TODAY’S MAZE

Happy Friday, MarketMaze readers! Amazon just made a quiet but telling move — pulling its ads from Google Shopping after more than a decade of partnership.

Trade restrictions aimed at limiting dependence on China are having an unexpected result: they are forcing Chinese firms to rapidly globalize. These companies are building new production, logistics, and R&D centers across three continents, moving far beyond their historic manufacturing base.

This structural shift redefines Chinese firms as global supply-chain coordinators, not just the world’s factory.

In today’s MarketMaze:

Chinese firms globalize supply chains

TikTok Shop raises EU take rate

Coupang CEO resigns amid breach

AI reshapes where shoppers begin their online journeys in 2025

Amazon: a 3rd-party engine in an omni world

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Trade restrictions designed to limit dependence on China are having the opposite effect, instead compelling Chinese firms to rapidly globalize their operations and build new production, logistics, and R&D centers across three continents, according to the Global Supply Chain Report 2025. This structural shift moves Chinese manufacturers from being the world’s factory to becoming global supply-chain coordinators.

Chinese enterprises are rapidly expanding their global footprint, establishing new hubs across Asia, the Middle East, Europe, and the Americas to manage supply chain coordination and localized production global expansion.

While nearshoring shows material progress in Mexico and Central America for certain goods, the movement of production closer to the US market still has limited traction in the fast-moving apparel sector.

The report highlights how the integration of AI and automation allows logistics providers like DHL to streamline contract logistics and enables hubs such as Hong Kong to sustain significant Hong Kong re-exports.

Why it matters: Ecommerce operators must urgently re-map their landed cost models and supplier risk assessments to account for these newly distributed Chinese manufacturing and logistics hubs. This fundamental shift also mandates increased investment in supplier ESG traceability and AI-enabled fulfillment partners to navigate rising regulatory requirements and capture gains in operational precision.

FROM OUR PARTNERS

Inside Kraft Heinz’s Talent-to-Value Playbook

When you're responsible for scaling talent in a fast-moving business, you don’t have the luxury of slow hiring cycles, disconnected systems, or reactive HR. You need frameworks that help you move faster — and actually influence the business.

That’s exactly what you’ll take away from this session.

Andrea Rickey, VP of Talent at Kraft Heinz, breaks down the tools and processes you can use to transform your own talent function — from AI-powered high-volume hiring to the talent-to-value model that helps you prioritize the roles that matter most. You’ll see how these systems unlock faster decisions, stronger leadership pipelines, and real alignment with business outcomes.

Whether you're supporting 50 employees or 50,000, you’ll leave with practical ways to streamline your talent workflows, elevate HR’s role, and operate at the pace your company needs heading into 2025.

