TODAY’S MAZE

Happy Monday! OpenAI has fired a major shot across the bow of established marketplaces with the launch of its new Shopping Research tool inside ChatGPT.

By focusing on deep product comparison and excluding major platform listings like Amazon, the tool forces brands to optimize product data for decentralized discovery. The question for retailers now is: how quickly can they adapt their visibility strategies for this new wave of commerce agents?

In today’s MarketMaze:

ChatGPT launches new commerce agent

China’s Retail Reckoning

UK postpones de minimis tax break

Amazon invests $50B in AI infrastructure

Europe’s Retail Shape

+

Handpicked recent news you need to know:

🏬 Ecommerce Players (Marketplaces, e-Retailers, D2C)

📣 Ecommerce Ecosystem (Marketing, Tools, Logistics)

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: OpenAI just rolled out its new Shopping Research AI-powered shopping tool within ChatGPT, enabling in-depth product comparison and personalized recommendations complete with integrated images, signaling a direct challenge to the consumer discovery funnel currently dominated by established search engines and marketplaces.

The tool initiates personalized discovery by generating a short quiz to clarify user priorities like size and budget, allowing users to then refine recommendations by swiping right or left on item images.

Shopping Research relies on websites that permit its browsing agents, meaning Amazon product listings will likely be limited since the retailer chose to block several OpenAI crawlers.

Major retailers are aligning with this agent-driven trend, with Walmart, Etsy, and Shopify utilizing Instant Checkout, and Target also announced plans to launch the retailer’s app inside ChatGPT.

Why it matters: This launch makes product discovery competitive, forcing brands and retailers to ensure their product data and reviews are accessible and structured for non-Amazon AI agents that prioritize organic content. Ecommerce teams must focus on high-quality web visibility, since the tool is trained to prioritize trustworthiness and relevance over showing sponsored results.

FROM OUR PARTNERS

Make Every Platform Work for Your Ads

You’re running an ad.

The same ad. On different platforms. Getting totally different results.

That’s not random: it’s the platform effect.

So stop guessing what works. Understand the bit-sized science behind it.

Join Neuroscientist & Neurons CEO Dr. Thomas Ramsøy for a free on-demand session on how to optimize ads for different platforms.

Register & watch it whenever it fits you.

MAZE DEEP DIVE

The Maze: Temu’s rise looked unstoppable until gravity showed up. Growth, traffic, and market penetration across five regions reveal a simple truth: price wins fast, but policy and behavior win slow. The data tracks how Chinese platforms scale globally, where they stall, and why the next phase will be harder than the first.

Temu leaps 4,727.6% in ’23 then falls to 34.8% in ’25 while Shein slides from 237.9% in ’20 to 6.3% in ’26, showing discount fueled growth always normalizes.

US visits to Temu, Shein, Aliexpress hit more than 450M in early ’25 before new tariffs cut volume sharply, revealing how policy moves shape shopper behavior overnight.

Combined global traffic for Temu, Shein, Aliexpress climbs from about 600M in ’22 to nearly 3B in Aug ’25, overtaking Amazon’s 2.8B for the first time.

