TODAY’S MAZE

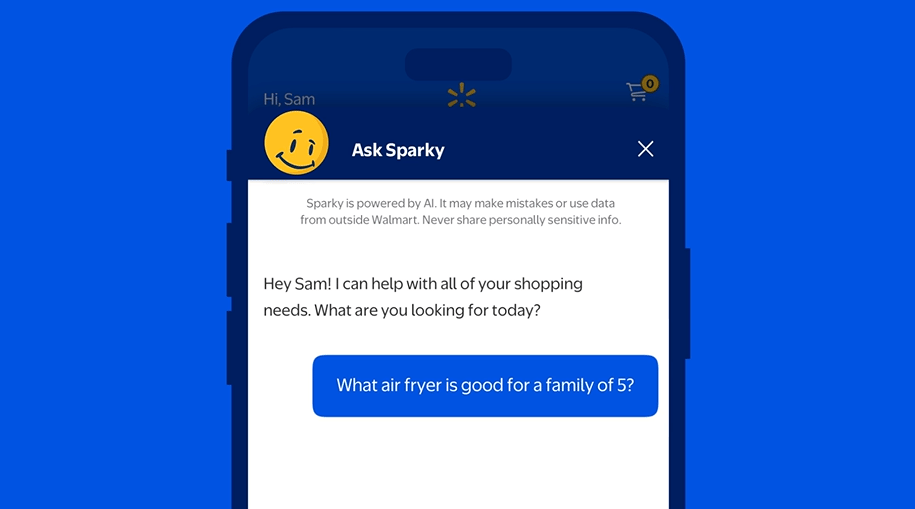

Happy Tuesday! Retail media is rapidly moving from traditional search results pages into proactive, conversational chat flows. Walmart is accelerating the monetization of its AI shopping assistant, Sparky, by testing "Sponsored Prompts" to integrate ads directly into user conversations.

This confirms that retailers view AI agents as the next major advertising frontier. For brands, the immediate question is: how quickly must media teams adapt to target these high-value, agentic touchpoints?

In today’s MarketMaze focus:

Walmart's AI assistant ad tests

Fast Fashion peaks

Alibaba prioritizes instant retail growth

Shein Faces Shutdown in France

Marketplaces lose ground

+

Handpicked recent news you need to know:

🏬 Ecommerce Players (Marketplaces, e-Retailers, D2C)

📣 Ecommerce Ecosystem (Marketing, Tools, Logistics)

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Walmart is accelerating the monetization of its generative AI shopping assistant, Sparky, by reportedly testing "Sponsored Prompts" to integrate advertisements directly into conversational commerce flows. This move follows the lead of Amazon's Rufus, signaling that the industry views commerce agents as the next major advertising frontier.

The test ad format features a “sponsored prompt” that, when clicked by the user, responds with an answer and an immediate click-to-buy ad for the advertised product.

Rival Amazon recently added similar sponsored prompts to its AI assistant, Rufus, which CEO Andy Jassy claims is on track to deliver over $10 billion in incremental annualized sales.

Launched in June, Sparky makes recommendations and allows customers to understand specific product features, compare items, and even serve as a party planner.

Why it matters: This strategic evolution makes AI assistants a crucial component of retailer ad stacks, demanding that brands adjust media spending to target these new conversational touchpoints. E-commerce teams need to quickly understand how sponsored prompts shift advertising from traditional product search to proactive, agentic engagement that influences purchasing decisions earlier in the funnel.

FROM OUR PARTNERS

Stop Duplicates & Amazon Resellers Before They Strike

Protect your brand from repeat offenders. KeepCart detects and blocks shoppers who create duplicate accounts to exploit discounts or resell on Amazon — catching them by email, IP, and address matching before they hurt your bottom line.

Join DTC brands like Blueland and Prep SOS who’ve reclaimed their margin with KeepCart.

