The Maze: Europe’s biggest marketplaces saw sharp swings in traffic, referrals and conversions as shoppers chased deals across platforms. A multi-week view of visits and behaviour shows how fast winners can change. The data tracks traffic spikes, cross-site hopping and AI search adoption to reveal a new competitive map.

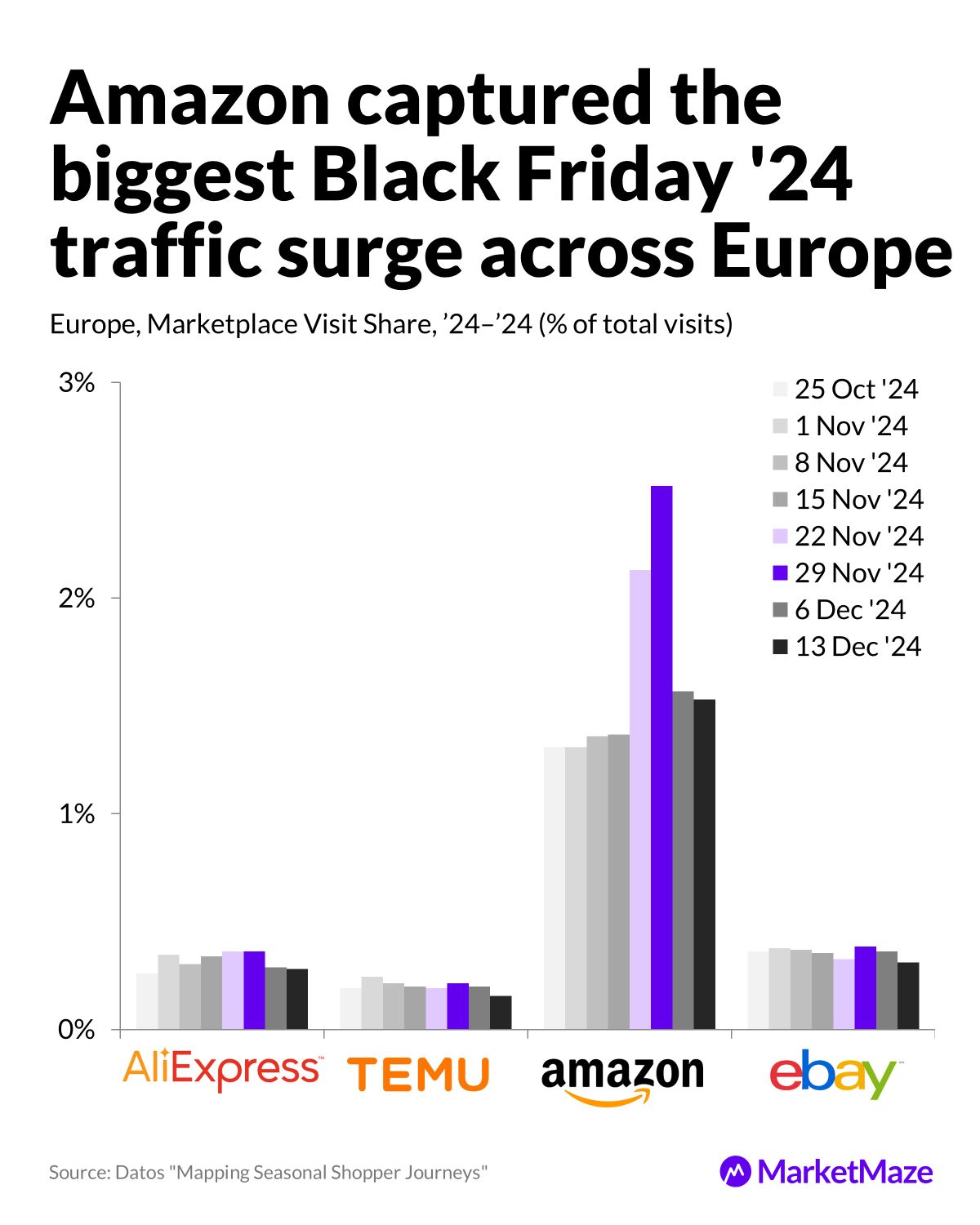

→ Amazon’s Black Friday surge hit roughly 3% visit share while rivals stayed near 0.3 to 0.5%, giving it the clearest traffic win across Europe.

