TODAY’S MAZE

Happy Friday! TikTok’s U.S. operations are moving to domestic ownership. ByteDance reached a deal with Oracle to finalize the sale before the looming deadline.

This transition offers the stability brands need to commit budgets to social commerce. Will new ownership help the app avoid political pressure?

In today’s MarketMaze focus:

TikTok’s US unit sold

Elliott’s $1B Lululemon stake

Nike’s China revenue slump

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: TikTok parent ByteDance signs an agreement to divest its U.S. operations to a U.S.-led investor group to resolve national security concerns. This landmark deal effectively ends a years-long regulatory saga and secures a future for the app's massive user base and merchant ecosystem just weeks before the expected January 2026 closing date.

The new joint venture assumes total control over U.S. data protection and recommendation algorithms per an internal memo from CEO Shou Chew that confirms the deal's expected closing on January 22.

This transaction values the stateside business at roughly $14 billion and follows a Supreme Court ruling that upheld federal laws requiring ByteDance to sell its strategic assets.

Major private equity players like Silver Lake and MGX join Oracle to form the ownership group that will oversee content moderation under a framework approved by Trump in September.

Why it matters: Resolving the threat of a ban provides the long-term stability necessary for brands to commit substantial budgets to the platform’s growing ecommerce features. This transition allows teams to prioritize technical growth and encourages deeper merchant investment in TikTok Shop and integrated social commerce infrastructure throughout 2026.

FROM OUR PARTNERS

Banish bad ads for good

Your site, your ad choices.

Don’t let intrusive ads ruin the experience for the audience you've worked hard to build.

With Google AdSense, you can ensure only the ads you want appear on your site, making it the strongest and most compelling option.

Don’t just take our word for it. DIY Eule, one of Germany’s largest sewing content creators says, “With Google AdSense, I can customize the placement, amount, and layout of ads on my site.”

Google AdSense gives you full control to customize exactly where you want ads—and where you don't. Use the powerful controls to designate ad-free zones, ensuring a positive user experience.

DATA TREASURE

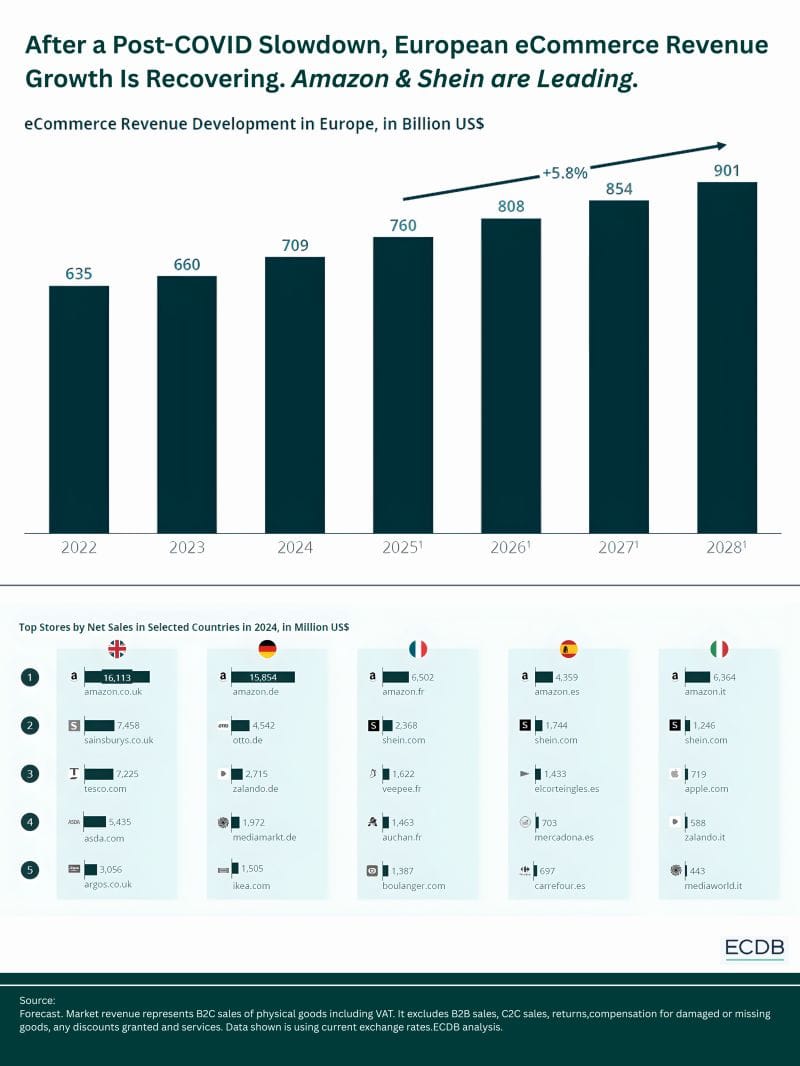

The Maze: Europe’s ecommerce engine is back online. After two soft years, online retail crossed $700B in 2024 and is now on track to hit $901B by 2028, with a sharp rebound expected in 2025. Growth is slower than the US or Asia, but scale and concentration are rising fast, and Amazon is tightening its grip across every major market.

