The Maze: Fast fashion has been running on steroids, but the data shows the cycle turning. A mix of GMV trends, US shopper reach, policy hits, and brand share shifts reveals two giants still growing but no longer breaking gravity. Growth is becoming effort, not inevitability.

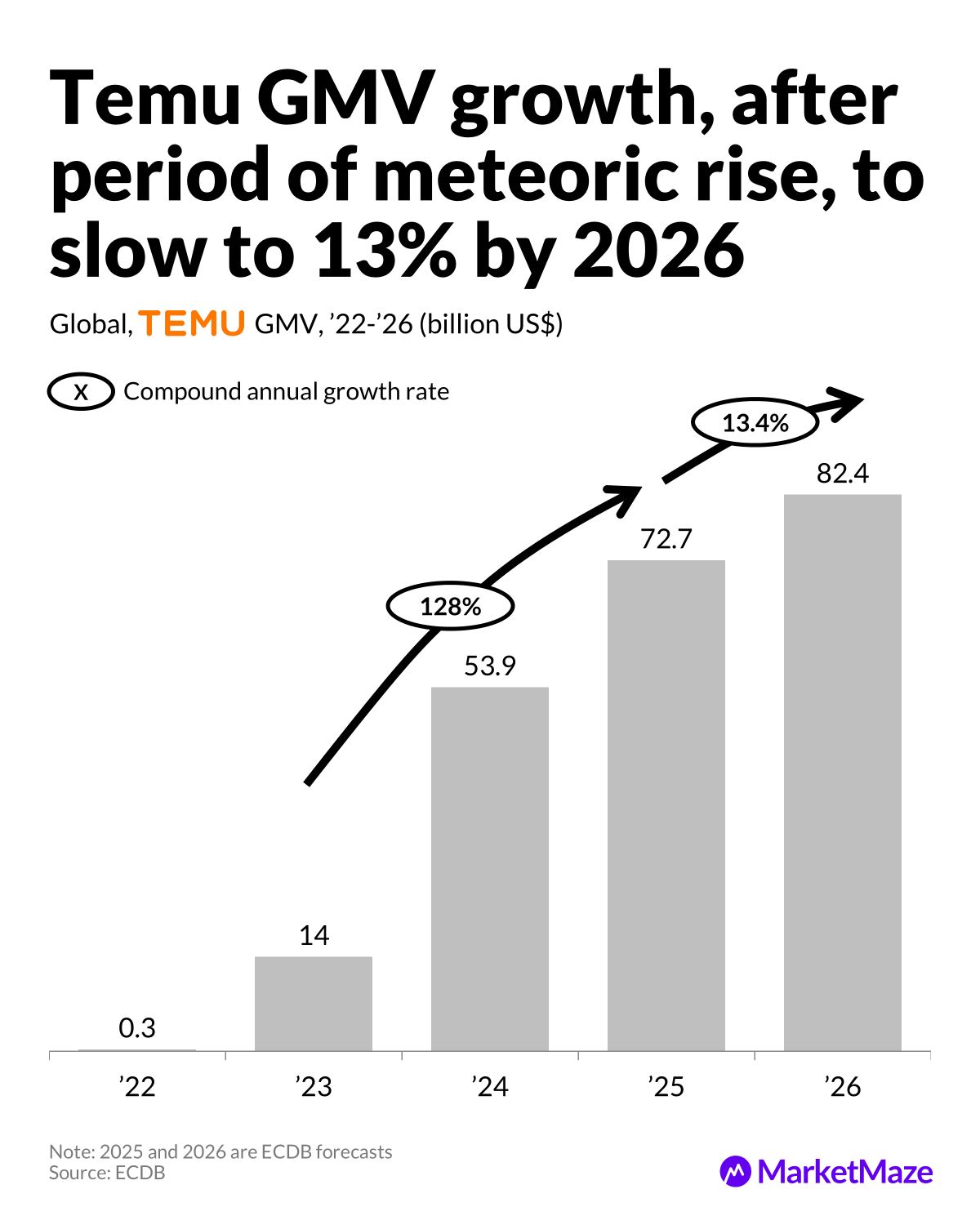

→ Temu scales from 0.3B to 82.4B GMV by ’26 while annual growth falls from 128 percent to 13 percent as the model hits cost and logistics friction.