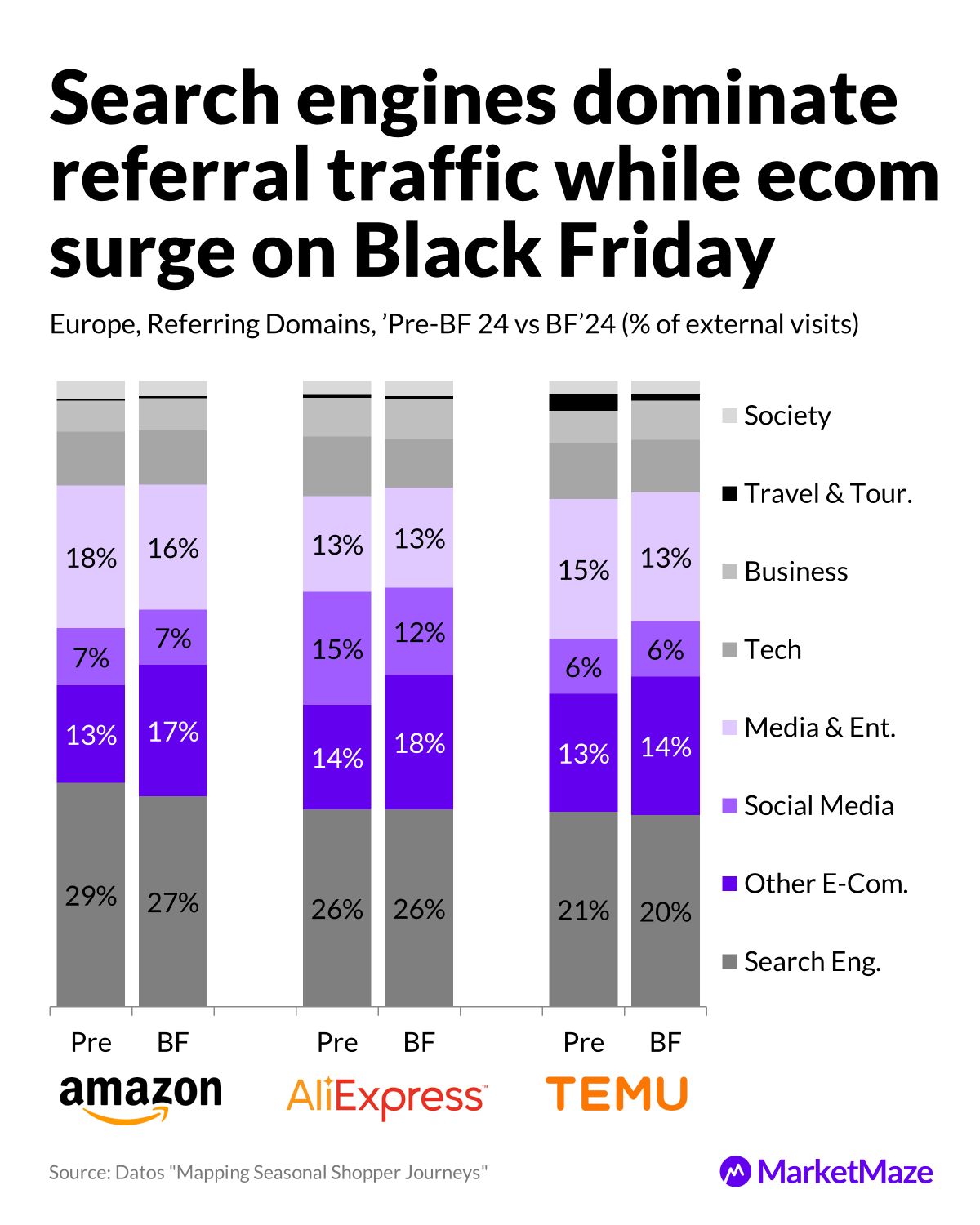

→ Search engines drove up to 29% of referrals before Black Friday and 27% on the day, while other e-commerce sites lifted Temu and AliExpress to 18% and 14%.

