TODAY’S MAZE

Happy Tuesday! The era of unrestrained AI spending, fueled by enormous valuations and market FOMO, is officially ending across the enterprise sector. That critical shift is here as venture capital firms begin demanding measurable Return on Investment (ROI) for every AI dollar spent starting in 2026.

In today’s MarketMaze:

VCs demand AI ROI

Google shifts to AI agent

Strategic cargo theft rises

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Venture capitalists and enterprise leaders agree that 2026 marks the critical shift from unrestrained AI spending and astronomical valuations to demanding measurable Return on Investment (ROI) for all AI tools. This necessary reckoning follows a year of frenzied capital raises, where numerous AI unicorns achieved billion-dollar status without generating revenue.

Enterprise spending on generative AI surged to $37 billion in 2025, which drives massive demand for foundation models and supporting infrastructure according to Menlo Ventures.

AI accelerates the trend of companies doing more with less, especially as tools impact creative and digital marketing workflows.

AI agents will soon shift the business model from paying for access to paying for work completed, enabling them to act like junior staff that can issue refunds or purchase inventory.

Why it matters: Ecommerce leaders must immediately enforce stricter financial discipline, shifting AI budgets away from unproven pilots toward solutions that demonstrate tangible productivity gains, such as finance or voice AI.

FROM OUR PARTNERS

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

Unlock a focused set of AI strategies built to streamline your work and maximize impact. This guide delivers the practical tactics and tools marketers need to start seeing results right away:

7 high-impact AI strategies to accelerate your marketing performance

Practical use cases for content creation, lead gen, and personalization

Expert insights into how top marketers are using AI today

A framework to evaluate and implement AI tools efficiently

Stay ahead of the curve with these top strategies AI helped develop for marketers, built for real-world results.

DATA TREASURE

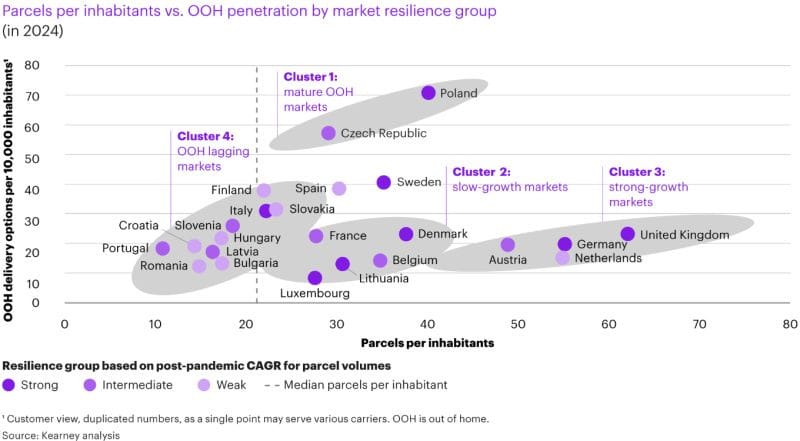

Europe’s parcel locker demand is accelerating, especially during peak season, but rollout is slowed by fragmented regulations and long permitting cycles.

Locker networks reduce last-mile costs by consolidating drops, cutting failed deliveries, and stabilizing courier routes at scale.

The next growth phase depends less on hardware and more on coordination between cities, regulators, carriers, and locker operators.

Why it matters: Parcel lockers are becoming core last-mile infrastructure. Faster deployment improves ecommerce reliability and unit economics as home delivery reaches cost and capacity limits.

FROM OUR PARTNERS

Can you scale without chaos?

It's peak season, so volume's about to spike. Most teams either hire temps (expensive) or burn out their people (worse). See what smarter teams do: let AI handle predictable volume so your humans stay great.

MAZE STORY

The Maze: Google is rapidly transitioning from a search engine providing links to an AI agent that performs user tasks, accelerating the zero-click crisis by removing merchants from the traditional discovery funnel. This shift already severely impacts content acquisition models, evidenced by AI Overviews cutting traditional organic clicks by 34.5% when present in results.

In test markets like the US, AI Summaries now occupy 51% of Google Discover feed positions, enabling Google to keep users within its ecosystem as 77% of primary exits default to inline YouTube plays rather than external publisher websites.

The most immediate threat involves new agent functionality that enables automated price tracking and automated purchasing, allowing Google to execute transactions without the user ever visiting a merchant’s storefront.

Traditional Google Search traffic to publishers plummeted from 51% in 2023 to just 27% by 2025, validating the shift away from link-based SEO toward a system focused heavily on audience engagement signals.

Why it matters: This pivot demands that Ecommerce teams rapidly shift their focus from optimizing for organic traffic volume to generating direct audience relationships and maximizing deep conversions.

