Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces. Get all the insights you need in just 5 minutes!

🧠 Big Story:

Local Beats Global in Retail Expansion Plans 🏠

📊 Key Data:

Want AI Traffic? Start With Google First 🧭

📖 Ecommerce ecosystem news:

🇮🇪 Amazon launches sponsored ads and Stores for Irish sellers to boost local e-commerce.

🇺🇸 Meta uses AI to improve Facebook and Instagram ad targeting and boost ad revenue.

🇩🇪 TikTok Shop struggles in Germany, trailing far behind local e-commerce giants.

🇺🇸 Google Ads introduces a new goals interface to make campaign tracking easier.

🇵🇱 Poczta Polska &Temu team up to speed up deliveries & handle e-commerce boom.

🇺🇸 US ends de minimis rules for Chinese packages, slashing air freight capacity by a third.

+ over 15 handpicked hot ecommerce news from the last week you need to know 🔥

Local Beats Global in Retail Expansion Plans 🏠

Let’s get to the point: Retailers are shelving the global fantasy and banking on their own backyard. That’s not a hunch—it’s straight from Asendia’s 2025 “Beyond Borders” survey of 1,000 retail decision-makers. If you think cross-border growth is about jet-setting to new continents, you haven’t seen the numbers—read on to see why local is the new global.

