The Maze: Resale is no longer a side hustle. It is a global growth engine scaling from $197B to $317B by ’27, flipping margins from deep red to green as operators industrialise. Consumer behaviour shifts and brand adoption create a flywheel that pushes resale into the mainstream. The result is a category moving faster than traditional fashion and reshaping value flows.

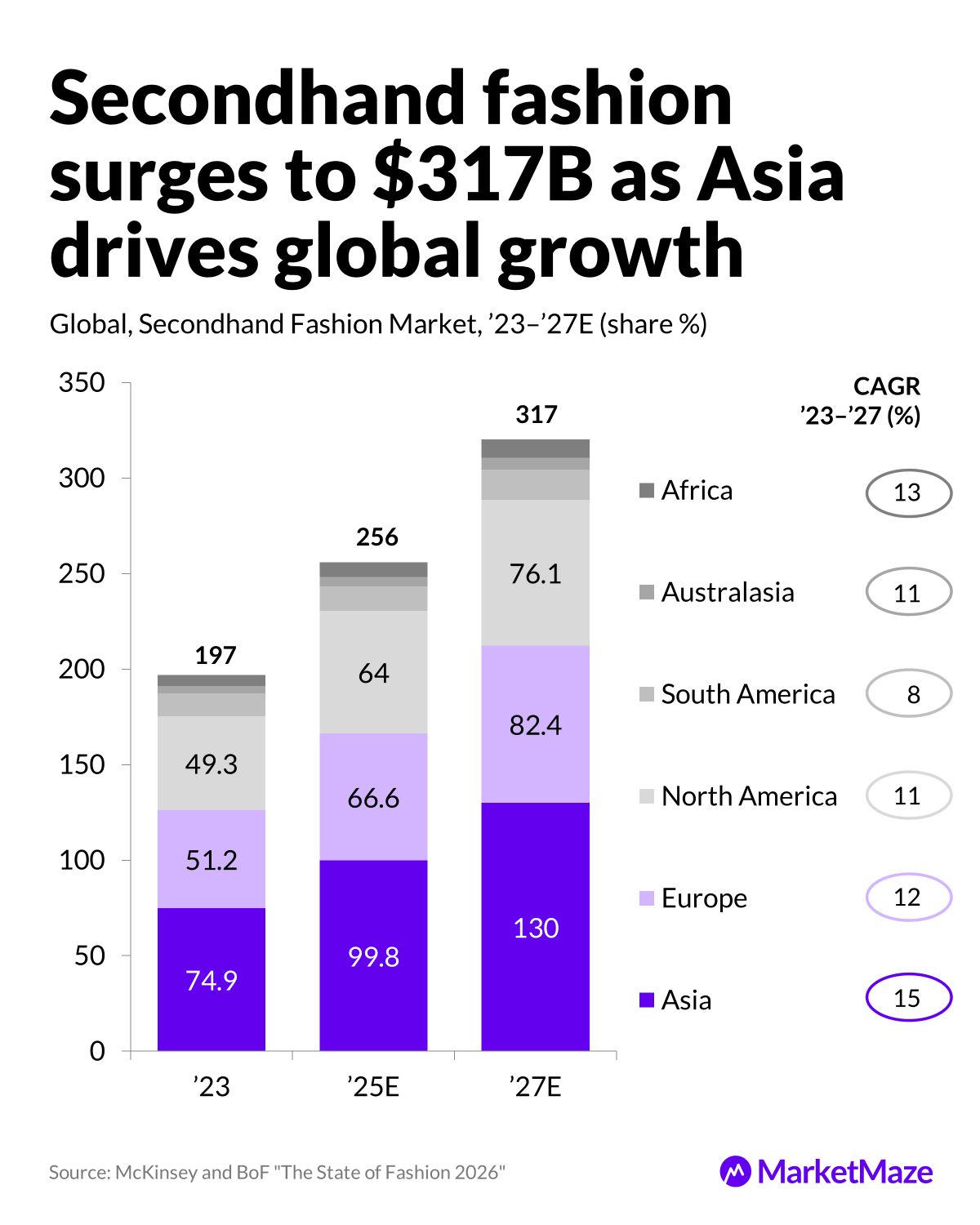

→ Secondhand fashion jumps from $197B in ’23 to $317B in ’27, with Asia lifting its share to 41% and North America holding near 25%, showing global demand widening fast.