DATA TREASURE

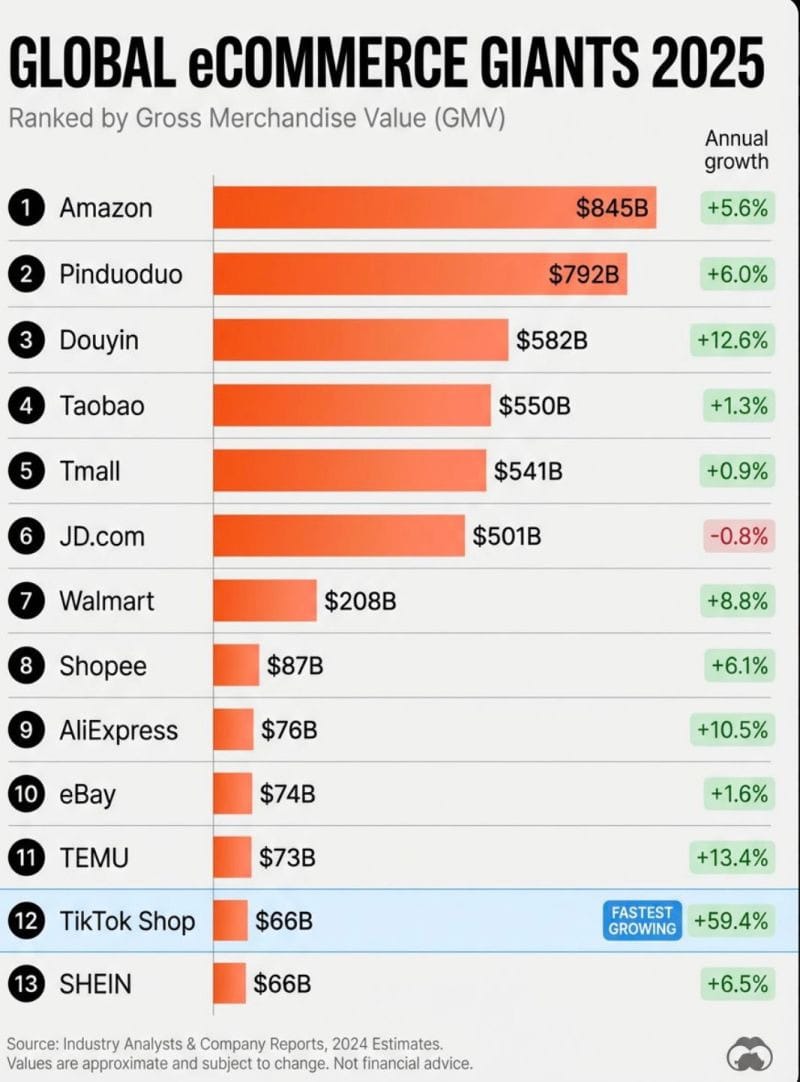

In 2025, Amazon still leads global GMV at roughly $845B, but ranks 2–6 are dominated by China-led platforms including Pinduoduo, Douyin, Taobao, Tmall, and JD.

TikTok Shop is the fastest-growing major marketplace at around +59%, showing how social discovery is becoming a primary commerce engine.

Cross-border challengers like Temu and AliExpress continue to scale aggressively, keeping price pressure high across most categories.

Why it matters: Global ecommerce is shifting toward attention-led shopping and cross-border scale. Marketplaces that control discovery and logistics, not just catalog size, will keep compounding advantage.