→ Amazon leads US reach at 73 percent while Temu grabs 20 percent and Shein reaches 17 percent, signalling that discount platforms have gone mainstream.

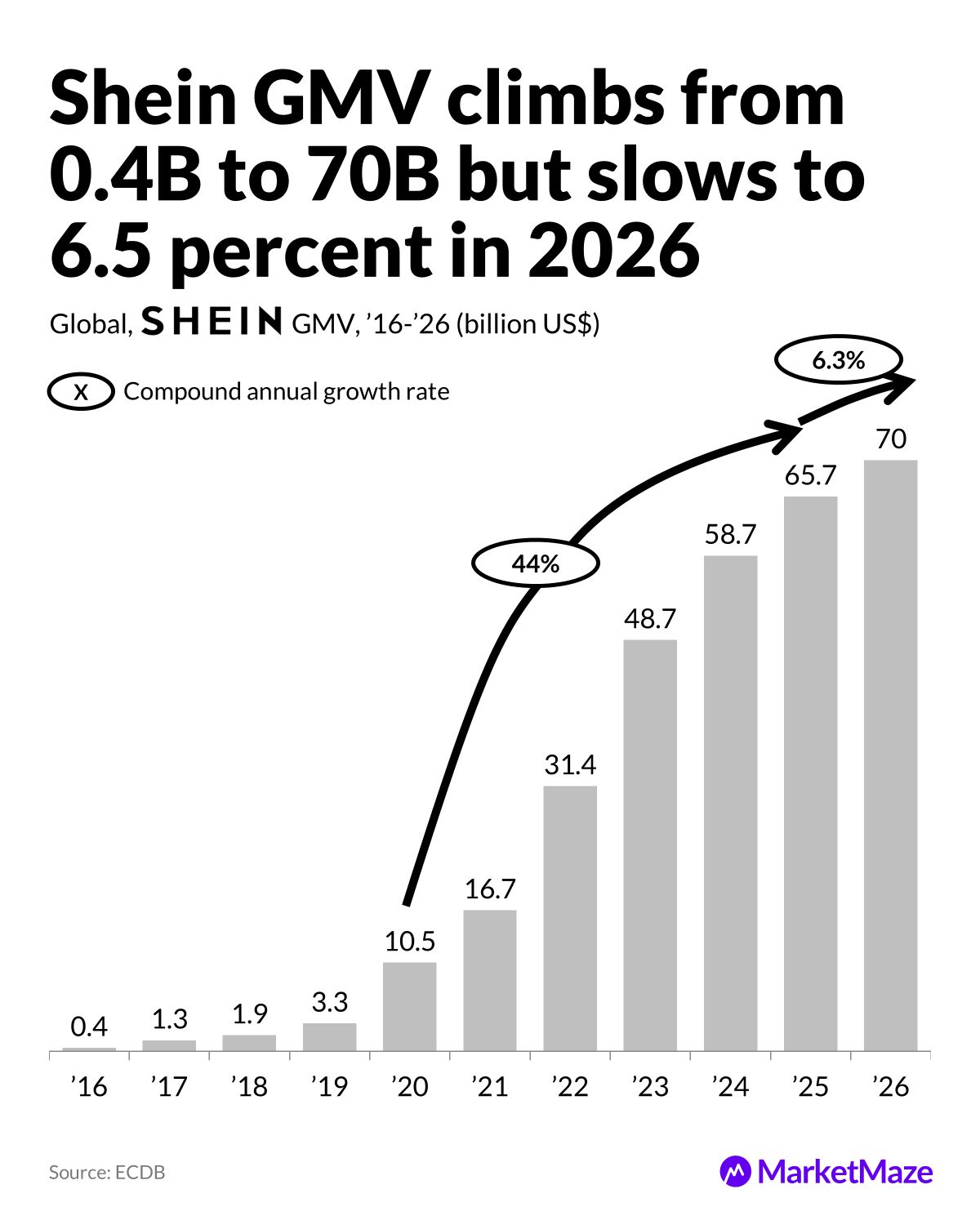

→ Shein grows from 0.4B to 70B in a decade but slows to 6.5 percent in ’26 as scale and scrutiny increase.