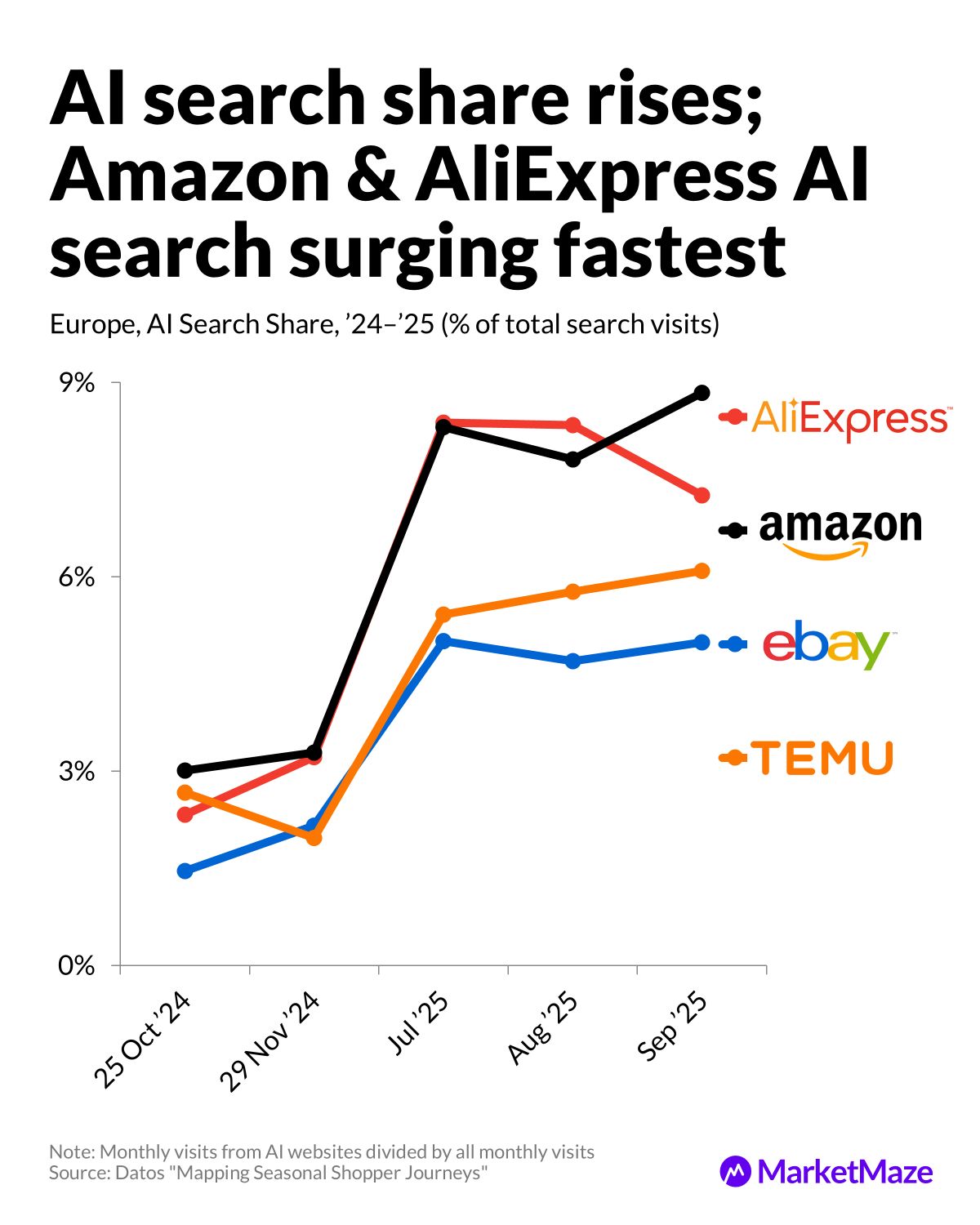

→ AI search share jumped from 2 to 3% in late 2024 to 6 to 9% by mid-2025, with Amazon and AliExpress reaching peaks near 8 to 9%.

