The Maze: Polish logistics loyalty climbed for a decade, then snapped to a record high in 2025. The data tracks Net Promoter Score, client mix, service quality, and complexity across 2014–2025. Together, they show execution beating volatility at last.

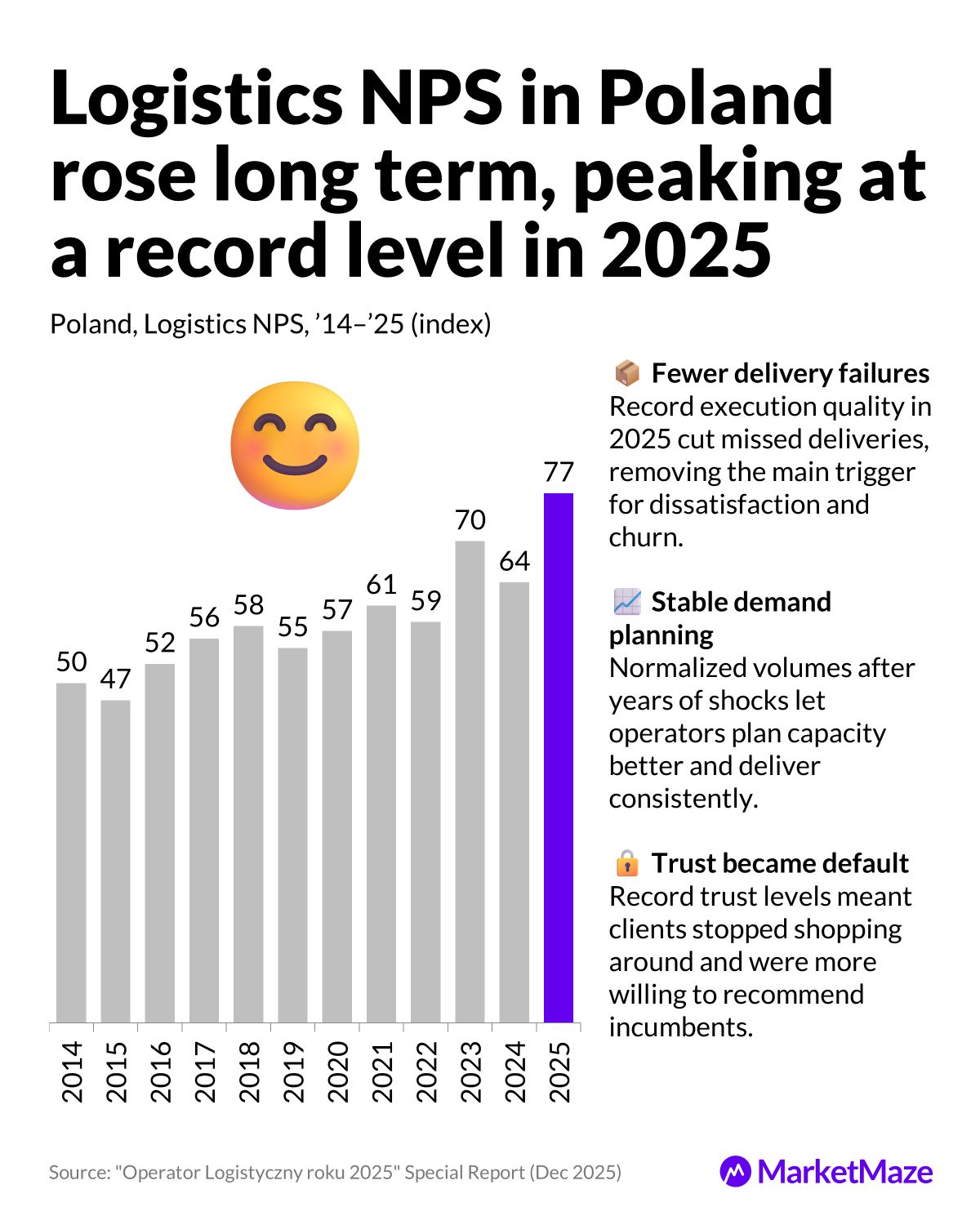

NPS (Net promoter score) rose from 50 in ’14 to 77 in ’25, despite sharp dips during demand shocks in ’15 and ’19–’22