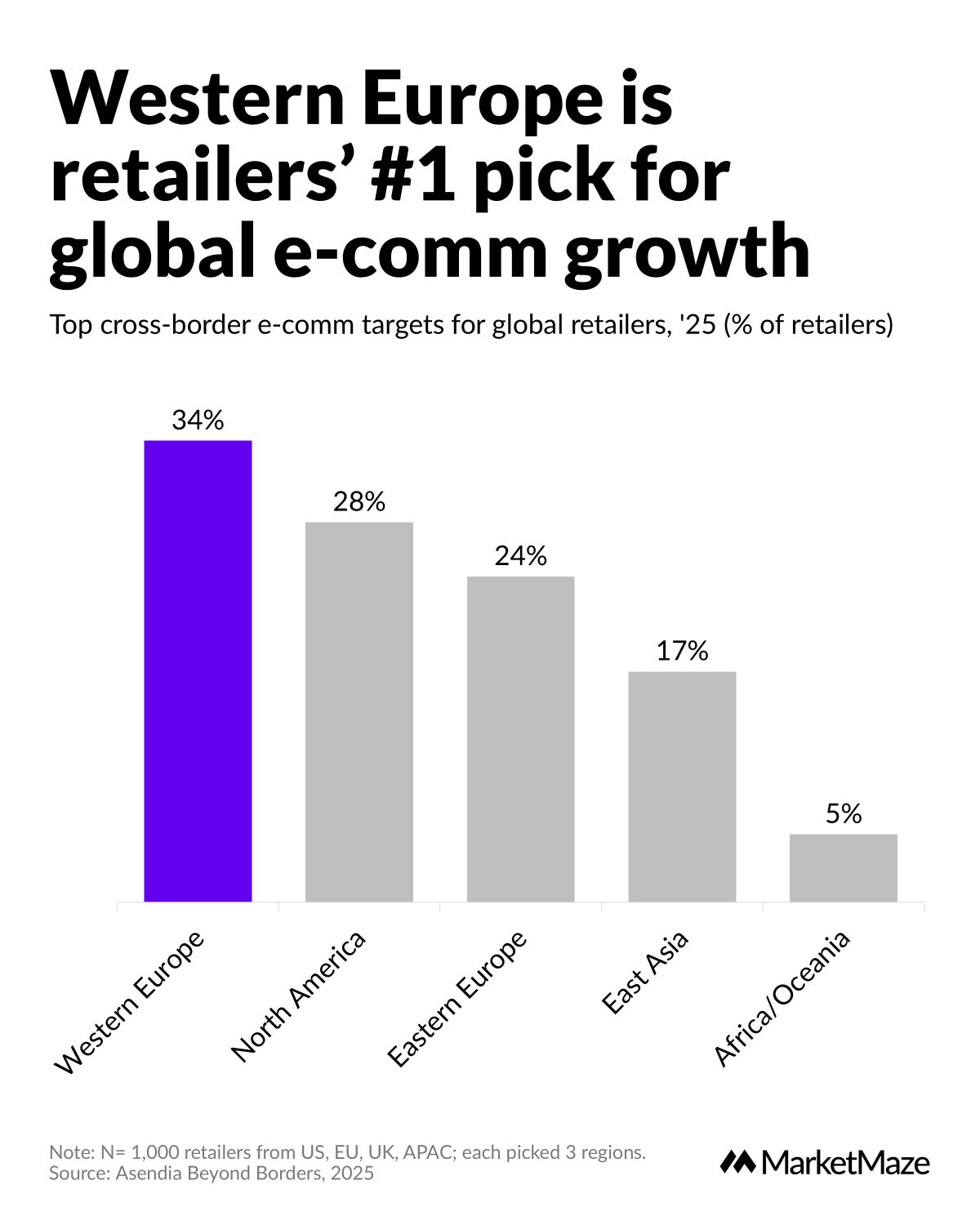

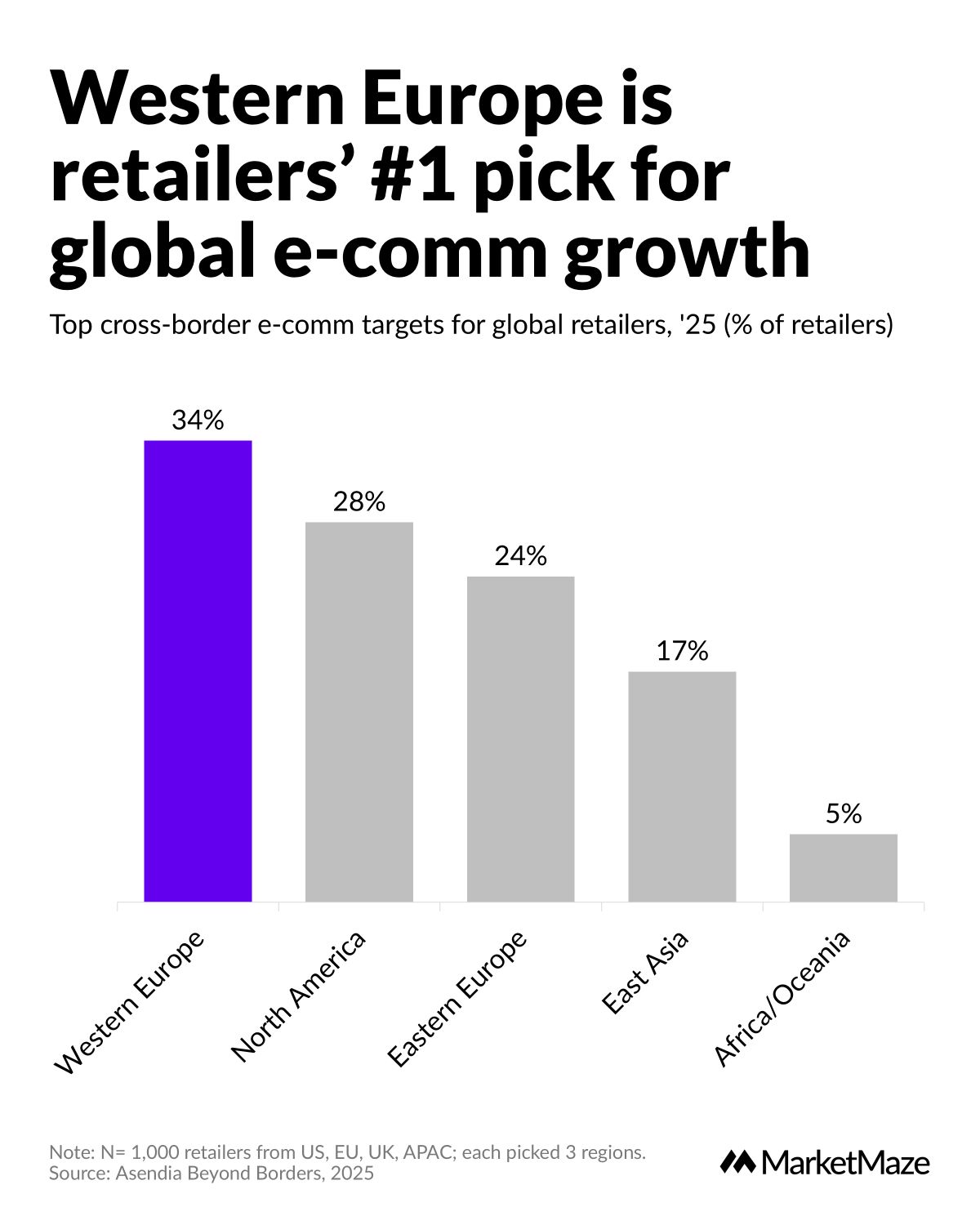

Europe Tops Global E-Comm Wishlist 🌍

Western Europe is the main prize for global retailers in 2025, with 34% picking it as their first target for cross-border growth. North America isn’t far behind at 28%, but Eastern Europe (24%) and East Asia (17%) are also hot on the radar. Africa and Oceania are distant runners—just 5%—but don’t count out Aussies and Kiwis; digital adoption there is strong. The data comes from a 1,000 retailer survey across US, EU, UK, and APAC, each naming their top three expansion bets.

Retailers Bet on Their Own Backyard 🏡

When global retailers map out 2025, “think global” really means “think next door.” In Asia Pacific, 40% chase East Asia and 36% target Southeast Asia. Europeans? 56% eye Western Europe for their next move. The U.S. leans hard on Canada (47%), with South America (24%) the backup plan. Only 14% of German retailers see North America as a target—lowest in the EU. Bottom line: proximity beats ambition when the world gets messy.