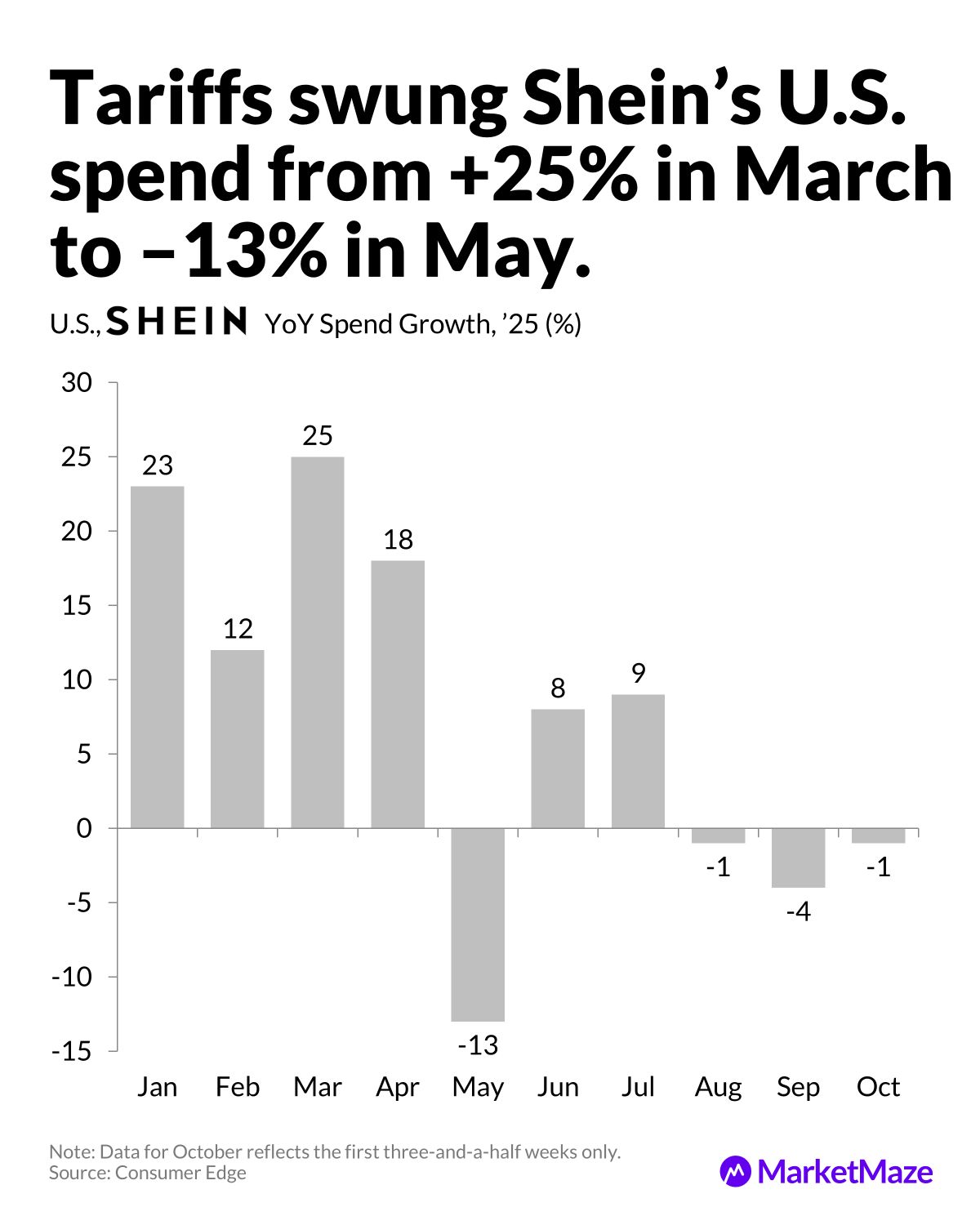

→ US tariffs push Shein from plus 25 percent in March to minus 13 percent in May, a sharp reversal for a momentum brand.

