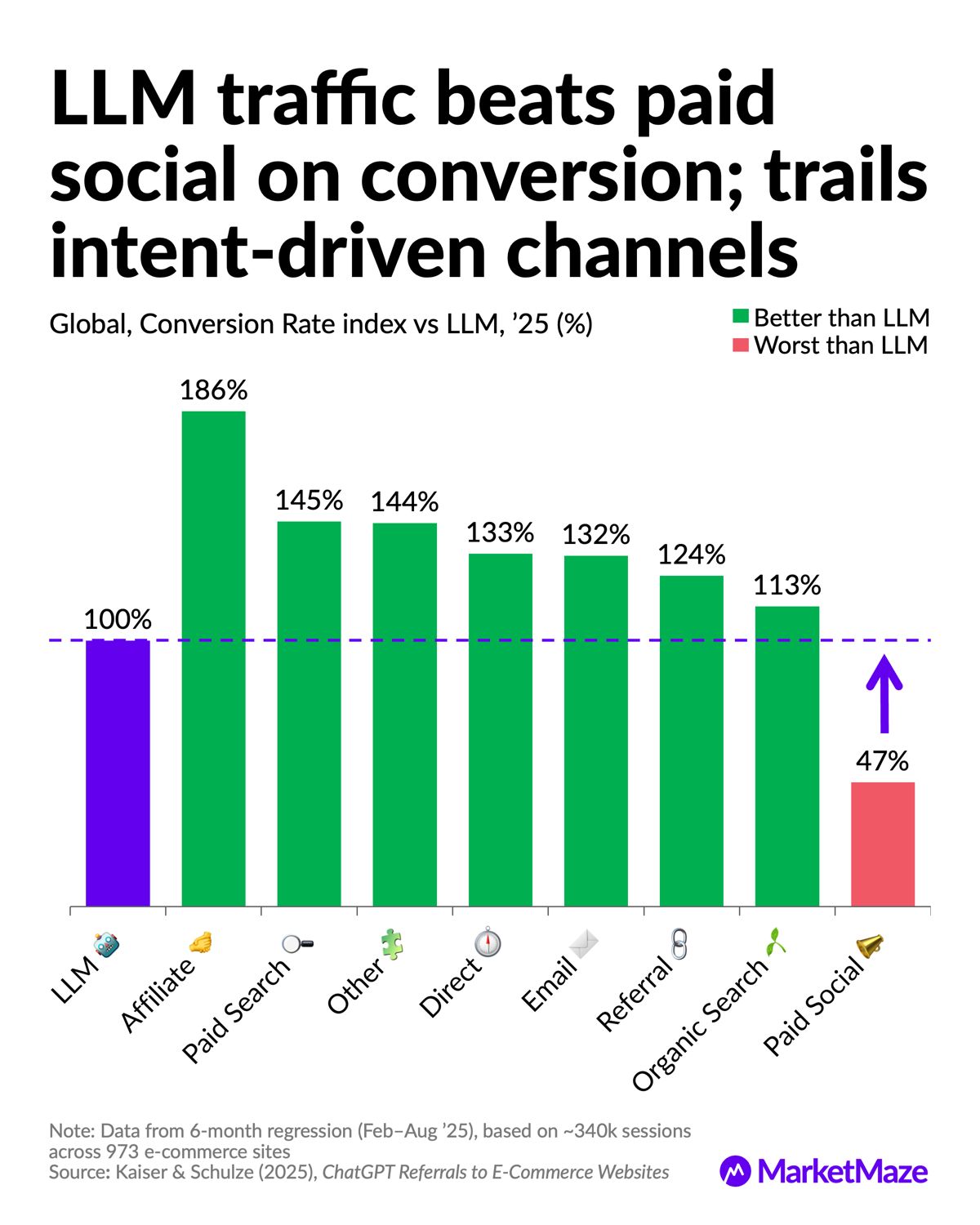

• Conversion index vs LLM shows affiliate at 186%, paid search at 145%, email at 132%, while paid social collapses to 47%, confirming LLM beats interruption traffic but trails intent-led channels