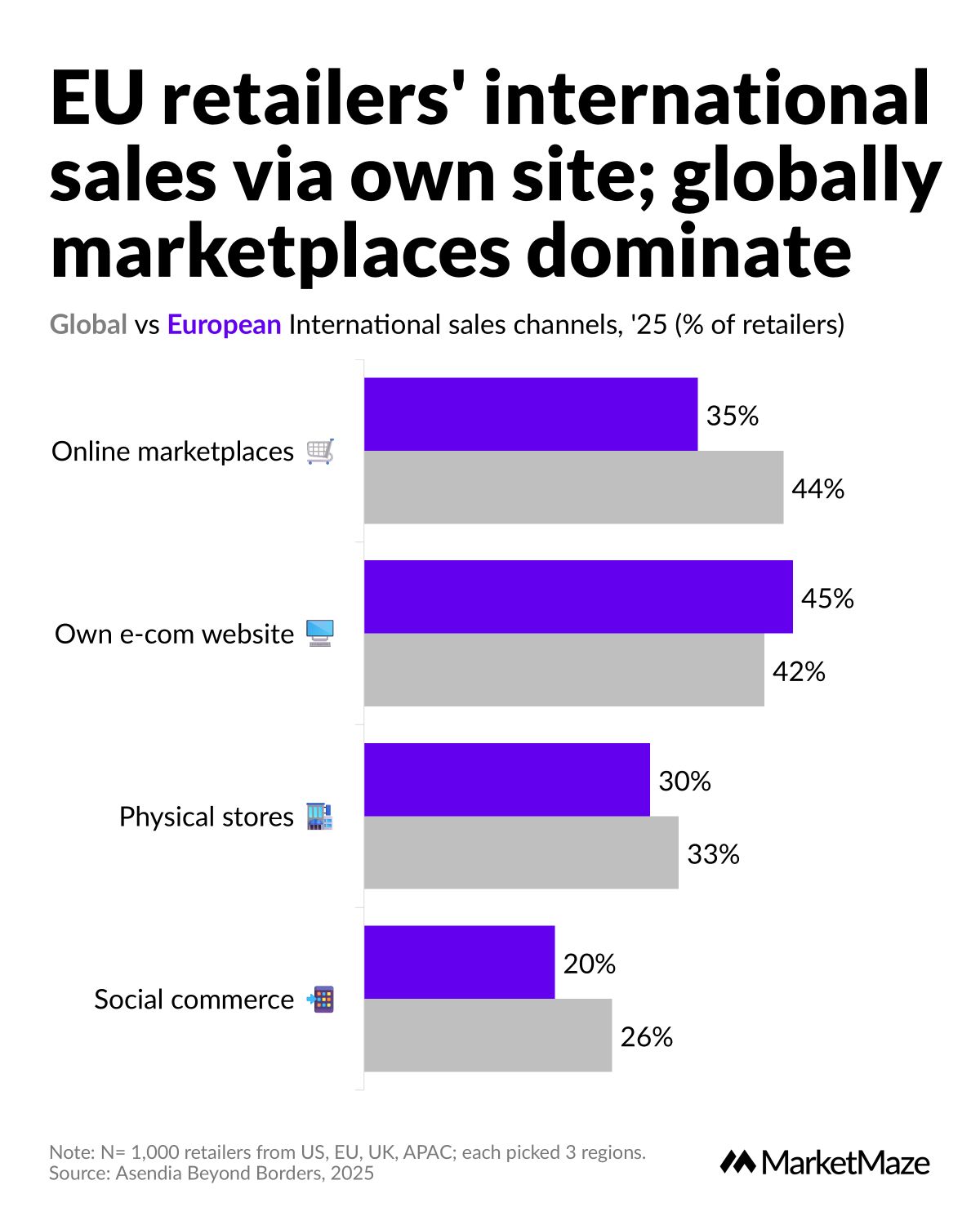

Marketplace Muscle Goes Global 💪

Globally, 44% of retailers pick online marketplaces as their top international sales channel, just edging out owned sites (42%). In the EU, the script flips: 45% lean on their own websites, while only 35% go marketplace. Physical stores with cross-border shipping still matter, with 30–33% using them. Social commerce is on the rise, hitting 26% globally—so don’t sleep on TikTok and Instagram. The new omnichannel? It’s messy, it’s hybrid, and it’s where the money is.

Want AI Traffic? Start With Google First 🧭

SEO still matters. Even for AI search.

(Here’s the data to prove it)