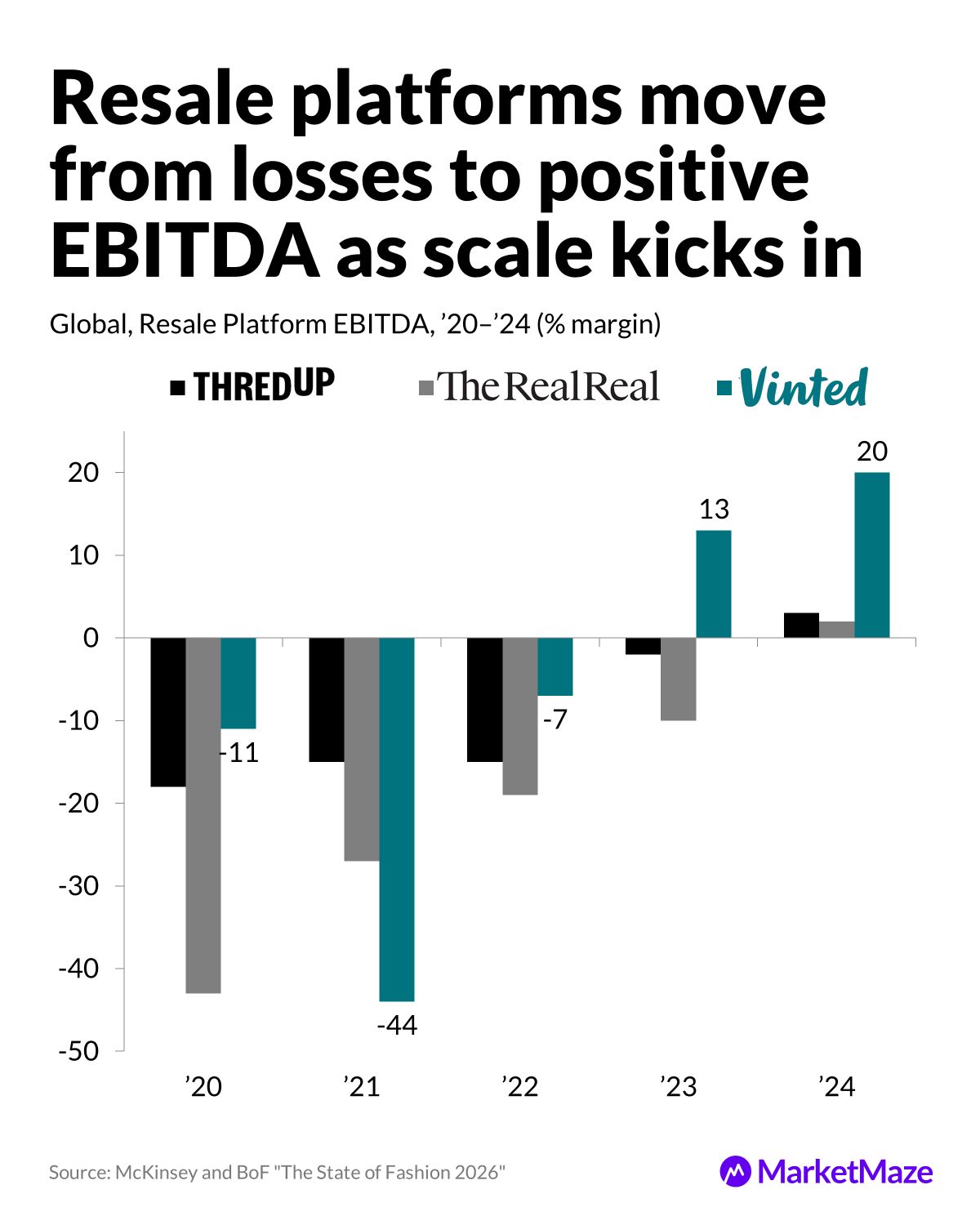

→ Resale platforms reverse years of losses as EBITDA margins swing from negative double digits in ’20 to 13% for ThredUp and 20% for Vinted in ’24, proving scale economics kick in.

