Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

Temu & Shein turn to Europe🛫

📊 Key Data:

Surge of South Korea’s Amazon🚀

📖 Ecommerce players news:

🇪🇺 Temu, Shein Face EU Regulatory Hurdles Amid US Tariff Woes.

🇺🇸 Walmart, Amazon Eye Stablecoins as Senate Pushes Rules.

🇫🇷 French Senate Passes Ultra-Fast Fashion Regulation Bill.

🇮🇳 Shein Expands Manufacturing in India Amid Trade War.

🇨🇿 Rohlik Spins Out Veloq for AI Grocery Fulfillment.

🇩🇪 Picnic Opens Europe’s Largest E-Food Warehouse.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

Confession: I missed sending out Wednesday’s issue. Still, it landed on LinkedIn and the web. If you missed it, here’s the link: Local Beats Global in Retail Expansion Plans 🏠 + Want AI Traffic? Start With Google First 🧭. Both stories and news coverage are worth your time.

Today, I’m a bit under the weather, but you’re still getting a fresh issue. Also, heads up -we’re in the middle of a full website revamp and tweaking the email format. Can’t wait to show you the results soon. Stay tuned!

Temu & Shein turn to Europe🛫

America’s lost that loving feeling, but Temu and Shein just swiped right on Europe. According to fresh Consumer Edge transaction data, both giants are doubling down on EU markets as US growth stalls and trade tensions heat up. If you want to know where the next retail power shift is happening, buckle up—this flight is headed straight for the heart of the continent.

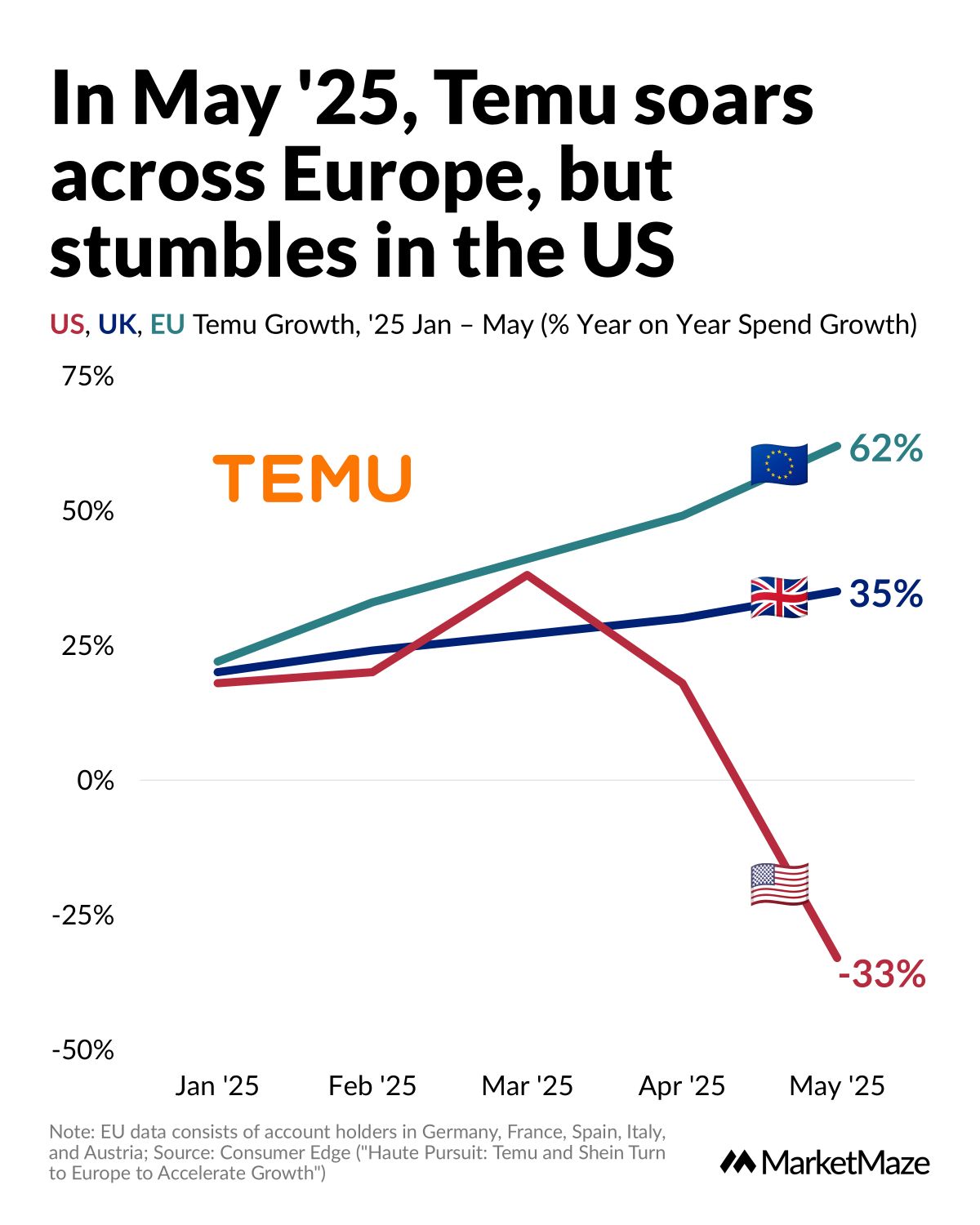

Temu Rockets in Europe, Tanks in the US 🚀

Temu is living a split reality in 2025. Europe can’t get enough, with year-over-year (YoY) spend growth up 62% in the EU and 35% in the UK from January to May. Meanwhile, the US is ghosting Temu—spend growth crashed to -33% YoY in May as trade tensions bite. Temu’s EU push isn’t random. Transaction data shows acceleration: EU YoY spend growth was only +25% in January, ramped to 40–50% in March and April, then exploded past 60% in May. All this as the company pivots away from a frosty US market, betting big on Europe where handling fees for low-value imports remain much lower than across the Atlantic.