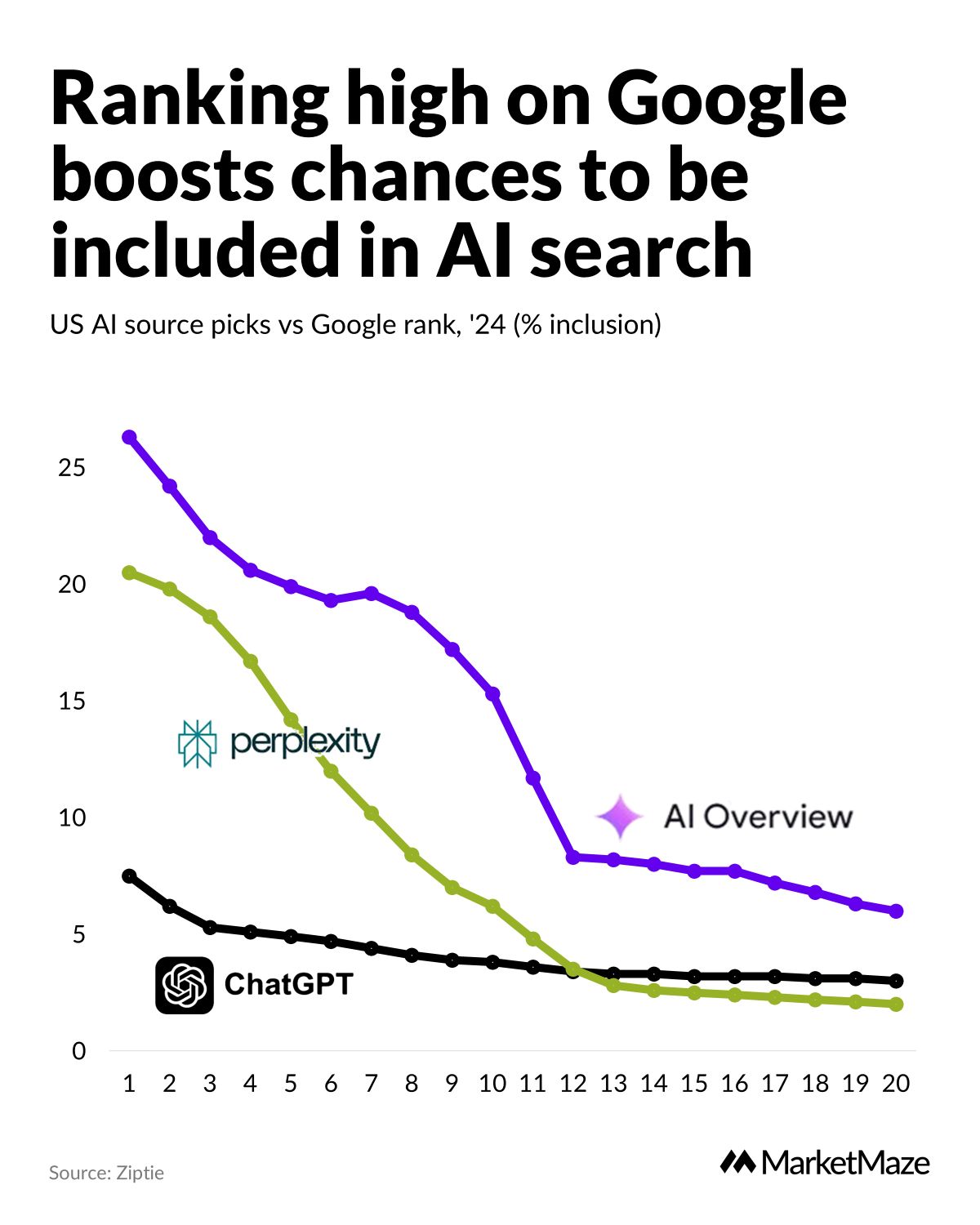

Ziptie analyzed 25,000+ real user queries across ChatGPT, Perplexity, and Google AI Overviews.

And the chart says it all

If your site ranks #1 on Google,

you have a 25% chance of being used in Google’s AI Overviews.

Higher Google rank = higher inclusion rate

→ in AI Overviews, Perplexity, and ChatGPT.

Even in an AI-first world — ranking still matters.

This is real-world data, not a hot take.

So why do we still see low-ranking sources show up?

Two reasons:

Personalization & Caching — different users, different top 10

Query Fan-Out — AI breaks your query into sub-queries

(Perplexity even shows this live in action)

So even if you're not in the top 10 for the main query...

you could rank for a sub-question → and still get pulled in.

SEO isn’t dead.

It’s just evolving.

