The Maze: Shoppers are shifting their first clicks fast, and AI is pulling forward demand. The data shows how search habits, referral flows, and retailer exposure changed across markets in a single year. The story is simple: platforms that guide choice win, and those relying on old funnels lose.

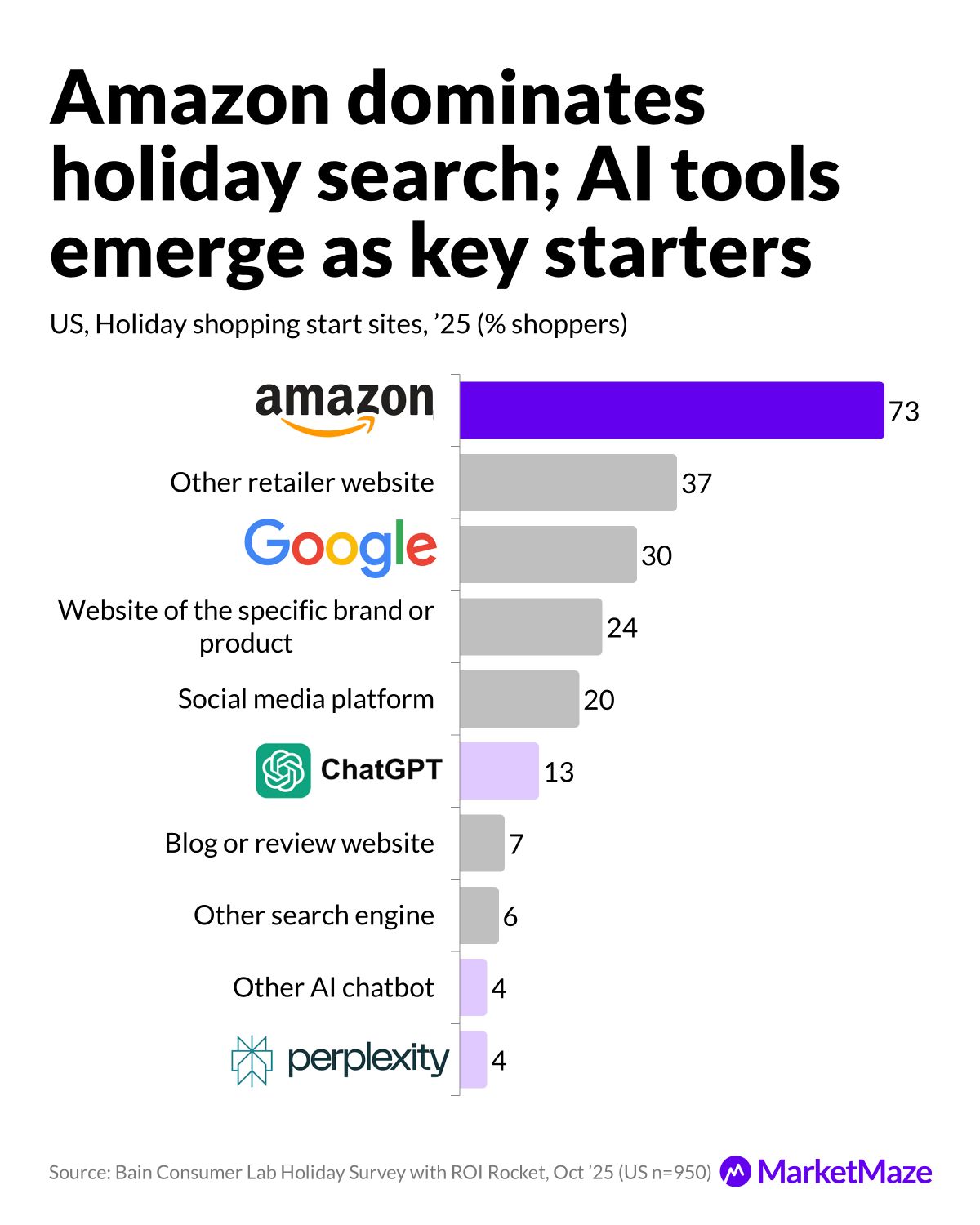

→ Amazon remains the US default with 73% starting holiday search there, while Google holds 30% and AI tools like ChatGPT and Perplexity reach 13% and 4%.