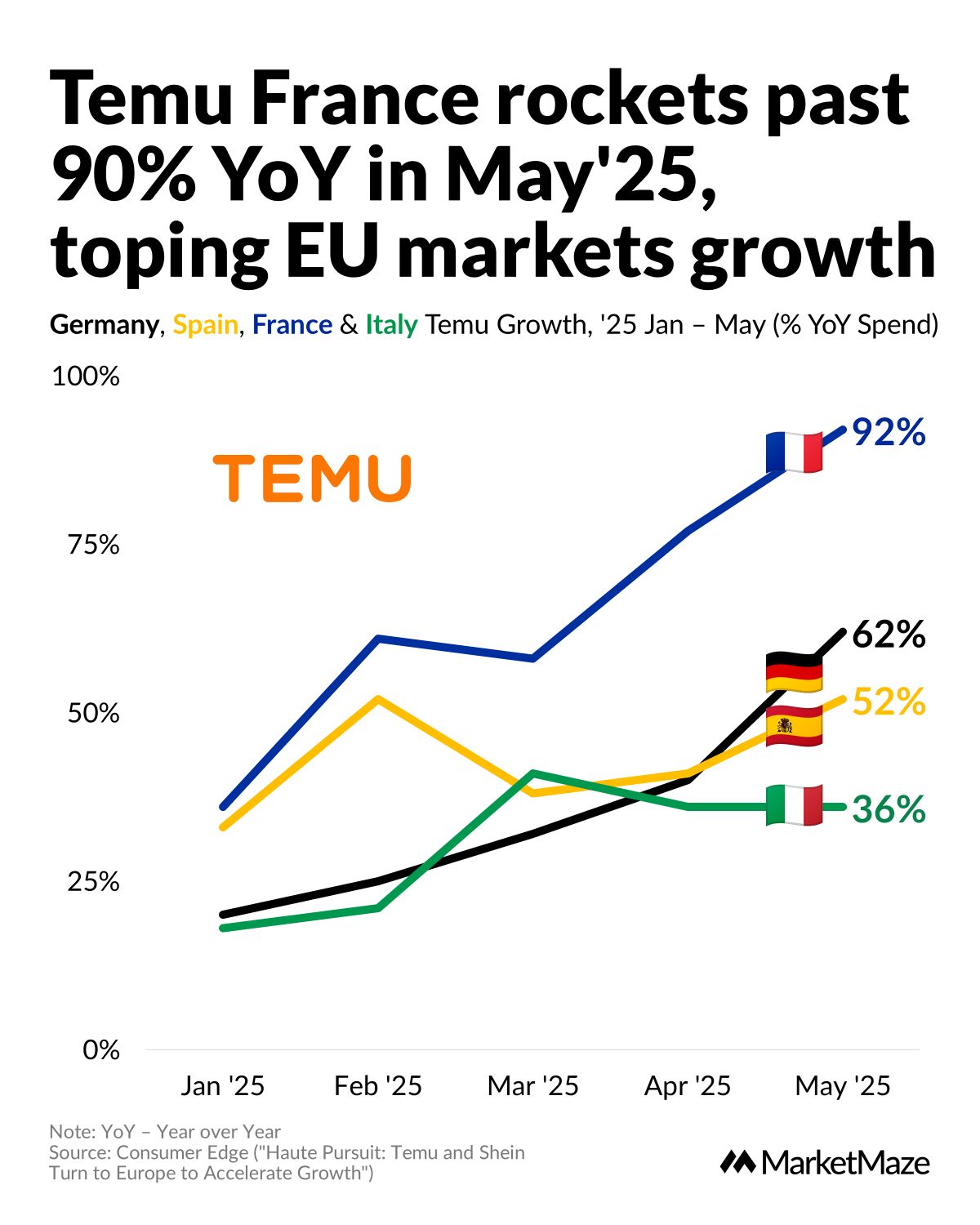

France Fuels Temu Mania in Europe

Temu is riding a France wave—year-over-year spend in France soared 92% in May ’25, making it the fastest-growing EU market for Temu. Germany clocked 62% YoY, Spain hit 52% YoY, and Italy cruised at 36% YoY. Southern Europe is Temu’s new playground, and France is leading the hypergrowth charge.

