TODAY’S MAZE

Happy Cyber Monday! Coupang, South Korea’s e-commerce powerhouse, has revealed a security crisis affecting nearly 34 million accounts. Unauthorized access occurred on overseas servers, exposing non-financial PII data like customer names and shipping addresses.

While payment details were reportedly safe, the incident represents the complete exposure of their customer base and highlights the rising risk of cross-border data vulnerability. Can e-commerce operators truly mitigate the erosion of brand trust when entire customer databases are compromised?

In today’s MarketMaze:

Coupang's entire customer base exposed

German rules challenge algorithmic transparency

Black Friday Search Power Shift

Rufus Drives Checkout

TikTok Fuels Early Intent

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: South Korean e-commerce giant Coupang disclosed a massive security breach exposing the personal data of approximately 33.7 million customer accounts starting in June 2025 via overseas servers, forcing immediate regulatory reporting and intense investigation in the market often called the "Amazon of South Korea".

The exposed data includes names, emails, and shipping addresses, but critically excludes sensitive payment details or customer login information, mitigating immediate financial fraud risks.

Coupang discovered the unauthorized access on November 18 and later confirmed the 33.7 million figure represents its entire customer base, labeling the event as the biggest crisis in company history.

This large-scale exposure arrives as cyber insurance providers struggle with volatility; one major insurer, Beazley, reported an 8% fall in gross written premiums while increasing claims strain the market [].

Why it matters: Ecommerce operators must recognize that non-financial PII data breaches still erode brand trust and trigger significant compliance costs, demanding immediate reinforcement of cross-border data protection frameworks. This high-profile incident enables executives to prioritize rapid threat detection and response, adjusting risk mitigation strategies as cyber insurance providers deal with rising claim costs globally.

FROM OUR PARTNERS

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

MAZE DEEP DIVE

The Maze: Europe’s biggest marketplaces saw sharp swings in traffic, referrals and conversions as shoppers chased deals across platforms. A multi-week view of visits and behaviour shows how fast winners can change. The data tracks traffic spikes, cross-site hopping and AI search adoption to reveal a new competitive map.

Amazon’s Black Friday surge hit roughly 3% visit share while rivals stayed near 0.3 to 0.5%, giving it the clearest traffic win across Europe.

Search engines drove up to 29% of referrals before Black Friday and 27% on the day, while other e-commerce sites lifted Temu and AliExpress to 18% and 14%.

