TODAY’S MAZE

Happy Sunday! Amazon is testing a new system using AI to harvest data from independent sellers. These unauthorized listings often contain errors that confuse shoppers.

This move signals a shift in how platforms capture data from the web. Can merchants maintain control when AI begins managing their product presence?

In today’s MarketMaze focus:

Amazon’s unauthorized AI listings

Saks faces bankruptcy risk

ASOS launches returns dashboard

E-commerce market reaches maturity

US and China dominance

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Amazon is testing a secretive initiative called Project Starfish that scrapes data from independent retailers to create AI-generated product listings without permission. This beta program populates the shopping app with inventory from external sites, often leading to factual errors that damage brand reputations.

Independent brands discovered that Amazon uses AI to harvest their proprietary product data from shops like Hitchcock Paper to generate unauthorized listings and scrape private web content.

These automated listings frequently display AI hallucinations, such as outdated prices or items that are currently out of stock, which creates technical discrepancies and inventory friction.

The program enables browsing external sites within a closed ecosystem where available products recently increased to over 500,000 items total across the shopping app.

Why it matters: This shift forces brands to engage in agentic optimization to ensure AI agents do not distort their product information. As platforms capture intent signals from independent domains, it makes managing brand reputation harder for merchants who lose control over their pricing and customer data.