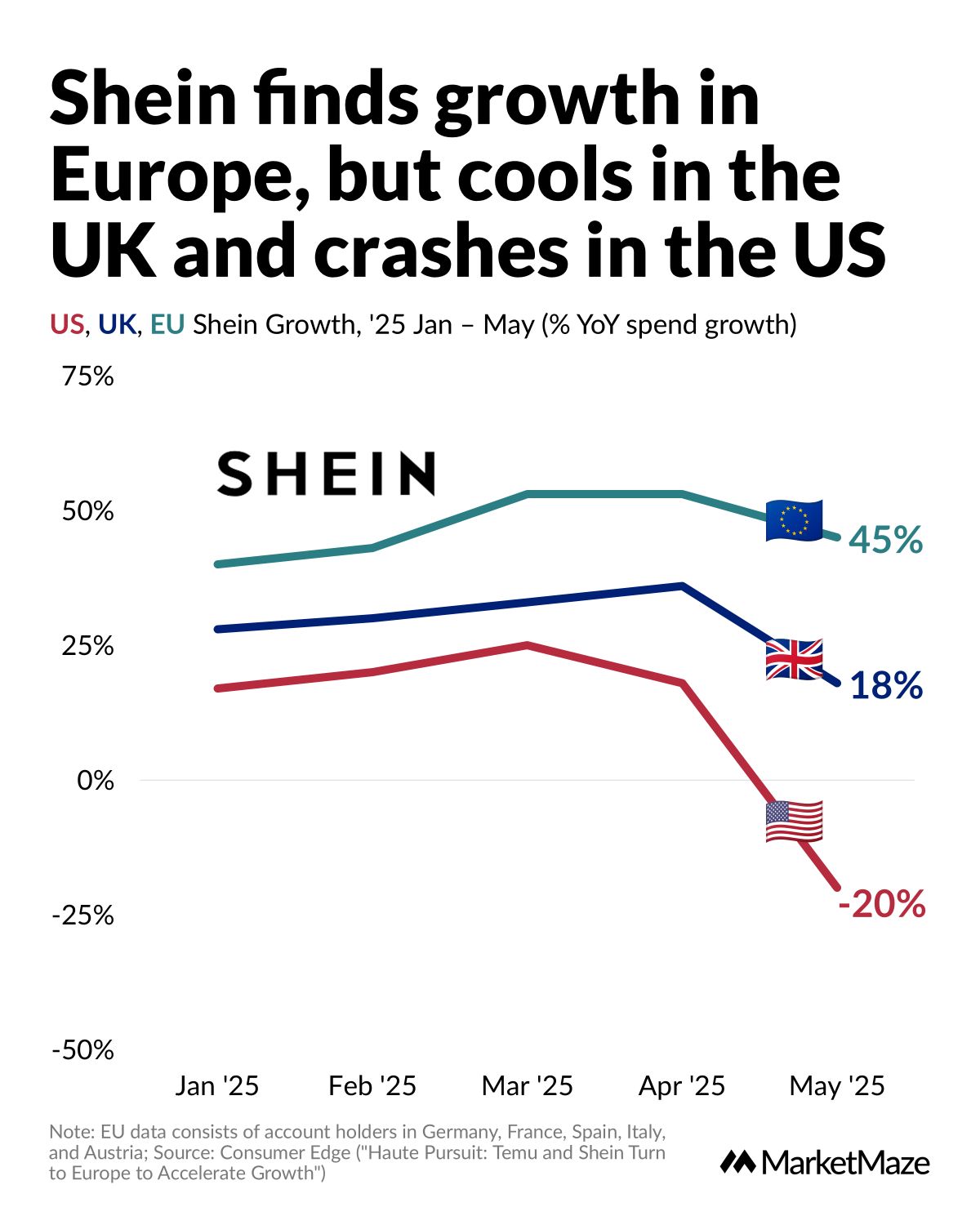

Shein Wins in Europe, Loses in the US 🌍

Shein’s 2025 is a tale of three continents. EU shoppers keep spending—45% YoY growth from January to May, fueled by a shift in focus as US sales soften. The UK cools to 18% YoY, still strong, while the US sees a fashion exodus, plunging to -20% YoY as regulatory heat rises. Shein’s European sales are up nearly 20% YoY in May, outpacing April’s single digits. Despite the US still dominating total revenue, a pivot to Europe could flip the balance, especially since new EU import fees are lighter than those stateside.

News you’re not getting—until now.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