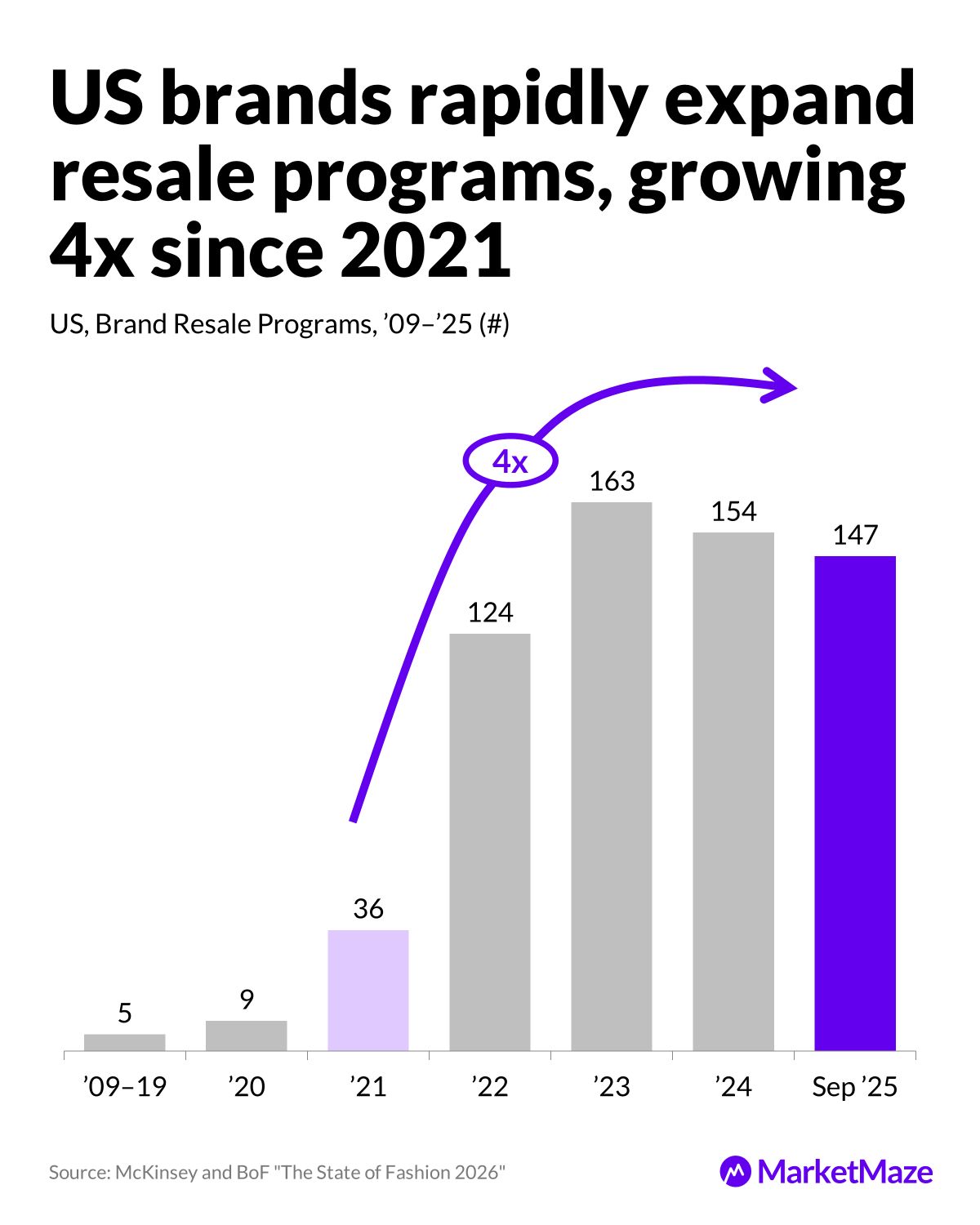

→ US brands expand resale programs from 36 in ’21 to 147 by Sep ’25, a 4x jump that signals institutional adoption and new customer acquisition pressure.