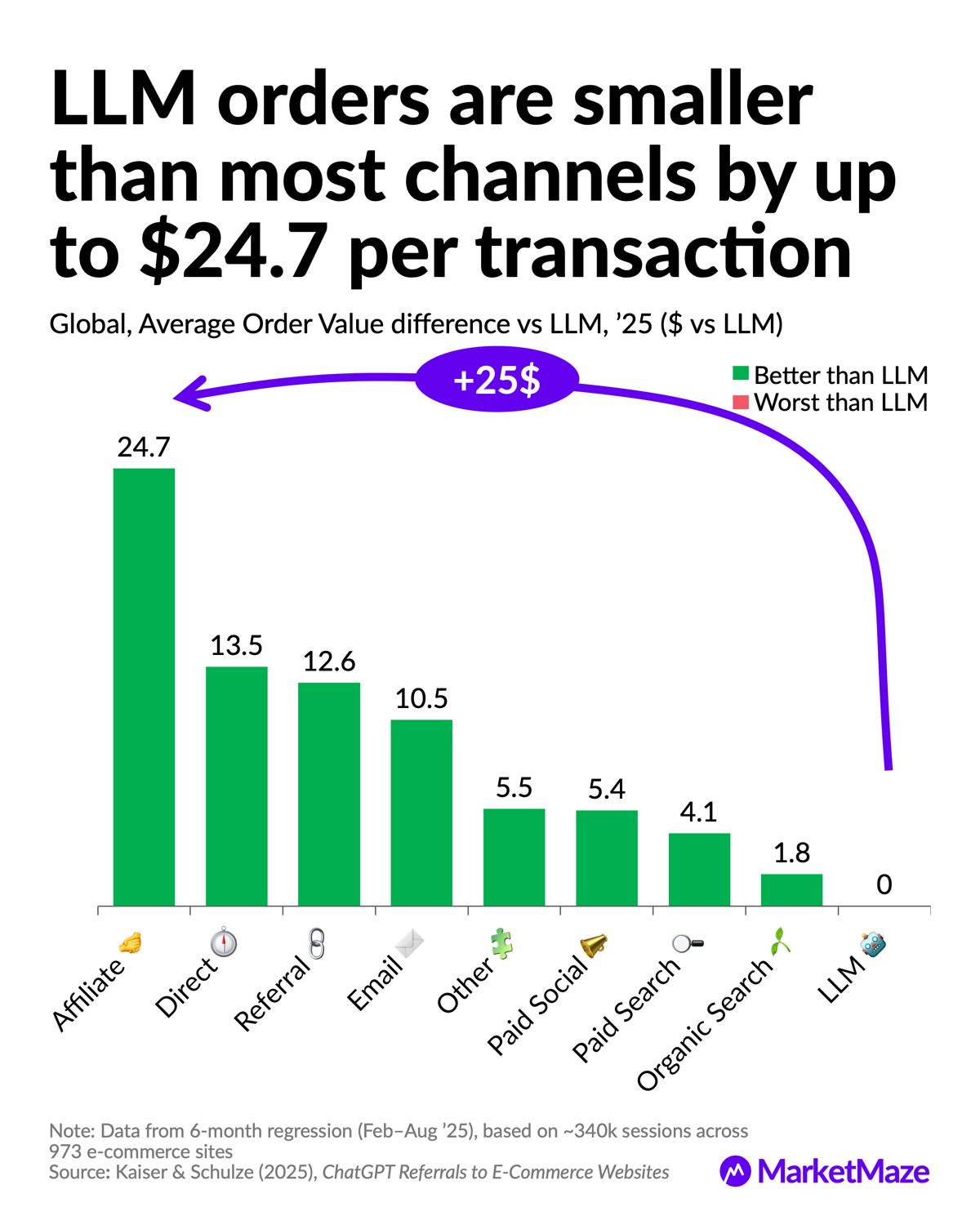

• AOV vs LLM reveals a sharp gap, with affiliate +$24.7, direct +$13.5, referral +$12.6, while LLM anchors at $0 and paid social barely clears +$5