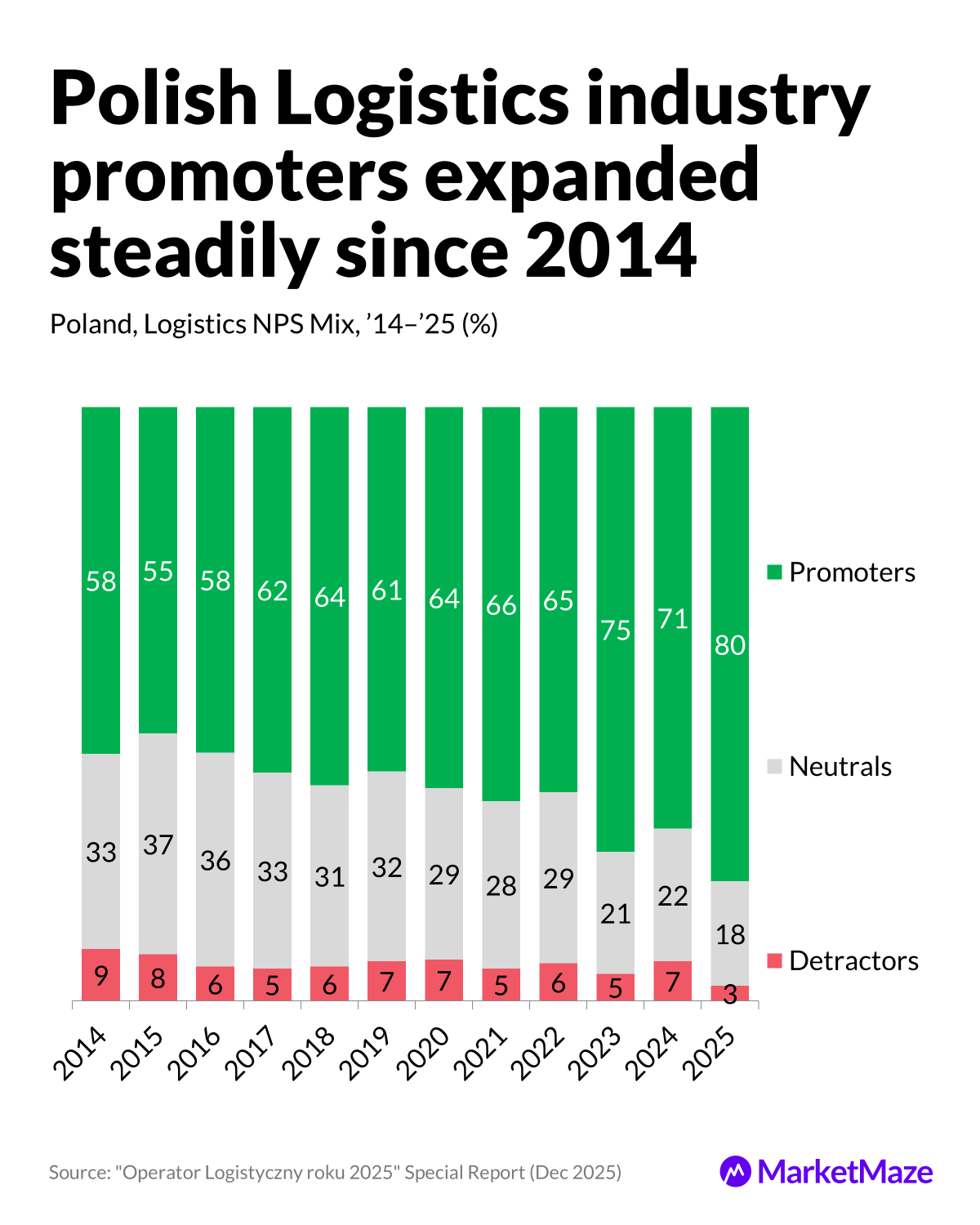

Promoters expanded from 58% to 80%, while detractors fell from 9% to just 3% by ’25

