The Maze: Ecommerce traffic is not disappearing. It is moving. Across 2023 to 2025, site visits stall, users flatten, and sessions migrate into apps and marketplaces, concentrating demand into fewer, faster, habit driven surfaces.

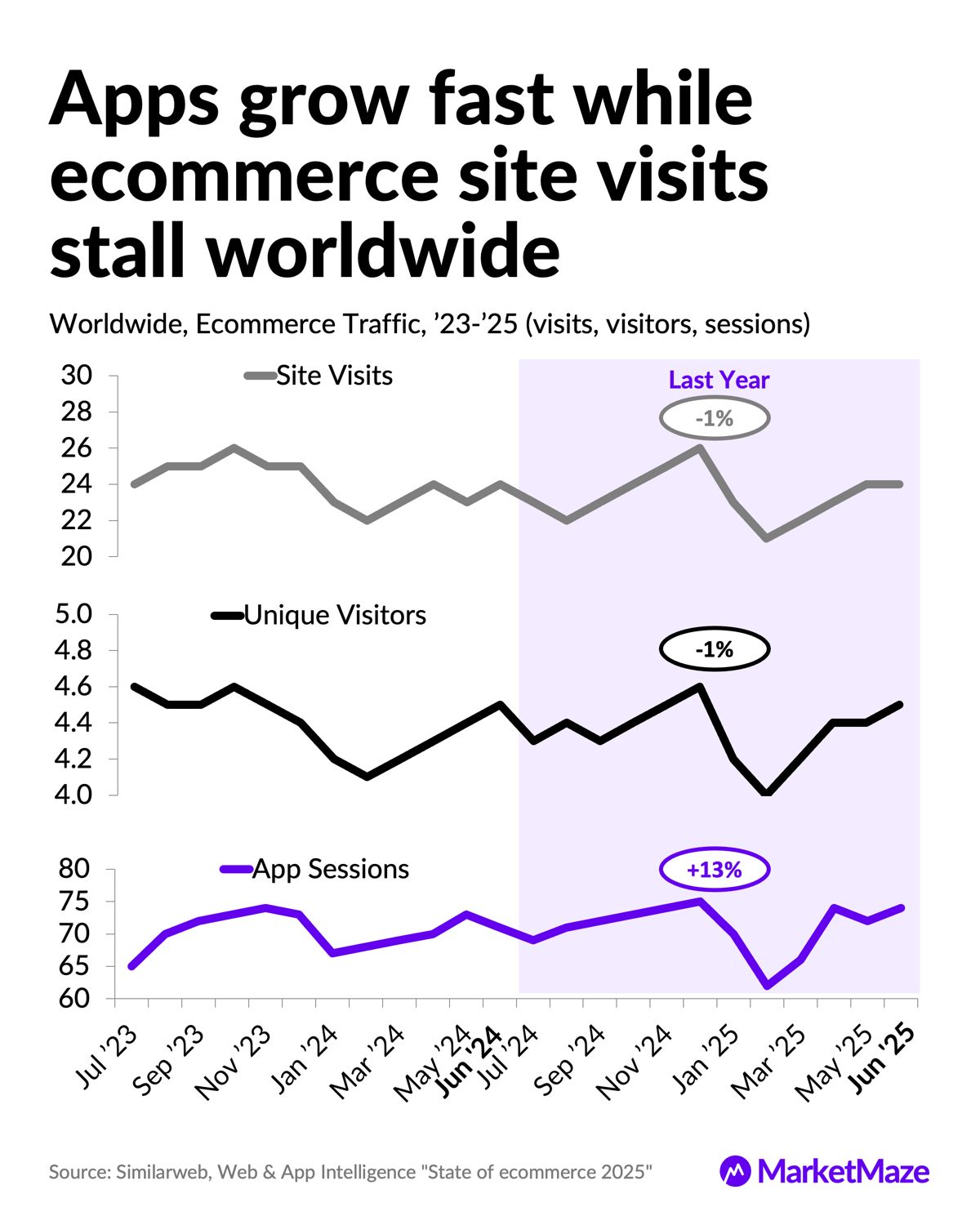

Apps post +13% session growth YoY while site visits and unique visitors both slip -1%, signaling engagement is rising even as reach stagnates