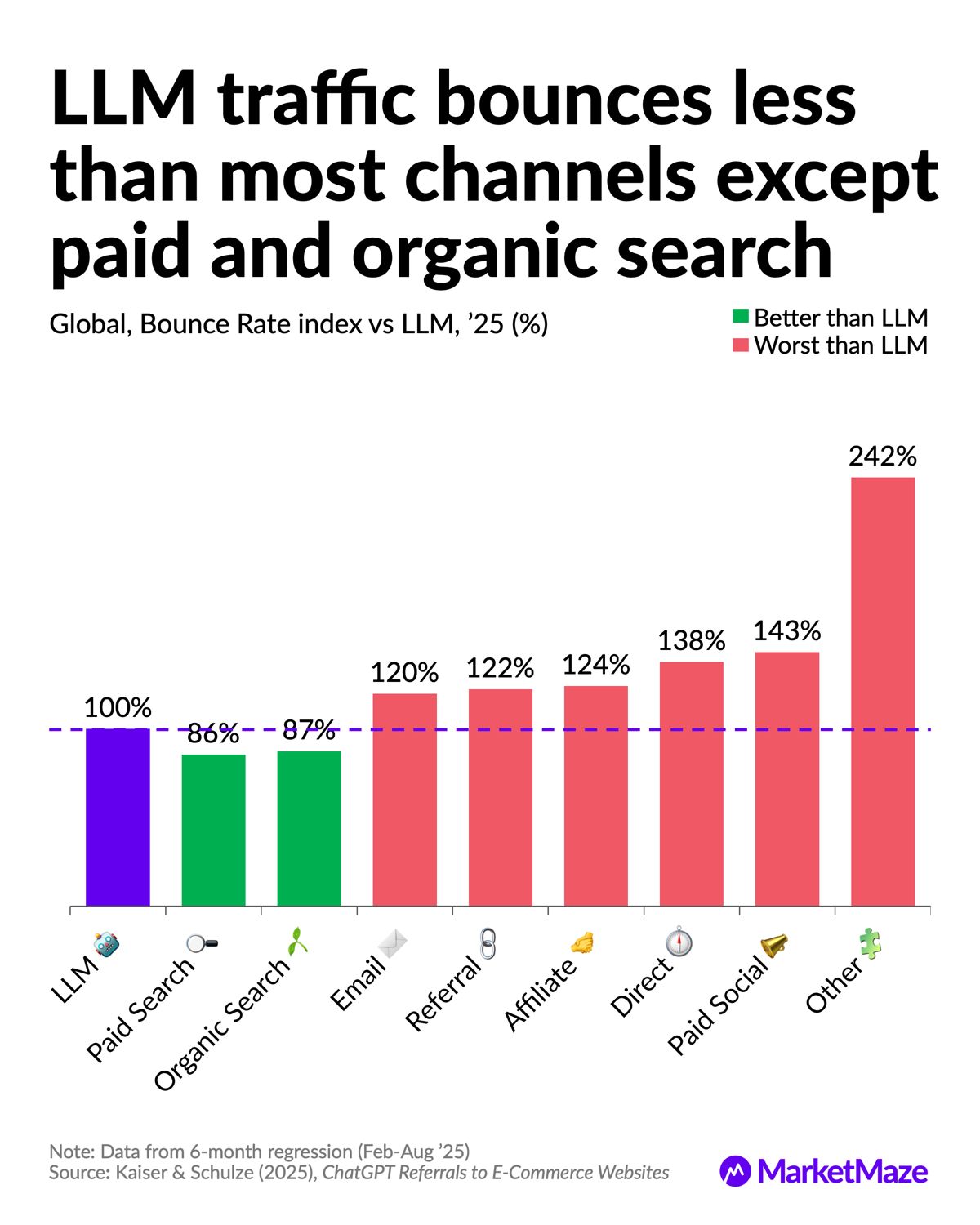

• Engagement metrics split sharply as LLM sessions are shorter, shallower, yet bounce less than most channels except paid and organic search

Why it matters: Ecommerce growth now depends on traffic quality, not volume. LLMs deliver efficient intent capture but weak monetization. Brands must design funnels where AI drives entry, and owned channels drive value.

🤖 Conversion Power

LLM beats paid social, trails intent channels

LLM traffic converts meaningfully better than paid social, but still lags channels rooted in explicit purchase intent. It sits in the middle of the funnel, strong enough to matter, not strong enough to dominate.

• Affiliate traffic converts at 186% of the LLM baseline, the strongest signal of deal-driven, bottom-funnel intent

• Paid search and email deliver 145% and 132% conversion indices, reflecting users actively seeking or returning to buy

• Paid social collapses to 47%, proving LLM referrals outperform interruption-based discovery despite lower depth

LLMs compress intent efficiently, but they do not replicate the commercial urgency of search or affiliate ecosystems. They are helpers, not closers.

💸 Order Size

Smaller baskets cap LLM value

Orders originating from LLMs are consistently smaller than almost every other channel. The gap is not marginal, it is structural.

• Affiliate-driven orders exceed LLM baskets by $24.7 per transaction, the largest delta in the dataset

• Direct and referral traffic deliver +$13.5 and +$12.6 respectively, showing brand familiarity drives spend

• Paid social barely outperforms LLMs on order size, reinforcing its weakness as a revenue channel

LLMs help users decide faster, but they do not encourage browsing, comparison, or upsell. Fewer decisions mean smaller carts.

🚪 Bounce Behavior

LLM traffic exits efficiently, not randomly

LLM sessions bounce less than most channels, a signal of relevance rather than stickiness. Only paid and organic search perform better.