Surge of South Korea’s Amazon🚀

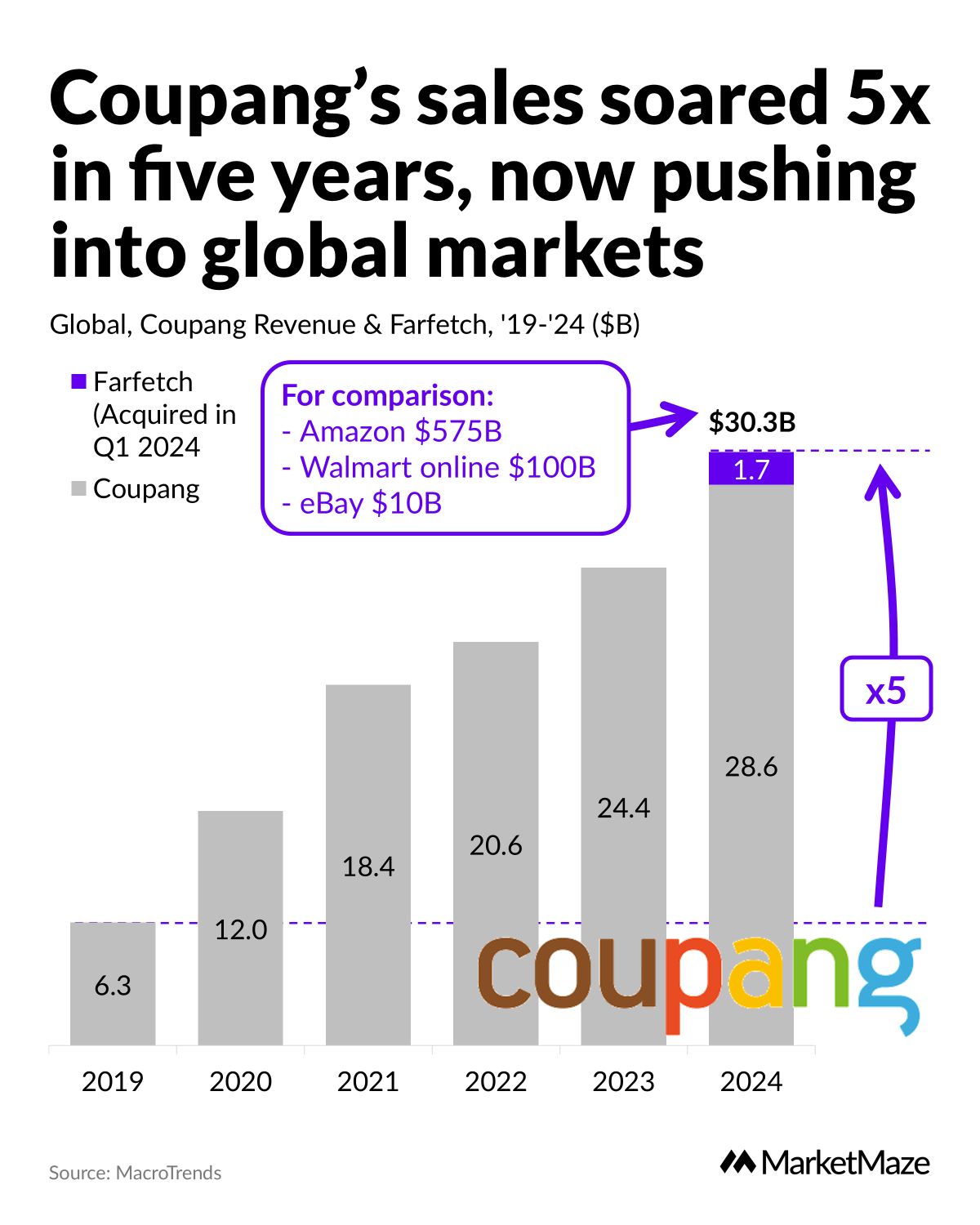

Often dubbed “the Amazon of South Korea,” Coupang sits at the top of Korean e-commerce and is clawing its way up the global ladder. In 2023, Coupang hauled in $24.4B revenue, notching a 43% CAGR since 2018. Nearly half of South Korea’s 52M people are Coupang buyers. Its Rocket WOW subscription? Over 14M members—covering two-thirds of Korean households. Coupang isn’t just winning at home—it’s building a playbook for global e-commerce.

Coupang’s Growth Rocket Ignites

Coupang quintupled revenue to $30B in five years, landing among the fastest-growing global retailers. The ride from 2019 to 2024 reads like a highlight reel:

2019 – Launched Rocket Fresh, expanding into grocery delivery

2020 – COVID-19 surge fuels market share; big logistics bets pay off

2021 – IPO on NYSE, closing day valuation: $102B

2022 – Entered Japan and Taiwan, first markets outside Korea

2023 – Logged first profitable year, bought Farfetch for $500M (completed in Jan 2024)

Not just Korea’s Amazon anymore—Coupang’s eyeing the world.

