The Maze: The new data tracks receipts in Poland across major marketplaces and compares users who do and do not shop on Shein, Temu or AliExpress. The patterns reveal sharp splits in spend, habits and loyalty.

Chinese-platform users buy almost twice as often and spend nearly twice as much, but they do it through small, low-value baskets. This creates a high-volume, low-margin shopping pattern.

Their category mix skews toward practical, low-cost items, while non-Chinese shoppers put more money into lifestyle segments like fashion, kids, and supermarkets.

Allegro keeps strong loyalty from local-only shoppers, but Chinese-platform users spread their spend across Shein, Temu, and AliExpress, diluting domestic share.

Why it matters: The two shopper groups follow different online economies that influence logistics, loyalty and retail media performance. Volume-driven buyers tilt toward small, cheap and frequent purchases while local-only shoppers drive higher basket values. Understanding these splits helps brands predict lifetime value, ad returns and product mix.

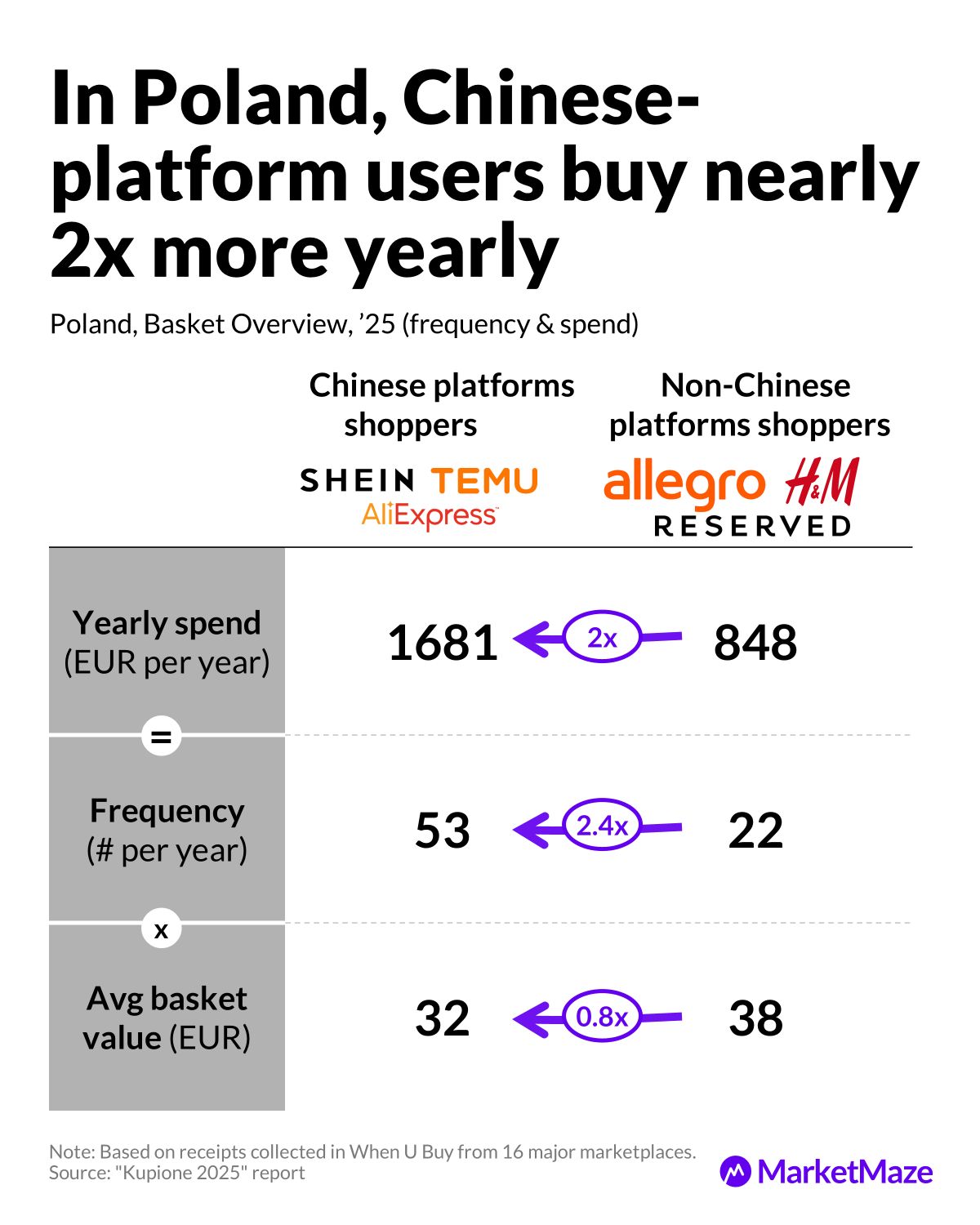

🛒 Spend Gap

Chinese shoppers nearly double yearly spend

Chinese-platform shoppers generate higher volume, buying more often and doubling annual outlay. Their smaller basket signals a habit built on constant repeat orders rather than big purchases.

→ Yearly spend hits 1681 EUR vs 848 EUR, almost 2x.

→ Frequency reaches 53 yearly orders vs 22.

→ Basket value drops to 32 EUR vs 38 EUR.

The pattern drives demand for faster delivery, tighter promo cycles and constant engagement. Local-only shoppers deliver better margin per order, but Chinese-platform users fuel the daily traffic that shapes marketplace economics.