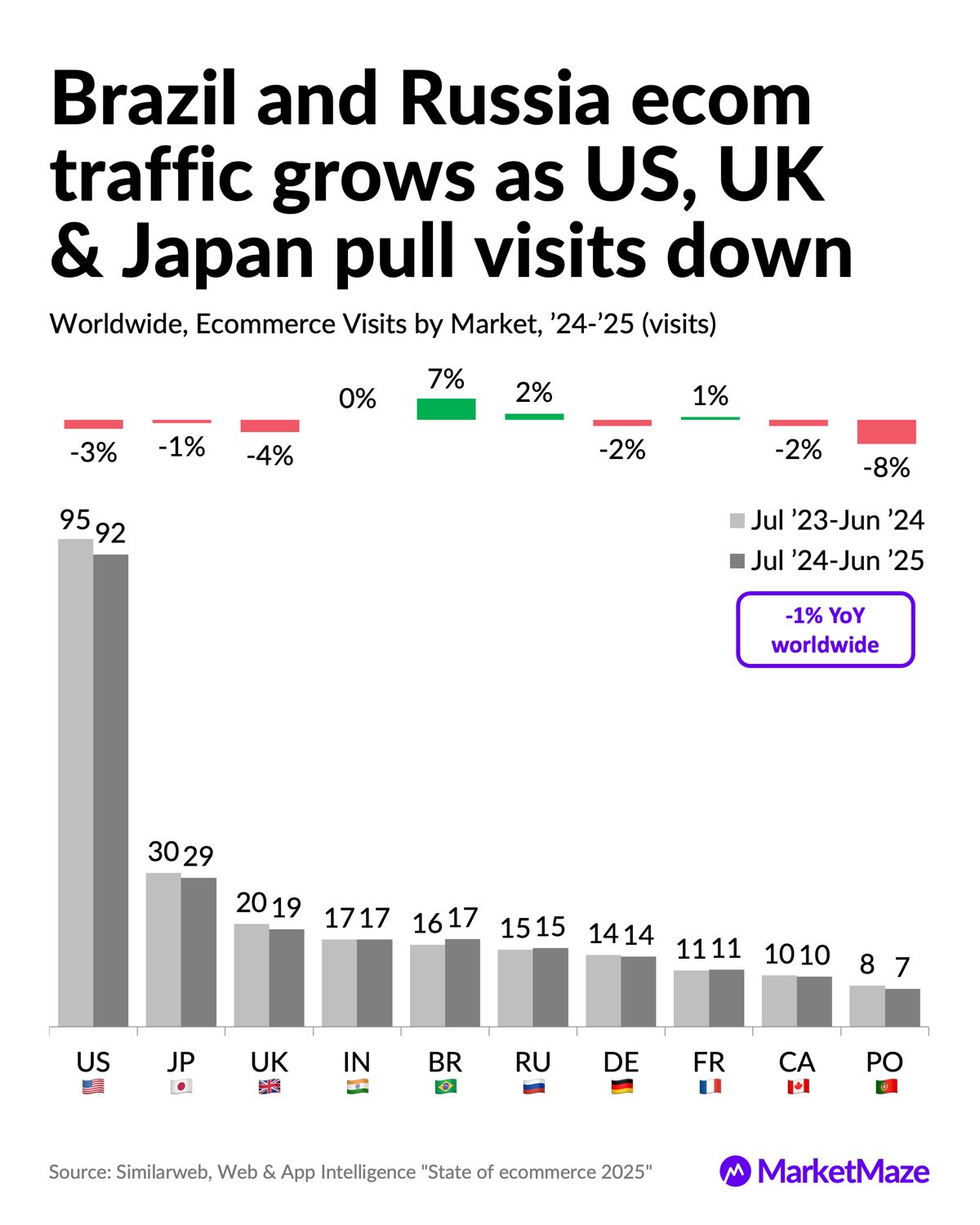

US, UK and Japan drag global ecommerce visits down -1% YoY, but Brazil +7% and Russia +5% partially offset mature market fatigue

