TODAY’S MAZE

Happy Thursday! Google is finally blinking. After pressure from UK regulators, it is testing opt-out controls that let publishers block AI-generated answers while keeping classic search visibility. For the first time, content creators may be able to say no to AI summaries without disappearing from search.

In today’s MarketMaze focus:

Google AI Gets Leashed

Allbirds shutters US stores

Microsoft’s massive AI backlog

Amazon’s uneven category dominance

Digital attention remains mispriced

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Google is testing opt-out controls that let publishers block AI search answers without losing classic search traffic, after pressure from the UK regulator. This is the first real crack in the forced deal where content fuels AI, but clicks never come back.

On Jan 28, 2026, Google confirmed it is exploring AI-specific opt-outs for AI Overviews and AI Mode, responding to UK rules demanding publisher choice, after years of binary controls that tied AI use directly to search visibility.

Since mid-2024, AI summaries have cut organic clicks by 61% and paid clicks by 68%, while AI Overviews scaled to 200 countries and over 1B users, shifting value from publishers to Google at industrial scale.

Google says AI traffic is “higher quality”, yet news sites report 38% traffic drops and niche creators up to 90%, turning search from a discovery engine into an answer engine that monetizes attention, not creators.

Why it matters: Search is the front door of ecommerce and media. If publishers can finally say no to AI answers, Google’s growth model slows, but if they can’t, content supply weakens and the long tail that feeds commerce starts to break.

As Google expands AI Overviews and AI Mode globally, how do you expect classic organic search traffic to change for most commercial websites?

- 🌍 Global decline (traffic keeps falling across most regions and categories)

- 🇺🇸🇪🇺 Regional split (larger declines in US and UK, milder impact in EU and emerging markets)

- 🏢 Enterprise advantage (large brands stabilize traffic, smaller sites lose visibility)

- 🧱 Pay-to-play shift (organic weakens, paid search becomes the main lever)

- 🔄 Short-term shock (initial drop followed by stabilization at a lower baseline)

FROM OUR PARTNERS

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

MAZE STORY

The Maze: The sustainable footwear brand is closing all remaining full-price US retail locations by late February to pivot resources back to e-commerce and wholesale channels.

The retail footprint shrinks from 29 US locations recorded last September to just two domestic outlet stores, effectively erasing the brand's physical expansion efforts.

CEO Joe Vernachio frames the retreat as essential for "profitable growth" after the business saw a 23.3% net revenue drop in Q3 compared to the prior year.

The company currently holds a market cap of just $32 million, marking a harsh correction from the aggressive brick-and-mortar expansion that defined its post-IPO strategy.

Why it matters: This capitulation proves that the "growth at all costs" physical retail playbook is failing for D2C brands that lack the wholesale margins to support high-rent visibility.

FROM OUR PARTNERS

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

MAZE STORY

The Maze: Microsoft revealed that OpenAI now accounts for roughly 45% of its commercial cloud backlog, highlighting a massive dependency even as the tech giant ramps up capital expenditure to record highs.

Commercial remaining performance obligations exploded 110% year over year to $625 billion, a figure heavily distorted by OpenAI's massive long-term commitments to Azure infrastructure.

Capital expenditures surged 66% to $37.5 billion this quarter as the company races to secure the GPUs and data centers required to support this insatiable hunger for compute.

Microsoft keeps 80% of sales from OpenAI models sold to Azure customers, creating a revenue flywheel that helps offset the costs of chasing AI leadership.

Why it matters: This shift signals that AI is evolving from experimental software into the structural backbone of enterprise commerce. Brands ignoring this infrastructure rollout risk falling behind as competitors build directly on top of these integrated, heavy-compute environments.

DATA TREASURE

The Maze: Amazon looks unbeatable until you zoom in by category. It owns discovery driven markets like electronics and books, but struggles where shopping is habitual and logistics heavy, giving Walmart real room to grow in everyday spend.

By Q3 2025 Amazon held ~75% share in books and hobbies and ~61% in electronics, but only ~14% in food and ~7% in health, showing dominance tracks assortment depth, not basket frequency.

Apparel and home sit in the middle at ~48% and ~43%, big enough to matter but still contestable as returns, fit, and delivery speed reshape buyer choice.

Categories with low margins and repeat purchases reward proximity, not scale, which explains why store backed players gain share without beating Amazon overall.