FROM OUR PARTNERS

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

MAZE STORY

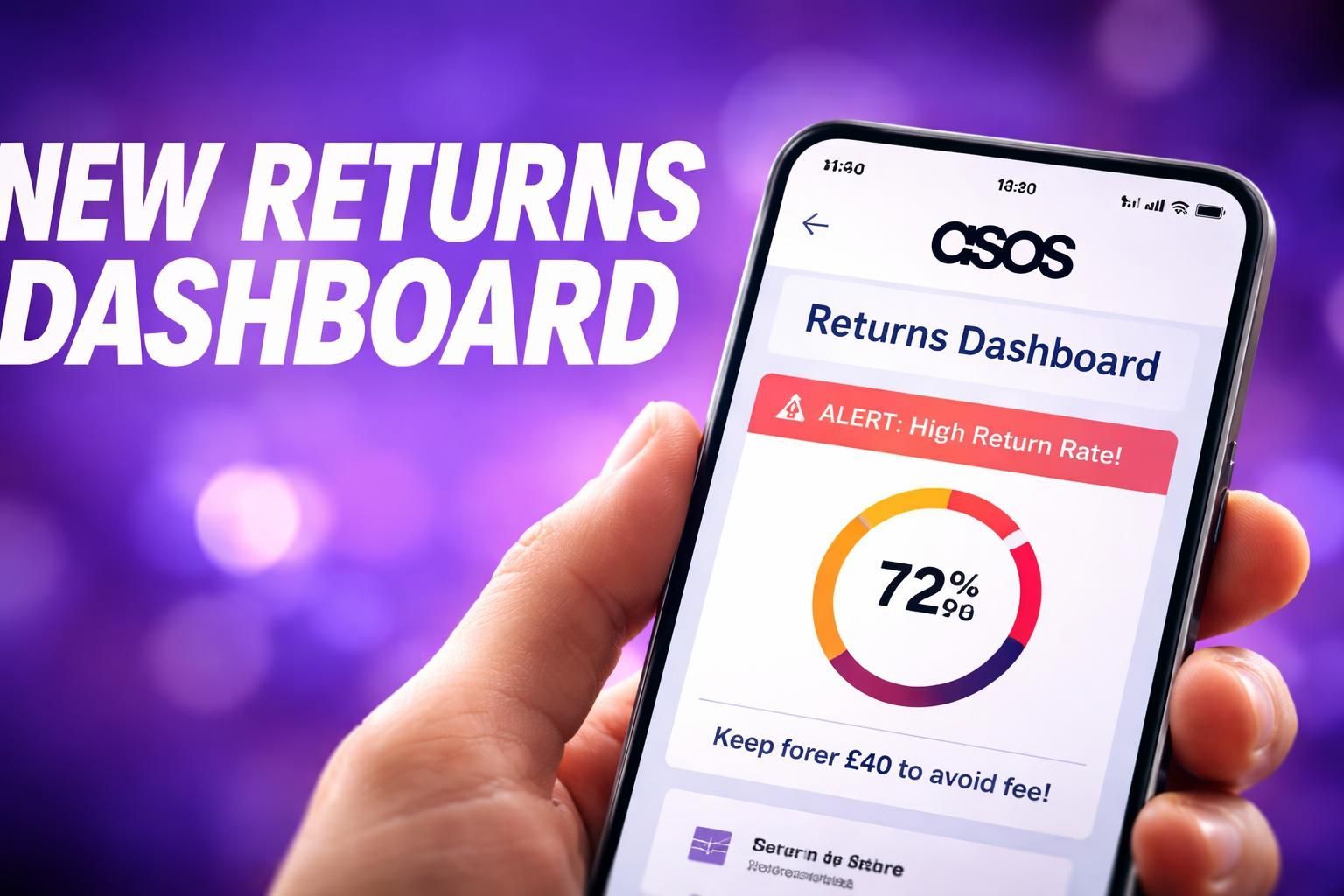

The Maze: ASOS introduces a first-of-its-kind transparency feature that provides UK shoppers with clear visibility into their past purchase behavior. This dashboard helps customers track their frequency of returns and avoid new fees designed to offset rising logistics costs while ensuring sustainable free returns for core markets.

Individual shoppers with a return rate exceeding 70% will pay a US 5.02feeiftheykeepitemsworthlessthanUS5.02feeiftheykeepitemsworthlessthanUS 50.80 from their order, while those over 80% also incur an additional restocking charge.

The updated mobile application issues proactive alerts when a user nears these chargeable thresholds to help them adjust their buying habits and maintain access to free shipping for future orders.

The retailer complements this data-driven initiative with existing tools like 360-degree imagery and sizing guidance to reduce unnecessary shipping volumes while preserving loyalty among the vast majority of shoppers.

Why it matters: Shifting from punitive fees to transparent data helps retailers protect margins while empowering consumers to make better choices. By gamifying return behavior, brands can curb the logistics crisis without sacrificing the high-trust relationship required for modern D2C success.

FROM OUR PARTNERS

Easy setup, easy money

Your time is better spent creating content, not managing ad campaigns. Google AdSense's automatic ad placement and optimization handles the heavy lifting for you, ensuring the highest-paying, most relevant ads appear on your site.

MAZE STORY

The Maze: Marc Metrick stepped down as Saks Global CEO, handing the reins to Executive Chairman Richard Baker. Saks Global is the largest multi-brand luxury retailer in the world, comprising Saks Fifth Avenue, Neiman Marcus, Bergdorf Goodman, Saks OFF 5TH, Last Call and Horchow. This leadership pivot arrives as the luxury giant reportedly weighs a bankruptcy filing following a missed $100 million interest payment on its massive debt.

Baker brings extensive retail experience from his time overseeing Germany's Galeria Kaufhof and will now directly lead the complex digital transformation of the combined luxury portfolio to improve efficiency.

The company continues to evaluate strategic liquidity options like selling a minority stake in Bergdorf Goodman to help reduce the mounting interest obligations incurred during the recent multibillion-dollar Neiman Marcus acquisition.

Recent reports indicate the firm failed to meet its latest interest obligation, which triggered immediate public scrutiny regarding the success of its recent turnaround efforts and its ability to remain competitive against rivals.

Why it matters: This consolidation of power under Richard Baker signals a desperate attempt to stabilize operations before a potential Chapter 11 filing. The struggle of these iconic banners suggests that scale alone cannot offset the decline of department stores as luxury shoppers migrate to brand-owned boutiques.