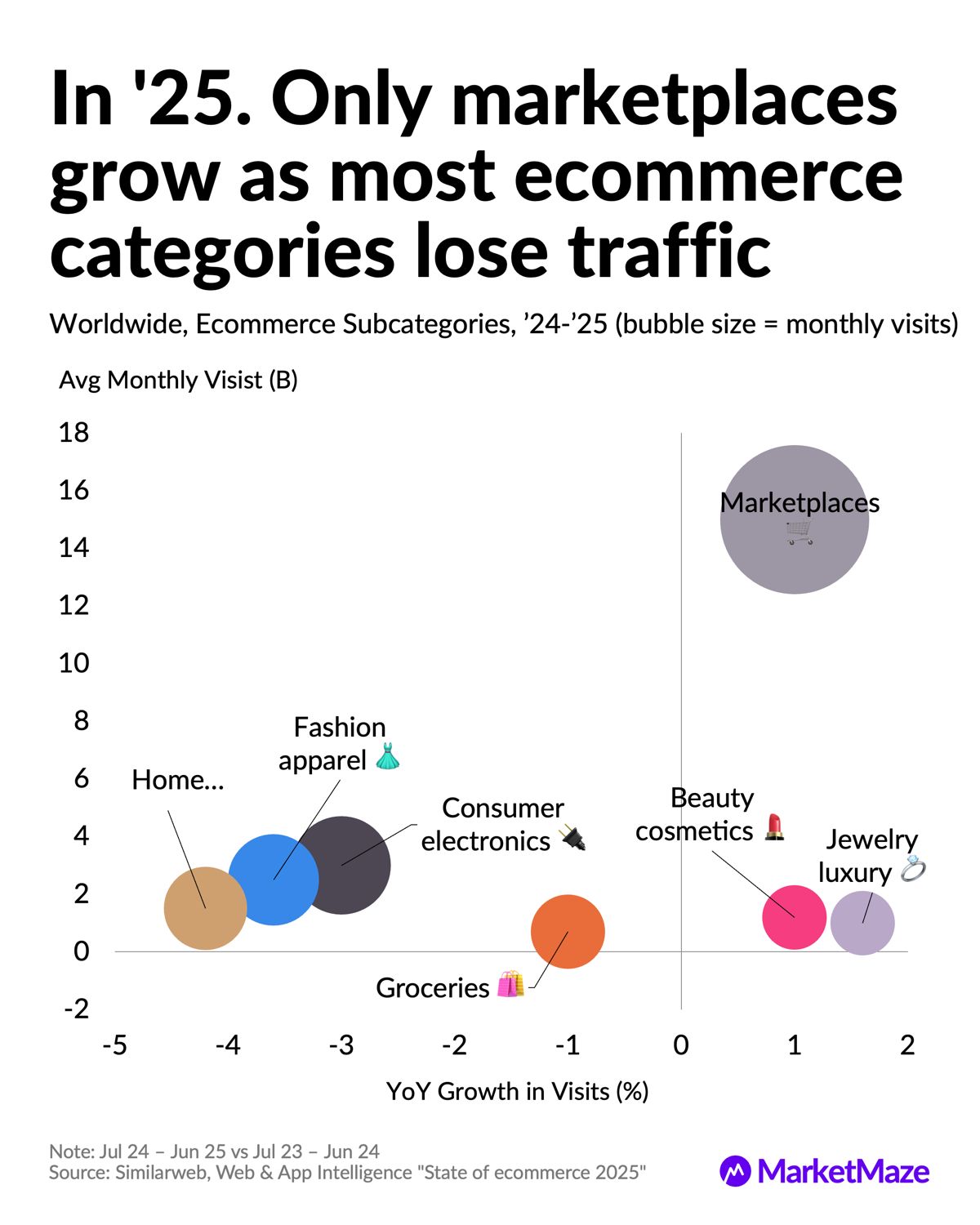

Marketplaces are the only subcategory growing in 2025 at ~15B monthly visits, while fashion, electronics and home lose 3% to 5% YoY