Why it matters: Ecommerce is not one market, it is many. Winning online depends less on size and more on matching category economics to fulfillment reality.

DATA TREASURE

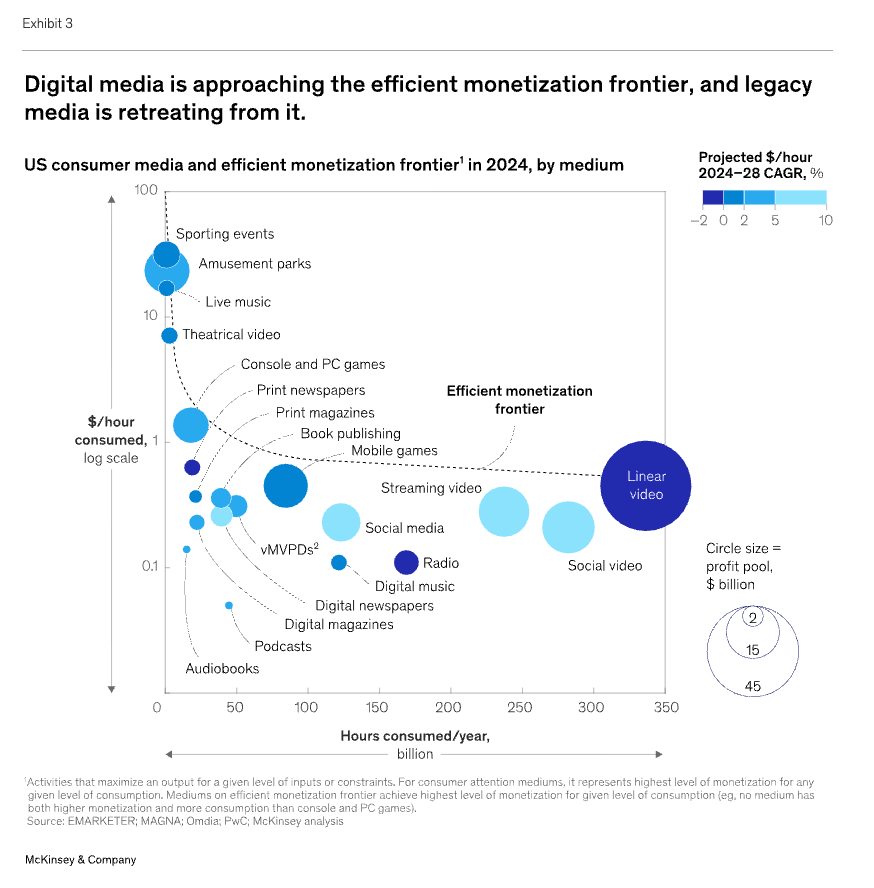

The Maze: Time spent does not equal money earned. Digital media captures huge attention but often monetizes it poorly, leaving a gap between how much time people spend and how much value brands extract.

Social and streaming formats absorb hundreds of hours per user each year, yet earn far less per hour than live or intent heavy formats that command focus.

Legacy formats still punch above their weight because concentrated attention converts better than passive exposure, even as audiences shrink.

The biggest upside sits in improving value per minute, not chasing more minutes, especially where intent is visible and measurable.

Why it matters: Retail media and commerce ads win because they monetize fewer moments better. Ecommerce growth follows attention quality, not just reach.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Amazon is winding down its Amazon One palm recognition service, removing the biometric payment tech from Whole Foods and all physical locations by June.

🇯🇵 SoftBank is reportedly considering a massive $30 billion investment in OpenAI, which would significantly deepen the capital moat around the AI leader.

🇺🇸 Levi Strauss posted 7% organic growth as it successfully pivots to a direct-to-consumer model, with DTC now acting as the primary revenue engine.

🇬🇧 Debenhams decided in a strategic U-turn to keep PrettyLittleThing, citing a successful turnaround and the brand's transition to a fashion marketplace.

🇬🇧 TikTok Shop has surged to become the fourth-largest beauty retailer in the UK, driven by content-led discovery that is reshaping purchase paths.

🇬🇧 Google is exploring controls that allow publishers to opt out of AI Overviews without disappearing from search results, following UK regulatory pressure.

🇺🇸 DHL received US Customs approval to collect and remit postal charges, streamlining cross-border ecommerce flows.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team