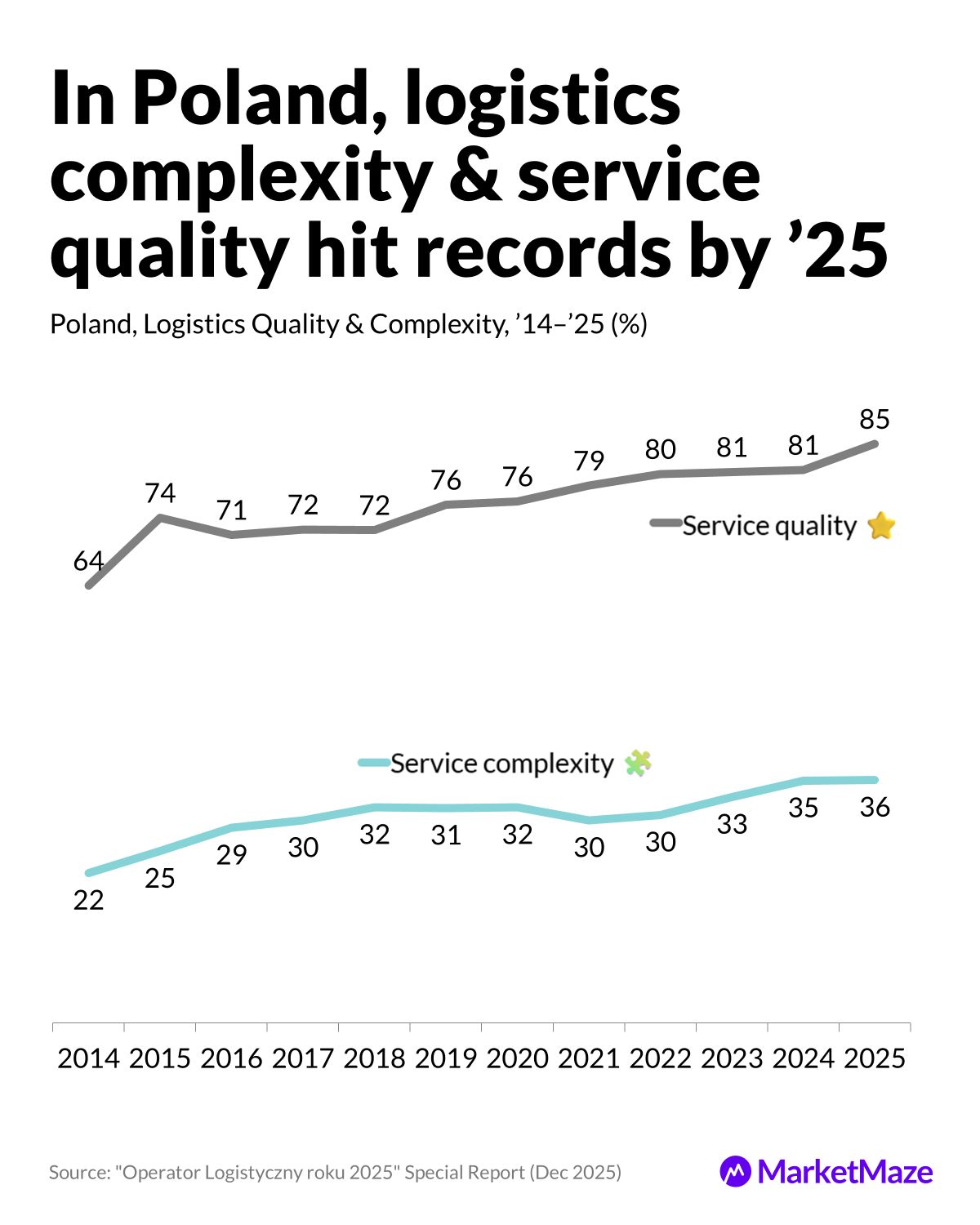

Service quality climbed from 64% to 85%, even as service complexity rose from 22% to 36%