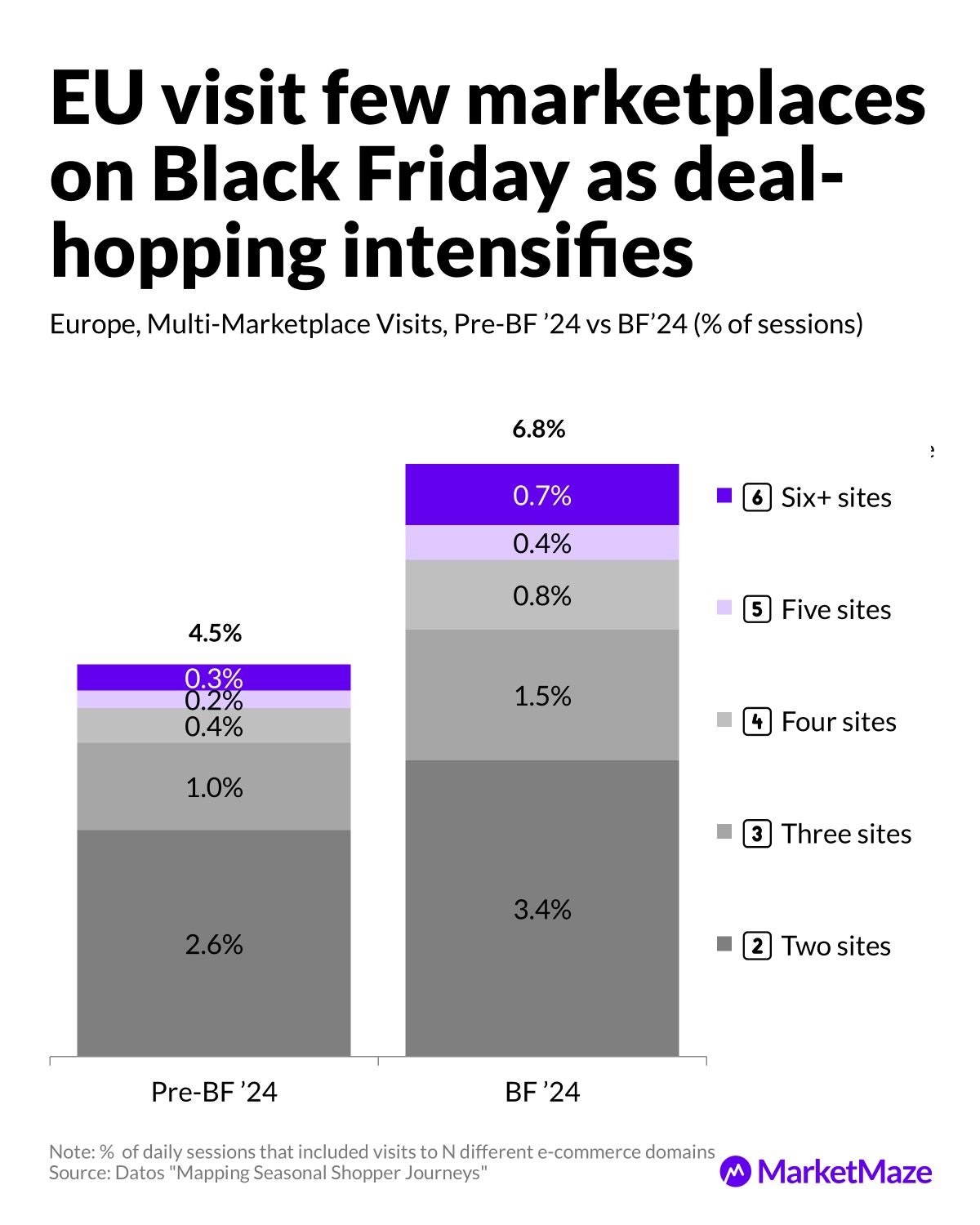

→ Multi-marketplace visits climbed from 4.5% to 6.8% on Black Friday as users visited two to six different platforms in a single day.

