The Maze: Europe’s bargain giants just crossed a scale milestone. New consumer data shows how AliExpress, Shein and Temu grew fast, why shoppers pick them, and what that says about value, baskets and product life cycles.

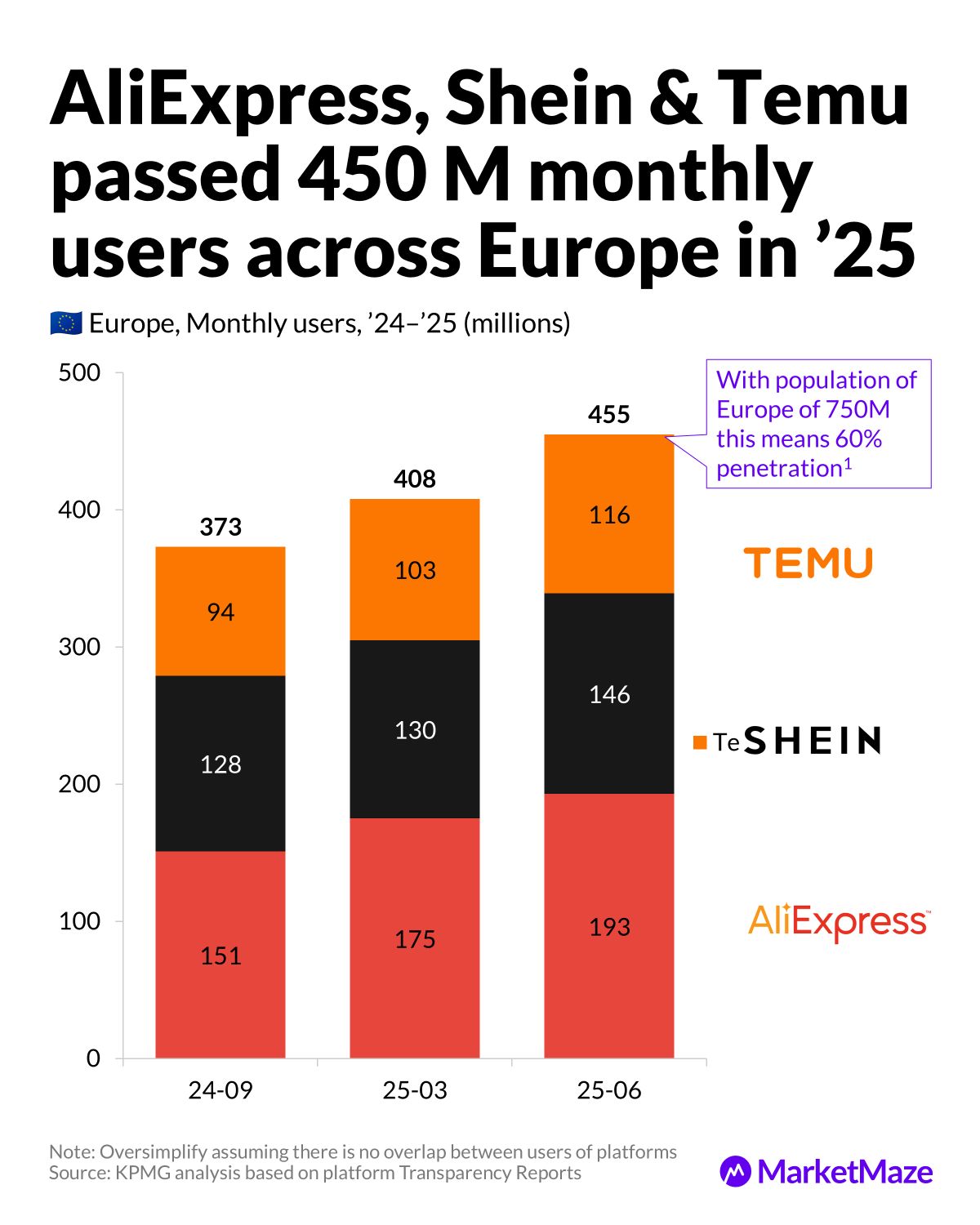

→ AliExpress, Shein and Temu passed 455 M monthly users across Europe by mid ’25, implying near 60% reach if users did not overlap.