Why it matters: Ecommerce depends on reliability, not promises. As failures dropped and trust hardened, shippers stopped switching providers. Loyalty became structural, not cyclical, giving logistics leaders pricing power and stickier ecommerce contracts.b as wide premiums risk losing price sensitive customers and search visibility.

😊 NPS Climb

Loyalty reached an all-time high

Polish logistics loyalty did not rise in a straight line. It survived demand shocks, execution stress, and rising expectations, then broke out in 2025 when failures finally became rare.

→ NPS moved from 50 in ’14 to 58 in ’17, slipped during volatility, then surged to 77 in ’25

→ The sharpest jump came after ’22, when normalized volumes restored delivery reliability

→ By ’25, NPS exceeded all prior peaks, including pre-pandemic highs

The takeaway is simple. Loyalty followed execution, not marketing. Once operators delivered consistently again, recommendations snapped back fast.

📊 Promoter Shift

More fans, fewer critics

The NPS mix tells the real story behind the headline number. Promoters steadily replaced neutrals and detractors over the decade.

→ Promoters grew from 58% in ’14 to 80% in ’25, a +22 p.p. structural shift

→ Neutrals fell from 33% to 18%, signaling less indecision among clients

→ Detractors dropped from 9% to 3%, removing the main drag on NPS

This matters because churn lives in the middle. Once neutrals disappeared, loyalty gains accelerated instead of inching forward.

⭐ Quality Wins

Better service, despite more complexity

Polish logistics did something rare. It improved service quality while adding complexity across transport, warehousing, courier, and contract logistics.

→ Service quality rose from 64% in ’14 to 85% in ’25, the highest level recorded

→ Service complexity increased from 22% to 36% as operators added more integrated services

→ The gap between complexity and quality narrowed, proving systems scaled faster than demand

This is the quiet win. Complexity usually breaks operations. Here, it strengthened client relationships instead.

🏆 Trusted Five

The Maze: Among business clients in Poland, trust is concentrating fast. In 2025, a small group of operators pulled clearly ahead in perceived reliability and advocacy. The ranking shows who converted execution into loyalty, not who made the loudest promises.

→ #1 Transport TVM, #2 GLS, #3 DHL Supply Chain led the business-client trust ranking, followed by ANITA (#4) and DHL Global Forwarding (#5).

→ NPS among the Trusted Five stayed consistently above 70%, signaling strong advocacy and low churn across key accounts.

→ Transport TVM topped the group with the highest NPS at 87%, ahead of GLS (71%) and DHL Supply Chain (67%), driven by execution discipline rather than scale.

Why it matters: In B2B logistics, trust compounds. Once NPS moves above 70%, clients stop benchmarking alternatives and default to incumbents. The leaders here show that predictable delivery and operational control now matter more than brand size or network breadth.

