The Maze: Shoppers are voting with their wallets and the latest pricing sweep shows clear winners and losers. Using five years of category level price gaps, we mapped how retailers stack up against Amazon’s benchmark. The picture is blunt: Walmart closes in, Target drifts, and Amazon keeps the crown.

→ Amazon holds lowest prices across all major categories with gaps ranging from 1 to 5%, pulling ahead in staples like packaged foods and household goods.

→ Walmart strengthens its price position, posting gains of 9 ppts in video games and 5 ppts in pet supplies while trimming gaps to 4% on average.

→ Target remains the most expensive of the three with premiums as high as 29% in vitamins and 25% in packaged foods and only slight relief in books and sports.

Why it matters: Price competition sets the tone for ecommerce traffic and margin pressure. Amazon’s consistency forces rivals into selective discounting, while Walmart’s gains show growing intent to win value shoppers. Target faces a tougher climb as wide premiums risk losing price sensitive customers and search visibility.

🛒 Amazon Lead

Amazon holds lowest prices across categories

Amazon sets the baseline in every tracked category and keeps spreads narrow enough to dominate value perception. The retailer blends consistency across essentials and discretionary goods which strengthens its pull as the default search start. Walmart appears in nearly every second lowest slot but rarely narrows the gap fully.

→ Appliances, books and fashion land spreads of three to five percent, showing Amazon’s strength in high traffic and high recurrence categories.

→ Sports and pet supplies sit at one percent gaps, proving Amazon’s grip in everyday essentials where loyalty compounds.

→ Chewy is the only non mega retailer matching closely with a one percent pet supply difference.

Amazon’s uniformity reinforces shopper trust and resets the price tempo for the entire market. The narrow spreads help Amazon defend traffic and shape customer expectations heading into more competitive categories.