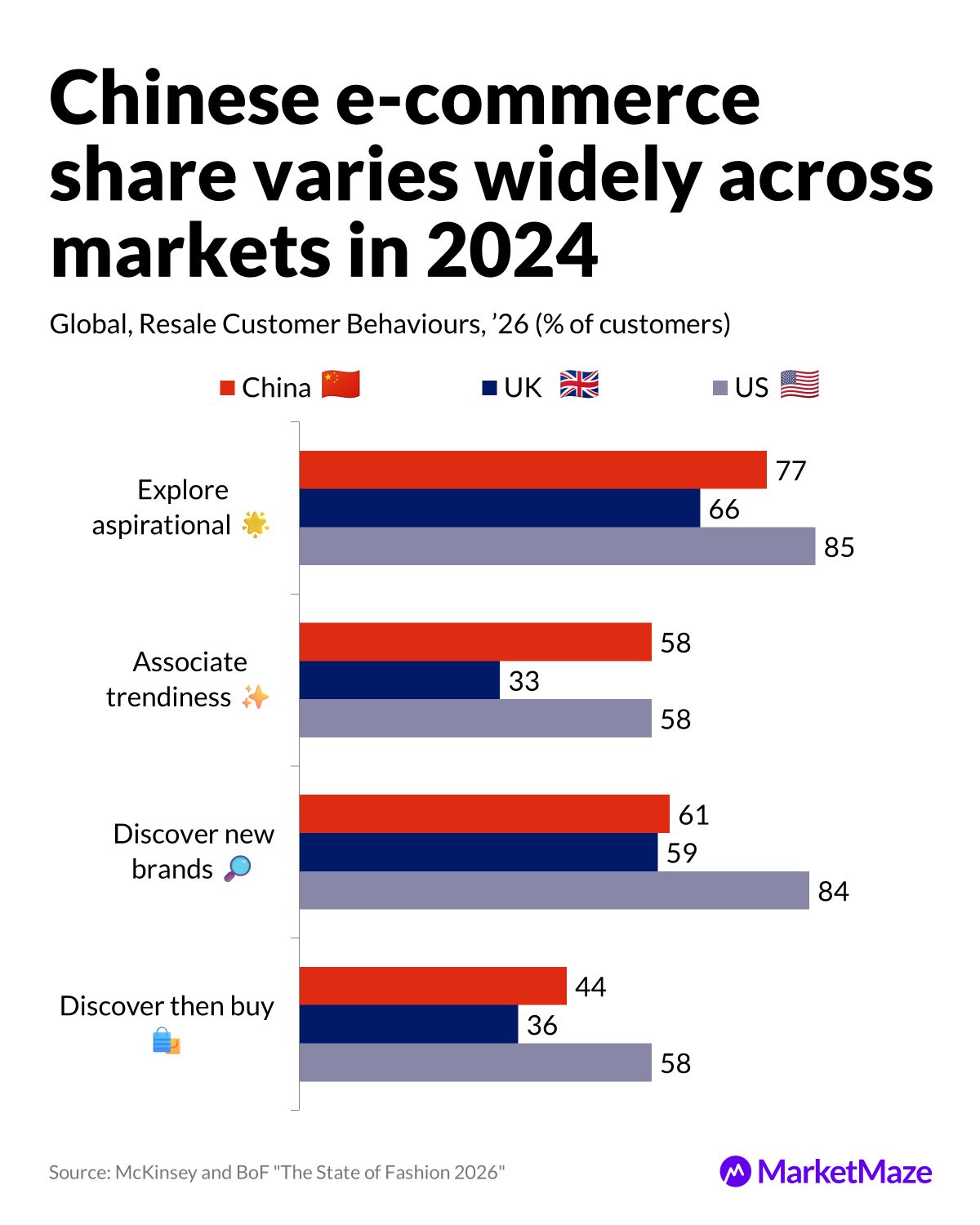

→ Consumers in the US, UK and China use resale to explore aspirational brands, with rates ranging from 66% to 85%, turning resale into a discovery funnel.

Why it matters: Resale is becoming a strategic channel, not an afterthought. Platforms unlock profit with automation and logistics scale while brands capture new customers and extend product life. Consumers reward value and sustainability as economic uncertainty reshapes behaviour, reinforcing resale as a durable part of the commerce stack.

📈 Global Growth

Secondhand fashion market surges to $317B

Resale rockets ahead as the fastest growing part of fashion, adding $120B between ’23 and ’27 while Asia becomes the largest engine. This shift shows consumers trading down but not trading off, choosing value, sustainability and brand access.

→ Asia’s share rises from 38% to 41% by ’27 as disposable income and digital resale adoption accelerate.

→ North America stays steady at roughly 25% while Europe holds at 26%, proving resilience in mature markets.

→ CAGR ranges from 8% in South America to 15% in Asia, showing uneven but strong multi-regional lift.

Resale’s expansion changes who controls fashion demand and how product value compounds over multiple owners, setting the stage for platform consolidation and brand integration.

💰 Profit Shift

Resale platforms flip EBITDA into positive territory

After years of losses, major players finally break through. ThredUp and RealReal cut operating drag while Vinted rides scale to 20% margins. This marks a turning point for a category long accused of being structurally unprofitable.

→ ThredUp climbs from a -18% margin in ’20 to 13% in ’24 as automation and logistics efficiency expand.

→ RealReal moves from -43% in ’20 to 2% in ’24, a dramatic recovery driven by authentication improvements.