• Paid search and organic search post bounce indices of 86% and 87% vs LLM, reflecting explicit intent

• Email, referral, and affiliate bounce 120% to 124% higher than LLM, despite longer sessions

• The residual “other” category explodes to 242%, highlighting how unfocused traffic collapses on arrival

Low bounce does not mean deep engagement. It means users found what they needed quickly and left.

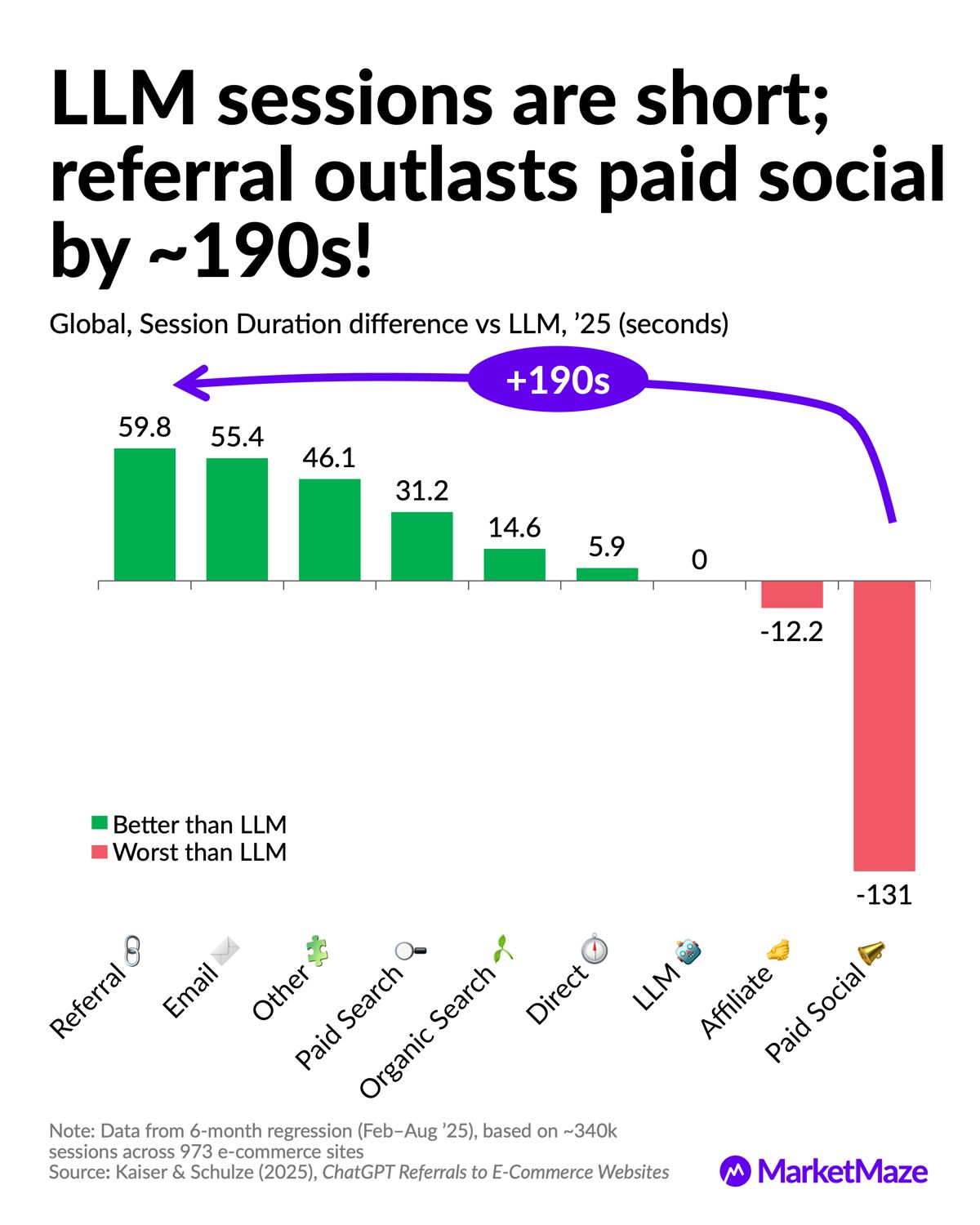

⏱️ Session Length

Referral outlasts paid social by ~190s

LLM sessions are short by design. They deliver answers, not journeys. Referral and email traffic behave very differently.