MAZE DEEP DIVE

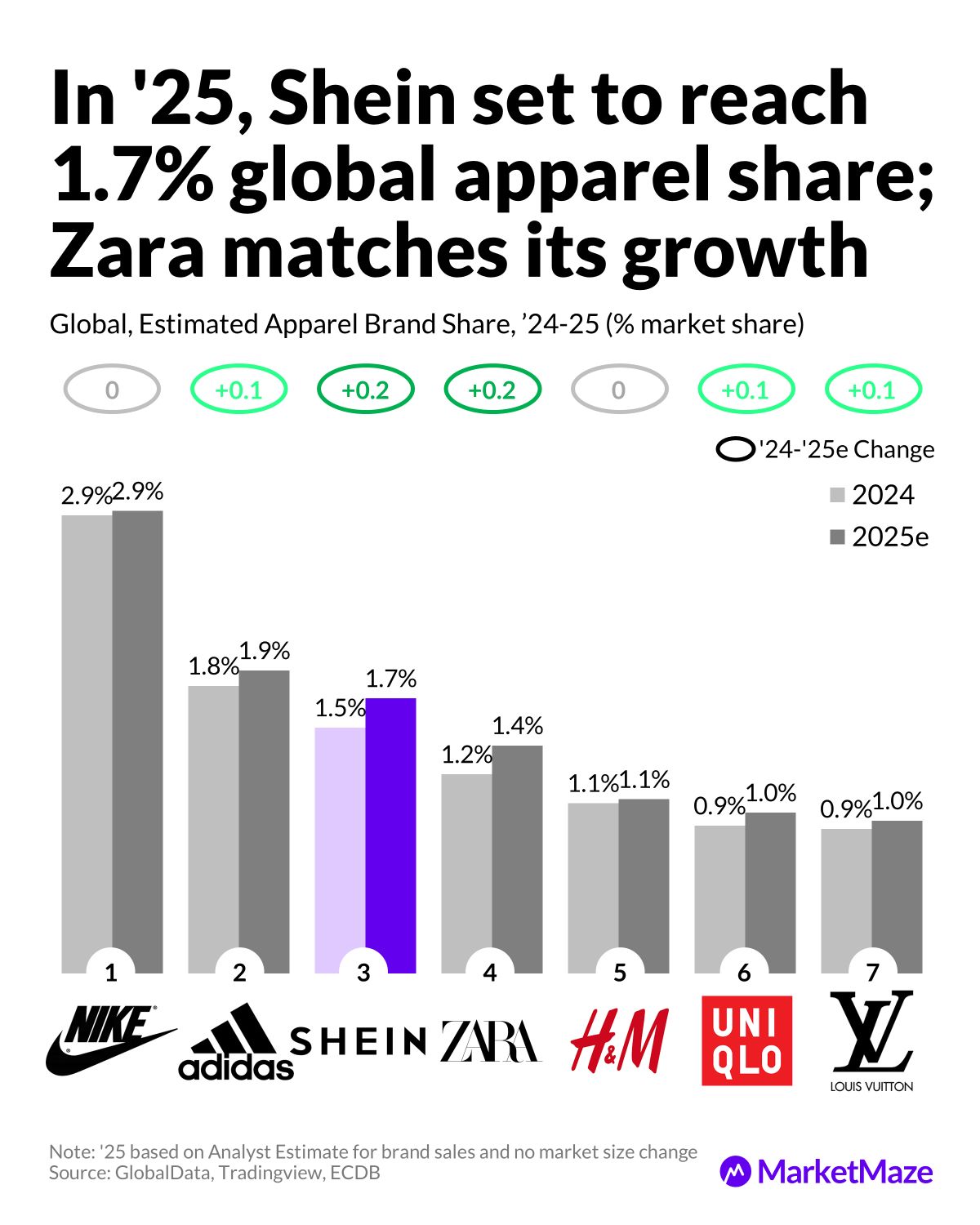

The Maze: Fast fashion has been running on steroids, but the data shows the cycle turning. A mix of GMV trends, US shopper reach, policy hits, and brand share shifts reveals two giants still growing but no longer breaking gravity. Growth is becoming effort, not inevitability.

Temu scales from 0.3B to 82.4B GMV by ’26 while annual growth falls from 128 percent to 13 percent as the model hits cost and logistics friction.

Shein grows from 0.4B to 70B in a decade but slows to 6.5 percent in ’26 as scale and scrutiny increase.

In US, Amazon leads US with reach of 73% of conumers while Temu grabs 20% and Shein reaches 17%, signalling that discount platforms have gone mainstream, but the growth stalled recently

US tariffs push Shein from plus 25% in March to minus 13% in May year over year growth, a sharp reversal for a momentum brand.

Shein to hit 1.7% apparel share in ’25 globally while Zara 1.4%, tightening the race among global leaders.

Why it matters: The playbook of endless SKUs, ultra low prices and algorithmic merchandising is reaching its natural ceiling. Policy, logistics, and brand power now matter as much as discounts. The winners will be those who turn scale into durability, not just velocity.

FROM OUR PARTNERS

Most teams don’t need more calls, they need better recall. Fathom turns conversations into searchable notes: automatic recording and transcription, instant summaries and highlights, and one-click sharing that gets action items where work happens.

✔ Record and transcribe every call automatically

✔ Get instant summaries and highlight clips

✔ Works with Zoom, Microsoft Teams, and Google Meet

Let your meetings do the writing. You focus on decisions.