DATA TREASURE

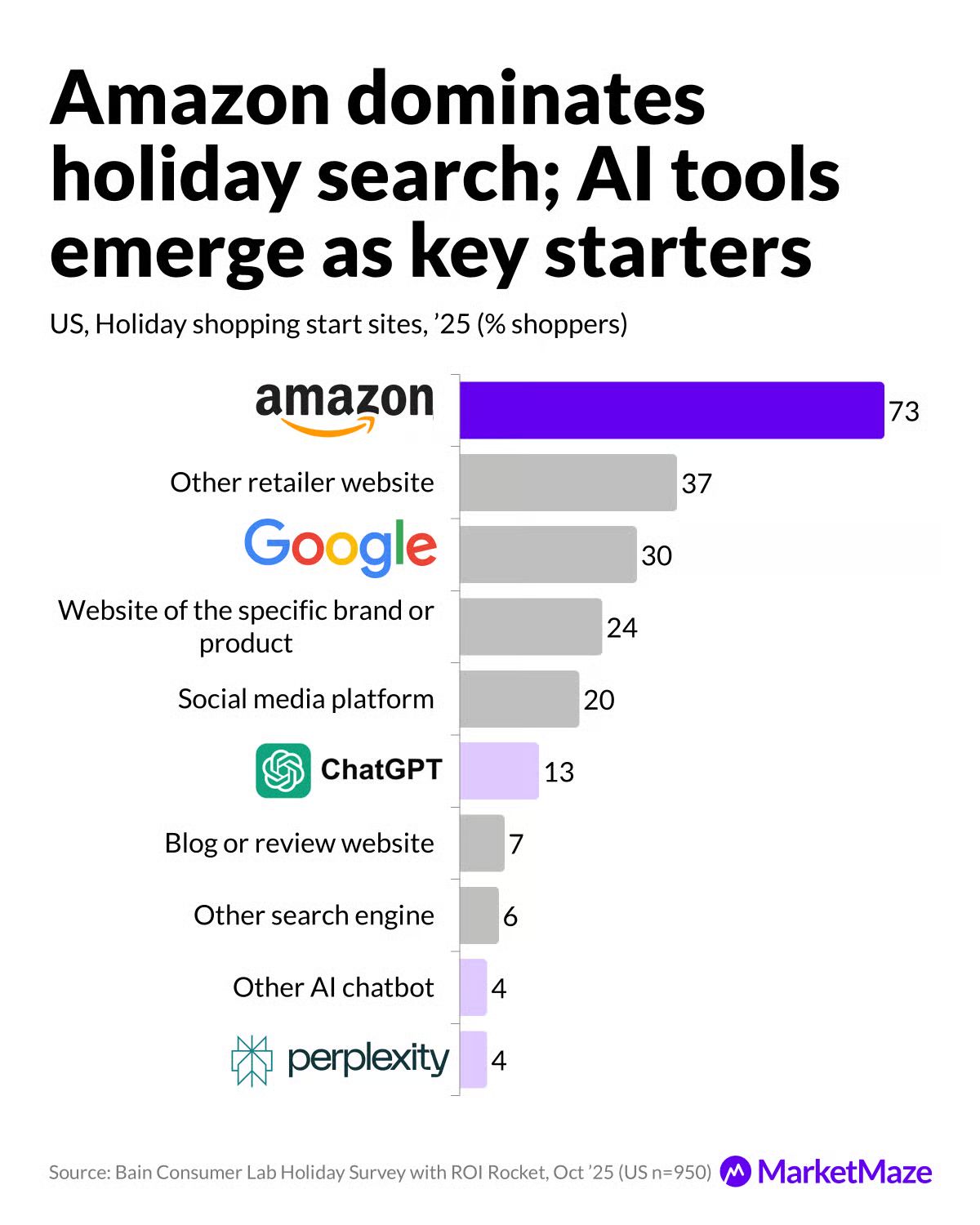

The Maze: Shoppers are shifting their first clicks fast, and AI is pulling forward demand. The data shows how search habits, referral flows, and retailer exposure changed across markets in a single year. The story is simple: platforms that guide choice win, and those relying on old funnels lose.

Amazon remains the US default with 73% starting holiday search there, while Google holds 30% and AI tools like ChatGPT and Perplexity reach 13% and 4%.

ChatGPT referrals explode from 1.7M to 14.4M in the US, 0.4M to 2.6M in the UK, 0.4M to 4.4M in Germany, and 0.3M to 2.3M in France.

Referral concentration varies: Amazon takes 9% of US ChatGPT retail referrals, 16% in the UK, 38% in Germany, and 29% in France.

AI driven referral share is still tiny but rises everywhere: Best Buy climbs from 0.2% to 0.8%, Walmart from 0.1% to 0.7%, and Macy’s from 0.0% to 0.7%.

Why it matters: AI discovery is turning into a new retail front door. Countries diverge, categories fragment, and early movers capture intent faster than traditional search. Retailers positioned closest to the top of AI guided journeys stand to collect the next decade of growth.

MAZE STORY

The Maze: TikTok Shop is significantly increasing its sales commission in five key EU markets (Germany, Spain, France, Italy, Ireland), raising the standard rate from 5% to 9% for sellers beginning early next year, marking a decisive shift toward monetization as the platform matures. This strategic hike sets a new take rate for the European marketplace, signaling TikTok is ready to optimize margins after building audience traction.

Operators must prepare to recalibrate unit economics for the five EU countries as of 00:00 CET on January 8, 2026, confirming the details of the commission increase.

The platform previously executed a similar move in the UK, where it reported 85% more sellers year-over-year, demonstrating the viability of higher fees after establishing market share.