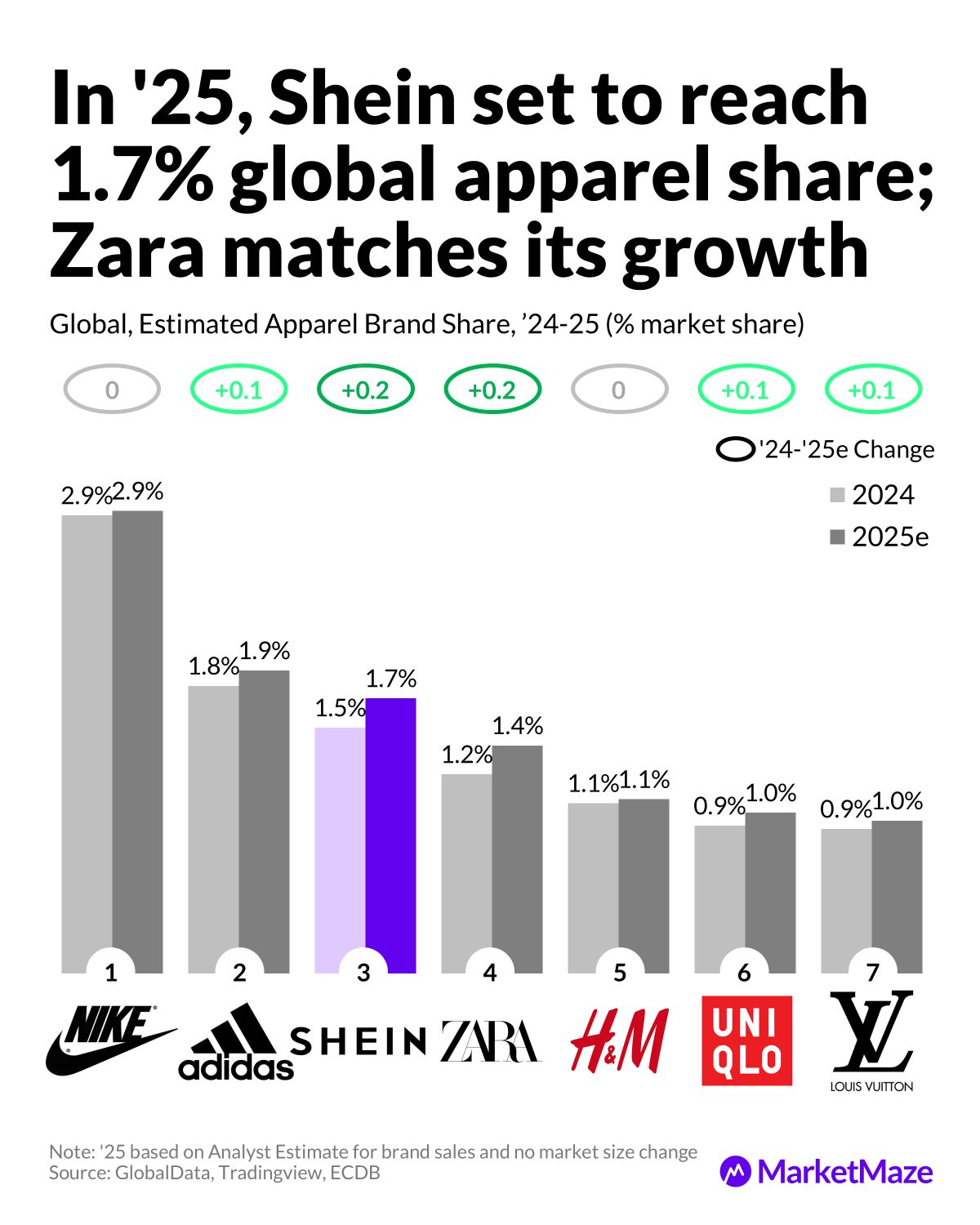

→ Shein hits 1.7 percent apparel share in ’25 while Zara rises to 1.4 percent, tightening the race among global leaders.

