TODAY’S MAZE

Happy Thursday! Bezos’ new AI venture is making a bold entry into the agent race, snapping up a startup built to let software take action instead of just giving advice.

The move shows how fast agentic systems are becoming real tools for work, not experiments. The open question is how quickly these agents will reshape the way ecommerce teams operate when they start making decisions on their own.

In today’s MarketMaze:

Bezos agent push

Year-end shopping shifts

Agentic checkout tools

Alibaba AI-fueled growth

Triopoly ad momentum

+

Handpicked recent news you need to know:

🏬 Ecommerce Players (Marketplaces, e-Retailers, D2C)

📣 Ecommerce Ecosystem (Marketing, Tools, Logistics)

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Project Prometheus is a $6.2B bet that the next big AI win is not chat, it is control. Bezos and Vik Bajaj are building an industrial AI company, then quietly buying the talent that can make software act. Jeff Bezos’ New AI Venture Quietly Acquired an Agentic Computing Startup. The General Agents deal signals a pivot from “smarter models” to “AI that clicks, types, and ships work.”

In June 2025, Vik Bajaj hosted an off the record AI dinner at Saison in San Francisco, and public filings show an acquisition entity was formed the next morning, then merged with General Agents four days later, fast even by startup standards.

Prometheus is reported to have ~$6.2B funding, 100+ employees, and co CEOs Bezos and Bajaj, positioning it as a heavyweight from day one, not a garage experiment that might matter later.

General Agents’ founders include Sherjil Ozair (ex DeepMind, Tesla) and William Guss (ex OpenAI), and their product Ace launched in April 2025 as a “computer pilot,” a clue that Prometheus wants agents that can operate today’s tools, not just talk about them.

Why it matters: This is the agent shift: AI stops advising humans and starts executing tasks inside real systems, with real consequences. For ecommerce, that means smaller teams can run more catalog, ads, pricing, and customer ops, but mistakes scale just as fast. The winners will be the companies that pair speed with controls, because autonomous clicks can burn cash faster than any intern.

FROM OUR PARTNERS

Simplify Training with AI-Generated Video Guides

Simplify Training with AI-Generated Video Guides

Are you tired of repeating the same instructions to your team? Guidde revolutionizes how you document and share processes with AI-powered how-to videos.

Here’s how:

1️⃣ Instant Creation: Turn complex tasks into stunning step-by-step video guides in seconds.

2️⃣ Fully Automated: Capture workflows with a browser extension that generates visuals, voiceovers, and call-to-actions.

3️⃣ Seamless Sharing: Share or embed guides anywhere effortlessly.

The best part? The browser extension is 100% free.

MAZE DEEP DIVE

The Maze: Shoppers are rewriting the playbook as year-end sales turn into global smart-spending rituals. Consumers compare harder, plan earlier, and lean on GenAI to cut through the noise. Despite price pressure and uncertainty, intent to buy rises and spending shifts toward essentials and strategic splurges.

Across markets, 70–90% plan to shop year-end deals, led by Italy 95% and the US 86%; intent rises even as cautious sentiment persists.