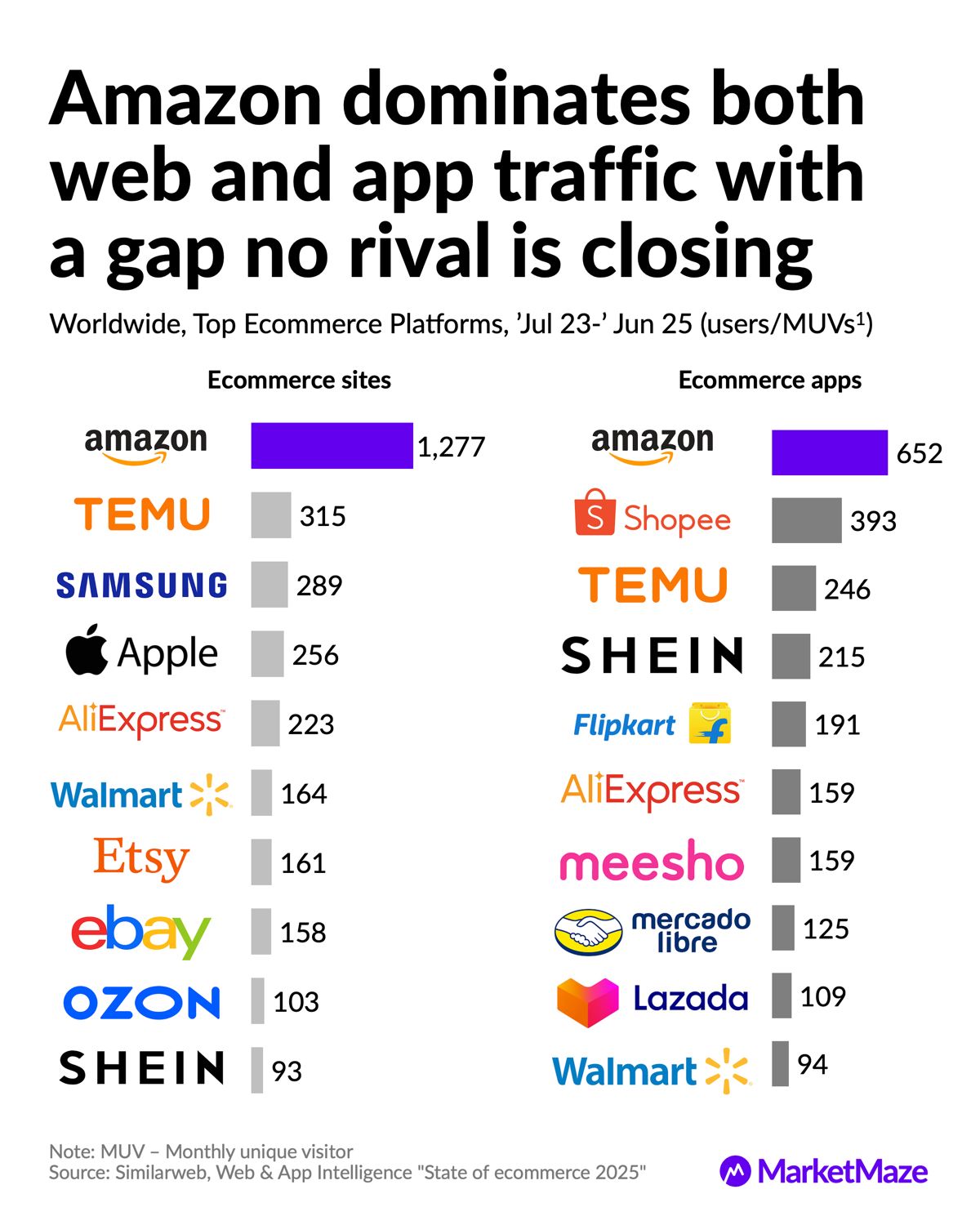

Amazon reaches 1.3B monthly web users and 652M app users, with no rival closing the gap across either surface

