TODAY’S MAZE

Happy Wednesday! The retail world has a new trillion-dollar titan, and it isn't a Silicon Valley native. Walmart has officially broken into the exclusive valuation club, proving a legacy giant can successfully pivot into a tech-forward enterprise platform.

With new leadership prioritizing high-margin digital services, the company is trading physical supply chains for algorithmic efficiency. The big question is: can this momentum hold as they go head-to-head with the tech industry’s heaviest hitters?

In today’s MarketMaze focus:

Walmart enters trillion-dollar club

Amazon breaks delivery records

Costco Instacart enter Europe

Walmart outpaces Amazon growth

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Walmart officially crossed the $1 trillion market cap threshold Tuesday, becoming the first traditional retailer to join the tech-heavy club just days after John Furner took the helm as CEO of the enterprise.

New leadership is already restructuring the organization to treat enterprise platforms as primary profit engines, signaling a definitive shift from physical supply chains to software-led growth.

Wall Street rewarded the aggressive pivot to AI and automation with a stock surge to $127.71, as the retailer’s valuation gains outpaced the S&P 500 by nearly double over the last year.

High-margin digital bets are paying off, with Walmart+ hitting 28.4 million members and the new OnePay credit card helping lock in customers seeking relief from inflation.

Why it matters: This milestone proves that the future of mass retail lies in embedding high-margin technology into low-margin operations. Walmart isn't just moving boxes; it's monetizing the ecosystem around them.

In 2026, what will be the biggest driver of profit growth for large retailers: operations or digital monetization?

☝️ Vote to see results!

FROM OUR PARTNERS

The Hustle: Claude Hacks For Marketers

Some people use Claude to write emails. Others use it to basically run their entire business while they play Wordle.

This isn't just ChatGPT's cooler cousin. It's the AI that's quietly revolutionizing how smart people work – writing entire business plans, planning marketing campaigns, and basically becoming the intern you never have to pay.

The Hustle's new guide shows you exactly how the AI-literate are leaving everyone else behind. Subscribe for instant access.

MAZE STORY

The Maze: Amazon announced it delivered a record 13 billion items same or next-day globally in 2025, including 8 billion in the US alone—a 30% year-over-year jump.

Amazon extended its fast-shipping network to 4,000 smaller cities and rural areas across 44 states by converting existing delivery stations into hybrid fulfillment hubs.

Essentials drove volume as customers ordered over 4 billion grocery items for fast delivery, even as the company closes specific Amazon Fresh locations.

Operations are getting faster as the company expands Amazon Now for under-30-minute delivery into international markets while testing the service in US cities.

Why it matters: Speed is shifting from a premium perk to a baseline requirement for retention, forcing competitors to rethink logistics density to survive against Amazon’s regionalized fulfillment engine.

FROM OUR PARTNERS

ECDB shows what actually happens in online retail. Real transactions. Real rankings. Real market shares. No surveys. No vague estimates.

Know who’s winning and why.

Track online sales performance across retailers, marketplaces, and categories worldwide.Compare like-for-like across markets.

Standardized data makes cross-country and cross-category analysis finally possible.Turn data into decisions.

Used for market entry, competitive strategy, investor analysis, and growth planning.Enterprise-ready by design.

APIs, exports, and robust data coverage built for serious teams.

MAZE STORY

The Maze: Costco and Instacart export their successful North American partnership to Europe, launching same-day delivery websites in France and Spain powered by Instacart’s Storefront Pro technology.

Instacart partners with local European companies to handle picking, packing, and last-mile delivery rather than deploying its own gig workforce in these new territories.

The expansion capitalizes on recent momentum where Costco ecommerce sales growth topped 20%, driven by a strategic push to modernize access for international members.

Shoppers using the new sameday.costco.fr portals access the same value and pricing they expect in-store by paying a single flat service fee per order.

Why it matters: Instacart is effectively transitioning into a global infrastructure provider, allowing retailers to scale delivery without building proprietary tech stacks from scratch. This validates the exportability of North American grocery models to fragmented European markets while unlocking immediate digital scale for Costco abroad.