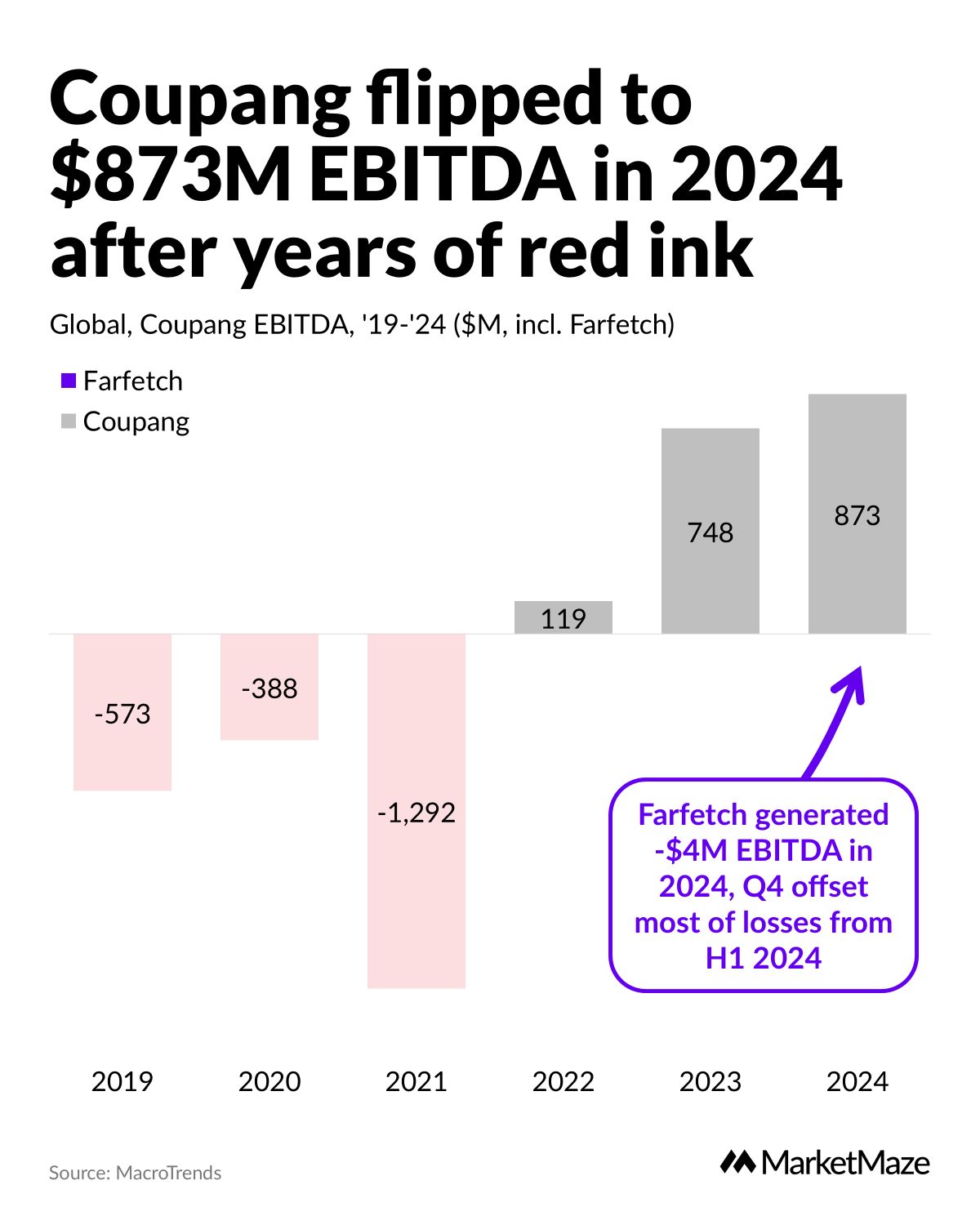

Coupang’s Profit Flip: Red Ink to Black

After years in the red—including a brutal -$1.3B EBITDA in 2021—Coupang’s relentless expansion finally paid off. The company hit $873M EBITDA in 2024, up from $748M in 2023. Even with the Farfetch deal (which dragged -$4M EBITDA), Coupang’s numbers kept rising. Now ranked #142 on the Fortune 500, Coupang is showing that global ambition and scale can finally turn losses into profit.

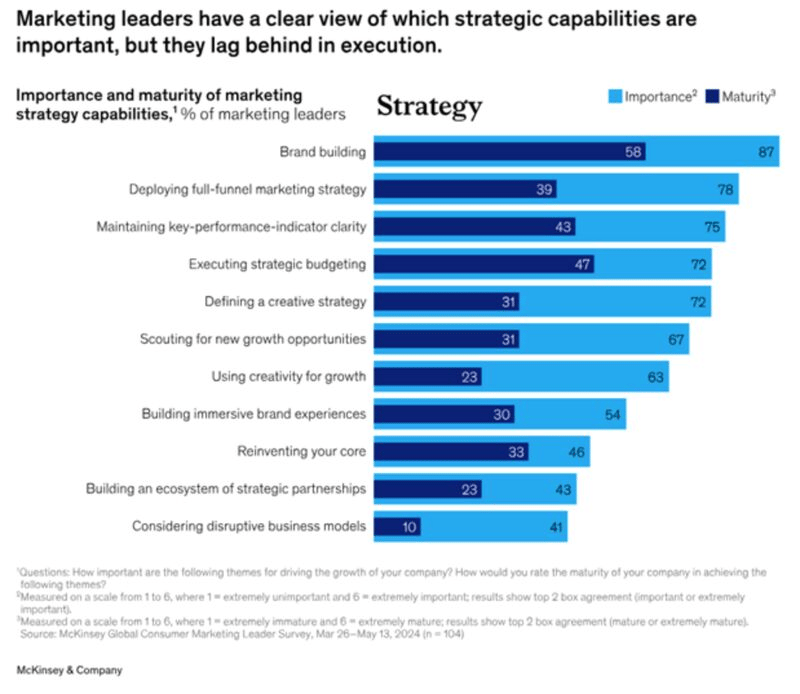

How to Actually Measure Brand Impact (With Data).

Dharmesh Damani dives into the messy world of brand measurement, pushing for a more scientific approach instead of the usual gut feeling. He lays out why tracking brand is just as important as sales—think correlation, not just causation. Key takeaway: Only what gets measured gets managed, and the tools are finally catching up. 👉 Dharmesh Damani on LinkedIn

Bond Capital’s TAI Report: Where the Internet Goes Next.