→ Vinted posts the strongest swing, rising from -11% in ’20 to 20% in ’24 as volumes surge and fixed costs dilute.

Profitability unlocks strategic optionality, allowing platforms to reinvest in data, AI and logistics that widen the moat against smaller resale operators.

🏷️ Brand Adoption

US brand resale programs grow 4x since 2021

Brand participation jumps as resale matures from a consumer behaviour to a corporate strategy. The number of programs surges from 36 in ’21 to 147 by Sep ’25. Brands now see resale as customer acquisition, margin expansion and circularity compliance.

→ Programs rise from 36 in ’21 to 124 in ’22 and peak at 163 in ’23 before stabilising at 147 in ’25.

→ Growth since ’21 represents a 4x increase, showing rapid institutional adoption across categories.

→ Retailers use resale to reach younger shoppers at lower price points, reducing dependency on promotions.

This shift turns resale into a brand-controlled channel rather than a pure marketplace play, setting up battles for ownership of the second product lifecycle.

🌏 Consumer Behaviour

Resale habits vary sharply across US, UK and China

Consumers now treat resale as discovery, aspiration and price access. But behaviour differs by market, reshaping how platforms customise strategy.

→ US consumers lead in aspiration with 85% using resale to explore high-end brands versus 66% in the UK and 77% in China.

→ Using resale to discover new brands hits 84% in the US, far ahead of the UK’s 59% and China’s 61%.

→ China and the US tie at 58% associating resale with trendiness, while the UK lags at 33%.

Resale is becoming the new top of the funnel, shifting influence from advertising to product circulation, with brands needing to rethink how discovery happens.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team