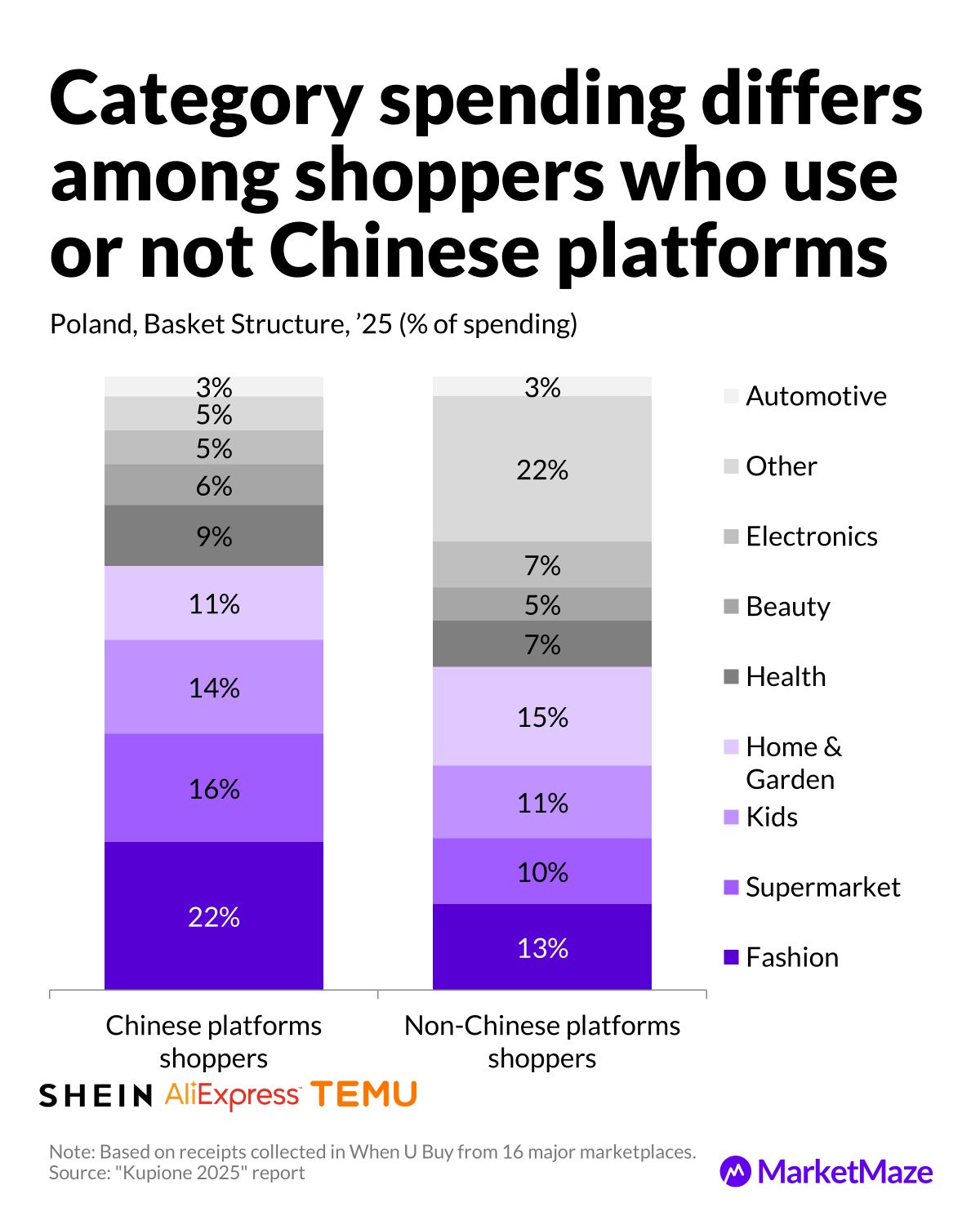

📦 Basket Mix

Category splits show different priorities

Spend allocation reveals how differently each group shops. Chinese-platform users hunt deals and utility items, while lifestyle and fashion categories dominate among non-Chinese shoppers.

→ Other hits 22% among Chinese-platform users vs 5%.

→ Home & Garden reaches 15% vs 11%.

→ Fashion jumps to 22% among non-Chinese shoppers vs 13%.

Two missions emerge: practical low-cost shopping vs style-driven, home-oriented buying. Merchants must tailor their pricing and messaging for each shopper type.

