TODAY’S MAZE

Happy Wednesday! The price war in European ecommerce just entered a new chapter, and Amazon is the one making the first bold move. Starting December 15, the company will roll out broad fee cuts across its EU marketplaces to help sellers compete with the rising pressure from Temu and Shein.

The shift lowers costs in fashion, fulfillment, and low-price tiers, giving merchants room to sharpen their price points without sacrificing margin. For ecommerce operators, this is a clear signal: the battle for Europe’s value consumer is accelerating, and the platforms are now adjusting their economics to keep pace.

In today’s MarketMaze focus:

Amazon’s EU Fee Reset Begins the Price War

Chinese Shoppers Rewrite Poland’s Ecommerce Map

OpenAI Hits ‘Code Red’ as AI Rivalry Escalates

Mexico Joins the World’s Digital Retail Leaders

UK Bans Greenwashing Ads from Major Brands

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Facing heavy competition from ultra-low-cost rivals like Temu and Shein, Amazon announced a comprehensive European fee reduction plan that makes selling cheaper in key high-volume categories, effective starting December 15, 2025. This strategic move aims to boost seller participation and strengthen Amazon’s position in the low-price segment of its European marketplaces.

Referral fees for Clothing and Accessories will drop significantly, falling from 8% to 5% for items priced up to £15/€15, directly targeting the high-volume fashion segments.

Fulfillment fees under FBA for parcels will decrease by an average of £0.26/€0.32 across the UK, Germany, France, Italy, and Spain, a change Amazon executive Dharmesh Mehta confirmed helps align European fees with adjustments made in other regions.

Amazon expands its reduced Low-Price FBA rates to include products priced at or below £20/€20, a change that lowers FBA fees for newly eligible products by an average of £0.40/€0.45 per unit.

Why it matters: This aggressive fee restructuring allows European sellers to immediately capture lower price points, making them more competitive against ultra-cheap imported goods and likely increasing overall GMV volume. Ecommerce operators must evaluate how this shift enables them to optimize product listings and promotions, particularly in the expanded low-price tiers, to defend market share.

FROM OUR PARTNERS

Is Your PPC Strategy Leaving Money on the Table?

When’s the last time you updated your digital marketing strategy?

If you’re relying on old-school PPC tactics you might be missing out on a major revenue opportunity.

Levanta’s Affiliate Ad Shift Calculator shows how shifting budget from PPC to creator-led partnerships can significantly improve conversion rates, ROI, and efficiency.

Discover how optimizing your affiliate strategy can unlock new profit potential:

Commission structure: Find the ideal balance between cost and performance

Traffic mix: See how creator-driven traffic impacts conversions

Creator engagement: Measure how authentic partnerships scale ROI

Built for brands ready to modernize how they grow.