In 2025, European ecommerce is expected to jump 7.2%, the fastest pace since the post COVID reset, signaling demand normalization after inflation, inventory overhangs, and cautious consumers dragged growth down in 2022 and 2023.

Amazon ranks number one by net sales in Germany, the UK, France, Spain, and Italy, while challengers differ locally, from UK grocers to Germany’s Otto, showing how national retail DNA still shapes second place.

Shein’s presence among top sellers in France and Italy confirms fast fashion has shifted from social trend to structural demand capture, competing on price, assortment, and logistics at national scale.

Why it matters: Europe is no longer a growth story. It is a share story. In mid single digit markets, visibility beats novelty, retail media becomes a toll road, and brands that win marketplaces win demand. Ecommerce maturity raises the cost of being invisible.

FROM OUR PARTNERS

AI that actually handles customer service. Not just chat.

Most AI tools chat. Gladly actually resolves. Returns processed. Tickets routed. Orders tracked. FAQs answered. All while freeing up your team to focus on what matters most — building relationships. See the difference.

MAZE STORY

The Maze: Elliott Investment Management secured an activist stake exceeding $1 billion in Lululemon as the brand faces slowing domestic sales. This move arrives as CEO Calvin McDonald prepares to exit, leaving the athleisure leader at a critical crossroads.

The company makes entering India a priority through a partnership with Tata CLiQ, utilizing their marketplace infrastructure to minimize logistics capital expenditures.

While international revenue grew 30%, soft demand in the US enables tracking inventory risks as Americas sales declined 2% during the third quarter.

Elliott Management leads collaboration efforts with veteran retail executives to accelerate a search that allows finding a CEO capable of reviving the brand's premium positioning.

Why it matters: Activist involvement typically forces a pivot toward managing inventory more leanly and expanding digitally to protect margins against low-cost threats. This shift indicates that even dominant premium brands must leverage franchise partnerships and marketplace data to sustain global growth.

DATA TREASURE

The Maze: The modern $100B company has an address, and it is usually in one of a few dense tech hubs. The Bay Area alone produced 21 companies above $100B since 1990, including Databricks at a $134B valuation, while Europe created only a handful. Talent density compounds faster than policy slogans.

Databricks raised $4B in 2024 at $134B, becoming the 21st Bay Area firm above $100B, built on the idea that enterprise data infrastructure is the choke point for scaling artificial intelligence inside real companies.

No $100B companies emerged from the US East Coast in the same period, marking a historic shift from finance and industrial power centers to software driven ecosystems optimized for speed, risk, and repeat founders.

China’s $100B firms cluster across Beijing, Shenzhen, Hangzhou, and Shanghai, showing that concentration, not country, predicts outcomes, while Europe’s fragmentation slows scale despite strong research talent.

Why it matters: Capital, talent, and ambition cluster, then self reinforce. Ecommerce, software, and artificial intelligence reward ecosystems that ship fast and recycle winners into new founders. Geography is not destiny, but density is strategy.

MAZE STORY

The Maze: Nike recorded a 17% revenue decline in Greater China for Q2, marking its sixth consecutive quarterly drop and prompting leadership to reset regional operations. Nike reported total revenues of $12.4 billion as the footwear giant navigates a multi-year turnaround under CEO Elliott Hill.

Nike Direct revenues fell 8% to $4.6 billion while digital sales plummeted 14%, highlighting significant challenges within the company’s owned e-commerce ecosystem.

The new internal structure allows removing layers of senior leadership to speed making decisions according to a recent announcement to restructure.

Higher North American tariffs primarily caused gross margins to contract by 300 basis points, which slashed quarterly net income by 32%.

Why it matters: This performance shift makes prioritizing hyper-localized digital experiences essential for global brands to combat regional consumer disconnects. A heavy reliance on wholesale growth signals that even the strongest direct-to-consumer players still need robust marketplace partnerships to maintain scale.

BRIEFING

🏬 Everything else in Ecommerce

🇪🇺 The EU is introducing a €3 flat customs duty on shipments under €150 starting July 2026, a move designed to regulate the high volume of low-value parcels from overseas marketplaces.

🇨🇳 Alibaba accelerated its flash commerce offensive through logistics arm Cainiao, launching 31 new warehouses for Tmall Supermarket to meet surging demand for instant delivery.

🌍 Lyst named Miu Miu the world's hottest brand for 2025 as search demand for "accessible" luxury items like Labubu bunny charms spiked by 625%.

🇺🇸 Google deployed Gemini 3 Flash as the default model for its Search AI Mode globally, enabling faster reasoning and improved comparison tools for complex shopper queries.

🇨🇦 Shopify partnered with Contentsquare to integrate AI-driven behavioral insights, allowing merchants to analyze the full customer journey from first interaction to checkout.

🇺🇸 Victoria’s Secret is shifting from air to maritime freight to mitigate the impact of rising tariffs, accepting temporary inventory increases to manage costs amidst shipping delays.

🇺🇸 OnePay joined Google's Agent Payments Protocol (AP2) to help standardize how autonomous AI agents select and store payment credentials for automated commerce.

🇬🇧 ZigZag launched a new "Donate by Post" portal in partnership with The Salvation Army, allowing shoppers to divert unwanted apparel from landfills to charitable secondary markets.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team