TODAY’S MAZE

Happy Saturday! Walmart is quietly capturing substantial e-commerce market share across New York City, proving that digital distribution density can successfully bypass the need for physical stores in dense urban environments. Is the age of mandatory urban storefronts is truly over?

In today’s MarketMaze:

Walmart’s urban e-commerce surge

eBay invests in Creator AI

Amazon Pushes Voice Booking Future

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Walmart is capturing significant e-commerce market share across New York City, demonstrating that localized logistics and digital focus make building physical stores optional in dense urban markets, a strategy contrasting with rivals planning 300+ store closures through 2026. This online surge is fueled by dedicated fulfillment infrastructure and tech investments like the recent Nasdaq listing, signaling a major platform shift.

Walmart's online sales doubled in Manhattan over the past five years while increasing between 90% and 120% across the Bronx, Brooklyn, and Queens, according to the Financial Times report.

The retailer enables same-day delivery of fresh produce and shelf-stable goods to parts of three boroughs by using stores located outside of the city, focusing on compressing delivery corridors to lower fulfillment costs.

This digital pivot is supported by Walmart's transition to an AI-laced commerce platform that includes a partnership with OpenAI to enable ChatGPT shopping experiences with Instant Checkout.

Why it matters: Retail leaders must recognize that digital distribution density now trumps physical store footprint for securing market share in high-cost urban regions.

FROM OUR PARTNERS

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

DATA TREASURE

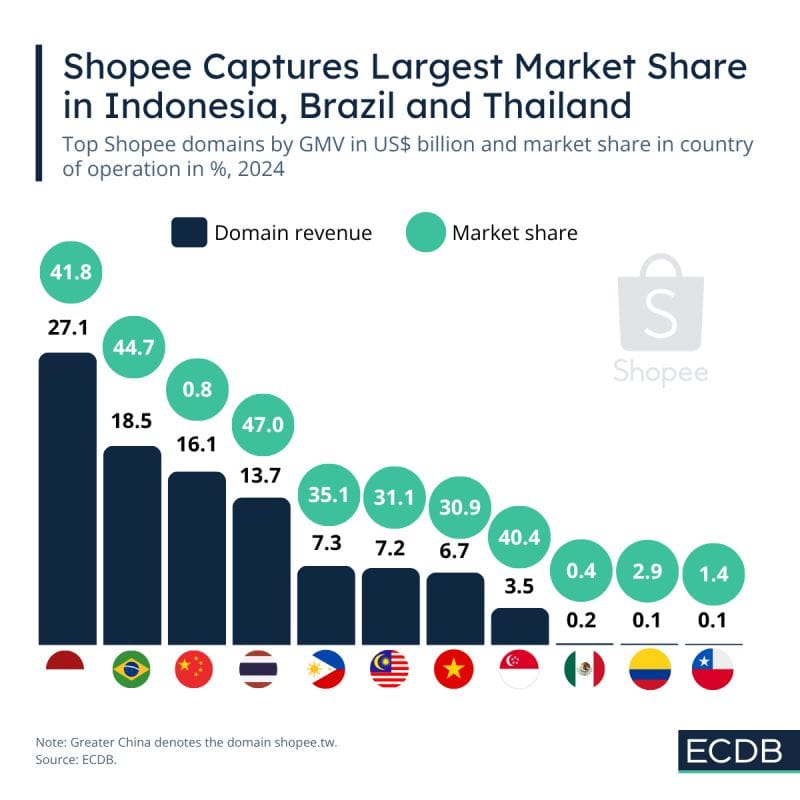

The Maze: Shopee proves global retail leadership no longer comes from legacy markets. It dominates Indonesia, Brazil, and Thailand by becoming the default shopping layer, not just a marketplace. When one platform controls close to half of national ecommerce, it sets prices, habits, and expectations.

In 2024, Shopee generates $27.1B GMV in Indonesia alone, capturing 41.8% of all ecommerce spend in the country.

Brazil follows with 44.7% market share, showing how early localization converts into long term dominance.

Across Southeast Asia, Shopee connects millions of small sellers via B2C and C2C, accelerating digital retail adoption.

Why it matters: Emerging markets are no longer optional growth bets. They are where platforms can win outright. Ecommerce scale now comes from habit creation, not market maturity.

FROM OUR PARTNERS

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

MAZE STORY

The Maze: Traditional marketplaces are aggressively leveraging their venture capital arms to double down on AI, directly countering the massive $1.9 billion flowing into creator economy startups specializing in social shopping and content automation tools.

The growth of social shopping creates market pressure, as EMARKETER projects US social commerce sales will surpass $100 billion next year.

eBay Ventures continues to back key AI startups, recently participating in the $500 million funding round for AI coding platform Poolside.

The marketplace is building a next-generation AI customer service platform in collaboration with Artium.AI and OpenAI, raising questions about whether user data is being shared for AI training, a practice facing regulatory scrutiny in Europe.

Why it matters: The intense capital deployed into creator AI and social platforms forces incumbents to accelerate their technology adoption, making internal AI initiatives critical for retaining market relevance against vertical rivals.