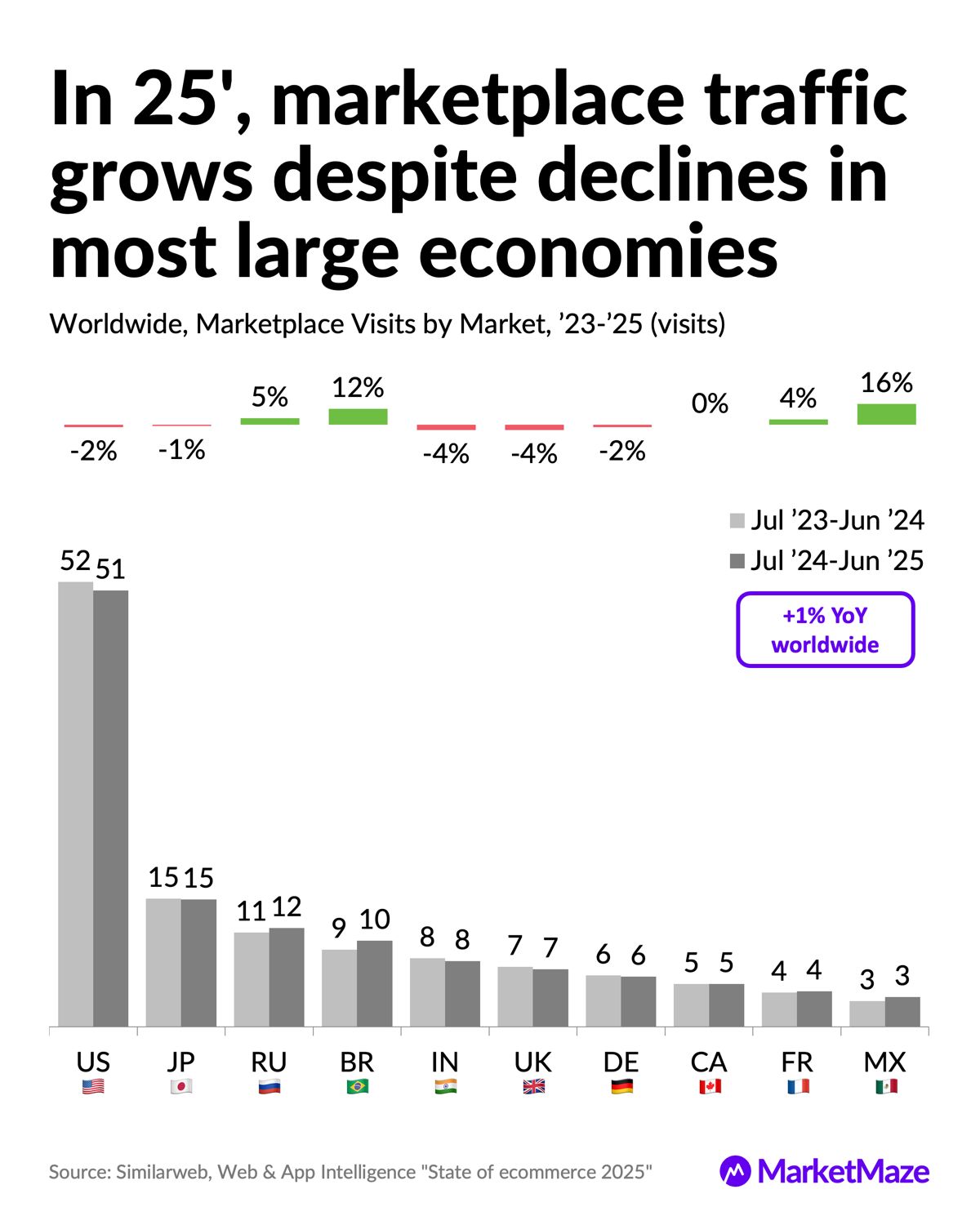

Marketplace visits grow +1% globally in 2025 despite declines in the US -2%, UK -4% and Germany -2%, driven by Brazil +12% and Mexico +16%