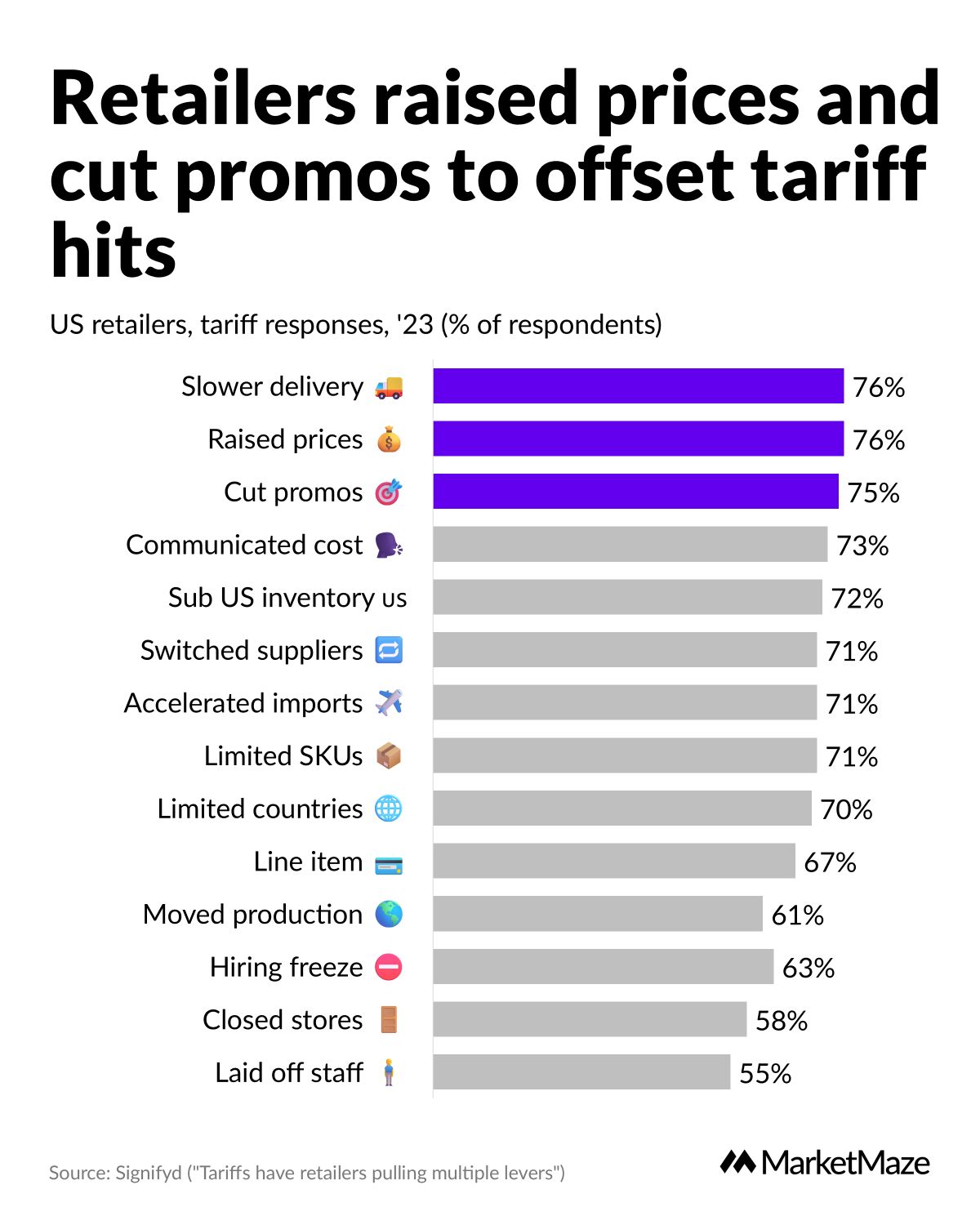

Retailers Are Raising Prices—And Cutting Perks—To Survive Tariffs.

Signifyd surveyed global retailers on how they’re responding to tariff shocks. Over 75% raised retail prices or cut discounts, and most reworked supply chains to dodge extra costs. The real lesson: consumers pay the price, one way or another. 👉 Signifyd Blog