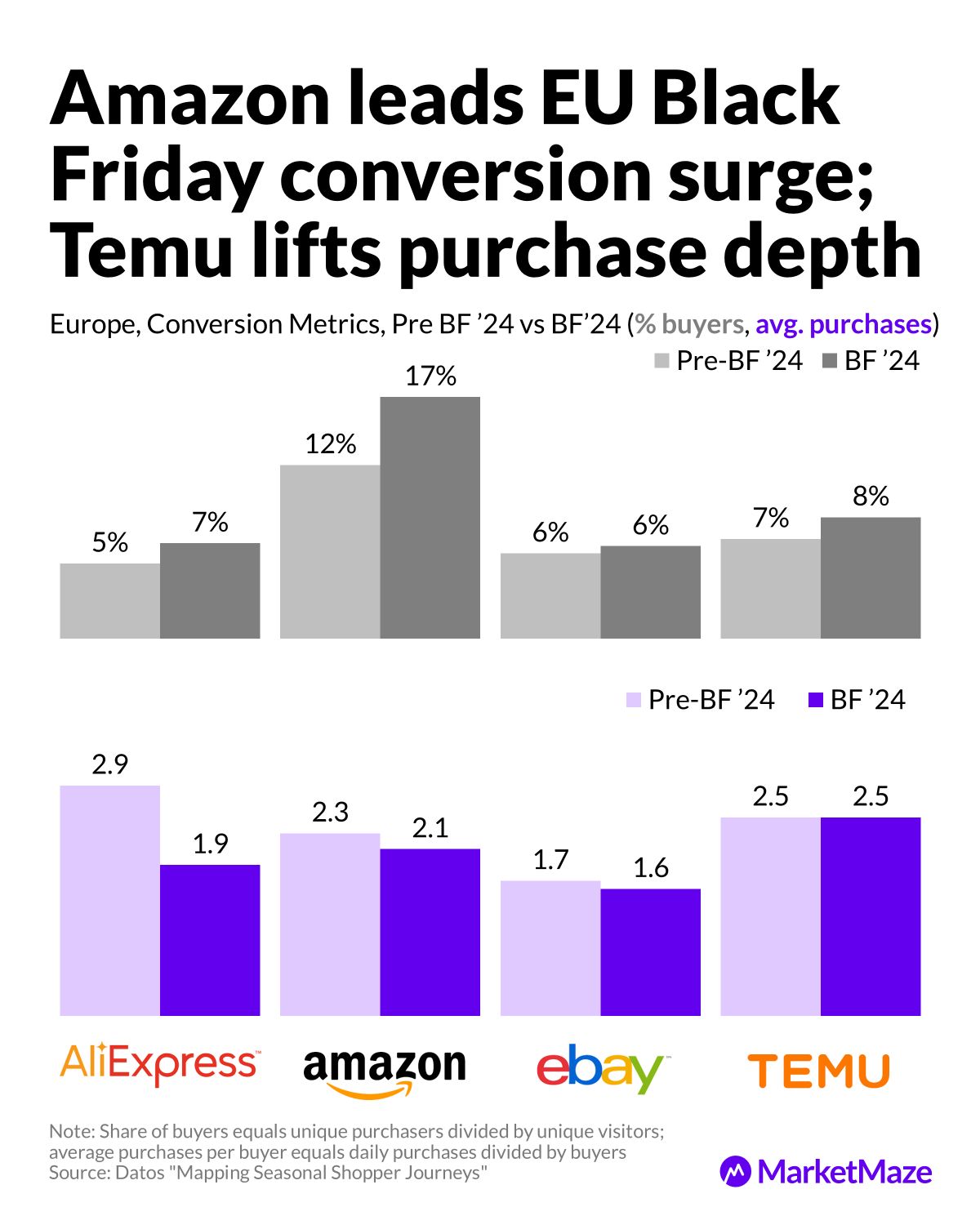

→ Conversions rose fastest at Amazon, from 12% to 17%, while Temu held the strongest purchase depth at 2.5 per buyer.

