Geo: Global

Area: Mass

Type: Market

Theme: Commercial

🌀 Key points

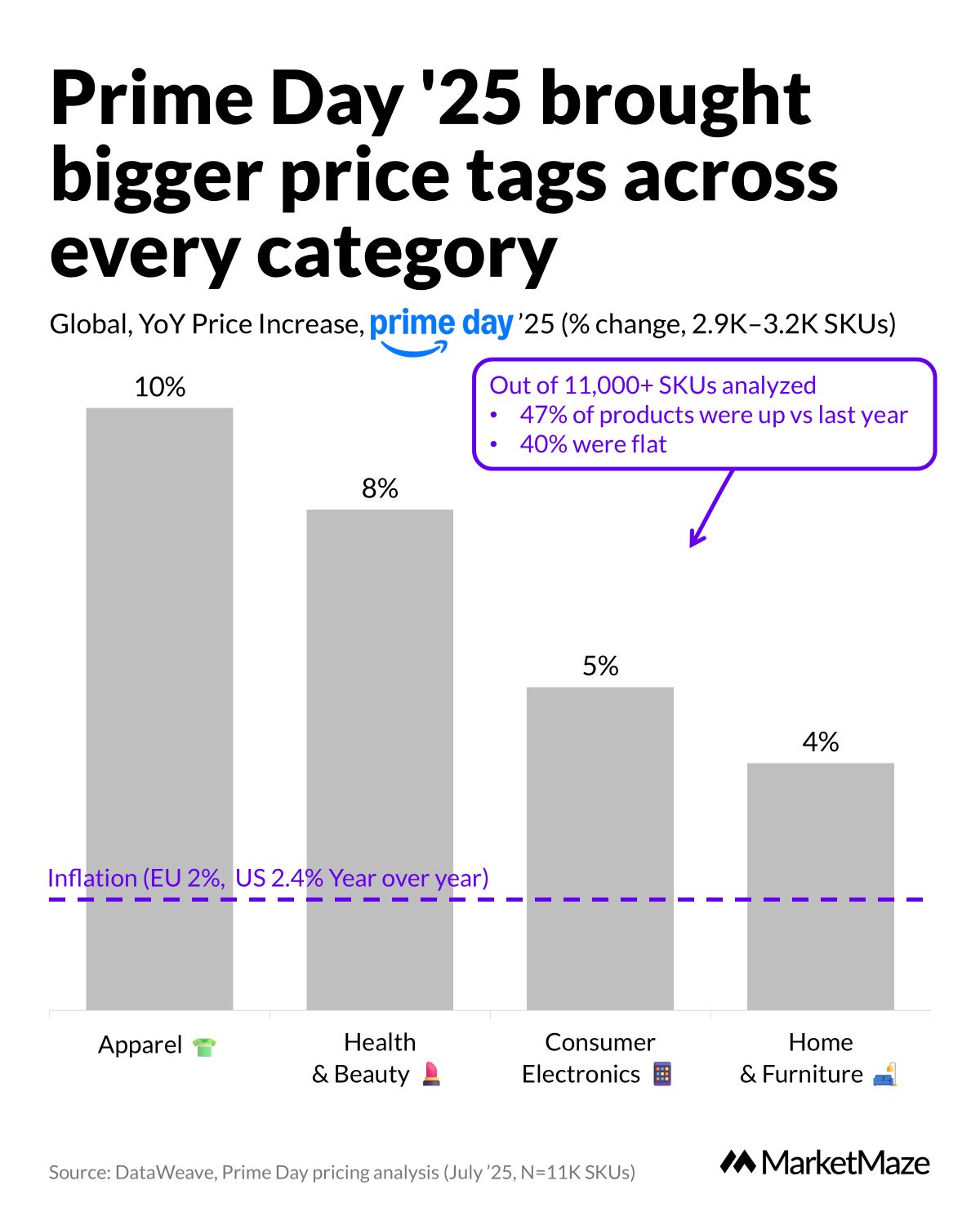

47% of SKUs had higher prices YoY during Prime Day

Apparel saw the largest spike: +10% vs 2024

All categories grew faster than inflation benchmarks

💎 Data Gem

Prime Day used to mean big savings. In 2025, it meant bigger price tags. The only thing growing faster than Amazon's deals? The prices behind them.

🗺️ What’s the Maze?

DataWeave’s deep dive into 11,000+ global SKUs reveals a pattern that can’t be ignored:

47% of products were more expensive than they were during Prime Day 2024

40% held steady

Only 13% got cheaper

Across four major categories, here’s how prices shifted YoY:

Apparel: +9.5%

Health & Beauty: +7.9%

Consumer Electronics: +5.1%

Home & Furniture: +3.9%

For comparison, inflation during the same period was 2% in the EU and 2.4% in the U.S.—meaning Prime Day pricing outpaced inflation across all verticals.

In some categories, like Home & Furniture, over half the SKUs were priced higher than last year. This wasn't just a few outliers—it was systemic.

The takeaway? Prime Day 2025 was less about competing on price, more about protecting margins.

🏁 Why It Matters?

This is a reality check for both consumers and retailers:

Rising cost pressure: Supply chains aren’t fully healed. Retailers are passing on higher logistics and manufacturing costs to customers

Discounts in disguise: Many “deals” were relative to inflated base prices, not true markdowns from last year

Value erosion: As prices rise faster than wages or inflation, shoppers may skip impulse buys and focus on essentials

Consumers are learning to read between the lines. A 10% rise in apparel pricing means that even with a 20% “discount,” you're paying about the same—or more—than last year.

For Amazon, this signals a shift: Prime Day is no longer just about loyalty or volume. It's a pricing power test. Can Amazon still move product, even when prices go up?

Answer: Maybe. But don’t be surprised if next year’s strategy leans harder on membership perks and exclusive bundles instead of blanket price cuts.

🎓 Found this insightful?

📩 Get free weekly news and insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports with detailed sources and links

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

📖 Data Source

Name: Only for MarketMaze+ subscribers

Publish date: Only for MarketMaze+ subscribers

Region: Only for MarketMaze+ subscribers

Method: Only for MarketMaze+ subscribers

Link to source: Only for MarketMaze+ subscribers

See raw data from the chart below 👇 ((Only for MarketMaze+ subscribers)

Subscribe to MarketMaze+ to read the rest.

Become a paying subscriber to get access to all insights with sources and other subscriber-only content.

Try it now