MAZE STORY

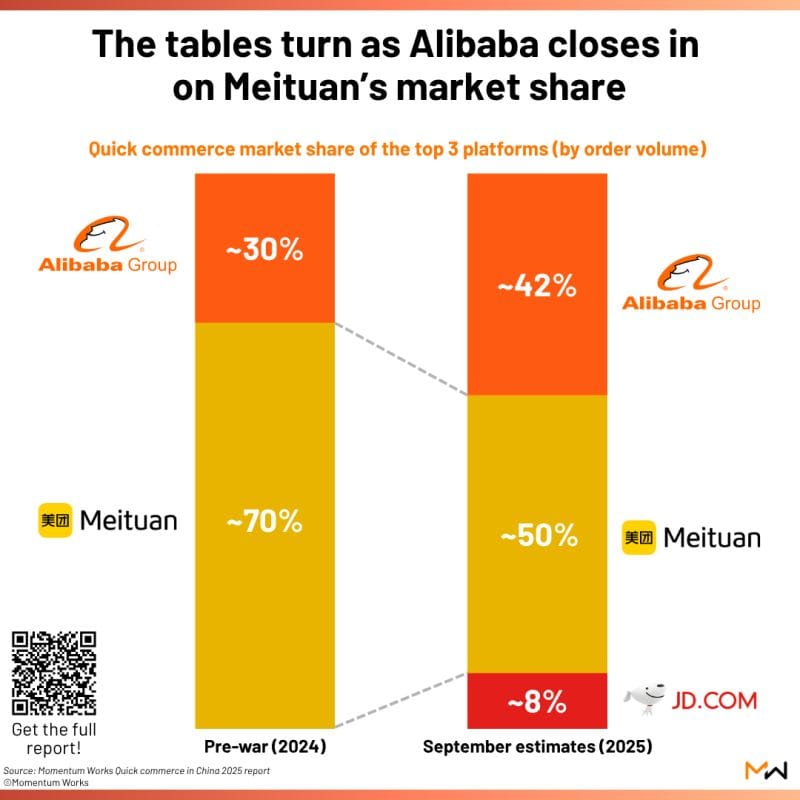

The Maze: Alibaba is heavily prioritizing high-frequency instant retail and massive AI infrastructure build-out, aiming to embed its Taobao Instant Commerce ecosystem into daily life and reduce reliance on expensive external traffic sources. This strategic pivot caused quarterly operating profit to tumble 85% due to substantial investment costs, even as the Group reported revenue growth exceeding market estimates in its latest quarter.

Alibaba is catching up, and Meituan’s lead is slipping. Before subsidies, Meituan held ~70% of China’s food delivery market and Alibaba ~30%. By Sep 2025, estimates show Meituan at 50%, Alibaba at 42%, and JD.com at 8%.

The strategy requires Alibaba to invest deeply in logistics, aiming for one-hour delivery of essentials to challenge Meituan’s dominance in China’s local services and food delivery markets.

Alibaba is using AI as a broad platform for third-party developers, making it a core operational layer for optimizing speed, convenience, and personalization across its ecosystem.

This aggressive move contributed to overall revenue rising 5% to 247.8 billion yuan, driven by strong growth in the cloud division and the instant delivery market, a pattern recognized by the Economic Times.

Why it matters: The future of ecommerce depends less on external traffic acquisition and more on building ecosystem loyalty through high-frequency, indispensable daily services like instant retail. Ecommerce leaders must recognize that AI integration is no longer a marketing add-on; it is foundational to logistics efficiency, speed, and maintaining margins against competitors focused on rapid fulfillment.

MAZE STORY

The Maze: France is taking aim at Shein after investigators found illegal items on the platform, turning a compliance slip into a national showdown. The government wants a three month suspension and is ready to force ISPs to block the site. The case has grown from a product-safety issue into a stress test of how Europe will police ultra fast fashion.

In early November French inspectors uncovered childlike sex dolls and banned weapons on Shein, triggering an urgent procedure that the finance ministry escalated to court on 26 November 2025.

Shein removed the items and paused its marketplace on 5 November, but France kept the judicial case alive and summoned operators including Orange, SFR, Bouygues and Free for possible nationwide blocking.

The clash intensified as DGCCRF (Directorate General for Competition, Consumer Affairs and Fraud Control) found similar items on Temu, AliExpress, Wish and others, pushing Paris to demand EU-wide enforcement while Shein battles falling profit and a valuation cut toward 30 billion dollars.

Why it matters: This is more than a scandal about illegal goods. Europe is signaling that big platforms will pay a real price when they fail to protect minors and consumers. If France wins the suspension, it becomes a template for tougher action on ecommerce players operating at global scale.