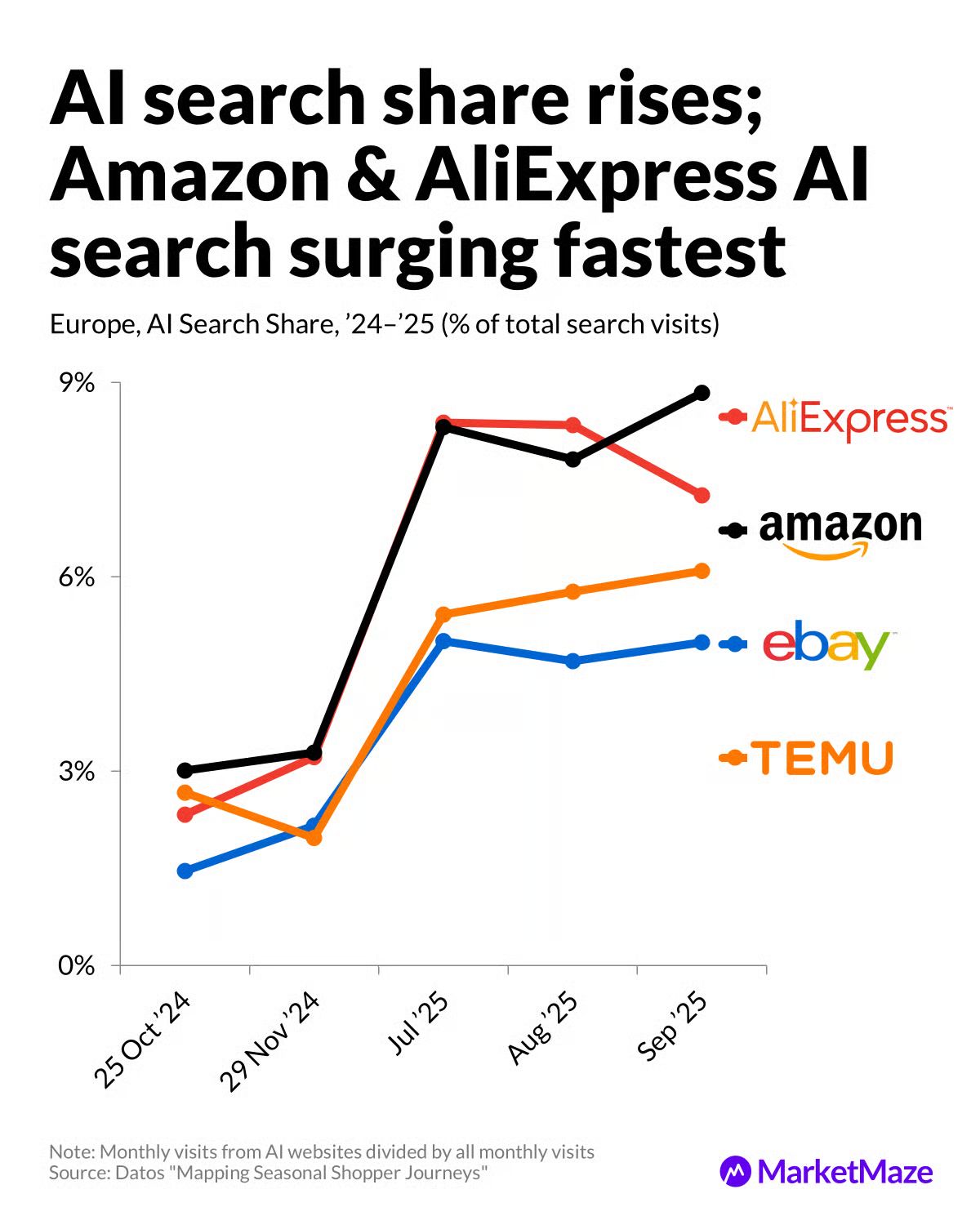

AI search share jumped from 2 to 3% in late 2024 to 6 to 9% by mid-2025, with Amazon and AliExpress reaching peaks near 8 to 9%.

Multi-marketplace visits climbed from 4.5% to 6.8% on Black Friday as users visited two to six different platforms in a single day.

Conversions rose fastest at Amazon, from 12% to 17%, while Temu held the strongest purchase depth at 2.5 per buyer.

Why it matters: Europe’s marketplaces now compete on discovery, not just price. AI search rewrites where the journey starts. Cross-site hopping means loyalty erodes when discounts rise. The race is no longer about owning the checkout but owning the first click.

FROM OUR PARTNERS

See What’s Missing From Your Digital Marketing Strategy

Want to uncover your hidden affiliate marketing potential?

Levanta’s Affiliate Ad Shift Calculator shows you how shifting budget from PPC to creator-led programs can lift your ROI, streamline efficiency, and uncover untapped marketing revenue.

Get quick results and see what a smarter affiliate strategy could mean for your growth.

MAZE STORY

The Maze: Germany is leveraging a potent mix of EU laws—the DSA, GDPR, and AI Act—to force transparency and accountability from platforms like Amazon, Meta, X, and TikTok, setting critical legal precedents across the entire European bloc.

Germany’s Bundeskartellamt found that Amazon’s algorithmic price-monitoring mechanisms likely breach competition law by enforcing seller conformity to internal thresholds, limiting price diversity across the broader e-commerce ecosystem.

X was ordered to provide engagement data, including likes, shares, and reach, to researchers for independent scrutiny, reinforcing that platforms whose algorithms shape political communication must submit to independent examination.

The Regional Court of Leipzig ruled that Meta violated GDPR by using tracking technologies like Meta Pixel and SDKs to collect extensive behavioral data from logged-out users without consent, directly attacking the unlawful inputs feeding its profiling systems.