Mary Meeker’s Bond Capital puts out a monster deck every year on tech, commerce, and digital everything—this year’s TAI report is no exception. If you want to see how AI, digital health, and e-commerce are actually moving markets (not just headlines), this is your roadmap. Warning: The charts come fast and furious, but if you want to win in tech, you need to be fluent in this stuff. 👉 Bond Capital TAI Report

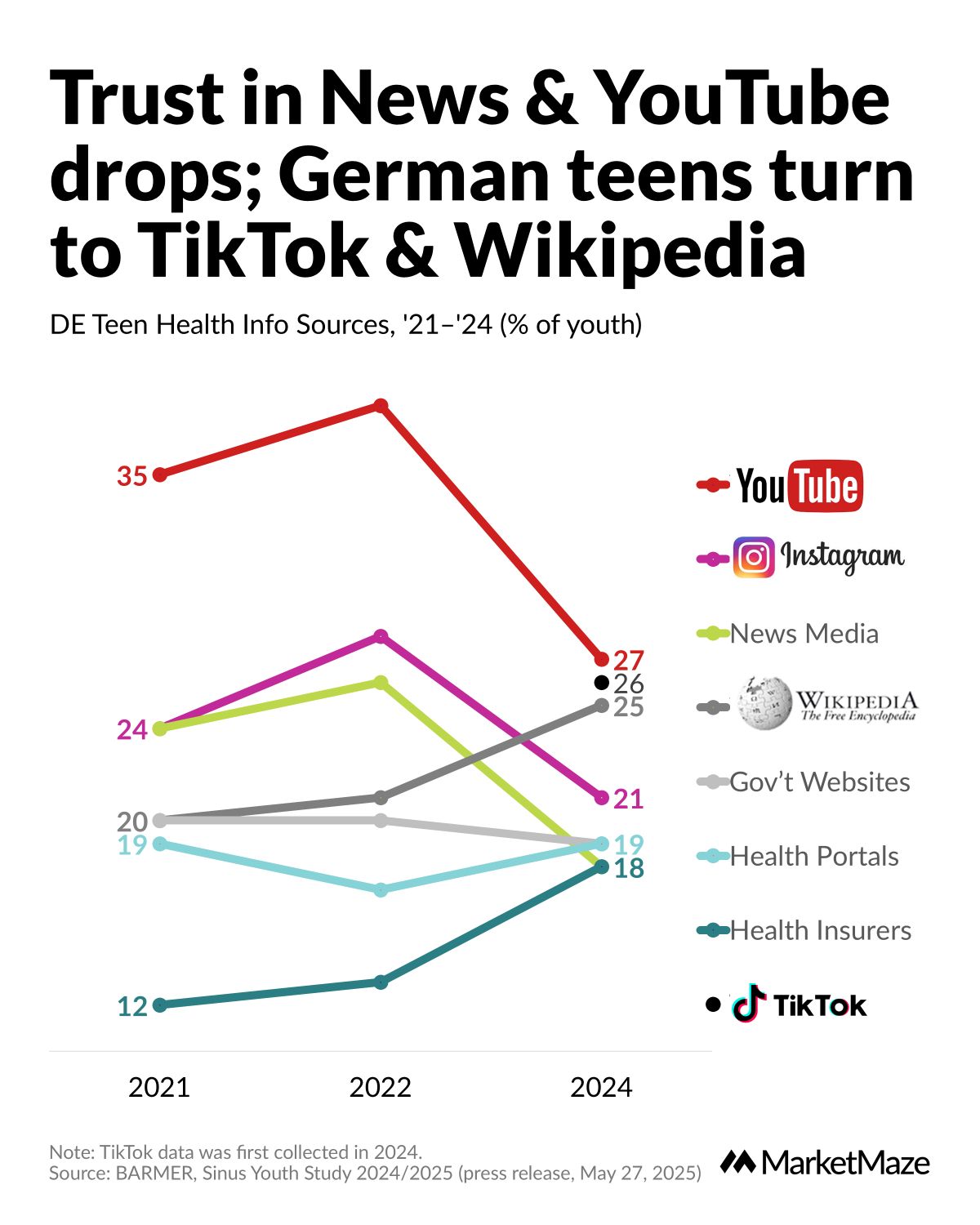

German Teens Trust Wikipedia, Not News or YouTube for Health.

The latest BARMER Sinus study is a reality check for anyone marketing to Gen Z: classic news outlets and YouTube are losing steam as trusted health sources, while Wikipedia and TikTok are surging. This press release from the German Sinus Institute breaks down the numbers behind the generational trust shift. Main insight: if you want to reach teens, old-school media is fading fast. 👉 BARMER Sinus Youth Study