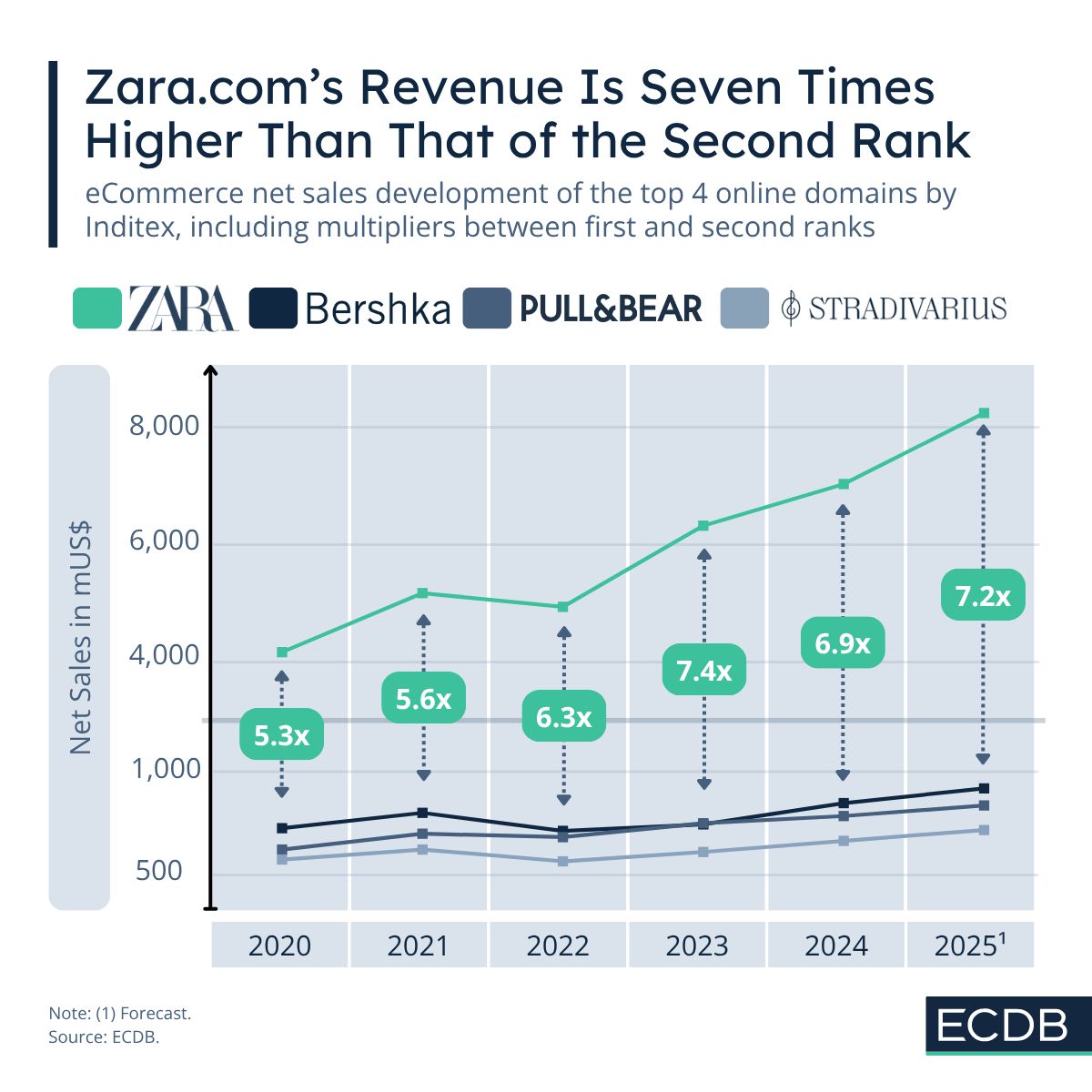

Zara.com Crushes Rivals—7x the Revenue of #2 in Inditex’s Online Empire.

ECDB crunches the numbers on Inditex’s digital crown jewels, with Zara.com clocking in at over $8B in net sales—leaving Bershka, Pull&Bear, and Stradivarius eating dust. The kicker? Zara widens the gap every year, proving category killers are alive and well in fast fashion. 👉 ECDB

Temu Takes Over Europe: The Map That Says It All.

@maps.interlude nails the viral story of 2024—Temu’s app topping download charts in nearly every European country. Klarna, TikTok, and ChatGPT make cameo appearances, but Temu’s orange logo is the new Euro-ubiquity. Download war or digital colonization? You decide. 👉 Instagram

What Nike Learned the Hard Way About E-Commerce.

Ben Thompson at Stratechery unpacks Nike’s wild ride from DTC (direct-to-consumer) evangelist to omnichannel pragmatist. When you gut your retail partners, you’d better own the whole customer experience—Nike found out the hard way it’s not that simple. A case study in why distribution still matters, even for giants. 👉 Stratechery

🇮🇪 Amazon Launches Sponsored Ads and Stores in Ireland. Amazon rolled out sponsored ads and its Stores feature to Irish sellers, letting them showcase products with custom pages and targeted ads. This move taps into Ireland’s growing e-commerce market, boosting small businesses’ reach on Amazon’s platform. 👉 Amazon Advertising

🇺🇸 Meta Bets Big on AI for Facebook and Instagram Ads. Meta is pushing AI to power ads on Facebook and Instagram, aiming to sharpen targeting and lift ad revenue, which hit $135 billion last year. The tech, led by execs like Mark Zuckerberg, promises advertisers better returns via smarter, data-driven campaigns. 👉 The Guardian

🇩🇪 TikTok Shop Struggles to Gain Traction in Germany. TikTok Shop lags in Germany, with low user adoption and sales far behind rivals like Amazon, despite TikTok’s 20 million monthly users there. Challenges include stiff competition and German shoppers’ preference for established e-commerce platforms. 👉 Ecommerce News

🇺🇸 Google Ads Unveils New Conversion Goals Interface. Google Ads rolled out a revamped conversion goals interface, letting advertisers track metrics like sales and sign-ups with sharper precision. Users report it’s easier to use, and Google claims it boosts campaign performance for its 2 million+ advertisers. 👉 Search Engine Roundtable

🇺🇸 US Judge Eyes Softer Antitrust Rules for Google. A US judge is weighing lighter antitrust measures against Google, which raked in $307 billion last year, after scrutiny over its ad and search dominance. Legal experts say this could ease pressure on Google’s market grip, unlike harsher EU penalties. 👉 Tech in Asia

🇺🇸 Reddit’s Shopping Ads Surge in Popularity. Shopping ads on Reddit are taking off, with brands seeing higher engagement among its 70 million daily users, driving ad revenue past $1 billion. Advertisers like Walmart are jumping in, lured by Reddit’s growing role as a product discovery hub. 👉 Retail Brew