MAZE DEEP DIVE

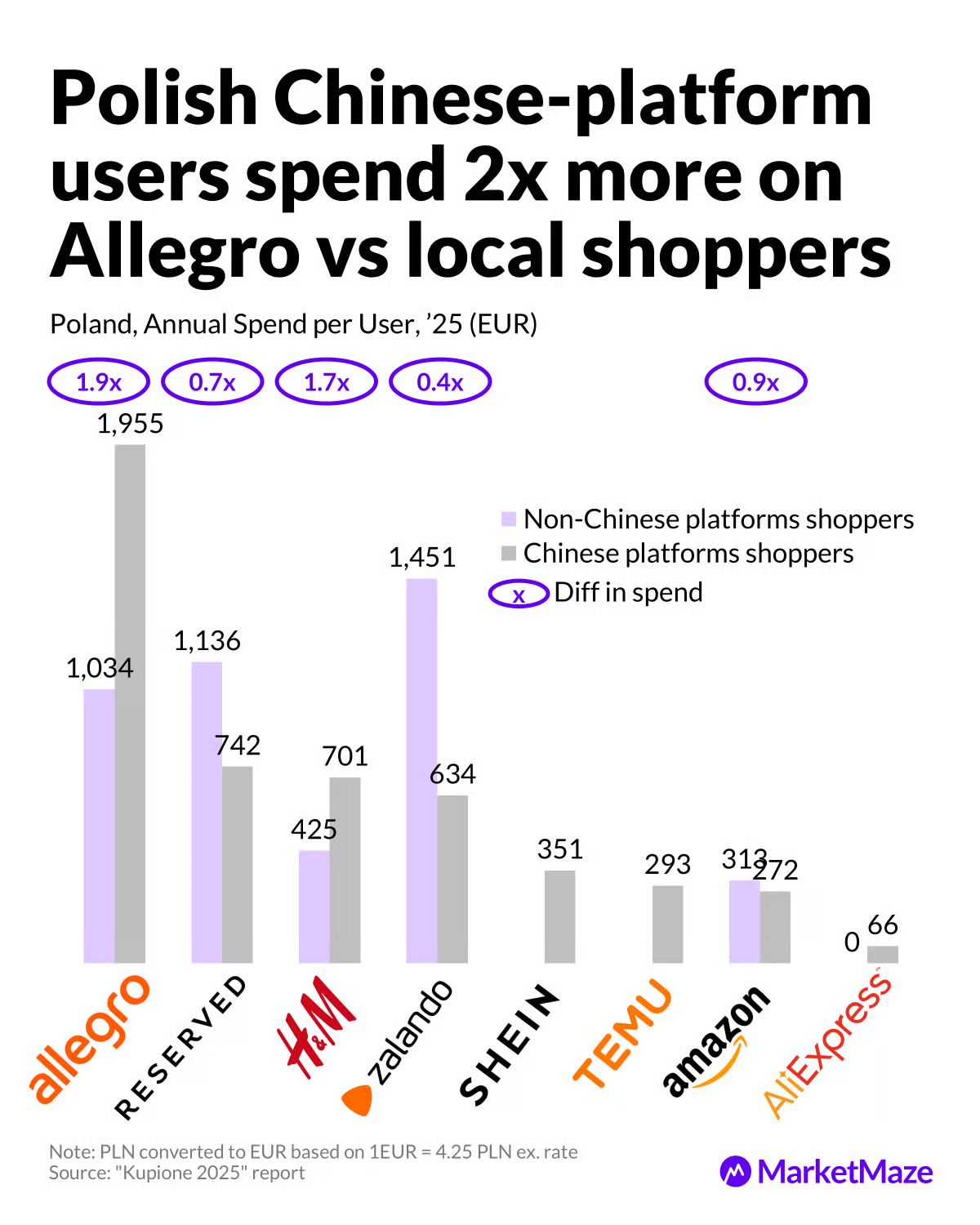

The Maze: The new data tracks receipts in Poland across major marketplaces and compares users who do and do not shop on Shein, Temu or AliExpress. The patterns reveal sharp splits in spend, habits and loyalty.

Chinese-platform users buy almost twice as often and spend nearly twice as much, but they do it through small, low-value baskets. This creates a high-volume, low-margin shopping pattern.

Their category mix skews toward practical, low-cost items, while non-Chinese shoppers put more money into lifestyle segments like fashion, kids, and supermarkets.

Allegro keeps strong loyalty from local-only shoppers, but Chinese-platform users spread their spend across Shein, Temu, and AliExpress, diluting domestic share.

Why it matters: The two shopper groups follow different online economies that influence logistics, loyalty and retail media performance. Volume-driven buyers tilt toward small, cheap and frequent purchases while local-only shoppers drive higher basket values. Understanding these splits helps brands predict lifetime value, ad returns and product mix.

FROM OUR PARTNERS

If you’ve been waiting for the right moment to start or scale your store, this is it. Spocket’s annual plans are 75% off until December 31, 2025 — the biggest discount of the year, applied automatically at checkout.

1️⃣ Find winning products from trusted US and EU suppliers — not random overseas listings.

2️⃣ Add them to Shopify, Wix, WooCommerce, BigCommerce, or Amazon in one click.

3️⃣ Ship in days, not weeks, so customers stay happy and your reviews stay strong.

More than 100k sellers use Spocket to build real brands without warehouses or upfront stock. With the 75% discount already active, it’s the easiest time to jump in and get a full year of tools for the price of a month.

MAZE STORY

The Maze: OpenAI CEO Sam Altman issued a company-wide "Code Red", signaling a major strategic pivot to delay new product initiatives, including the nascent ads business, and marshal resources exclusively toward improving core ChatGPT functionality amidst fierce competition from Google’s rapidly advancing Gemini models.

This urgency reverses the 2022 dynamic when Google's management issued its own internal alert following ChatGPT’s explosive launch and market disruption.

The pressure stems directly from the November launch of Gemini 3, which demonstrated advanced reasoning and new generative UI capabilities that surpassed OpenAI in key industry benchmarks.

By prioritizing core performance over monetization, OpenAI delays its ad business launch as it struggles to fund massive future data-center investments needed to meet its aggressive $200 billion annual revenue target for profitability by 2030.

Why it matters: This intense AI arms race accelerates the timeline for e-commerce operators, forcing platforms to integrate faster, more reliable AI models for superior discovery and personalized search experiences.