• Referral sessions last +59.8s vs LLM, email +55.4s, reflecting exploration and comparison behavior

• Paid social sessions end 131s faster than LLM, the weakest engagement profile in the dataset

• The gap between referral and paid social approaches 190s, underscoring the value of contextual discovery

LLMs optimize for speed. Human curiosity still lives elsewhere.

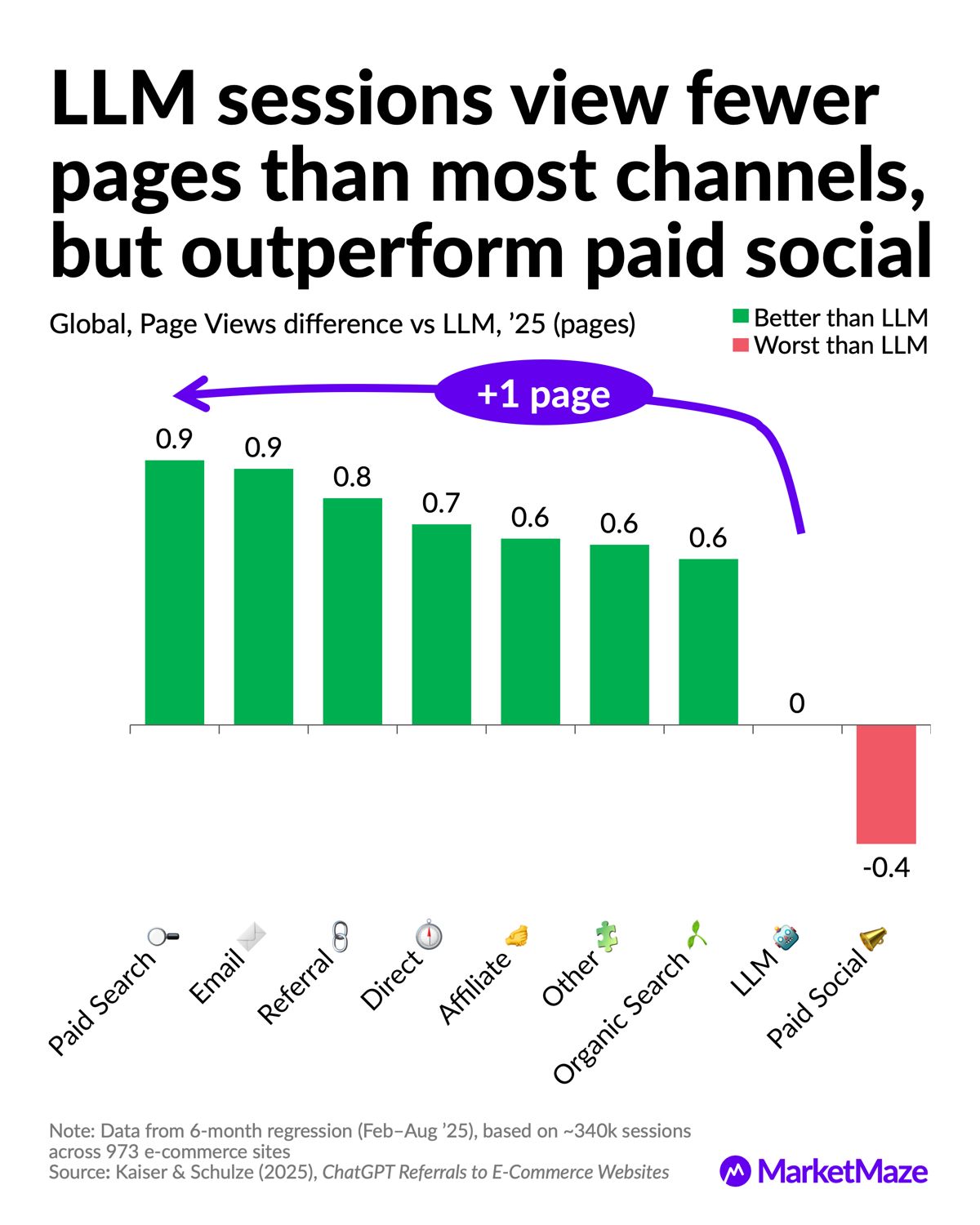

📄 Page Depth

Fewer pages, cleaner intent

LLM sessions view fewer pages than most channels, but still outperform paid social on depth. Precision replaces exploration.

• Paid search and email add ~0.9 pages per session vs LLM, driven by category and product hopping

• Referral and direct add 0.7 to 0.8 pages, consistent with evaluation behavior

• Paid social underperforms LLM by –0.4 pages, confirming its low-quality click dynamics

Page depth falls when answers improve. That is efficiency, not failure.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team