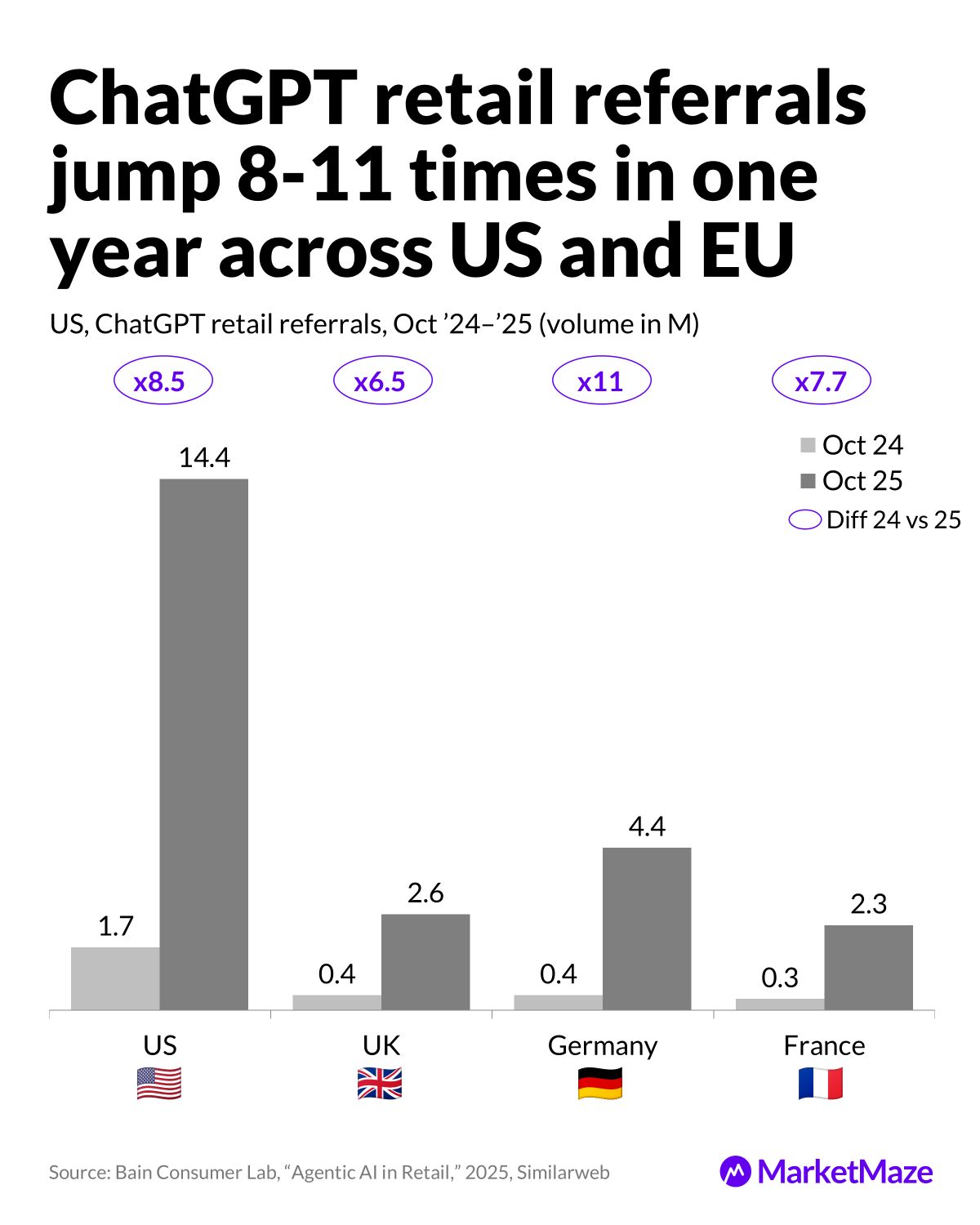

→ ChatGPT referrals explode from 1.7M to 14.4M in the US, 0.4M to 2.6M in the UK, 0.4M to 4.4M in Germany, and 0.3M to 2.3M in France.