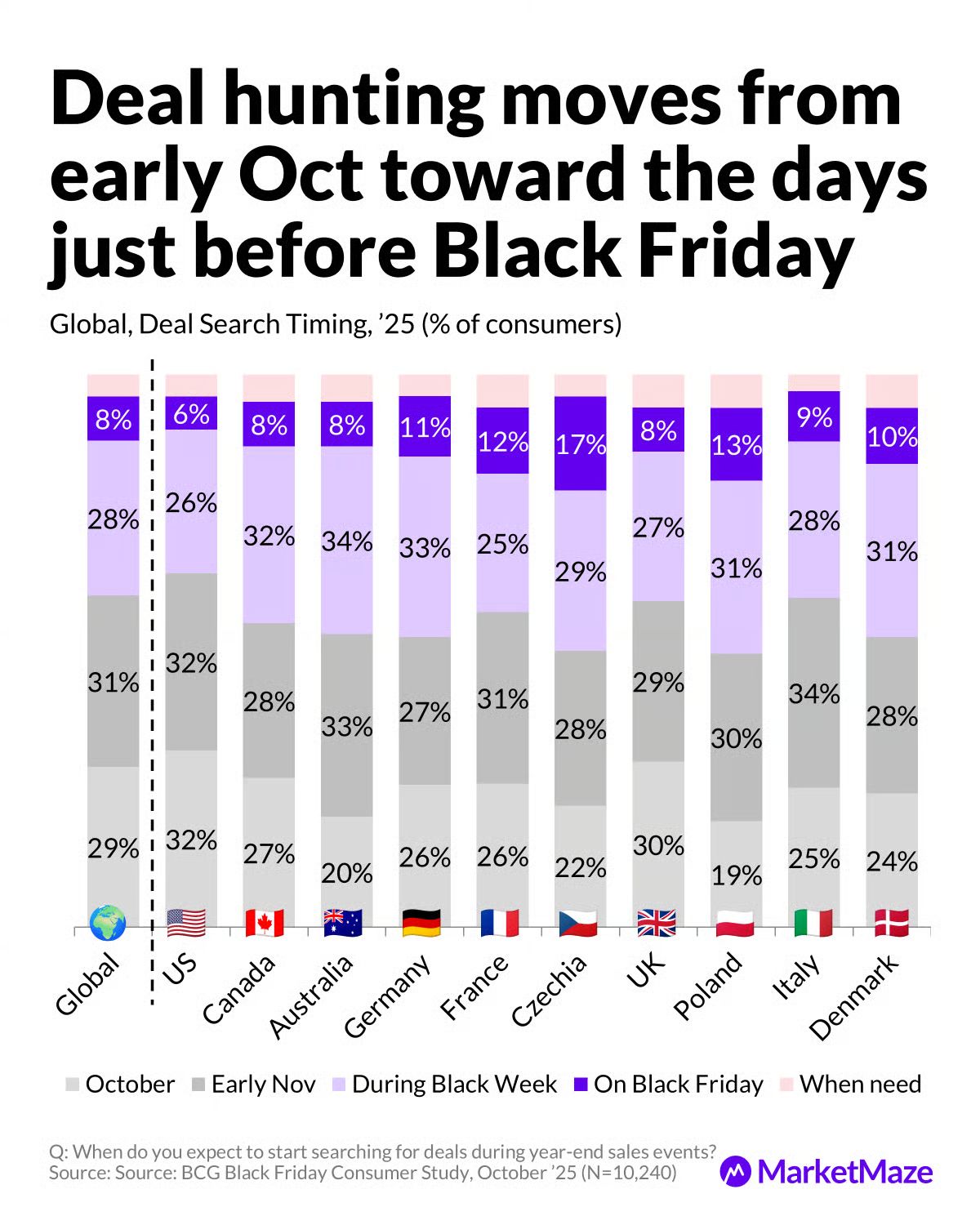

Deal hunting moves later, with 28% searching only days before Black Friday, up as shoppers wait for bigger discounts.

Essentials still dominate budgets globally at 56%, but higher-priced discretionary items gain traction as confidence inches back.

GenAI use jumps 9pp YoY, with 48% using or planning to use AI for research, price checks, and deal-hunting; the US leads with 51%.

Why it matters: Year-end events are now global battlegrounds where value decides loyalty and visibility equals revenue. AI-driven discovery reshapes how consumers search, compare, and buy. Retailers that communicate clearly, show real value, and win the early digital interface pull ahead in a market where trust

FROM OUR PARTNERS

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

MAZE STORY

The Maze: The era of agentic commerce is officially here, accelerating the distance between discovery and checkout as major players build transaction capabilities directly into AI models. Tech giants and payment processors are rapidly constructing the foundational rails necessary for autonomous purchasing, while retailers like Newegg integrate to capture purchase flows before the holiday rush.

Newegg uses PayPal’s Agent Ready and Store Sync features, allowing customers to discover products through AI environments and complete checkout leveraging trusted payment services.

Google’s release of its Agent Payments Protocol marks an incremental shift toward an automatic future, necessitating shared industry standards for nonhuman transaction actors to prevent fragmentation.

Fueled by its ability to convert customers 3-5x more than traditional sites, the AI search company Onton has raised $7.5 million in new funding to expand into categories like apparel and consumer electronics.

Why it matters: Autonomous agents are shrinking the distance between product discovery and the point of sale, effectively turning conversational platforms into dynamic marketplaces that execute transactions. This shift means ecommerce teams must rapidly integrate new agent-ready payment systems and adapt marketing strategies to influence non-human buyer intent, or risk becoming invisible to the next generation of digital commerce.

MAZE STORY

🇨🇳 Alibaba Cloud Sales Surge 34%

The Maze: Alibaba reported a 5% revenue increase in Q2, but the real story is its aggressive push into AI, which fueled a 34% jump in cloud computing revenue despite massive capital investment that slashed overall profitability.

AI-related product revenue achieved triple-digit growth for the ninth consecutive quarter, demonstrating sustained commercial adoption and validating the estimated 380 billion yuan investment in AI infrastructure.

CEO Eddie Wu dismissed talk of an AI bubble, noting that demand for AI resources remains strong, forcing the company to invest aggressively because they cannot keep pace with the deployment of new servers.

The company’s core China e-commerce revenue, housing platforms like Taobao and Tmall, rose 16% year-over-year, while revenue from quick commerce surged 60%, showing AI initiatives boost underlying commerce growth compared to the previous quarter.