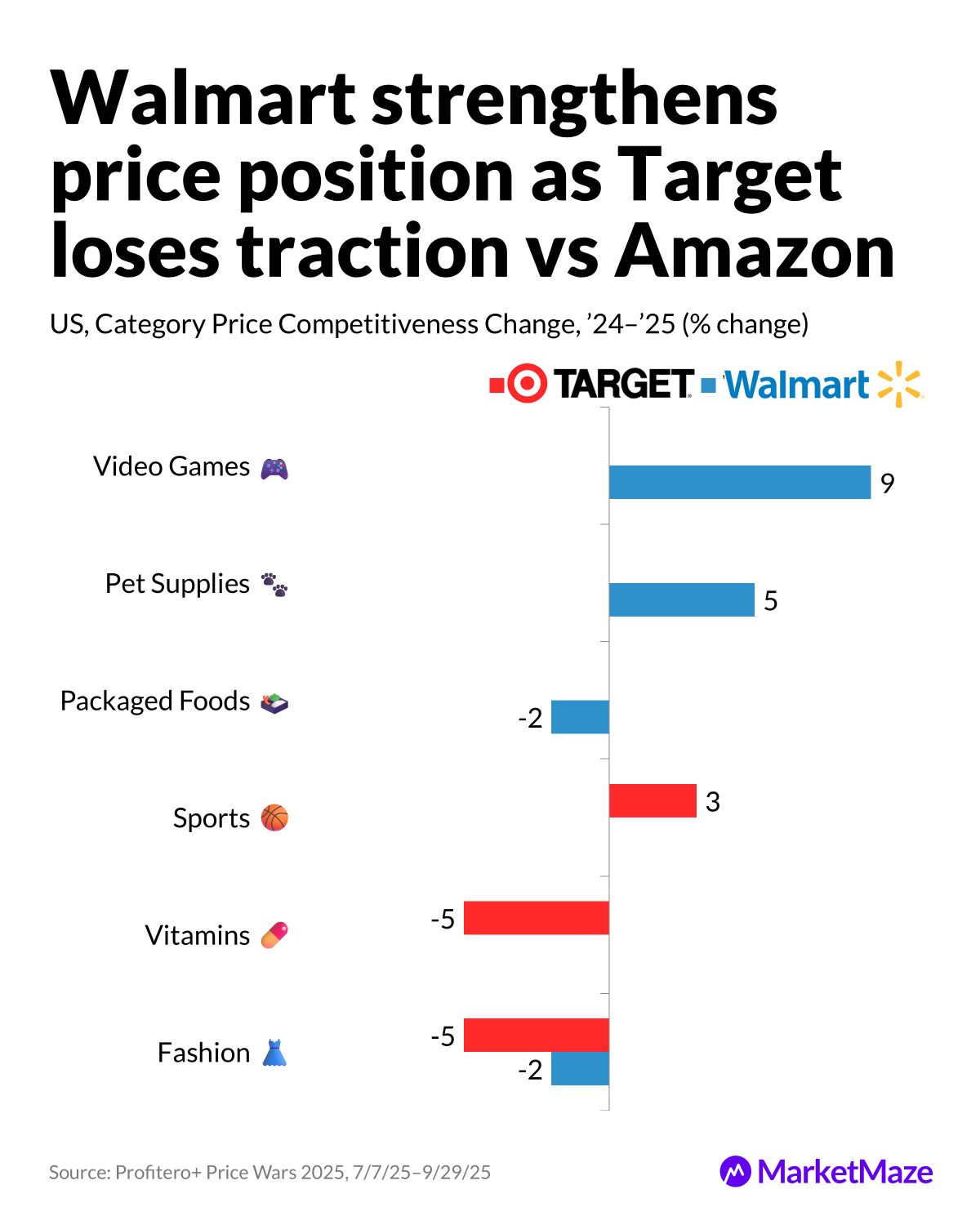

📈 Walmart Shift

Walmart strengthens price position in key categories

Walmart tightens price competitiveness in the categories that matter most for share and frequency. The retailer posts standout jumps in video games and pet supplies which directly influence its appeal to younger and recurring purchase segments. Small pullbacks in packaged foods reflect trade offs rather than a broader retreat.

→ A nine point improvement in video games signals Walmart’s push to win in digital heavy, high visibility verticals.

→ A five point lift in pet supplies reinforces Walmart’s commitment to recurring purchase categories critical to long term customer value.

→ A two point dip in packaged foods suggests recalibration in a cost pressured segment rather than weakening price stance.

Walmart is strategically compressing the gap where shoppers can feel it most. This measured aggression strengthens its competitive grip and pressures rivals to revisit category pricing logic.