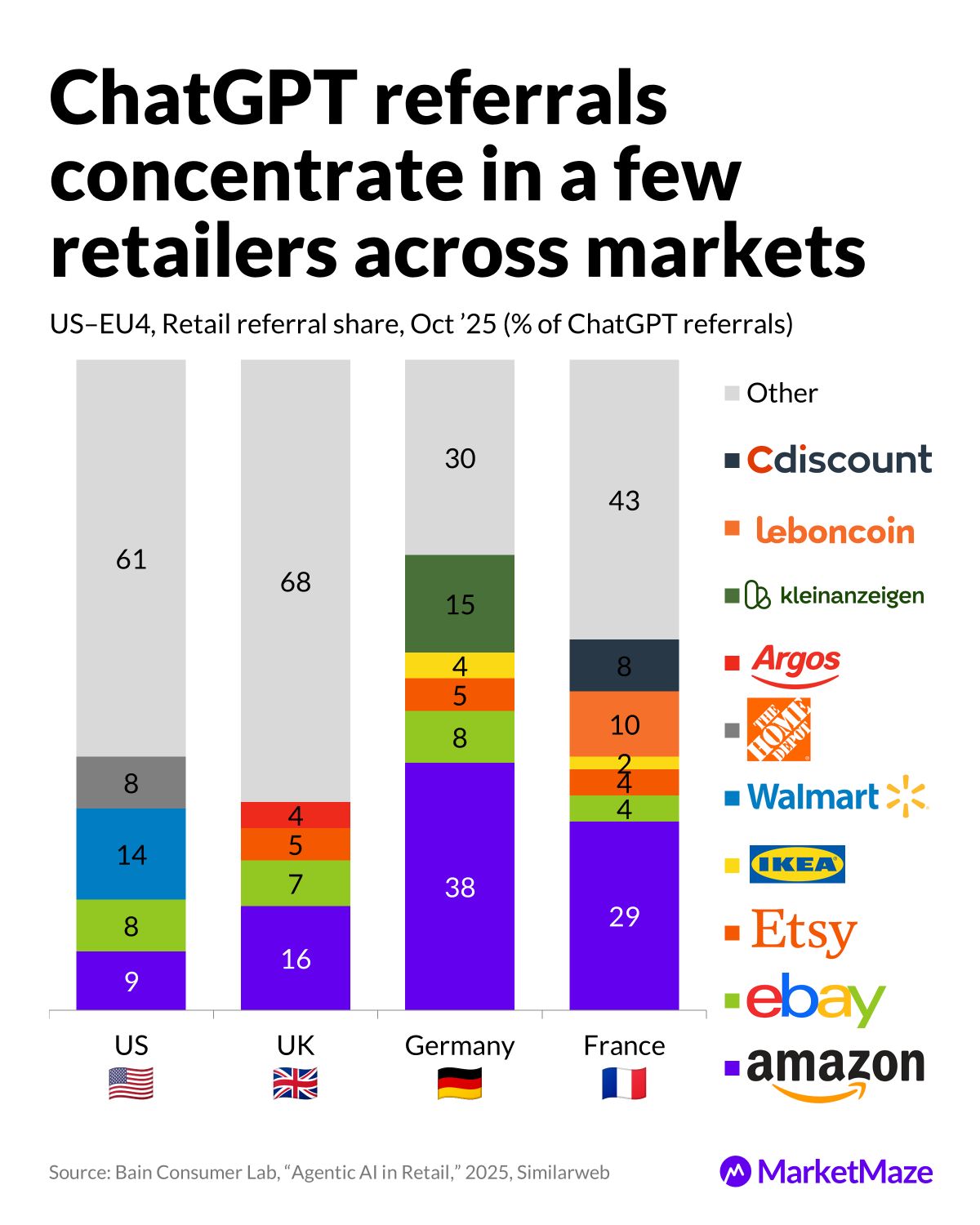

→ Referral concentration varies: Amazon takes 9% of US ChatGPT retail referrals, 16% in the UK, 38% in Germany, and 29% in France.