Why it matters: This report confirms that large-scale AI adoption is no longer optional; it requires massive capital expenditure to secure capacity and drive actual revenue growth in both cloud and consumer businesses. Ecommerce leaders must factor in the increasing cost and undersupply of AI resources, as this spending race dictates the future capabilities of global commerce platforms.

DATA TREASURE

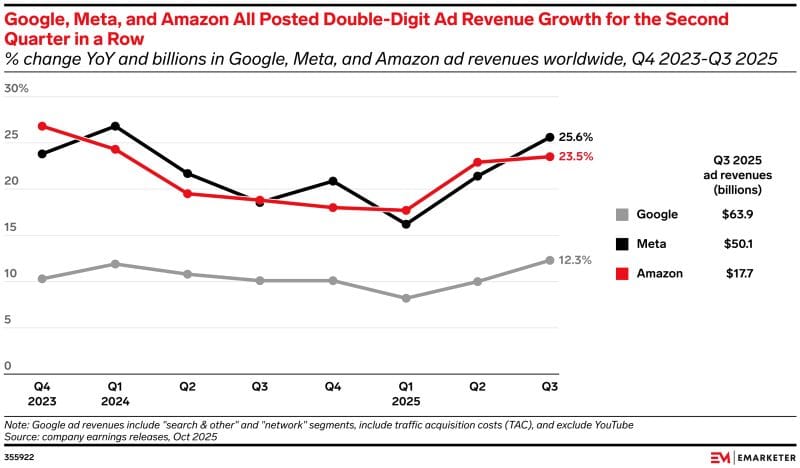

The Maze: The three giants of digital ads just logged another quarter of double-digit growth, but the story behind the numbers is a fight to stay ahead of rising AI costs, tougher rules, and shifting user habits. Google delivered record revenue but slower ad momentum, while Meta and Amazon posted faster gains built on smarter targeting and higher intent. The real signal is that the ad model is still the cash engine, yet the cost of defending it keeps growing.

In Q3 2025 Google hit its first $100B quarter, with Search and YouTube lifting ad revenue about 12 percent, yet year on year its growth rate trailed Meta and Amazon as AI projects pushed capex toward the $90B range and margins tightened.

Meta booked roughly 26 percent ad growth as impressions rose and price per ad climbed, even though a $16B tax charge hit net income and raised questions about how long high-growth targeting can outrun legal scrutiny.

Amazon posted around 24 percent ad growth, reaching nearly $18B, fuelled by retail media and Prime Video ads that convert high-intent shoppers into revenue at a pace neither of the other two platforms can easily match.

Why it matters: The triopoly still controls most digital ad spending and shows no signs of losing its grip. Strong performance signals that brands are shifting budget toward platforms that combine user intent with AI-powered measurement. The risk is that rising AI investment and tougher rules might slow the momentum, which would ripple across ecommerce players that depend on these platforms for reach, conversion, and growth.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇺🇸 HP announced it will reduce its corporate headcount by 4,000 to 6,000 jobs by the end of fiscal 2028, estimating it will save $1 billion through AI-driven process redesign and automation.

🇫🇷 Shein's physical retail push in Paris met regulatory resistance after a public prosecutor declined a request to block the site, highlighting the challenge the ultra-fast fashion giant presents to traditional department stores.

🇺🇸 Consumers upped their planned holiday gift spending budgets by 7% since summer, led by increased spending forecasts from Baby Boomer and Gen Z cohorts, countering earlier recessionary predictions.

🇮🇹 Primark reinforced its commitment to the Italian market by opening its 20th store and signing a deal to build its first 81,000-square-metre logistics hub in Alessandria, Italy.

🇺🇸 Abercrombie & Fitch lifted its annual profit forecast and projected a robust holiday quarter after net sales rose 7% in Q3, driven by strong demand for its in-trend Hollister apparel.

BRIEFING

📣Everything else in Ecommerce ecosystem

🔎 A new study tracking 25,000 search results confirmed that Google is placing ads within AI Overviews, albeit at a low frequency (0.052%), coinciding with significant reported declines in paid search CTRs.

🇺🇸 Target provided an exclusive look inside one of its regional distribution centers, highlighting the massive operational push required to ensure product availability during the holiday season.

🇺🇸 Kroger’s Harris Teeter banner is permanently closing its Alexandria, Virginia, online fulfillment spoke by February 1, continuing the restructuring trend within its dedicated digital fulfillment network.

🇺🇸 Albertsons and Chobani piloted a partnership with NBCUniversal’s retail media division to provide closed-loop measurement, connecting Connected TV (CTV) ad exposure directly to verified retail performance outcomes.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team