🇺🇸 Automattic Resumes WordPress Contributions. After a brief pause, Automattic is back to supporting the WordPress open-source project, which powers 43% of the web. This matters big time as the 6.9 release looms, promising AI upgrades and an admin facelift. 👉 TechCrunch

🇨🇦 Shopify’s Sci-Fi User Experience Overhaul. Shopify’s new design boss, Carl Rivera, is rolling out an AI-powered interface that predicts what users want and automates tasks. It’s built to make running a store dead simple for everyone from solo sellers to big brands. 👉 Fast Company

🇬🇧 ASOS Teams Up with Checkout.com for Smoother Payments. ASOS, with 18 million customers across 200+ markets, tapped Checkout.com to juice up payment acceptance and speed up checkouts. It’s all about keeping Gen Z happy—those kids want instant, glitch-free shopping. 👉 The Paypers

🇺🇸 WordPress Launches AI Team for Platform Innovation. WordPress set up an AI crew with pros from Automattic, Google, and 10up to crank out smart features fast. They’re gunning to keep WordPress the king of content, no matter how tech shifts. 👉 WordPress.org

🇺🇸 Pacvue Integrates TikTok Shop for Enhanced Advertising. Pacvue plugged TikTok Shop into its system, letting brands run ads across TikTok and 100+ platforms like Amazon. It’s a win for both giant brands and small fry looking to hit TikTok’s massive crowd. 👉 GlobeNewswire

🇪🇺 Zaelab’s Portul Simplifies B2B Commerce on Shopify in Europe. Zaelab dropped Portul, a Shopify app that cuts through messy B2B commerce for European firms with tools like quoting and SAP hooks. It’s designed to make big-league features work for every B2B seller. 👉 PR Newswire

🇬🇧 Visa Introduces Secure A2A Payments in the UK. Visa’s A2A Pay by Bank lets UK folks pay bills and subscriptions straight from their bank with card-style safety. It’s eyeing e-commerce next and could pump £328 billion into the UK economy in five years. 👉 FinTech Global

🇸🇪 Klarna Opts for Human Touch in VIP Customer Service. Klarna’s CEO, Sebastian Siemiatkowski, says VIPs get human support despite AI slashing staff—think hand-stitched luxury, not robot chat. It’s a premium perk for their top spenders in a sea of automation. 👉 TechCrunch

🇵🇱 Poczta Polska and Temu Boost E-Commerce Logistics in Poland. On June 3, 2025, Poland's postal service, Poczta Polska, teamed up with Temu to speed up deliveries using its 22,000+ pickup points. With Temu drawing 18 million Polish visitors in February 2025, VP Piotr Szajczyk said this will handle the e-commerce surge. 👉 Parcel and Postal Technology International

🌐 U.S. Rule Change Slashes Air Freight Capacity, Airlines Adjust. In May 2025, the U.S. ended de minimis perks for packages under $800 from China and Hong Kong, cutting air freight capacity by 33% for airlines like Cathay Pacific. Derek Lossing from CGA says this could hit e-commerce logistics hard. 👉 The Loadstar

🌐 DHL Rolls Out Monthly Fees to Cut Business Shipping Costs. Starting July 2025, DHL will charge businesses 7.95 to 119.95 euros monthly to lower per-parcel costs as volumes grow. This comes after extra fees were added for peak seasons in late 2025. 👉 Ecommerce News

🇺🇸 Veho and Rivr Test AI Robots for Smarter Deliveries in Austin. In May 2025, Veho and Rivr kicked off a pilot in Austin using AI robots to help drivers deliver faster. Rivr CEO Marko Bjelonic sees this boosting efficiency in e-commerce logistics. 👉 PR Newswire

🌐 E-Commerce Growth Spurs Warehouse Tech Upgrades. The global e-commerce market reached $5 trillion in 2025, with D2C set to hit $175 billion by 2032, pushing warehouses to adopt automation. Shopify’s Lucas Watson and Ambi Robotics’ Jeff Mahler say tech is key to keeping up. 👉 Material Handling & Logistics

❤️ Your Opinion matters!

Share your thoughts on today’s email with just 1 click in the poll—it’s quick and helps us improve.

What do you think of this issue?

For questions or more feedback, reply to this email.

Best,

MarketMaze team