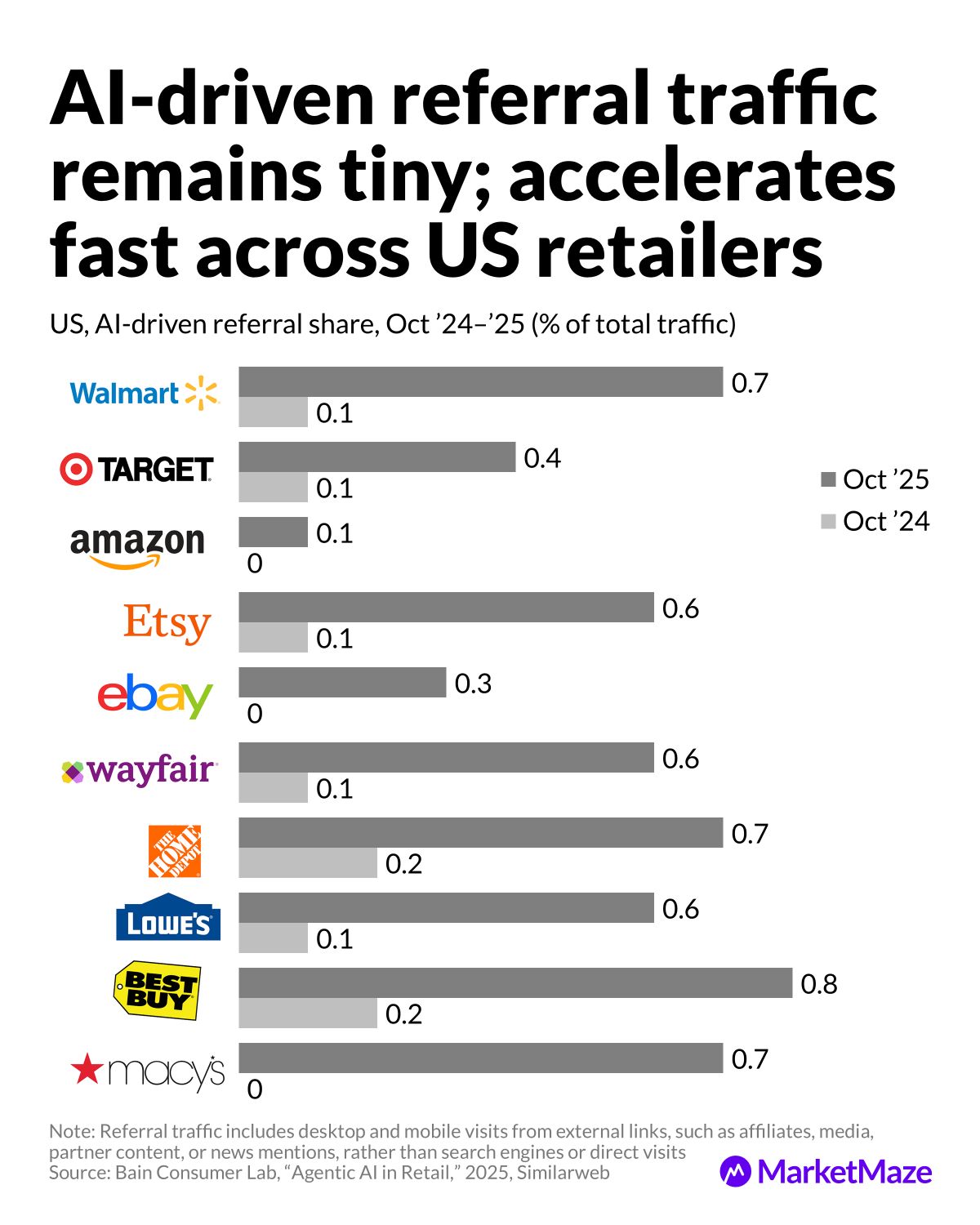

→ AI driven referral share is still tiny but rises everywhere: Best Buy climbs from 0.2% to 0.8%, Walmart from 0.1% to 0.7%, and Macy’s from 0.0% to 0.7%.

Why it matters: AI discovery is turning into a new retail front door. Countries diverge, categories fragment, and early movers capture intent faster than traditional search. Retailers positioned closest to the top of AI guided journeys stand to collect the next decade of growth.

🇺🇸 Shopper Shift

Amazon holds the start but AI moves in

Holiday search behavior in the US is dominated by a single player, but the edges are cracking. Amazon still commands 73%, yet Google slips to 30% and AI tools step into the flow.

Shoppers increasingly choose faster, narrower funnels and lean on tools that recommend not just what to buy but where to buy it.

→ Amazon captures 73% of first holiday search actions, with other retailer sites at 37% and Google at 30%.

→ ChatGPT enters the mix with 13% of shoppers, ahead of blogs at 7% and other search engines at 6%.

→ AI chatbots collectively draw 8% when including other tools like Perplexity.

Two forces collide: platform loyalty and rising algorithmic guidance. The funnel that wins is the one that answers fastest, not the one with the most pages.

📈 Referral Surge

AI referral volumes explode across markets

The jump in AI driven retail referrals in one year is staggering. Markets at different maturity levels still experience the same pattern: acceleration.

Volumes demonstrate how quickly AI can move from novelty to meaningful commercial intent routing.

→ US referrals surge from 1.7M to 14.4M, an 8.5x jump driven by heavier usage.