DATA TREASURE

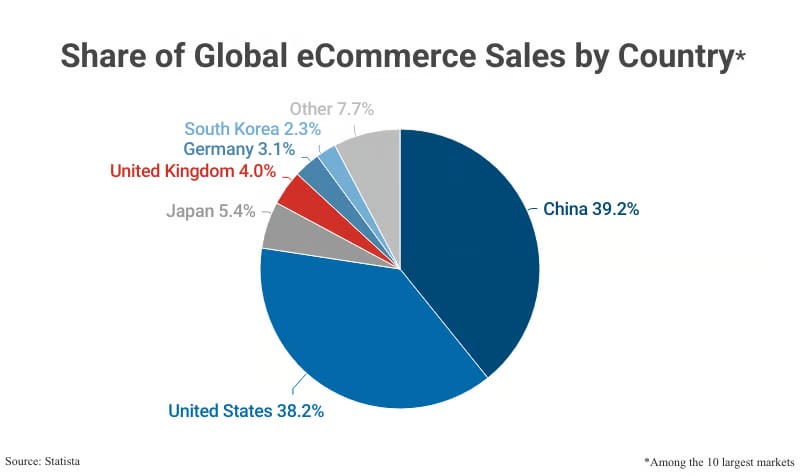

The Maze: Global e-commerce is effectively run by two countries. China and the US together control nearly four fifths of online retail value. Everyone else fights over the margins created by their platforms, logistics, and standards.

In 2025, China held 39.2% and the US 38.2% of global e-commerce sales, while Japan sat at ~5% and the UK and Germany near 4% and 3%.

Cross-border e-commerce reached $1.21T, growing 6.5% year over year as consumers chased price and selection across borders.

This split reflects two engines: China exports supply and price pressure, the US exports platforms, ads, and customer expectations.

Why it matters: Global brands are not competing in one market. They are navigating two gravity centers. Strategy now means choosing which ecosystem you optimize for and where you absorb the friction.