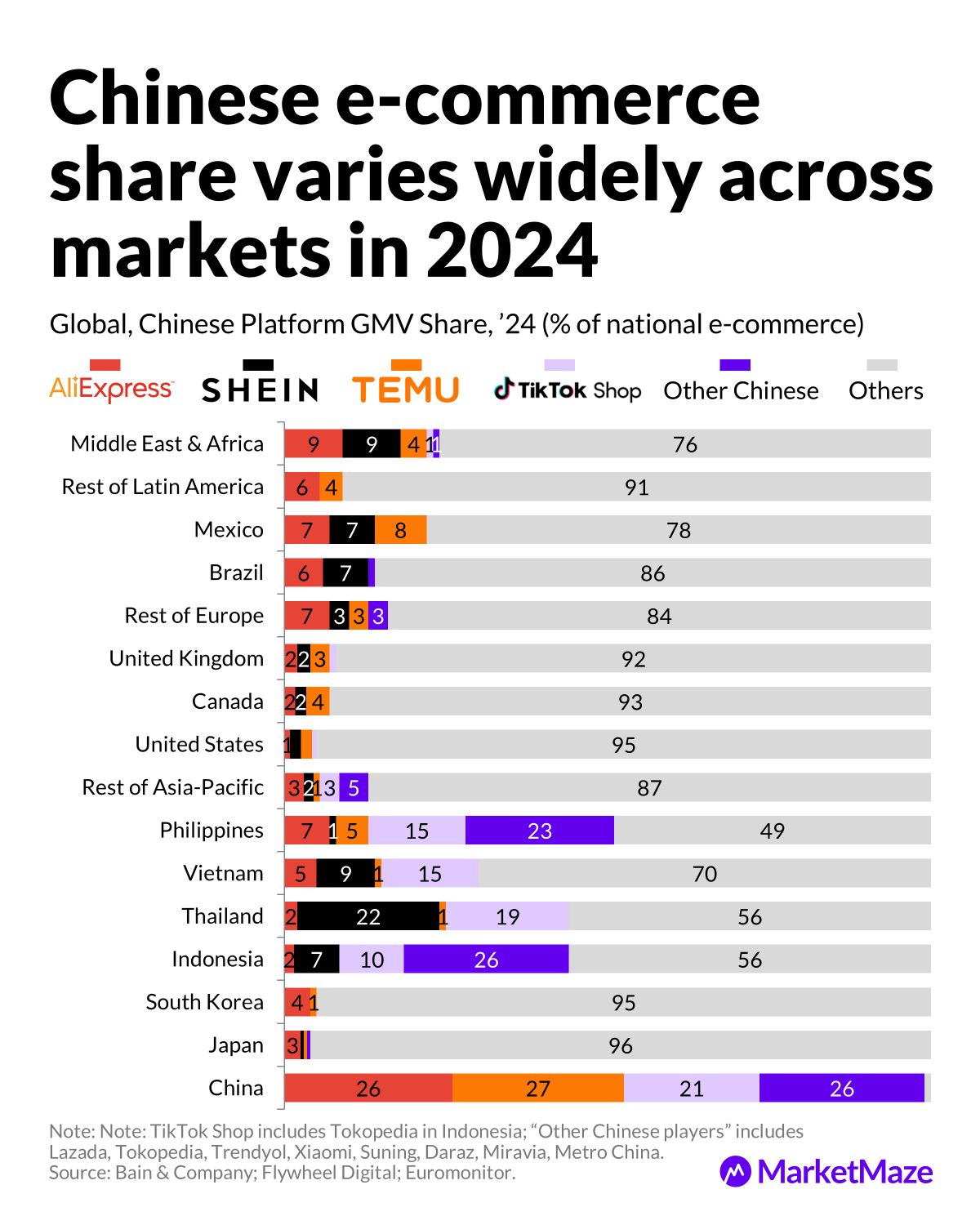

Chinese retailers penetration is highest where purchasing power is low and mobile habits dominate, with Indonesia, Vietnam and Philippines anchoring the fastest adoption curve.

Chinese retailers GMV share hits up to 56% in Indonesia and 49% in the Philippines while US, UK, Japan remain above 90% local due to stronger incumbents and higher consumer expectations.

Why it matters: Chinese ecommerce is no longer a regional story but a global variable. From traffic shocks to GMV redistribution, the world’s retail map is being redrawn by price, logistics and regulation. The next winners will be those who blend global scale with local behavior, not the ones spending the most on subsidies.

FROM OUR PARTNERS

See What’s Missing From Your Digital Marketing Strategy

Want to uncover your hidden affiliate marketing potential?

Levanta’s Affiliate Ad Shift Calculator shows you how shifting budget from PPC to creator-led programs can lift your ROI, streamline efficiency, and uncover untapped marketing revenue.

Get quick results and see what a smarter affiliate strategy could mean for your growth.

MAZE STORY

The Maze: Ecommerce sellers targeting the UK market just received a temporary reprieve after UK Chancellor Rachel Reeves postponed the removal of the controversial 'de minimis' rule, extending the £135 import duty exemption until March 2029.

The existing de minimis rule currently makes cross-border shipments under £135 duty-free, keeping product costs low for UK consumers and simplifying logistics for international sellers.

Critics argue the rule gives international third-party marketplaces a significant unfair price advantage over domestic UK retailers, avoiding charges that local businesses must pay.

This delay creates regulatory divergence in Europe, especially as Belgium prepares to introduce a separate new €2 parcel tax specifically targeting low-value shipments, increasing friction for sellers serving the European Marketplaces sector.

Why it matters: This extension buys international ecommerce operators four more years of simplified customs processes when selling to the UK, allowing them to delay integrating complex duty and VAT collection systems. Marketplace agencies must now focus on strategies that optimize current duty-free thresholds while preparing to manage the inevitable operational shift in 2029.

MAZE STORY

The Maze: Amazon is deploying a massive $50 billion investment into expanding its AI computing infrastructure for classified government workloads while simultaneously prototyping a new retail-style hub concept in Seattle designed for ultra-fast, local fulfillment.

This investment, set to break ground in 2026, aims to add nearly 1.3 gigawatts of data center capacity to specialized AWS GovCloud regions, supporting sensitive workloads.

Federal agencies will gain essential access to foundational AI tools, including Amazon SageMaker for custom model training and Amazon Bedrock for deploying AI models and building agents.

The company is testing a new retail-style fulfillment hub in Seattle, designed to support ultrafast fulfillment by placing inventory closer to customers for near-immediate delivery.