→ UK leaps 0.4M to 2.6M, Germany reaches 4.4M from 0.4M, and France climbs from 0.3M to 2.3M.

→ Growth ranges from 6.5x in the UK to 11x in Germany, showing how early gaps widen fast.

Markets diverge but the signal is universal: AI funnels scale faster than traditional search or social once consumers adopt them.

🏬 Market Split

ChatGPT referral share clusters in a few retailers

AI referral paths aren’t evenly distributed. They concentrate in a small set of retailers per market, revealing how shoppers depend on familiar anchors even in AI guided flows.

This fragmentation shows how algorithms interpret local retail structure.

→ Amazon’s share ranges widely from 9% in the US to 38% in Germany and 29% in France.

→ UK patterns skew to fragmentation, with 47% falling into Other retailers.

→ Germany displays mid tier strength with Ikea at 15% and Etsy at 8%.

The market map shifts from platform centric to portfolio centric. Retailers that form part of the algorithm’s shortlist rise fastest.

⚙️ Tiny but Rising

AI referral shares remain low but grow rapidly

AI still drives a sliver of total referral traffic, yet every retailer sees material uplift. The step change year over year signals the early stages of a new discovery infrastructure.

Small numbers can mislead. The slope matters more.

→ Best Buy jumps from 0.2% to 0.8%, Home Depot from 0.2% to 0.7%, and Macy’s from 0.0% to 0.7%.

→ Walmart rises from 0.1% to 0.7%, Etsy from 0.1% to 0.6%, Wayfair from 0.1% to 0.6%.

→ Even Amazon grows from 0.0% to 0.1%, showing universal adoption.

Every brand is climbing the same mountain. Some just start steeper.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team