DATA TREASURE

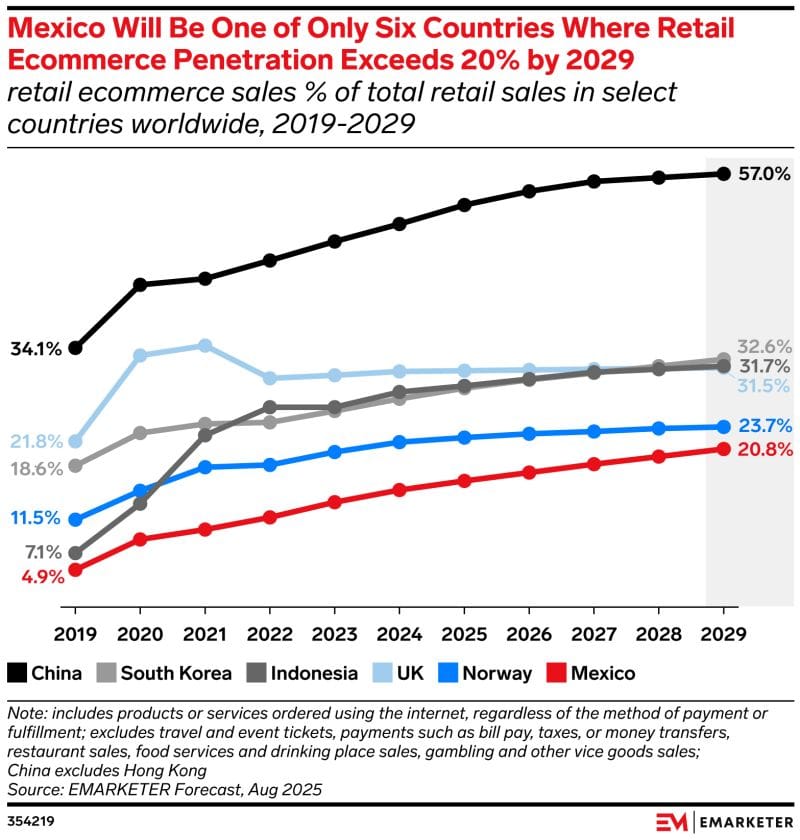

The Maze: Mexico is turning into one of the world’s fastest rising ecommerce markets, with online retail set to surpass the US in penetration by 2026. Growth is coming from young mobile shoppers, better logistics, and rapid adoption of digital payments. By 2029, one in five pesos spent in retail will come from online channels, placing Mexico among the six most digitally mature markets.

Mexico will reach 17.7%ecommerce share in 2026, slightly ahead of the US at 17.0%, marking a structural shift in regional digital retail.

Online penetration is projected to climb from 4.9% in 2019 to 20.8% in 2029, driven by mobile-first consumers and improving last mile delivery.

Year end peaks like Buen Fin and Christmas push millions of new shoppers online and accelerate repeat behavior across the country’s major retail categories.

Why it matters: Mexico shows how a late digital adopter can jump ahead when mobile access, payments, and delivery finally align. This shift will force retailers to rethink store roles, category margins, and cross border strategies. The winners will be players that use this new demand to build trust, lower friction, and earn the loyalty of a fast scaling online population.

MAZE STORY

The Maze: The UK's Advertising Standards Authority (ASA) cracked down on "greenwashing," banning paid advertisements from Nike, Superdry, and Lacoste for making unqualified claims of environmental sustainability without providing comprehensive life-cycle evidence.

The ASA determined that phrases like "sustainable" imply an absolute claim of no environmental harm throughout a product’s entire life cycle, which the brands failed to substantiate, according to the Lacoste ruling.

Nike’s banned ad, referencing tennis polo shirts made with 75% recycled polyester, lacked the necessary full life-cycle assessment to prove its broader environmental credentials.

Superdry also failed to provide public full life-cycle data and was required by the ASA to ensure the meaning and basis of all future environmental attributes are completely clear.

Why it matters: This regulatory shift signals higher compliance costs and increased reputational risks, forcing e-commerce operators and marketers to invest significantly in product substantiation and supply chain transparency before running sustainability campaigns. Brands must now move past vague, feel-good marketing to avoid costly enforcement actions.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇨🇳 TikTok Shop is shedding its “bargain-bin” reputation as subsidies fade and major brands join the platform, leading to sharp increases in average unit prices across multiple categories.

🇺🇸 AppDirect is set to acquire Tackle, unifying two major B2B platforms used by software vendors to list and sell products across cloud marketplaces like AWS, Microsoft Azure, and Google Cloud.

🇺🇸 The NRF reported a record 202.9 million shoppers participated in the Thanksgiving weekend through Cyber Monday, motivated primarily by targeted sales and limited-time promotions.

🇮🇹 Italy's luxury industry is facing intense scrutiny after probes revealed exploitative work conditions in subcontractors, pressuring brands like Tod's and Giorgio Armani.

🌎 The secondhand luxury fashion market is expanding three times faster than the first-hand market and is forecast to reach $360 billion globally by 2030, driven by affordability and increased confidence in platform authentication.

BRIEFING

📣Everything else in Ecommerce ecosystem

🇺🇸 ChatGPT referrals to major retailer apps increased 28% year-over-year during Black Friday, highlighting the growing, quantifiable role of conversational AI in consumer discovery and sales conversion.

🇺🇸 Google Ads updated Performance Max (PMax) reporting to include a separate Search Partners segment, giving advertisers greater transparency into budget spending.

🇺🇸 AWS unveiled new 'frontier agents' capable of autonomously handling complex, multi-day projects, marking a major enterprise push to dominate the next generation of AI infrastructure.

🇺🇸 Amazon is aggressively testing an “ultra-fast” delivery service, Amazon Now, offering thousands of essential items delivered in 30 minutes or less in pilot cities, intensifying competition with Q-commerce players.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team