Why it matters: This massive commitment to advanced infrastructure ensures Amazon maintains a significant lead in the global AI arms race, benefiting future commerce tools and services built on AWS. For ecommerce operators, the hyper-local fulfillment test signals an urgent focus on iterating last-mile logistics to meet consumer demands for near-instant delivery.

DATA TREASURE

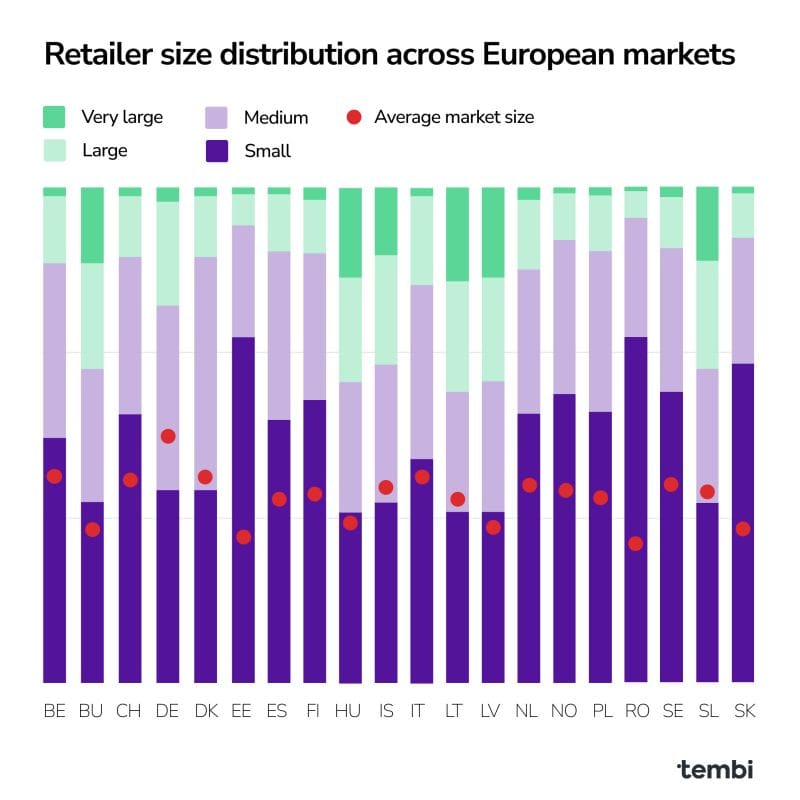

The Maze: This view shows how power in European ecommerce is uneven. Some countries run on thousands of small shops, while others rely on a few giants that set the rules. The balance between fragmentation and consolidation tells you who drives innovation, who controls scale and where the next wave of winners will emerge. It also shows which markets reward agility and which reward size.

In markets like Romania, Hungary and Slovakia the share of small retailers is dominant, creating fast testing cycles and room for new entrants to grow into category leaders.

Hybrid markets such as Italy and Belgium mix a strong long tail with a visible group of large players, creating space for consolidation and roll-ups.

In mature markets like the Netherlands, Germany and the Nordics large retailers pull ahead as shopper penetration reaches high levels and competition pushes out weaker players.

Why it matters: Understanding retailer mix helps brands pick their battles. Consolidated markets reward tight partnerships with a handful of big accounts, while fragmented ones require scalable marketplace strategies. The real opportunity sits in markets that are still fragmented but starting to consolidate, where professionalism rises and new leaders can scale quickly.

BRIEFING

🏬 Everything else in Ecommerce & key players

🌍 Black Friday demand is cooling as new data shows many “deals” weren’t the lowest prices of the year, pushing shoppers to scale back spending this Cyber Week.

🇺🇸 Amazon took action against a major trademark fraud ring and deployed internal AI agents to find platform vulnerabilities, doubling down on trust and site stability.

🇺🇸 Amazon is also rolling out new internal AI bug-hunters per a Wired report, strengthening defenses ahead of peak trade.

🇨🇦 Shopify dismissed staff after uncovering manipulated merchant-growth projections, highlighting governance and sales integrity issues.

BRIEFING

📣Everything else in Ecommerce ecosystem

🇪🇺 Logistics costs jumped as Belgium introduced a €2 parcel tax, while 🇬🇧 UK retailers are losing £2.1B annually by not claiming courier refunds for damaged or lost parcels.

🌍 Google PMax added direct-video uploads just as new findings show retailers are burning ad spend on Shopping ads for sold-out items.

🇺🇸 Home Depot launched an AI Blueprint Takeoffs tool to lock in B2B contractors earlier and expand its professional workflow share.

🇺🇸 Old Navy introduced same-day delivery through DoorDash, accelerating its omnichannel push and bringing fast-delivery models deeper into fashion retail.

🇪🇺 Cross-border shipping faces new pressure after Belgium introduced a €2 parcel tax, adding friction for EU merchants during peak-season volumes.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

See you next time in the maze!

MarketMaze team