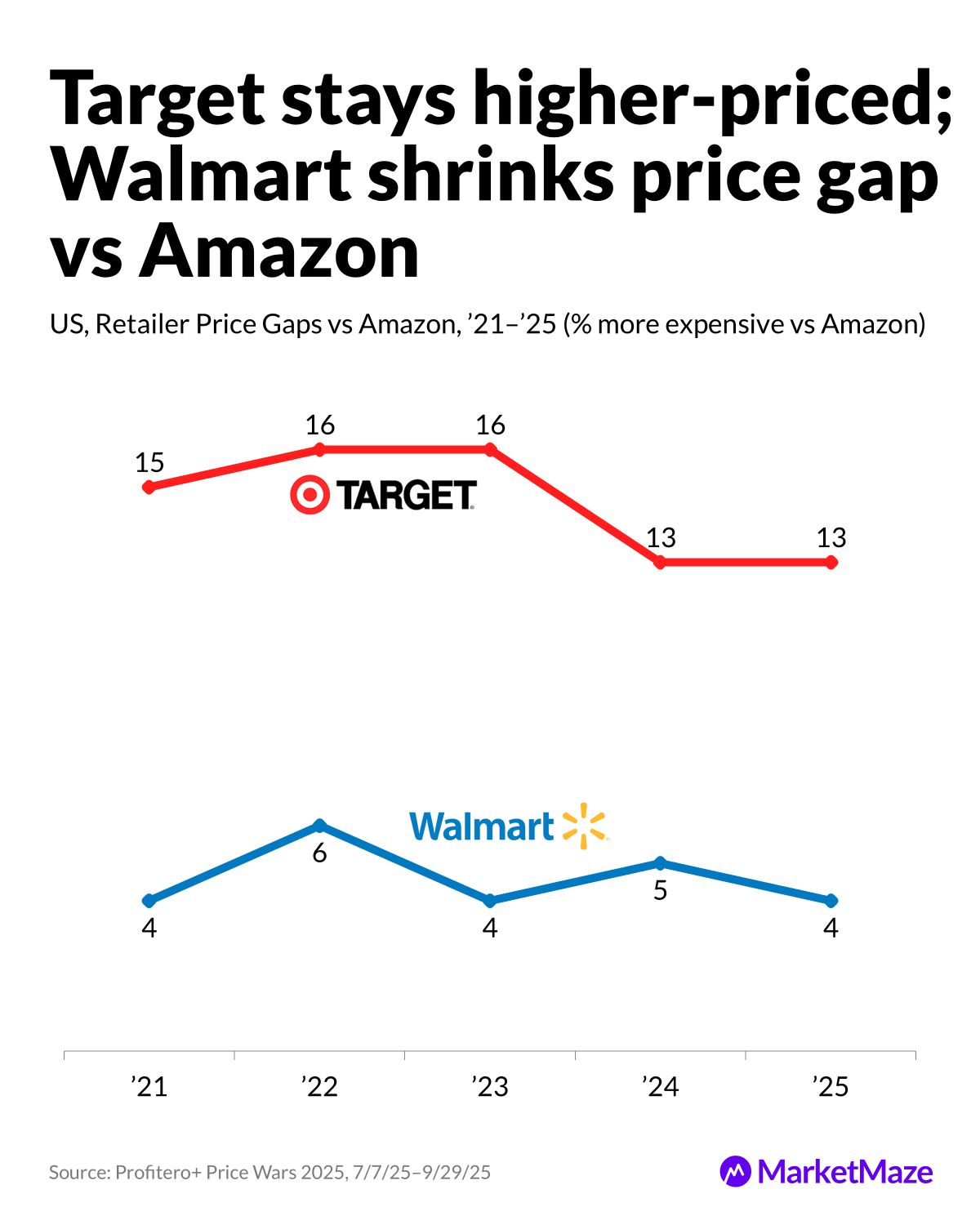

🎯 Target Premiums

Target stays higher priced throughout five year trend

Target carries the highest premiums in the dataset and shows little structural change even as isolated categories tighten. Wide gaps in essentials drive meaningful disadvantage because small premiums compound across full baskets. The long term view exposes Target’s struggle to position as a value choice.

→ Vitamins post a twenty nine percent premium and packaged foods show twenty five percent, the steepest spreads across any category.

→ Electronics, fashion and tools also hold double digit premiums which erode competitiveness during key seasonal events.

→ Five year spans between thirteen and sixteen percent highlight persistent price distance versus Amazon.

Target’s premium stance may work for curated assortments but weakens its pull in a comparison heavy environment. Without tighter price architecture, the retailer risks entrenched perception gaps.