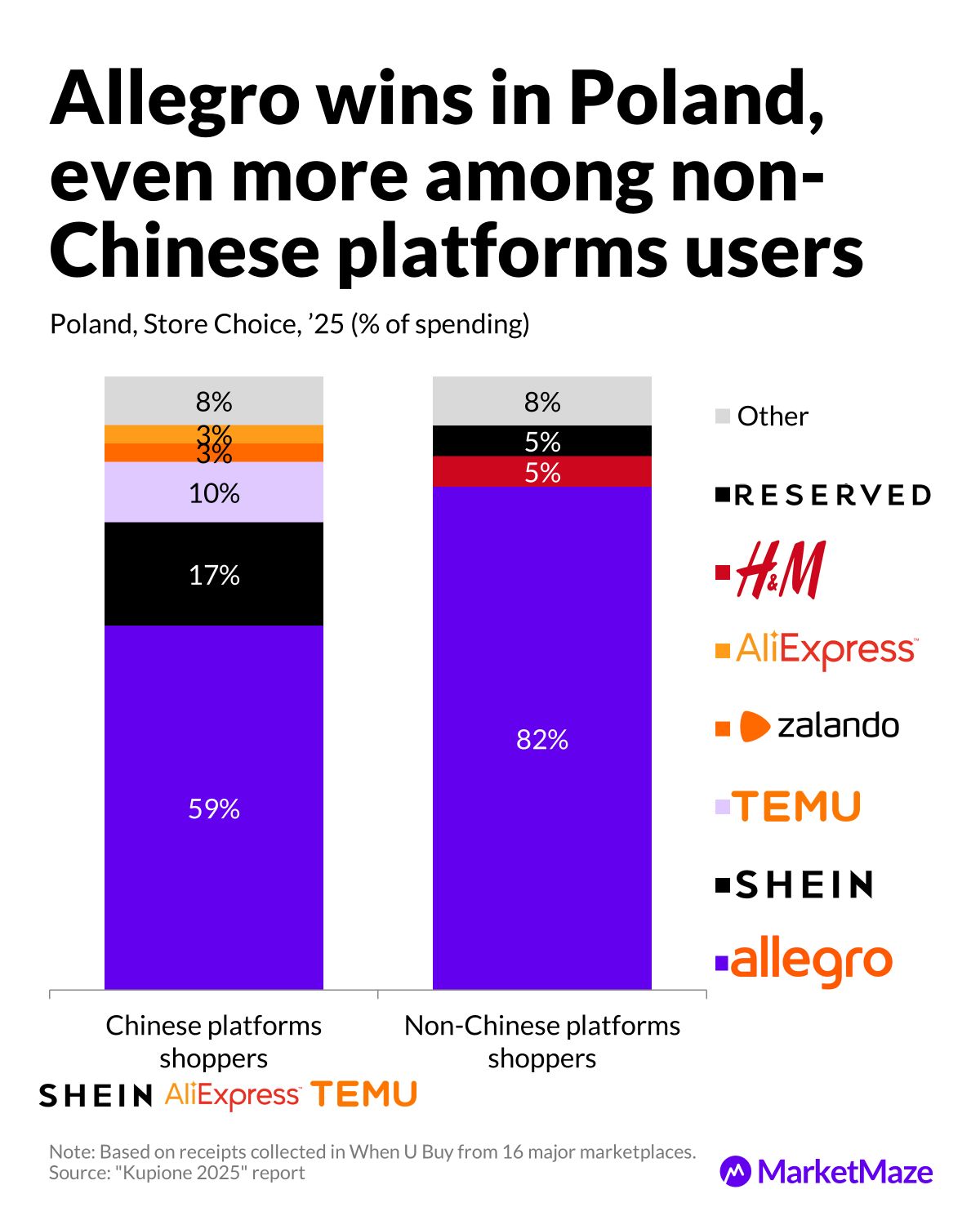

🏬 Store Choice

Allegro wins stronger loyalty from locals

Allegro remains Poland’s ecommerce anchor, but Chinese-platform shoppers spread their spend across global rivals. Loyalty splits sharply between ecosystems.

→ Allegro hits 82% among non-Chinese shoppers vs 59% among Chinese-platform users.

→ Shein captures 17% among Chinese-platform users vs 5% of locals.

→ Temu + AliExpress exceed 13% among Chinese-platform buyers.

Global low-cost imports dilute domestic loyalty. Allegro stays dominant, but its strongest commitment comes from shoppers avoiding Chinese platforms.

👟 Category Shape

Low-value goods dominate Chinese shoppers

Spending structure confirms that Chinese-platform users focus on small, functional items while non-Chinese shoppers anchor their spend in fashion and supermarkets.

→ Fashion climbs to 22% among non-Chinese shoppers vs 13% among Chinese-platform users.

→ Kids holds 11% among non-Chinese users vs 10% among Chinese-platform shoppers.

→ Electronics hits 7% among Chinese-platform users vs 5%.

The groups run on different cycles: rapid, low-value orders vs curated, lifestyle-focused baskets. Each model creates different unit economics and marketing returns.