MAZE STORY

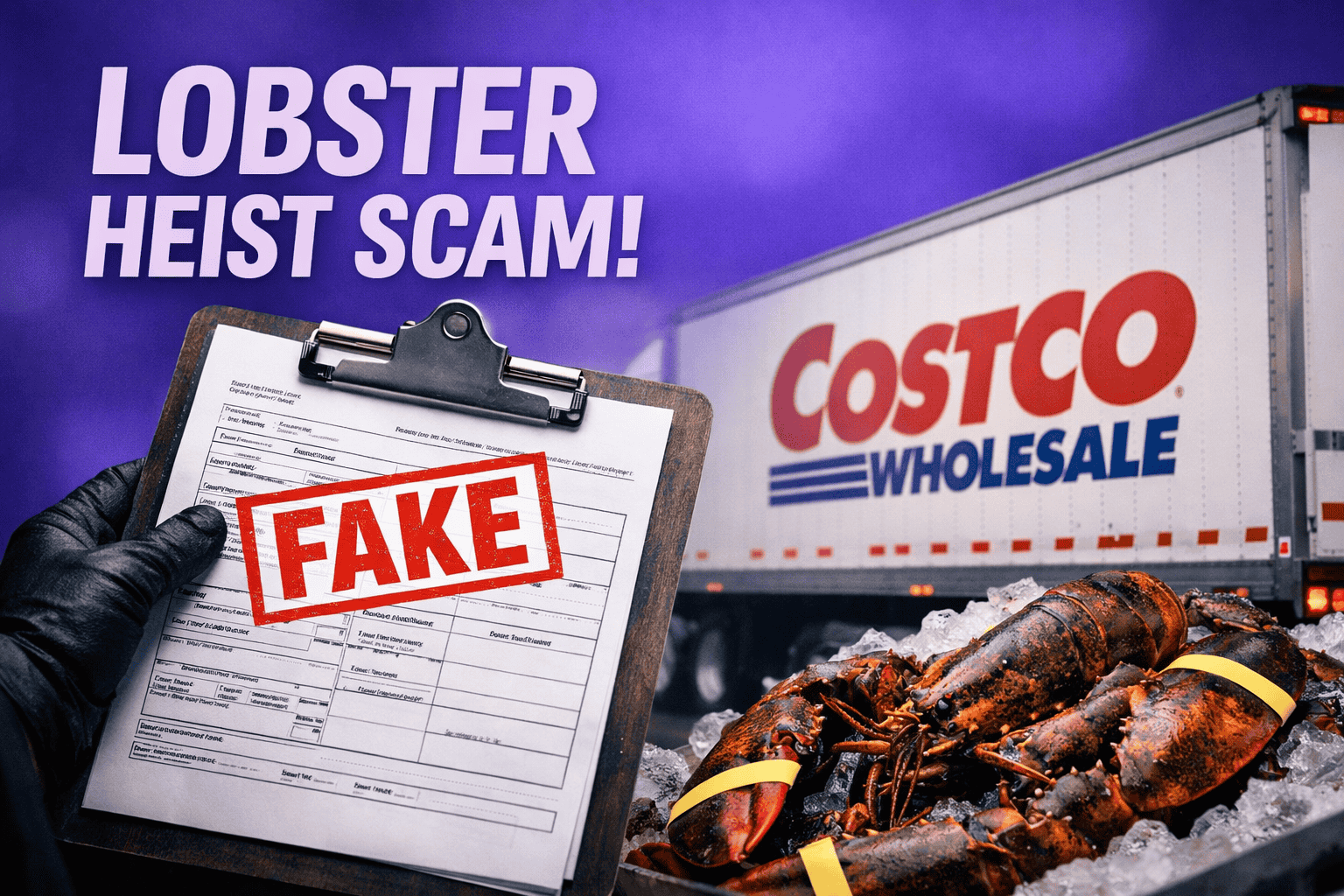

The Maze: Criminals used identity theft to impersonate a carrier, stealing a $400,000 lobster shipment bound for Costco, highlighting how growing supply chain fraud risks threaten high-value perishables logistics. The thieves leveraged stolen domains and email spoofing to divert the load, forcing distributors to confront uncertain insurance coverage and potential consumer price hikes.

The American Trucking Association (ATA) warns that strategic cargo theft has jumped 1,500% since Q1 2021, costing the U.S. economy up to $35 billion annually as criminals target freight shipments.

This type of identity-based freight scam exploits weak carrier vetting, evidenced by the 505 cargo thefts reported during the first quarter of 2025 with an average loss value exceeding $200,000.

This theft marks a clear trend of targeting premium goods, following 2024 incidents where $1 million worth of tequila and $30,000 in snow crustaceans have been hooked by supply chain criminals.

Why it matters: Ecommerce leaders must mandate advanced verification protocols and real-time GPS tracking to combat this rising strategic fraud, protecting margins on high-value perishable GMV.

BRIEFING

🏬 Everything else in Ecommerce

🇺🇸 Tariffs took an intense financial and emotional toll on founders in 2025, forcing companies to delay hiring, raise prices, and completely restructure their supply chains.

🇬🇧 UK DIY chains like Kingfisher and Wickes are enjoying glittering share price increases as high property costs drive consumers to invest in smaller home improvement projects rather than expensive renovations.

🇨🇳 China is drafting new rules requiring explicit user consent before AI companies can use chat logs to train models, emphasizing safety and collective public interest.

🇺🇸 Major US retailers are accelerating physical store network restructuring into early 2026, opting to streamline footprints and aggressively prioritize investment in profitable e-commerce channels.

🇺🇸 A planned $950M deal to sell 119 JCPenney store locations collapsed ahead of a year-end deadline, underscoring ongoing instability and friction in major retail real estate consolidation efforts.

🌍 Luxury and fast fashion models are collapsing due to consumer pushback against relentless price inflation and persistent overstock, forcing brands to adopt capital-efficient models focused on tighter offerings and digital precision.

💸 Investors poured $230 million into industrial AI logistics startups this week, funding platforms designed to automate warehouse docks, track performance, and reshape logistics insurance.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team