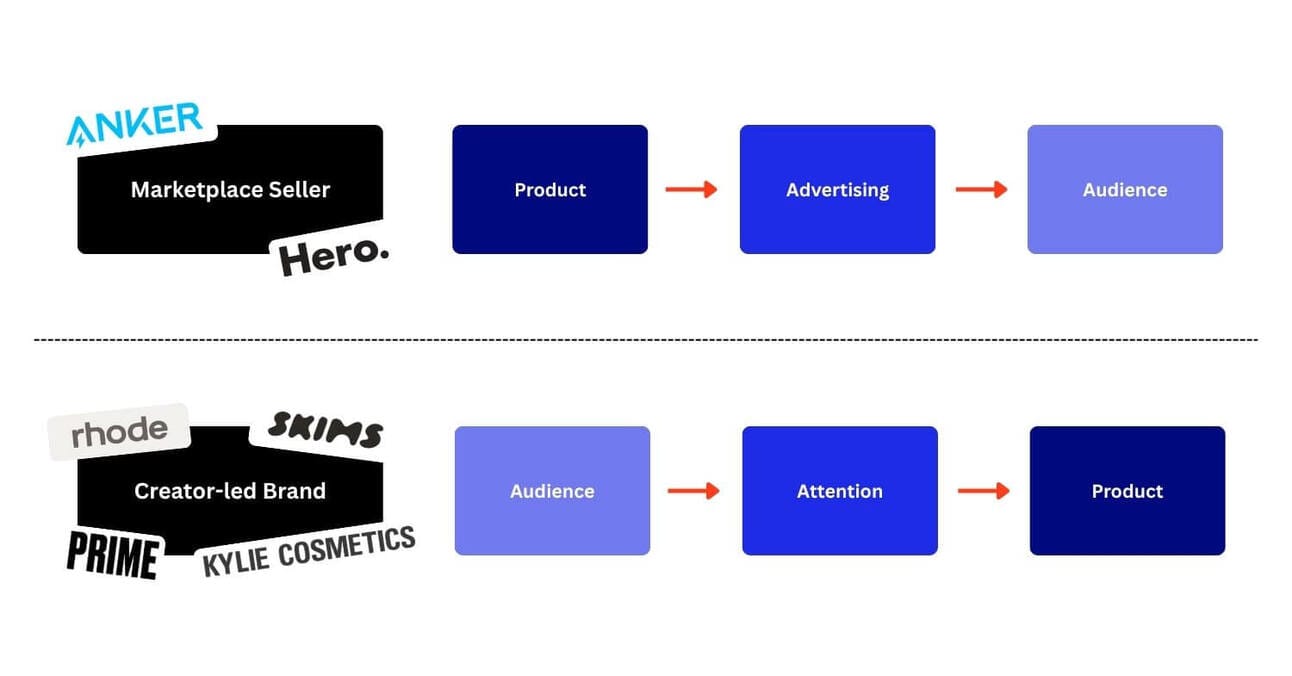

Another Billion-Dollar Creator Brand Joins the Party.

Marketplace Pulse’s latest piece tracks how creator-led brands like Prime, Skims, and Rhode aren’t just hype—they’re eating legacy brands’ lunch. These companies skip the traditional product-to-ad-to-audience playbook and start with an audience that already cares. TL;DR: In the creator economy, attention is the new currency, and it’s cashing out big. 👉 Marketplace Pulse

🚨 Want to become famous(er), grab more customers, and 100X your reach?

Stop burning budget on ads and hoping for clicks. Podcast listeners lean in, hang on every word, and buy from guests who deliver real value. But appearing on dozens of incredible podcasts overnight as a guest has been impossible to all but the most famous.

PodPitch.com is the NEW software that books you as a guest (over and over!) on the exact kind of podcasts you want to appear on – automatically.

⚡ Drop your LinkedIn URL into PodPitch.

🤖 Scans 4 Million Podcasts: PodPitch.com's engine crawls every active show to surface your perfect podcast matches in seconds.

🔄 Listens to them For You: PodPitch literally listens to podcasts for you to think about how to best get the host's attention for your targets.

📈 Writes Emails, Sends, And Follows Up Until Booked: PodPitch.com writes hyper-personalized pitches, sends them from your email address, and will keep following up until you're booked.

👉 Want to go on 7+ podcasts every month? Book a demo now and we'll show you what podcasts YOU can guest on ASAP:

/a

🇪🇺 Temu, Shein Face EU Regulatory Hurdles Amid US Tariff Woes. Temu and Shein see U.S. sales drop 36% and 13% due to new tariffs, pushing them to grow in Europe (Temu +63% EU, Shein +42% UK). EU’s proposed €2 customs fee and consumer law probes, started February 2025, challenge their expansion. 👉 CNBC

🇺🇸 Walmart, Amazon Eye Stablecoins as Senate Pushes Rules. Walmart and Amazon explore stablecoins to cut transaction fees, backed by the Senate’s GENIUS Act, which passed a 68-30 vote. The Act ensures stablecoin reserves, with a final vote nearing to reshape global payments. 👉 PYMNTS

🇦🇺 Amazon Business Launches in Australia for SMBs. Amazon Business enters Australia, offering cost-saving tools like business pricing and Business Prime for SMBs, with 92% facing rising costs. Lena Zak says it’s built for seamless shopping as businesses stock up. 👉 ChannelX

🌍 Amazon Business Hits 8M Global Customers, $35B Sales. Amazon Business serves 8M customers, including 66 FTSE 100 firms, with $35B in sales and 4x growth in socially responsible purchasing. Shelley Salomon highlights new features like Ariba integrations at ABX 2025. 👉 ChannelX

🇺🇸 Amazon Kills Posts Program That Failed to Drive Sales. Amazon’s Posts program, a social-style feed, ends July 31 after low engagement, with new posts stopped June 16. Emily Browning notes shoppers focus on buying, not browsing, unlike social media. 👉 Adweek

🇺🇸 Amazon Cuts <100 Jobs in Books Business to Streamline. Amazon lays off fewer than 100 in its books units, including Goodreads and Kindle, to optimize roles, not shrink the category. This follows the closure of physical bookstores three years ago. 👉 Retail Dive

🇺🇸 Amazon’s AI Video Ads Tool Goes Live for U.S. Sellers. Amazon’s Video Generator creates 6 video ads in 5 minutes for U.S. sellers, free after a 2024 beta, with features like video summarization. It boosts product visibility with multi-scene visuals and brand logos. 👉 The Verge

🇬🇧 eBay Live Brings Livestream Shopping to UK Market. eBay Live launches in the UK at MCM Comic Con with 18 live events, focusing on Collectibles and Luxury via interactive auctions. Eve Williams says it connects fans and sellers in real-time. 👉 ChannelX