DATA TREASURE

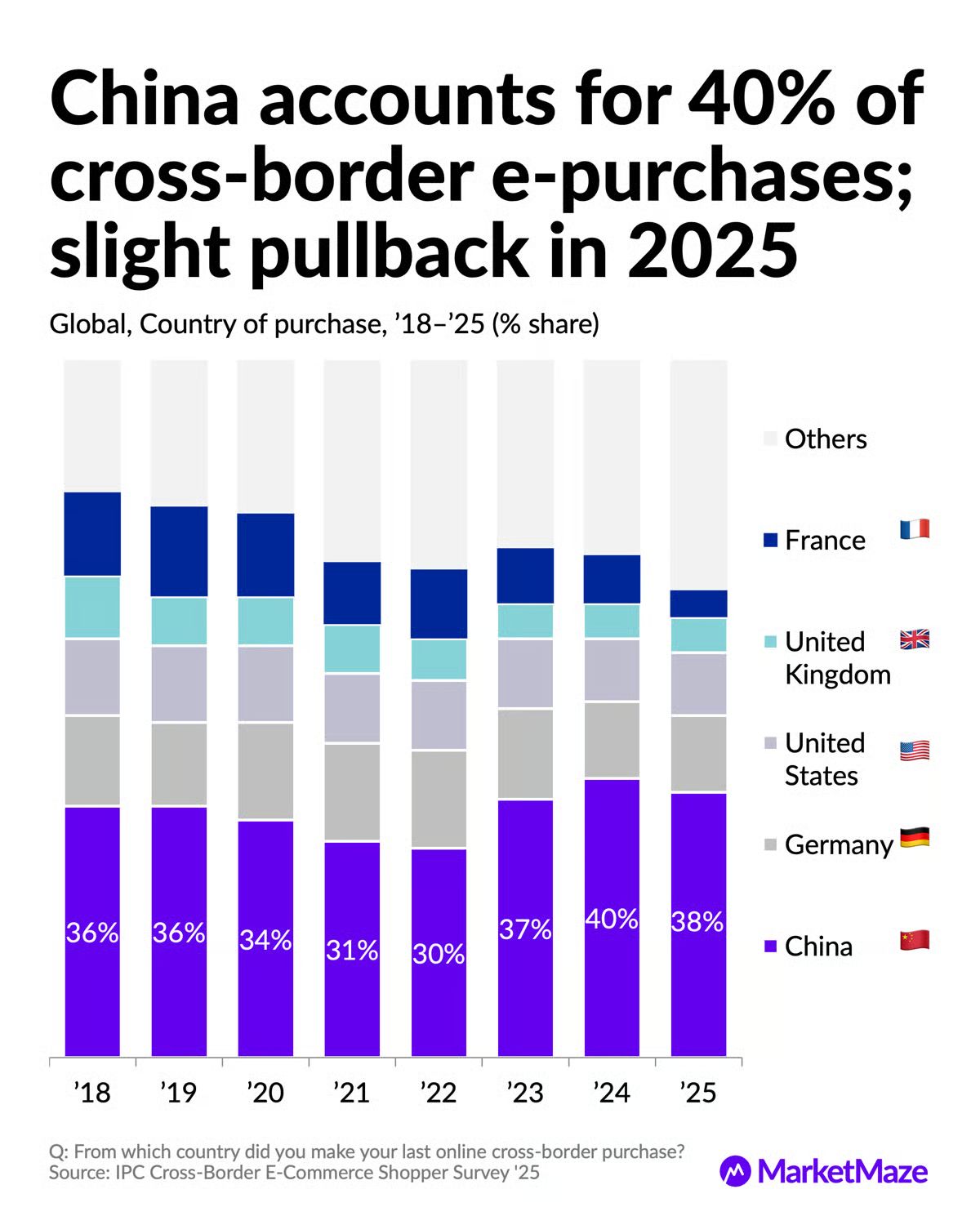

The Maze: Cross-border shopping is no longer niche behavior. It is mainstream, mobile-led, and China-centric. A global shopper survey across 37 countries tracks how buyers choose where to shop, who they buy from, how parcels arrive, and which device drives the decision.

China still dominates cross-border buying, holding close to 40% share despite a small pullback in 2025 as demand spreads beyond one exporter

Temu moved from near zero to joint leadership in three years, matching Amazon at 24% of last cross-border purchases in 2025

Doorstep delivery remains default, but parcel lockers grew fastest year over year as logistics costs and density rise

Smartphones crossed the 50% threshold, becoming the primary decision and checkout device for global online shopping

Why it matters: Cross-border commerce is consolidating around fewer platforms, fewer countries, and fewer devices. Scale now wins on price, logistics, and habit, reshaping how brands compete internationally and where value concentrates in e-commerce.