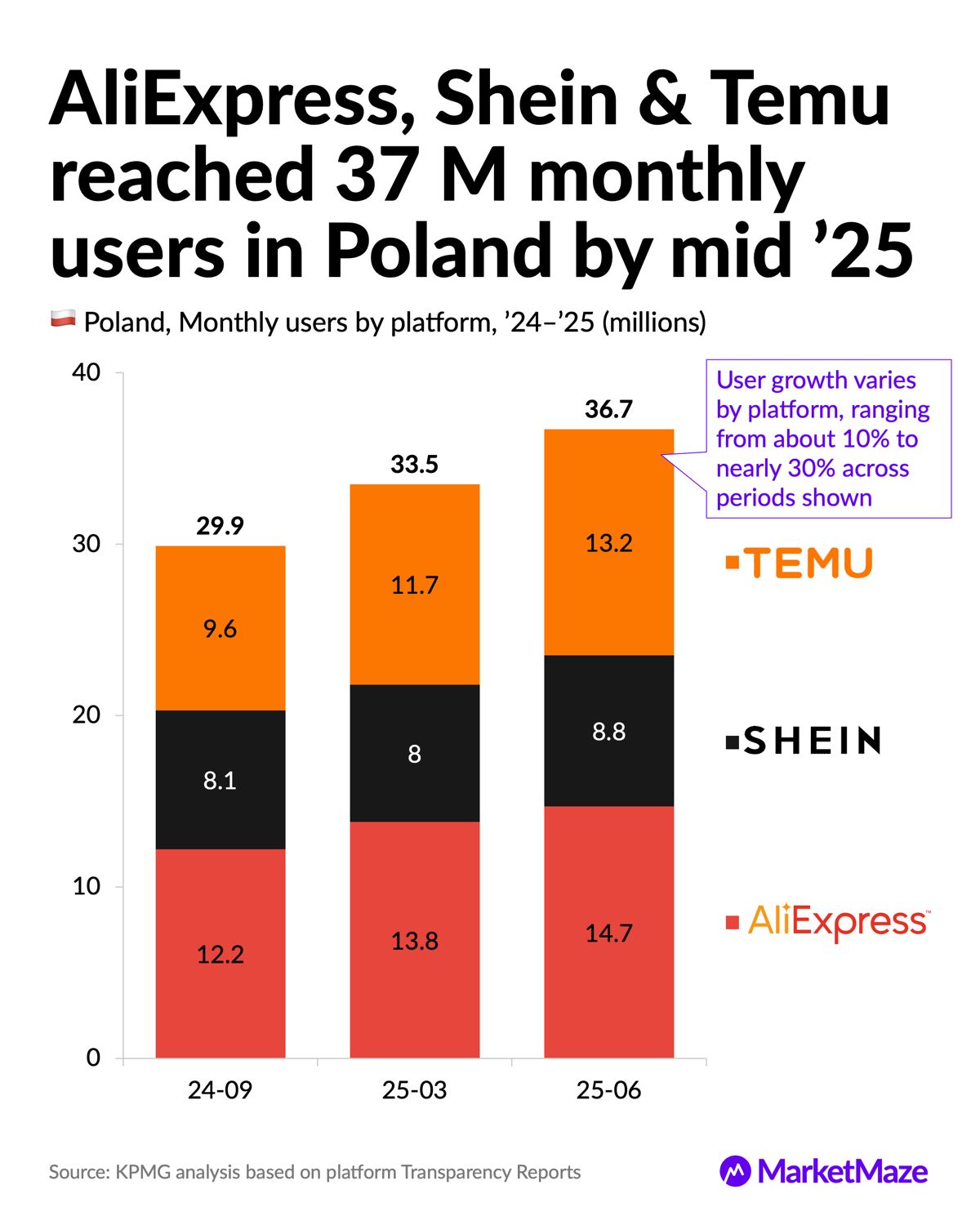

→ In Poland, the same trio reached 36.7 M users by mid ’25, with growth rates diverging sharply by platform and period.

→ Price dominates purchase decisions, but most orders stay below €25 and half of clothing is worn less than one season.

Why it matters: China platforms are winning on scale, not depth. They trade high frequency for low baskets and short product lives. That model reshapes pricing power, margins and sustainability across European ecommerce.

🌍 Europe Scale

450M users, fast and broad

AliExpress, Shein and Temu are no longer niche players in Europe. Their combined reach now rivals the largest Western platforms, driven by speed, spend and relentless user acquisition.

→ By mid ’25, AliExpress reached 193 M monthly users, Shein 146 M and Temu 116 M, totaling 455 M across Europe in less than two years.

→ Growth accelerated from 373 M users in Sep ’24 to 455 M by Jun ’25, a 22% jump in under nine months.

→ Assuming no overlap, that scale implies roughly 60% penetration versus Europe’s 750 M population.

Scale is now the moat. Once reached, it lowers unit costs, boosts ad leverage and reshapes competitive benchmarks for every European marketplace.

🇵🇱 Poland Reach

Big market, uneven growth

Poland has become one of the most important European growth markets for Chinese platforms, but the pace differs sharply by brand.

→ Total monthly users rose from 29.9 M in Sep ’24 to 36.7 M by Jun ’25, adding nearly 7 M users in nine months.

→ Temu grew fastest, from 9.6 M to 13.2 M users, while AliExpress climbed steadily from 12.2 M to 14.7 M.

→ Shein remained smaller and flatter, moving from 8.1 M to 8.8 M over the same period.

Poland is not a test market anymore. It is a scale engine, but one where growth is concentrated in price-led platforms.

💸 Why They Buy

Price first, everything else second

Consumers know why they are here. The value proposition is clear and it is not about quality or delivery.

→ Lower prices drive 61% to 72% of platform choice, far ahead of any other factor across AliExpress, Shein and Temu.

→ Wide assortment ranks second at 35% to 41%, while promotions cluster around 28% to 32%.

→ Quality and delivery time sit at the bottom, each below 10% for most platforms.

This is a value stack, not a trust stack. Platforms win by being cheaper and broader, not better.

🧺 Basket Size

Small orders, high frequency

The economics of Chinese platforms in Poland are built on many cheap orders, not big carts.

→ 43% of all Chinese platform orders fall in the €10 to €25 range, with Temu peaking at 47%.

→ AliExpress stands out with 31% of orders below €10, signaling extreme price sensitivity.

→ Orders above €50 remain marginal, typically 4% to 5% across platforms.

Revenue growth here comes from repetition, not ticket size. That caps margins and pressures logistics economics.

👕 Clothing Lifespan

Fast fashion, faster replacement

Low prices show up again in how long products stay in use.

→ 50% of shoppers say Chinese-platform clothing is worn less than one season, including 11% who never reuse it.

→ Only 22% say they often or always wear these clothes for more than one season.

→ The largest single group, 20%, say usage varies from item to item.

This is ultra fast fashion in practice. The model favors turnover over durability, with implications for brands, returns and regulation.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team