Why it matters: Ecommerce is consolidating around fewer doors. When growth slows, consumers compress choice, start shopping later, and favor platforms that bundle price, trust and delivery in one place.longs to those who optimize algorithms, not those who rely on awareness.

📱 App Shift

Sessions surge as ecommerce sites lose momentum

Apps are where ecommerce now happens. Sessions rise +13% YoY even as site visits and unique visitors both fall -1%. Shoppers are not browsing more stores, they are opening the same apps more often.

App sessions climb from ~69B to ~74B monthly in 2024 to 2025, while site visits fluctuate around 22B to 26B with no net growth

Unique visitors hover near 4.4B globally, showing ecommerce reach has plateaued even as engagement per user rises

The behavior shift favors apps with saved payment, push offers and faster repeat checkout over open web discovery

The bottom line is simple. Growth has moved from acquisition to frequency. Apps win because they reduce friction, shorten decisions, and reward habit.

🌍 Market Split

Brazil and Russia grow while big economies stall

Global ecommerce visits fall -1% YoY, but the average hides sharp divergence. Mature markets shrink while a handful of large emerging markets keep traffic alive.

The US drops from 95B to 92B visits and Japan from 30B to 29B, together pulling the global line down

Brazil grows from 16B to 17B visits +7% and Russia from 11B to 12B +5%, offsetting declines elsewhere

The UK -4%, Germany -2% and Portugal -8% show how fragile ecommerce traffic is in saturated markets

This is not about ecommerce adoption. It is about macro pressure and maturity. Where wallets tighten, traffic thins. Where penetration is still rising, growth remains.

🛒 Category Shakeout

Only marketplaces grow as categories lose traffic

In 2025, marketplaces stand alone. Every major ecommerce category shrinks except one, and it is not close.

Marketplaces generate ~15B avg monthly visits and grow while fashion apparel -3%, consumer electronics -3% and home -4% decline

Groceries slip ~1% as inflation fatigue hits frequency and basket size

Beauty and luxury grow slightly but remain niche at ~1B monthly visits each

When choice overwhelms and budgets tighten, shoppers start where comparison, reviews and price signals are strongest. That is the marketplace advantage.

👑 Amazon Gravity

No rival closes the web or app gap

Amazon is not just the biggest. It is structurally ahead on both surfaces, making competition asymmetric.

Amazon draws 1,277M monthly web users, over 4x Temu at 315M and nearly 8x Walmart at 164M

On apps, Amazon leads with 652M MAUs, ahead of Shopee 393M and Temu 246M

The same brand owning both web reach and app habit makes displacement extremely hard

This is why retail media grows faster than retail. Owning demand lets you tax it.