Why it matters: Platform operators must immediately audit their algorithmic governance and data collection practices to prepare for EU-wide compliance. This scrutiny confirms that opaque pricing and recommendation systems are now central legal risks, demanding transparent, verifiable design to protect both consumers and sellers.

MAZE STORY

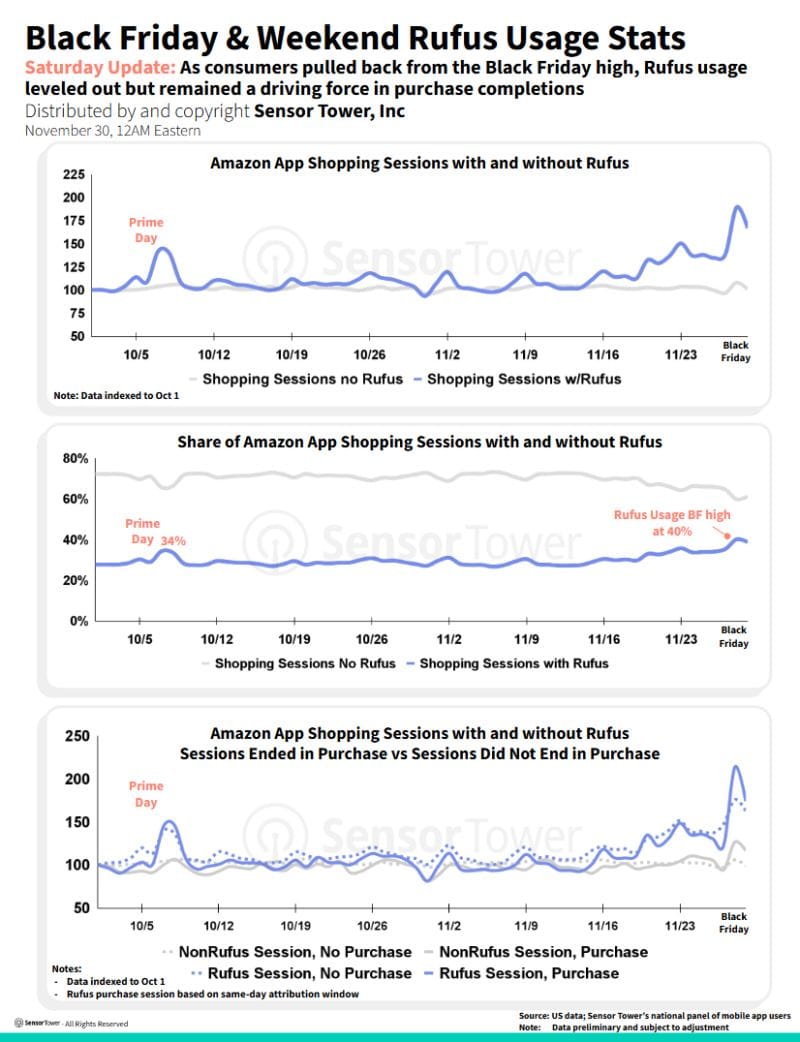

The Maze: Amazon’s agentic bot keeps climbing. Usage hit roughly forty percent of app sessions on Black Friday and dipped only slightly on Saturday. Shoppers who touch Rufus are far more likely to buy, turning the assistant from a feature into a revenue engine. External AI referrals remain tiny, so the real power sits inside Amazon’s walls.

• Between 15 November and Black Friday, Rufus usage jumped about seventy percent as total app traffic surged and Prime Day benchmarks faded.

• Users who engage with Rufus are roughly sixty percent more likely to complete a purchase, lifting Amazon’s annual sales by billions going into 2025.

• Weekend traffic fell after Friday, yet most conversions still came from Rufus sessions while other LLM referrals stayed under one percent of retailer traffic.

Why it matters: Commerce is shifting from search to agents. Amazon is training shoppers to buy through a guided conversation, not a static results page. The winner owns discovery and intent, and Rufus is fast becoming Amazon’s moat for both.