🇪🇺 AliExpress Local+ Speeds Up Shipping in Europe. AliExpress’s Local+ uses European warehouses for faster delivery, competing with Amazon, Shein, and Temu, amid looming €2 import levy by 2028. It simplifies shipping and returns for sellers with a badge for customers. 👉 EcommerceNews

🇫🇷 French Senate Passes Ultra-Fast Fashion Regulation Bill. The French Senate approved a bill targeting companies like Shein and Temu, imposing a tax of up to 10 euros per item by 2030 and banning fast fashion ads. It aims to curb environmental damage, with France’s fast fashion market growing from 2.3B euros in 2010 to 3.2B euros in 2023, and 48 items bought per person yearly. 👉 RFI

🇮🇳 Shein Expands Manufacturing in India Amid Trade War. Shein, with Reliance Retail, plans to grow Indian suppliers from 150 to 1,000, aiming to sell India-made clothes globally in 6-12 months. This move avoids US-China trade tensions and supports Shein’s IPO shift to Hong Kong, though labor concerns in India’s textile sector remain. 👉 CNBC

🇺🇸 Rebag Partners with Amazon for Pre-Owned Luxury Sales. Rebag joined Amazon’s Luxury Stores to offer 30K authenticated luxury items like Hermès handbags and Rolex watches, starting June 10, 2025. CEO Charles Gorra says it reaches more customers and promotes sustainable shopping through circular fashion. 👉 FashionUnited

🇨🇳 Shein Invests $15M in Product Safety for 2025. Shein will spend $15M to conduct 2.5M product safety tests, a 25% increase from 2024, working with agencies like SGS to meet US and EU standards. Over 540 non-compliant sellers were removed, and kids’ clothes will need chemical tests starting April 2025. 👉 RetailAsia

🇩🇪 Zalando Targets Net-Zero Emissions by 2040. Zalando’s report sets a goal of net-zero emissions by 2040, aligning with EU’s Green Deal, and aims for better worker conditions. Circular fashion in Europe could reach €31.3B by 2030, driven by regulatory and consumer demand for sustainability. 👉 Ecotextile

🇬🇧 M&S Resumes Online Sales After Cyber Attack. Marks & Spencer restarted online orders after a six-week cyber attack cost up to £300M in profit, with £25M weekly losses. Home delivery is back in England, Scotland, and Wales, with click-and-collect and fast shipping soon to follow. 👉 Retail Gazette

🇺🇸 Walmart’s Pre-Loved Luxury Sales Grow 200%. Walmart’s Marketplace saw a 200% rise in pre-loved luxury sales, offering 15K+ SKUs like Gucci handbags and Rolex watches via partners like StockX. Rolex watch sales jumped 32%, and a new GenAI assistant, Sparky, enhances the shopping experience. 👉 EcommerceBytes

🇬🇧 Vroom Classics Launches Classic Car Marketplace. Vroom Classics started a platform for classic car fans, offering parts, services, and community support since late 2024. It provides sellers targeted traffic and free marketing, simplifying ownership for enthusiasts. 👉 ChannelX

🇨🇿 Rohlik Spins Out Veloq for AI Grocery Fulfillment. Rohlik Group launched Veloq, an AI-driven platform, to streamline global grocery logistics with €1.1B revenue and $170M funding in 2024. Led by Richard McKenzie, Veloq offers 15-minute delivery and 25,000+ SKUs, aiming to rival Ocado. 👉 Tech.eu

🇩🇪 Picnic Opens Europe’s Largest E-Food Warehouse. Picnic GmbH’s €150M Oberhausen warehouse, with 1,500 robots, serves 150,000 families weekly and creates 1,000 jobs. It expands Picnic’s reach, including Bavaria, with 350,000 more households. 👉 Yumda

🇮🇳 Rapido’s Ownly Brings Zero-Commission Food Delivery. Rapido’s ‘Ownly’ platform, piloting in Bengaluru, charges restaurants ₹25-₹50 flat fees, no commissions, unlike Swiggy’s 16%-30%. Valued at $1.1B, it partners with NRAI for affordable meals under ₹150. 👉 CNBC-TV18

🇹🇷 Getir, BiTaksi Data Breach Hits 2,890 Users. A 2023 breach exposed user data like names and addresses, sparking a Turkish probe with 5-13 year sentences possible. Getir’s Ferhat Y. faces accusations of unauthorized access. 👉 Türkiye Today

🇮🇳 Rapido Enters Food Delivery with Fixed Fees. Rapido, valued at $1.1B, launches food delivery with a ₹25 fee for orders over ₹100, avoiding high commissions. Its 4M riders support the Bengaluru pilot, challenging Swiggy and Zomato. 👉 Reuters

🇬🇧 Poundland Sold for £1, Faces Store Closures. Gordon Brothers bought Poundland for £1, investing £80M, but up to 100 of 825 stores may close due to declining sales. Competition from Temu and Shein pressures the retailer. 👉 BBC

🇨🇦 Robot.com Pilots AI Food Delivery in Canada. Robot.com’s Markham pilot with Skip uses AI robots carrying 50 kg within 2 km, planning 500 robots in three years. It aims for sustainable, low-cost delivery. 👉 Access Newswire

🇰🇷 South Korea Cracks Down on Delivery Platforms. Baemin and Coupang Eats, holding 96% of the market, face scrutiny over labor and antitrust issues. President Lee Jae-myung pushes for tougher regulations. 👉 Korea Times

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team