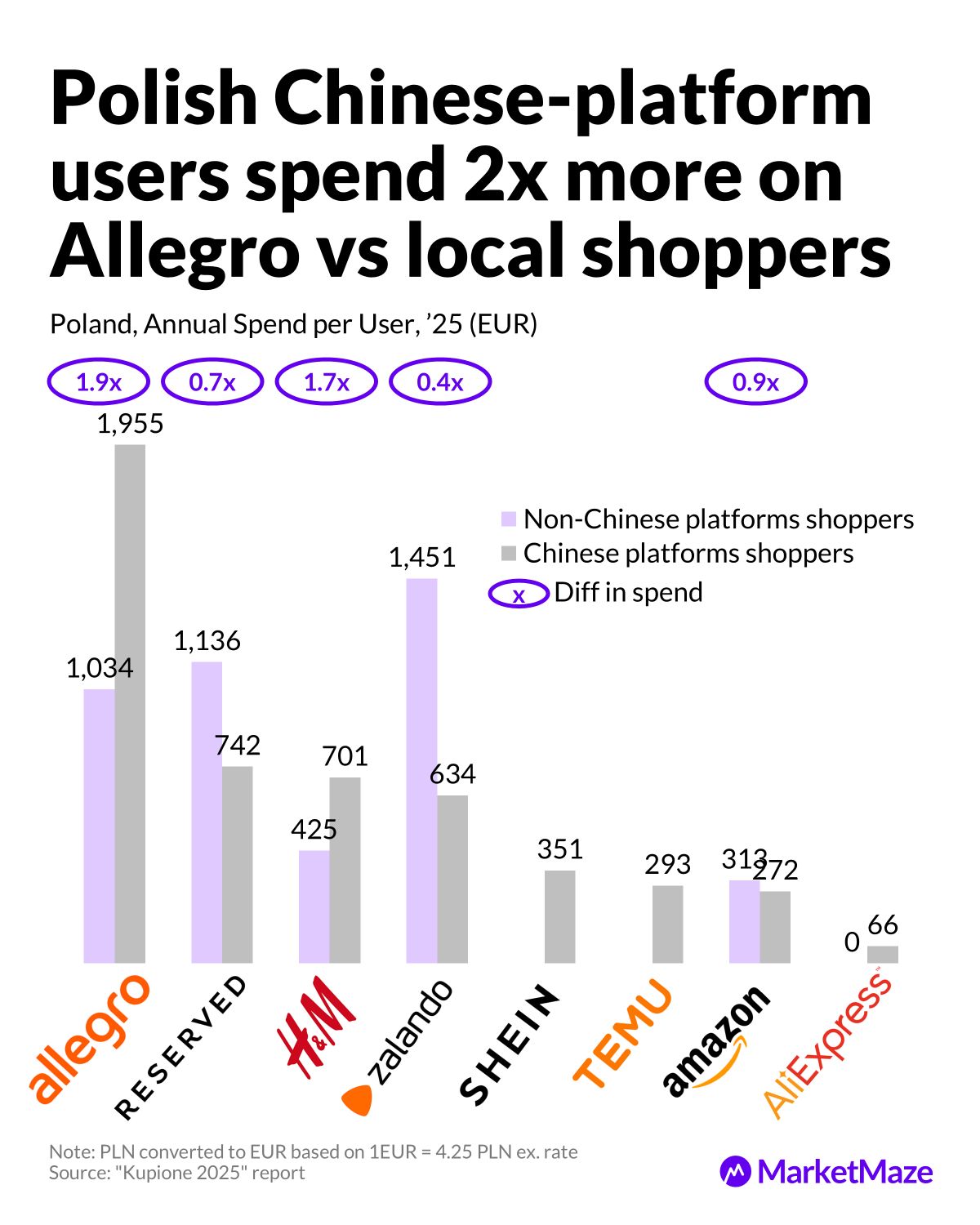

⏱️ Frequency Gap

Allegro leads activity across both groups

Frequency reveals which brands are part of everyday routine. Allegro stays unmatched even when shoppers also use global platforms.

→ Allegro reaches 65 yearly purchases among Chinese-platform users vs 39 for locals.

→ Shein leads non-Chinese shoppers with 32 purchases vs 10 for Chinese-platform users.

→ Temu hits 8 orders among Chinese-platform users vs 3 among non-Chinese shoppers.

The data shows Allegro’s habit strength. Chinese-platform users bring volume, but Allegro keeps the highest engagement across the market.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team