🔧 Top Three Moves

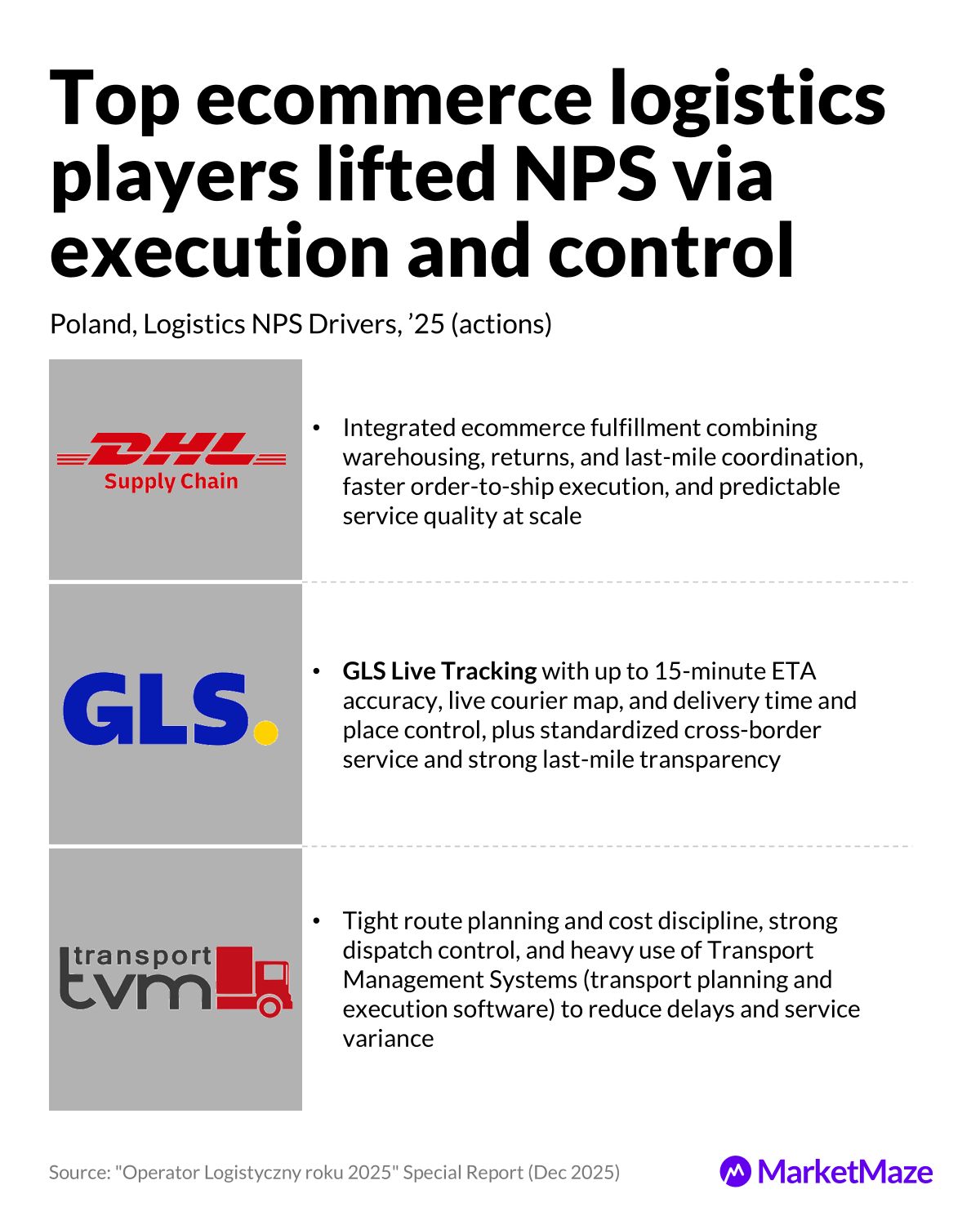

How leaders earned client advocacy

The top three didn’t win on marketing. They won by fixing the hard parts of logistics that clients feel every day, especially under ecommerce pressure.

→ Transport TVM invested in route planning, cost discipline, and transport management systems, keeping service reliable even as margins tightened.

→ GLS focused on customer control, with real-time tracking, flexible delivery options, and standardized service across its international network.

→ DHL Supply Chain built integrated ecommerce fulfillment, combining warehousing, returns, and last-mile coordination into one predictable operating model.

The common thread is operational credibility. As complexity rises, clients reward partners who absorb it quietly. In Poland’s ecommerce logistics market, trust is now built in the warehouse and on the road, not in the pitch deck.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team