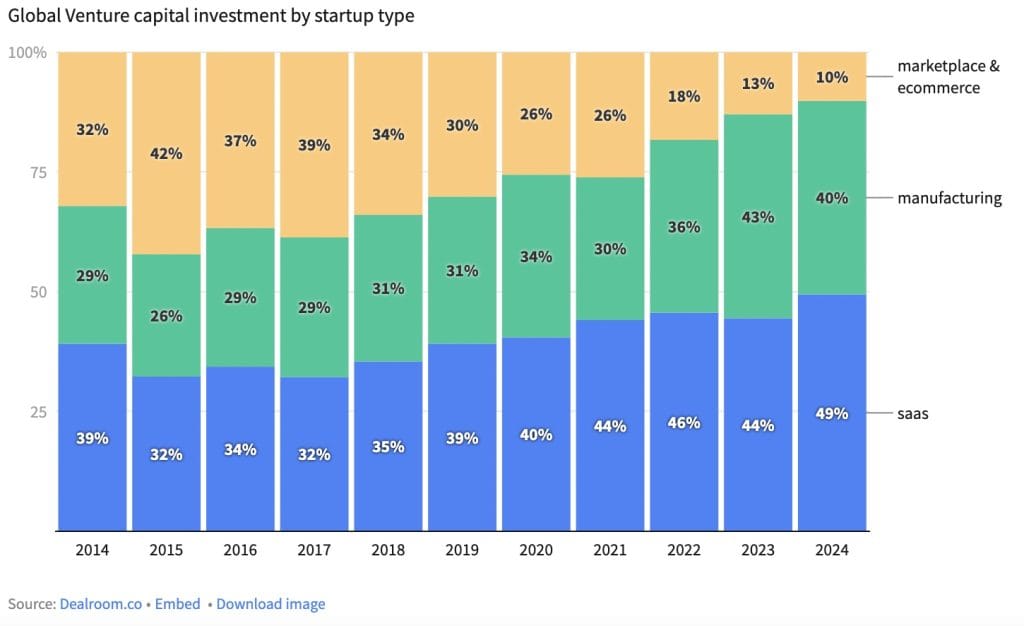

DATA TREASURE

The Maze: Venture capital has rotated away from platforms that move goods and toward companies that build software or hard tech. Marketplace funding collapsed from 32% to 10% in a decade, while SaaS and manufacturing pulled in most of the capital. This shift makes fundraising brutal for founders, but it also creates space for the few who can execute with discipline.

In 2015 marketplaces took about 42% of funding as money chased ridesharing and home-sharing, but by 2024 they captured only 10% of global venture capital.

SaaS rose from around 39% in 2014 to nearly 49% last year of funding as investors favored recurring revenue, AI workflows and cleaner unit economics.

Manufacturing climbed from roughly 29% to 40% in 2024 as capital moved into robotics, defence tech, energy systems and autonomous vehicles with strong institutional demand.

Why it matters: Marketplace builders now compete for a much smaller slice of the venture economy, so only models with real margins and retention survive. Lower competition means stronger founders can scale quietly while others stall. When capital cycles back to commerce and logistics, the companies built in this trough will be the ones left standing.

BRIEFING

🏬 Everything else in Ecommerce & key players

🇺🇸 AI-Powered Deepfakes are fueling retail return fraud, with deepfake detection firm Pindrop estimating that three in 10 fraud attempts targeting major retailers are now AI-generated during the peak holiday season.

🇬🇧 Temu Local partnered with Royal Mail to integrate Click & Drop, aiming to significantly simplify the shipping process and improve operational efficiency for its UK-based merchants.

🇺🇸 American Signature filed for Chapter 11 bankruptcy protection, citing elevated interest rates, tariffs, and a severe housing market decline as the 77-year-old furniture giant plans to shutter dozens of stores.

🇫🇷 Kering launched a new internal investment entity, 'House of Dreams,' designed to acquire stakes in and grow emerging luxury brands, reducing the group's historical reliance on Gucci.

BRIEFING

📣Everything else in Ecommerce ecosystem

🇬🇧 Debenhams Group renewed its partnership with Mirakl, integrating Mirakl Ads to launch a new retail media platform and further monetize its expanding third-party marketplace ecosystem.

🇸🇪 Klarna debuted KlarnaUSD, its first stablecoin and the inaugural bank-issued token on Tempo—a new payments-focused blockchain built by Stripe and Paradigm, positioning Klarna to test blockchain-based settlement.

🇺🇸 Major Brands are warning consumers they will be forced to raise prices on goods in response to the looming threat of President Donald Trump's proposed 10% baseline tariffs on imports.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

RECOMMENDED NEWSLETTERS

Craving more sharp reads? Check out these MarketMaze-recommended newsletters.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team