🇪🇺 Europe Upside

Faster Amazon growth outside the US

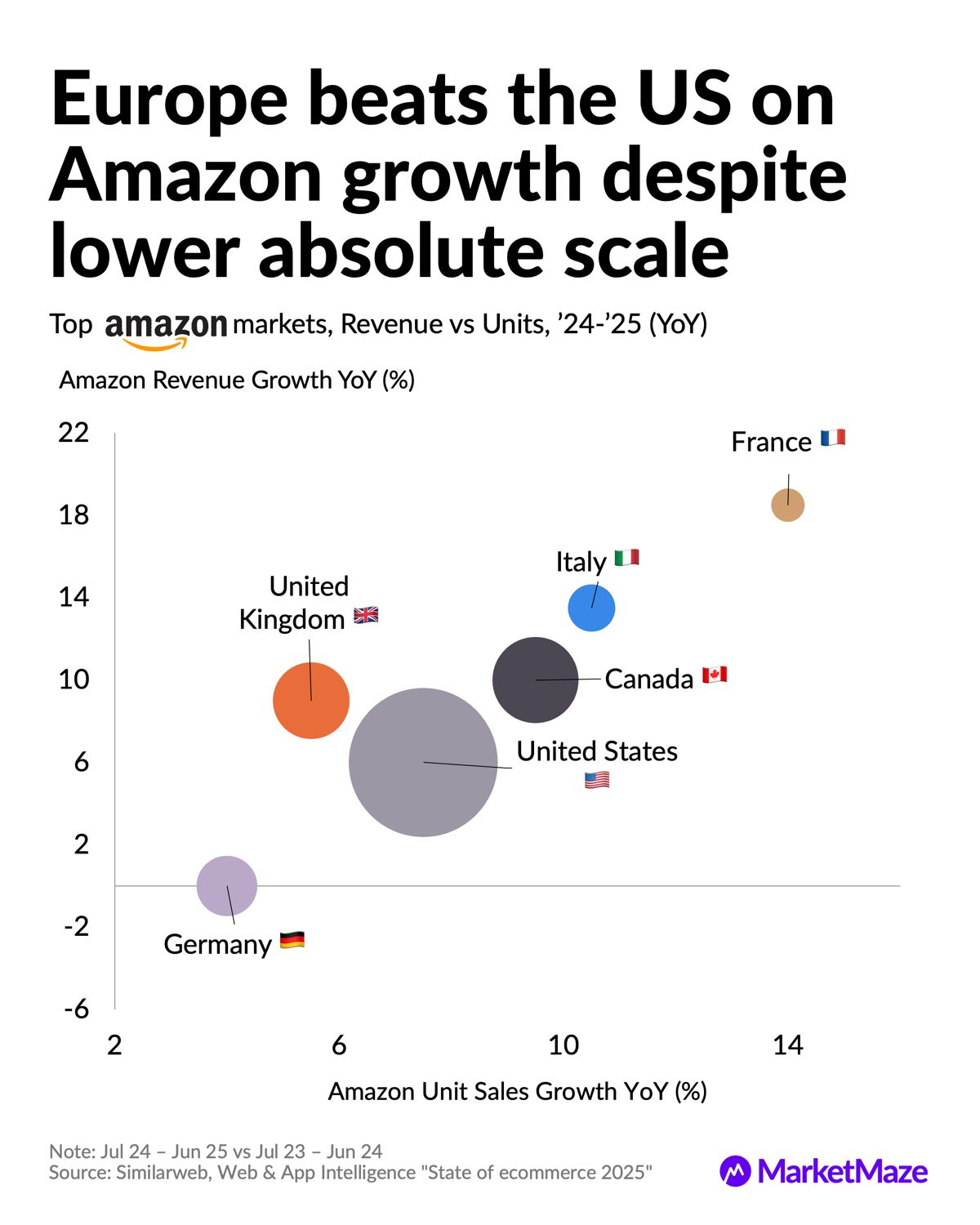

Europe beats the US on Amazon growth rates, even with lower absolute scale.

France posts ~14% unit growth and ~18% revenue growth, outperforming all peers

Italy follows with ~10% units and ~14% revenue, showing strong mix and pricing power

Germany underperforms with ~4% unit growth and slightly negative revenue, signaling heavier discounting

The US remains the profit pool. Europe is the growth story.

📈 Marketplace Paradox

Traffic grows despite big market declines

Marketplace visits rise +1% globally in 2025, even as most large economies shrink.

The US falls from 52B to 51B marketplace visits and the UK from 7B to 7B with -4% YoY

Brazil jumps from 9B to 10B +12% and Mexico from 3B to 3B +16%, driving net growth

Canada stays flat while France adds +4%, showing growth is coming from mix, not scale

Marketplaces win in downturns because they compress search, reduce risk and anchor price expectations.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team