TikTok asserts the increased take rate will fund platform improvements and added functionalities necessary to enhance the user experience across its content-driven commerce channel, while offering some categories a 7% commission.

Why it matters: This commission hike solidifies TikTok Shop’s transition from a subsidized experiment to a maturing marketplace, forcing merchants to assess if the platform’s high conversion from creator partnerships justifies the higher CAC. Ecommerce teams must analyze whether the added cost can be offset by improved discovery algorithms and new services now rolling out, adjusting their product assortment and pricing models accordingly.

FROM OUR PARTNERS

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

DATA TREASURE

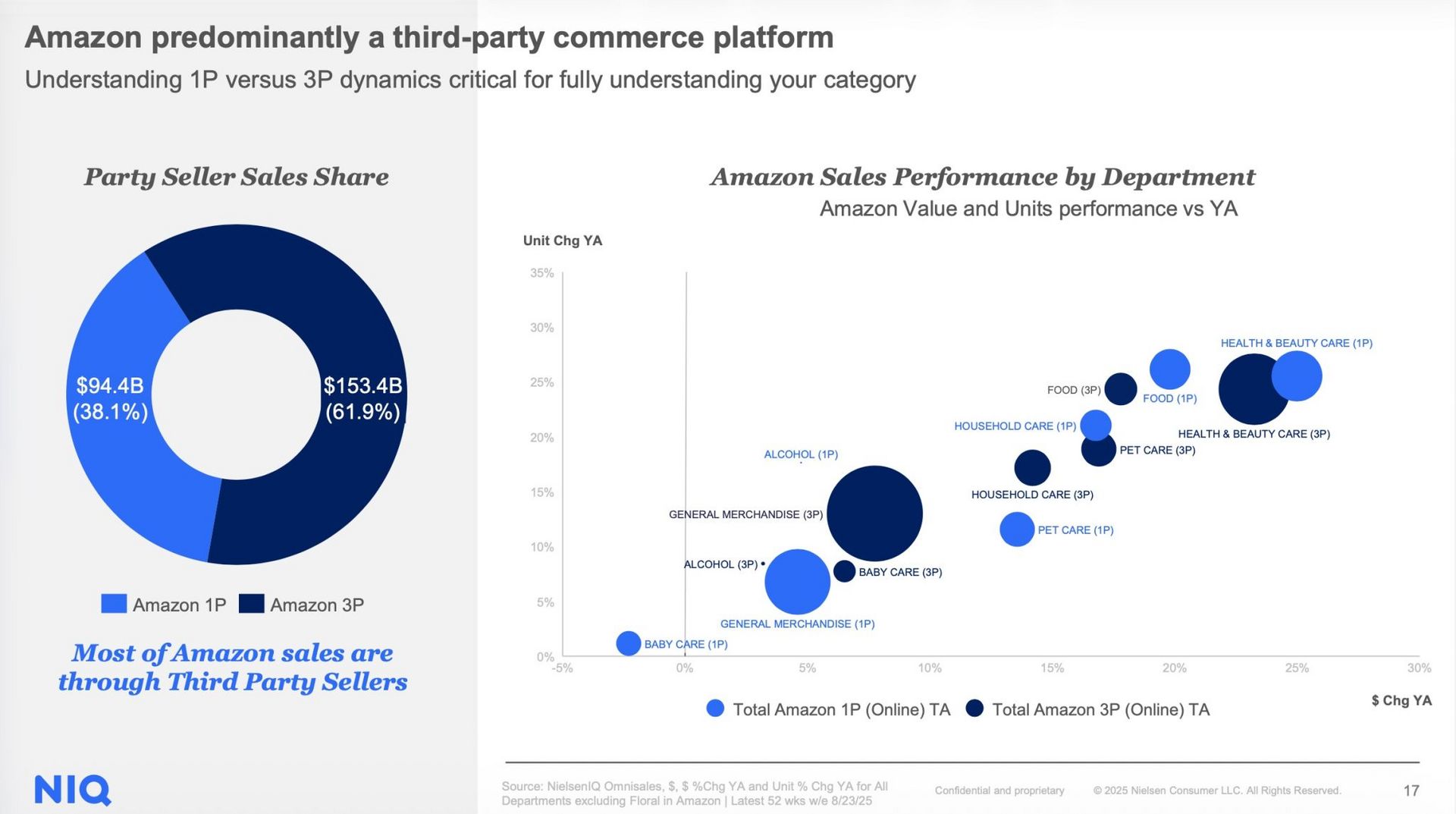

The Maze: Amazon today looks more like a mall than a classic shop and third party sellers now drive almost two thirds of its online sales value. NIQ puts 3P at about 153 billion dollars or 61.9 percent of sales, with 1P at 94.4 billion or 38.1 percent, and 3P leading growth in baby and general merchandise while 1P still punches hardest in health, beauty and food. Layer that on top of data showing that 94 percent of CPG buyers purchased online last year and you get a shopper who moves from store to screen in one mission while a mixed 1P and 3P ecosystem fights for the same basket.

• Online channels delivered roughly 83 percent of CPG dollar growth with ecommerce up about 12 percent year on year while stores grew less than 1 percent, so the most valuable buyer is now the one who checks a phone, a marketplace and a physical shelf in the same week.

• On Amazon, third party sellers own about 62 percent of sales value and dominate fast growing zones like baby and general merchandise while first party still leads in health and beauty and parts of food, which shows that category power has shifted from retailer owned inventory to a crowd of independent brands.

• For a CPG leader, NIQ omni shopper data can be used to re segment buyers by behavior, map where 3P or 1P is setting the growth rate in each department and reset spend toward the points where shoppers actually enter the brand, from search results pages to end caps in store.

Why it matters: The shelf is now a single system that spans store, app and marketplace and winners plan for that whole journey, not for one aisle at a time. Amazon proves that value increasingly flows through third party ecosystems where brands must win visibility, not just listings. In this world, category strategy starts with omni data and ends with one coherent plan for product, price and media across every place the shopper can tap or grab the product.