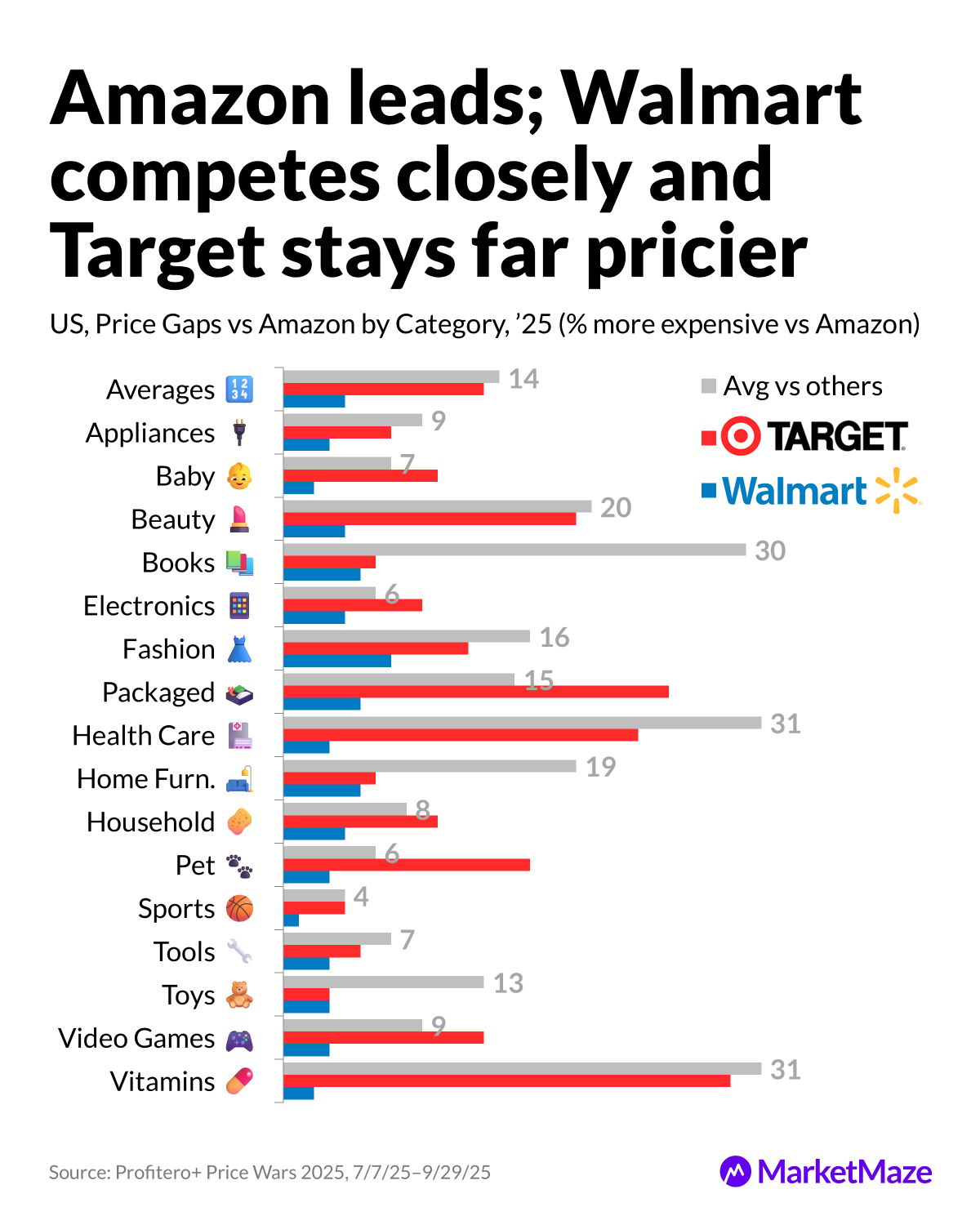

📊 Gap Spread

Average premiums show widening retailer divergence

Category averages uncover the broader pattern shaping share dynamics. Amazon sits at zero across every category while Walmart carries modest four percent premiums and Target climbs to thirteen. Wide spreads in books, vitamins and packaged foods highlight where Amazon’s scale delivers the sharpest advantage.

→ Vitamins hit thirty one percent category averages with Target close at twenty nine percent, underscoring Amazon’s dominance in health and wellness.

→ Books land at thirty percent averages which reinforces Amazon’s historical strength in its original core market.

→ Electronics remain relatively tight with Walmart at four percent and Target at nine which aligns with standardised pricing and predictable promo cycles.

The divergence is unmistakable. Amazon defines the baseline, Walmart tightens its chase and Target pays for a strategy that drifts from shopper sensitivity. Pricing is becoming the strongest lever shaping competition ahead.

Editable Slides & Sources:

🔒 Available for MarketMaze+ subscribers

🎓 Found this insightful?

📩 Get free ecommerce news & insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

That’s it!

Before you go we’d love to know what you thought of this maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team