DATA TREASURE

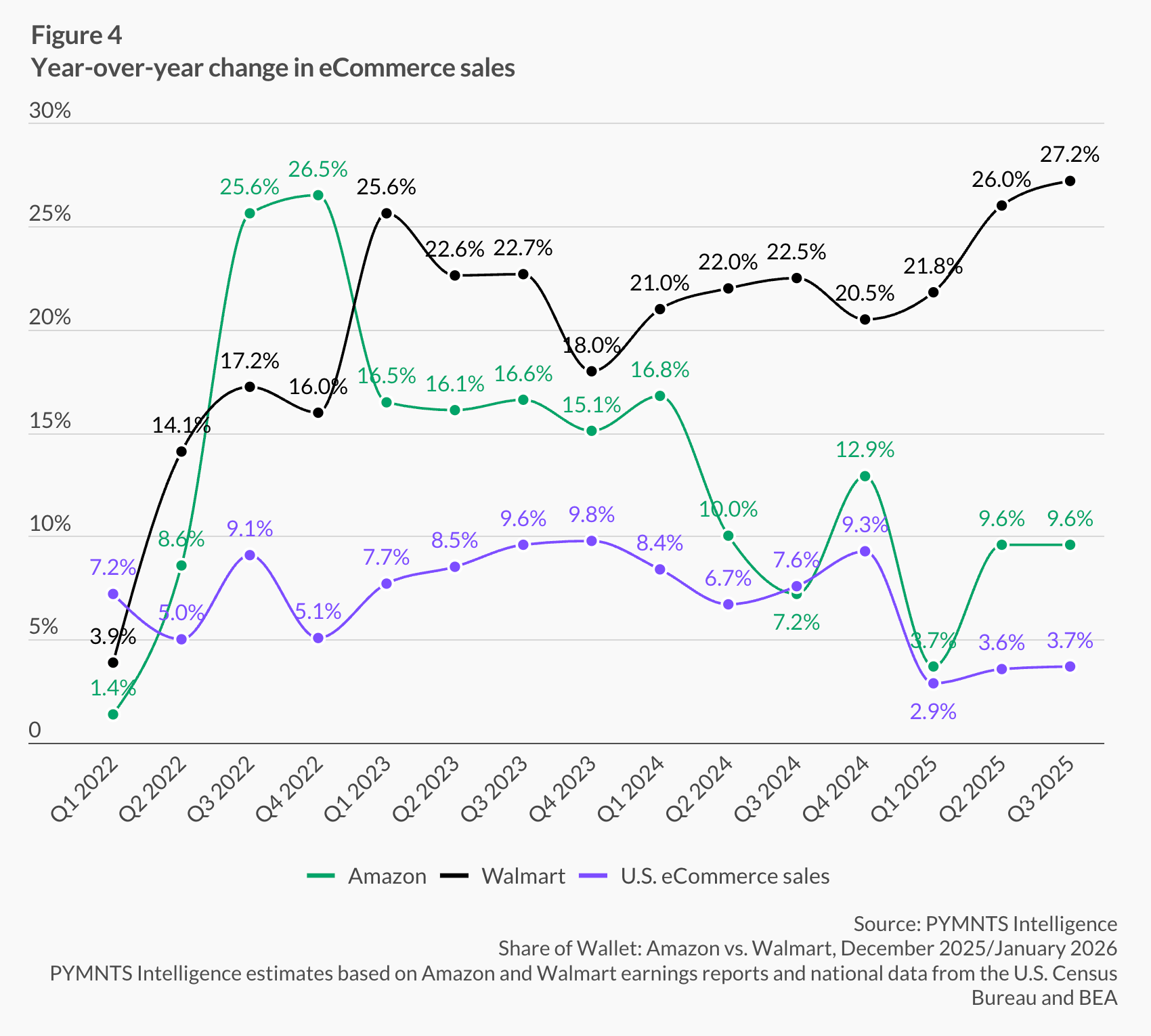

The Maze: Amazon still leads, Walmart accelerates. Online growth momentum favors Walmart even as Amazon remains far larger in absolute scale.

By Q3 2025 Walmart’s online sales grew ~27% YoY, nearly triple Amazon’s ~10% growth rate.

The base is smaller, but store based fulfillment and grocery frequency keep Walmart’s curve steep.

Growth tracks execution, not branding, and execution now favors proximity.

Why it matters: Ecommerce competition is shifting from who is biggest to who compounds fastest in daily spend categories.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Walmart pilots a new Post-Purchase Reviews program, allowing select third-party sellers to officially offer incentives for customer feedback.

🇺🇸 eBay tests a comparison feature directly in search results, raising seller concerns about ad-driven distractions over organic visibility.

🌏 Google faces scrutiny after analysis suggests Search Console hides roughly 75% of impression data, complicating performance tracking for SEOs.

🇬🇧 UK Shoppers leave over 26% of loyalty points unused annually, representing billions in lost value and missed retention opportunities for brands.

🇺🇸 Visa partners with UnionPay to allow clients to send cross-border payouts directly to cardholders in mainland China.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team