MAZE STORY

The Maze: South Korean e-commerce leader Coupang faces intense scrutiny after Coupang CEO Park Dae-jun resigned, taking responsibility for a data breach that compromised account details for nearly 34 million customers at the acquired Farfetch luxury platform.

The security incident potentially exposed account information, including email addresses, phone numbers, and shipping addresses, though no credit card details or login credentials were leaked.

Coupang Inc., the US-listed parent, appointed Chief Administrative Officer Harold Rogers as interim CEO to stabilize Korean operations and manage mounting legal issues, including planned US federal class-action lawsuits.

The breach affected 33.7 million users, significantly exceeding Coupang’s Q3 2025 reported 24.9 million active customers, signaling high risk for customer churn and reputational damage to the core Rocket Delivery ecosystem.

Why it matters: This leadership shift underscores the intense regulatory and reputational risk faced by global operators when user data exposure touches key differentiators like specialized logistics or luxury platforms. Marketplace teams must audit their data segmentation and invest in security tools to rebuild customer trust, which serves as the most effective competitive moat against fast-growing rivals.

BRIEFING

🏬 Everything else in Ecommerce

🇬🇧 TikTok Shop UK broke its all-time sales record on Black Friday, achieving 50% YoY growth and selling 27 items every second, confirming its rapid market momentum.

🇺🇸 Amazon is expanding the use of autonomous AI controls (BrainBox AI) in collaboration with AWS and Trane Technologies to significantly curb energy consumption within its grocery fulfillment centers.

🇫🇷 Mirakl and Stripe announced a strategic partnership leveraging Stripe’s AI connections to position Mirakl as a key enabler for 'agentic commerce' marketplaces.

🇺🇸 President Trump signed an executive order establishing a federal framework for AI regulation, limiting the ability of states to pass individual AI laws, aiming for a singular 'One Rulebook'.

🇺🇸 Disney announced a major partnership with OpenAI, licensing IP, including over 200 characters, for use in the Sora video generator to create AI-powered content aimed at boosting Disney+ engagement.

🇺🇸 OpenAI launched GPT-5.2, its new flagship model, confirming the intense competitive pace in the chatbot market following internal reports of a “Code Red” scramble against Google’s Gemini 3.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team