Why it matters: Europe’s marketplaces now compete on discovery, not just price. AI search rewrites where the journey starts. Cross-site hopping means loyalty erodes when discounts rise. The race is no longer about owning the checkout but owning the first click.

🛒 Traffic Spike

Amazon dominates Black Friday surge

Shoppers overwhelmingly gravitated to Amazon during Black Friday, giving it roughly a tenfold lead over AliExpress, Temu and eBay. The jump signalled a concentration of intent and a clear winner for promotional pull.

→ Amazon’s share moved from about 1.5% mid November to a Black Friday high near 3%, the strongest spike among major EU platforms.

→ AliExpress, Temu and eBay stayed around 0.2 to 0.4%, showing far smaller promotional uplift across key dates.

→ The difference widened post event as Amazon maintained stronger momentum while rivals fell back to baseline.

Amazon’s ability to convert peak windows into attention makes it the reference point for every promotion. Others must work harder to earn that first visit.

🔍 Referral Shift

Search dominates but e-commerce lifts rivals

Referral patterns reveal how shoppers arrive, and the split shows search engines still command up to 27 to 29% of traffic. But other e-commerce sites gained share fast, especially for Temu and AliExpress.

→ Amazon’s search engine referrals held near 27%, while Temu reached similar levels at 26%.

→ AliExpress lifted its other e-commerce referrals to 14.5% and Temu to 17.7%, signalling aggressive cross-platform pull.

→ Social media dipped for Temu from 15% to 11.5%, showing weaker social traction during peak periods.

Arrival paths are fragmenting and no single channel owns discovery. The mix of search, social and cross-commerce sends buyers in new directions and raises competitive pressure.

🤖 AI Search Rise

AI search accelerates across Europe

AI search share exploded from low single digits in late 2024 to strong single digits by Q3 2025. Amazon and AliExpress moved quickest, signalling a new discovery battleground.

→ AliExpress jumped from 3.2% to 8.4% by July 2025 before stabilising at 7.3% in September.

→ Amazon climbed from 3.3% to 8.8% in September, ending the quarter ahead of all peers.

→ Temu and eBay expanded from roughly 2% and 1.5% to 5 to 6%.

AI search is becoming the new homepage for retail. Whoever ranks highest wins intent before the shopper even touches a marketplace.

🔄 Deal Hopping

More users visit multiple marketplaces

Deal hunting intensified as users moved between two, three or even six platforms in a single day. This behaviour shows cross-platform churn and rising competition for attention.

→ Two site visits rose from 2.6% to 3.4% and three site sessions from 1.0% to 1.5%.

→ Heavy explorers visiting five or more sites nearly doubled from 0.5% to about 1.1%.

→ Total multi-visit activity climbed from 4.5% to 6.8% on Black Friday.

Shoppers now roam across ecosystems in minutes. Winning a session is no longer enough. Every platform must win the next tab.

💳 Conversion Edge

Amazon leads conversions, Temu wins depth

Black Friday improved purchase efficiency across platforms, but Amazon captured the strongest conversion lift and Temu held the best purchase depth.

→ Amazon’s buyer share increased from 12% to 17%, the strongest lift in Europe.

→ Temu’s purchase depth held at 2.5 per buyer, outperforming Amazon, eBay and AliExpress.

→ AliExpress lifted buyer share from 5.2% to 6.6% but saw depth fall from 2.9 to 1.9.

Two winners emerge. Amazon dominates conversion volume. Temu wins on repeated purchasing. Their strategies set the benchmarks for the next retail cycle.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team