DATA TREASURE

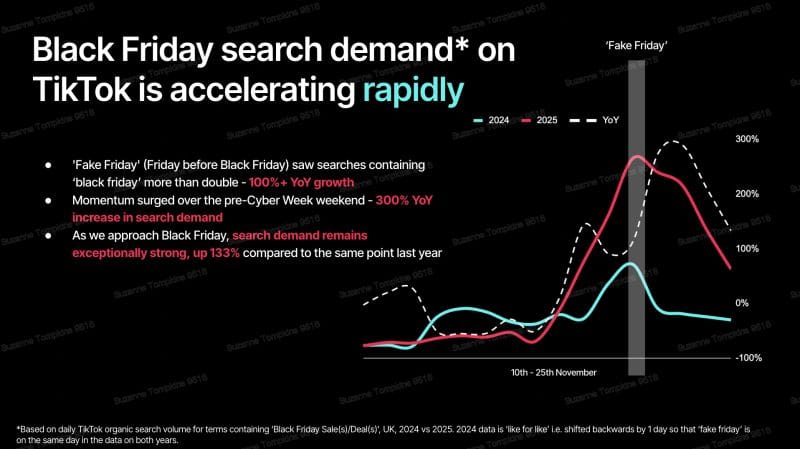

The Maze: Black Friday demand started early and stayed hot. TikTok search queries were more than double last year by Fake Friday and peaked at triple digit growth heading into Cyber Weekend. Shoppers were not waiting for the big day. They were already searching, comparing and buying inside TikTok’s feed.

• Fake Friday saw search demand rise more than one hundred percent year over year as TikTok users began hunting deals six days early.

• Over the pre Cyber Weekend stretch, search momentum hit roughly three hundred percent growth as interest stayed elevated instead of dropping.

• TikTok Shop is now delivering record results with triple digit shopper growth and lower ticket categories like beauty and apparel leading conversions.

Why it matters: TikTok is becoming the new search bar for retail. Intent now forms inside entertainment, not on traditional engines. If brands wait for Friday, they show up after the party, and the shopper has already hit checkout somewhere else.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇮🇹 The Italian competition authority launched a precautionary antitrust probe against Meta for excluding rival AI chatbot providers from operating on WhatsApp, raising questions about closed ecosystems.

🇺🇸 Amazon CTO Werner Vogels released his annual foresight, predicting 2026 will be defined by the transition towards AI companions and augmented human capabilities that enhance, rather than replace, workers.

🇮🇹 Golden Goose is leaning on its direct-to-consumer channels and full-price boutiques to drive strong nine-month sales growth, offsetting softer wholesale demand and proving that loyal luxury shoppers can still power expansion even in a gloomy retail environment.

🇮🇳 Gap is piloting compact “kiosk” stores in India’s high-traffic locations to test a low-cost, plug-and-play format that can enter new cities faster, build brand visibility, and validate demand before committing to full-size outlets.

🇮🇳 Indian denim brand Spykar has teamed up with fast-delivery startup Knot to offer 60-minute fashion delivery across Mumbai and Thane, pushing apparel into the quick-commerce space and training shoppers to expect near-instant access to jeans and casualwear.

BRIEFING

📣Everything else in Ecommerce ecosystem

📊 Smartly launched Creative Predictive Potential and Insights, leveraging AI to forecast creative performance across social, Google, and CTV channels before campaign launch.

📹 VuePlanner integrated Sundogs to provide predictive creative scoring across 150+ attributes for YouTube campaigns, allowing brands to forecast ad performance before launching spend.

🛠️ Kochava launched StationOne, a centralized platform designed to help marketing professionals manage multiple generative AI models through a single interface, streamlining the AI tech stack.

🇧🇩 Chinese approval for a crucial $335 million concessional loan to expand Mongla Port in Bangladesh has been postponed, creating uncertainty over the future timeline of a key infrastructure project.

🇺🇸 OpenAI’s key backers and infrastructure partners like SoftBank, Oracle, CoreWeave and others could collectively take on around $100 billion in debt and commitments to build AI data centers, allowing OpenAI to scale compute capacity while keeping most of the leverage off its own balance sheet. PYMNTS.com

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team