Why it matters: The playbook of endless SKUs, ultra low prices and algorithmic merchandising is reaching its natural ceiling. Policy, logistics, and brand power now matter as much as discounts. The winners will be those who turn scale into durability, not just velocity.

📈 TEMU SLOWDOWN

Explosive surge cools as scale hits limits

Temu’s ascent is one of the fastest in ecommerce history, but even rockets slow. GMV jumps from 0.3B in ’22 to 82.4B by ’26, yet annual growth sinks from 128 percent in the early phase to 13 percent at maturity. The model is shifting from shockwave to steady climb.

→ GMV reaches 53.9B in ’24 and 72.7B in ’25, driven by subsidies and viral acquisition loops that reshape cross border demand.

→ Logistics efficiency becomes a bottleneck as the platform expands from single parcel shipping to bulk fulfilment and regional hubs.

→ Growth remains high in absolute dollars, but marginal gains shrink as competition intensifies in the US and EU.

Temu’s trajectory shows a platform moving into its consolidation phase. The next question is whether it can convert scale into loyalty without its earlier cash burn.

🛒 US SHOPPERS SHIFT

Discount apps climb as giants hold dominance

US consumers show loyalty to incumbents but curiosity for value platforms. Amazon commands 73 percent reach, Walmart holds 51 percent, yet Temu with 20 percent and Shein with 17 percent are now undeniable forces in the American basket.

→ Target holds 26 percent, leaving room for mid tier players to defend share as Chinese entrants push deeper into value driven categories.

→ eBay, Apple and Best Buy land around 18 percent, signaling a stable but slow growing cluster outside the top group.

→ Temu’s 20 percent footprint highlights how aggressive pricing and gamified experiences have changed US buying behavior in less than two years.

The US ecommerce hierarchy is intact but under pressure. Price led challengers now influence the strategies of every major retailer.

👗 SHEIN PLATEAU

A decade of acceleration meets real limits

Shein built a global machine that scaled from 0.4B in ’16 to 70B by ’26, but growth is cooling. What was once exponential is becoming linear as the platform’s complexity, costs, and scrutiny rise. Scale has turned advantage into weight.

→ GMV hits 48.7B in ’23 and 58.7B in ’24 before reaching 65.7B in ’25 and 70B in ’26 with growth slipping to 6.5 percent.

→ The brand faces increasing regulatory attention in Western markets, testing its reliance on low duty imports and high SKU velocity.

→ Supply chain sprawl raises costs as the platform balances speed with compliance and inventory management.

Shein’s next phase will be defined by operational excellence, not just assortment breadth. It is moving from disruptor to incumbent status.

🇺🇸 POLICY WHIPLASH

Tariffs flip Shein’s US momentum

US trade policies hit Shein with immediate impact. Spending swings from plus 25 percent in March to minus 13 percent in May, the steepest drop of the year. The volatility reveals how exposed fast fashion models are to regulatory shocks.

→ Early months run hot with January at 23 percent and April at 18 percent before demand collapses under tariff pressure.

→ Summer rebounds with 8 percent in June and 9 percent in July before slipping again to minus 4 percent in September.

→ October sits at minus 1 percent, showing a market trying to stabilize but still reacting to policy uncertainty.

The shift underscores how dependent global ecommerce becomes on political decisions. Momentum brands need a regulatory strategy as much as a marketing one.

🌎 SHARE REORDERING

Fast fashion climbs as leaders hold steady

Global apparel share is tightening. Shein reaches 1.7 percent in ’25, Zara rises to 1.4 percent and Adidas advances to 1.9 percent. Nike stays at 2.9 percent but feels the pressure from value and fast moving players.

→ Shein’s rise of 0.2 points and Zara’s identical gain mark the fastest climbs among major brands heading into ’25.

→ Uniqlo and Louis Vuitton edge toward 1.0 percent, holding steady growth across premium and essentials categories.

→ The shifting mix shows consumers trading up and down at the same time, compressing the middle of the market.

The ranking changes signal a market where agility beats legacy. Fast fashion is no longer fringe, and legacy brands must fight to keep their lead.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team