DATA TREASURE

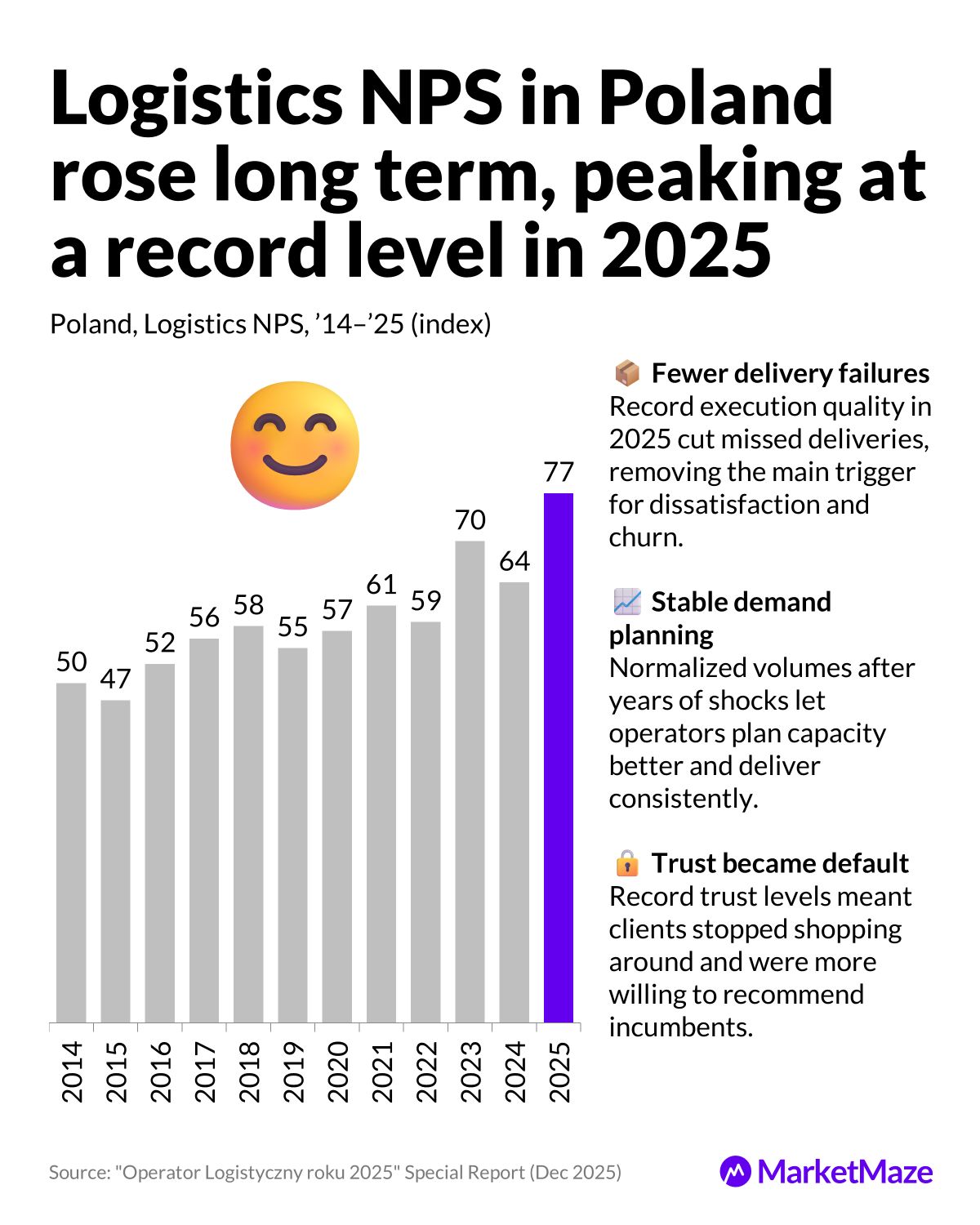

The Maze: Polish logistics loyalty climbed for a decade, then snapped to a record high in 2025. The data tracks Net Promoter Score, client mix, service quality, and complexity across 2014–2025. Together, they show execution beating volatility at last.

NPS (Net promoter score) rose from 50 in ’14 to 77 in ’25, despite sharp dips during demand shocks in ’15 and ’19–’22

Promoters expanded from 58% to 80%, while detractors fell from 9% to just 3% by ’25

Service quality climbed from 64% to 85%, even as service complexity rose from 22% to 36%

Why it matters: Ecommerce depends on reliability, not promises. As failures dropped and trust hardened, shippers stopped switching providers. Loyalty became structural, not cyclical, giving logistics leaders pricing power and stickier ecommerce contracts.b as wide premiums risk losing price sensitive customers and search visibility.

BRIEFING

🏬 Everything else in Ecommerce

🇺🇸 Amazon committed tens of billions of dollars to expand its AI and cloud infrastructure as demand for high-performance computing accelerates.

🇨🇳 BYD surpassed Tesla as the world's leading seller of battery electric vehicles in 2025, signaling a shift in global manufacturing dominance.

🇺🇸 Social Commerce Startups pulled in nearly $2 billion in 2025 by pivoting from traditional influencer models to AI-driven tools and community marketplaces.

🌍 Luxury Brands reported operating margins hitting a 15-year low of 15% as price-sensitive consumers abandon full-price retail for outlet stores.

🇬🇧 UK Fashion outpaced online channels through festive footfall in physical stores, buffering the industry against a broader digital sales slump.

🇨🇦 Shopify Merchants faced growing technical attribution gaps, requiring new diagnostic metric maps to navigate increasing platform tracking complexity.

🇺🇸 The White House delayed duty increases on furniture and cabinets for one year, keeping the current 25% rate while trade negotiations continue.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team