DATA TREASURE

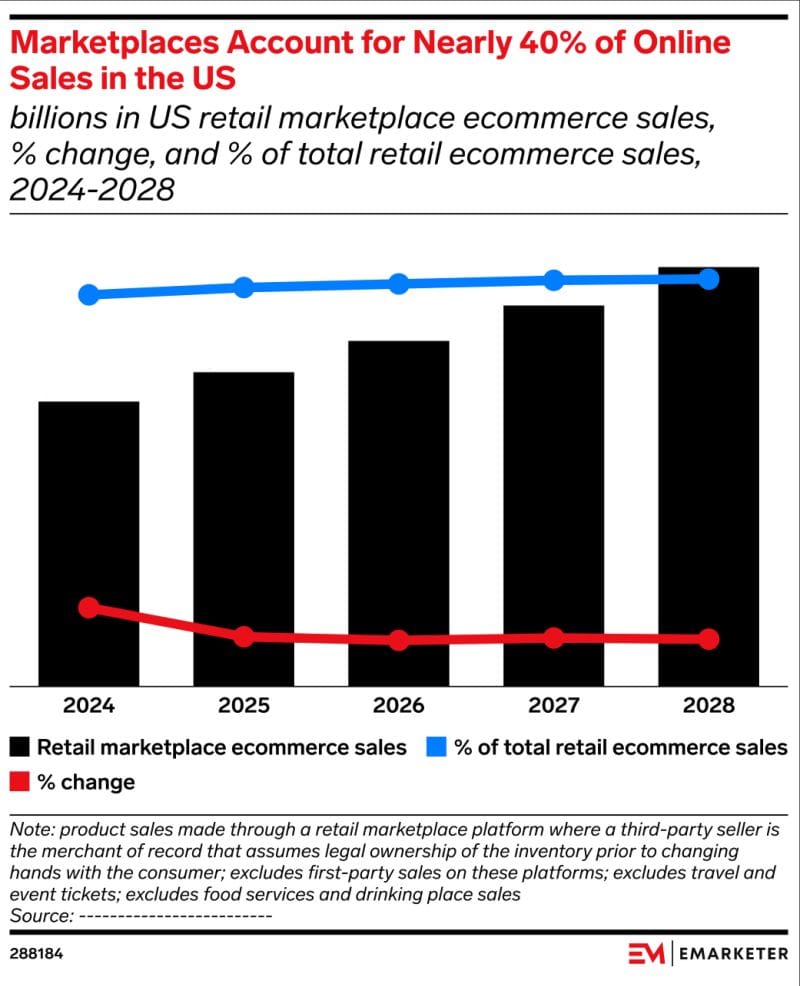

The Maze: Marketplaces are becoming the main engine of US ecommerce. Nearly 40% of online retail now flows through them as consumers choose convenience over brand hopping. Retailers follow the traffic.

By 2024, marketplaces approach 40% of US ecommerce sales as one stop shopping becomes the default.

Traditional retailers expand marketplaces to add assortment without owning inventory or risk.

Ads and third party sellers turn traffic into margin, reinforcing the marketplace flywheel.

Why it matters: Marketplaces are no longer channels. They are infrastructure. Brands that ignore them lose visibility where buying decisions actually happen.

MAZE STORY

The Maze: Amazon announced major new integrations for Alexa+, expanding the AI assistant's role from information retrieval to fully executing multi-step service bookings across travel, wellness, and home services.

The capabilities, set to launch throughout 2026, enable Alexa+ users to book hotels via Expedia and home services through Angi and Yelp, reflecting that 25% of consumers are comfortable entrusting AI travel planning.

This infrastructure extends commerce reach by integrating Alexa+ access into third-party hardware from partners like LG, Samsung, and BMW, which utilize the new custom AZ3 silicon chips.

By centralizing service discovery and booking, Alexa+ grants partners organic access to the Echo user base, forcing rivals like Booking Holdings to adapt to AI as an execution layer rather than simply AI as a discovery channel.

Why it matters: The shift to agentic commerce makes the conversational interface the new competitive battleground, moving value away from clicks and comparison shopping toward seamless outcome delivery.

BRIEFING

🏬 Everything else in Ecommerce

🇨🇳 TikTok introduced a dedicated ‘Minis’ section featuring micro dramas—short-form, episodic soap operas—as a strategic move to deepen content integration with TikTok Shop.

🇺🇸 The US economy is experiencing a ‘jobless boom’ where strong GDP growth is decoupling from hiring, driven by massive AI investments that prioritize efficiency and lead to white-collar workforce reductions.

🇬🇧 UK data indicates a strategic reversal among retailers, with increasing capital allocation towards physical stores—particularly shopping centers—challenging the long-term narrative of high street decline.

🇮🇳 Quick commerce platform Zepto is expected to file draft papers for an initial public offering valued at approximately $1.3 billion, validating strong investor interest in the ultrafast delivery sector.

🇺🇸 Major US retailers, including Macy’s and Carter’s, announced plans to close nearly 300 physical locations throughout 2026, signaling a continued shift of resources toward their online businesses.

🇺🇸 Following warnings about excessive optimization, Google Search Analyst John Mueller called formulaic SEO content 'digital mulch,' signaling stricter penalties for low-value, search-driven pages.

🇺🇸 Amazon is extending its Alexa+ voice assistant to enable direct booking and transactional capabilities across travel, home services (Angi), and wellness (Square).

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team