TODAY’S MAZE

Happy Thursday! Temu has officially matched Amazon’s global cross-border reach. The platform now captures a massive share of international orders via its new regional hubs.

This rapid growth challenges the logistical moats of established marketplaces. Can legacy giants keep their edge as global supply chains become commoditized?

In today’s MarketMaze:

Temu matches Amazon's reach

Amazon challenges Saks plan

AdSense revenue plunges 90%

Ecommerce platforms remain fragmented

AI shopping agents grow

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

SOMETHING NEW

Each issue, we’ll ask one sharp question tied to the main story. No long surveys. No fluff. Just a quick pulse from people who actually follow e-commerce closely.

We’ll publish the results in the next issue, so everyone can see where the community stands.

If this works and we gather enough signal, we’ll turn these into more structured, repeatable benchmarks over time.

Which platform do you think poses the bigger long-term threat to brands globally?

Let’s start.

P.S. We also slightly improved layout of insights page allowing for some filtering of deep dive articles.

MAZE STORY

The Maze: A new global survey reveals that Temu has achieved parity with Amazon in cross-border commerce, capturing a massive share of the international market. This rapid ascent places the PDD Holdings platform at the center of a global logistics duopoly alongside the Seattle giant.

The International Post Corporation gathered data from 30,970 shoppers across 37 countries to find that Temu surged from a 1% market share in 2022 to capturing 24% of all international orders by late last year.

While user growth in Europe slowed to 12.5% during the first half of 2025, the company continues to expand by establishing headquarters in Dublin to manage its 115.7 million shoppers.

Establishing regional hubs enables shipping 80% of orders from local warehouses while the company partners with sellers based across the European continent.

Why it matters: Temu's shift toward regional fulfillment and partnering with sellers directly challenges the logistical moats that previously protected incumbent marketplaces. Brands must decide whether to compete on price or lean into brand equity as China-based platforms commoditize the global supply chain.

FROM OUR PARTNERS

Find out why 100K+ engineers read The Code twice a week

Staying behind on tech trends can be a career killer.

But let’s face it, no one has hours to spare every week trying to stay updated.

That’s why over 100,000 engineers at companies like Google, Meta, and Apple read The Code twice a week.

Here’s why it works:

No fluff, just signal – Learn the most important tech news delivered in just two short emails.

Supercharge your skills – Get access to top research papers and resources that give you an edge in the industry.

See the future first – Discover what’s next before it hits the mainstream, so you can lead, not follow.

MAZE STORY

The Maze: Amazon asks a federal judge to block the bankruptcy financing for Saks Global, claiming its $475 million investment is now presumptively worthless. The tech giant warns that the proposed debt structure harms creditors after the luxury retailer failed to meet budgets and burned through hundreds of millions in less than a year.

The initial deal required Saks to launch a branded Saks at Amazon storefront and guaranteed $900 million in payments to the e-commerce leader over eight years.

Attorneys for Amazon filed a formal objection in Texas court arguing that the $1.75 billion financing package improperly saddles the company with debt for no material benefit.

Restructuring officers reveal that the retailers faced a liquidity crisis after inventory levels dropped 9% below previous years and failed to satisfy vendors with $244 million in late payments.

Why it matters: This legal battle signals a shift in how tech giants protect their strategic retail investments when traditional department stores falter. For brands and agencies, the outcome determines whether these high-end partnerships can actually survive or if the luxury powerhouse dream is ending.

FROM OUR PARTNERS

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

MAZE STORY

The Maze: Publishers across the globe are reporting catastrophic revenue losses as a massive technical failure strikes Google’s Ad Manager and AdSense platforms. These widespread disruptions triggered overnight earnings drops as high as 90%, leaving many ecommerce content creators struggling to maintain their digital operations during this volatility.

Google confirmed a systemic decline in match rates specifically affecting demand sources like Google Ads and Display & Video 360 across web display inventory to explain the sudden disappearance of programmatic advertising spots for many publishers.

Independent forum discussions reveal that German-language domains suffered severe volatility while French and Italian properties saw revenue declines of up to 76% that forced site operators to question their long-term digital viability.

Individual users noted that Chrome began actively removing ads for using too many resources, causing impression RPMs to plummet from $7.25 to just $4.00 despite publishers making no changes to their existing layouts.

Why it matters: This volatility exposes the extreme fragility of relying solely on a single tech giant for monetization as antitrust pressure mounts against Google’s ad stack. Diversifying revenue streams through direct brand partnerships provides a necessary safety net against unpredictable glitches and shifts that threaten content sustainability.

DATA TREASURE

The Maze: No ecommerce stack won outright. WooCommerce leads globally, Shopify follows, and a long tail fills the rest. Fragmentation is the system.

WooCommerce controls roughly one-third of ecommerce sites worldwide, while Shopify sits near 18%, leaving over 40% split across smaller platforms.

Merchants assemble stacks from plugins, apps, and services, creating a deep integration economy rather than a single winner.

Flexibility wins, but complexity rises, increasing operational and security risk.

Why it matters: Tools, not platforms, capture value. Ecommerce growth increasingly accrues to software layers that plug into many systems. Integration breadth beats platform loyalty.

DATA TREASURE

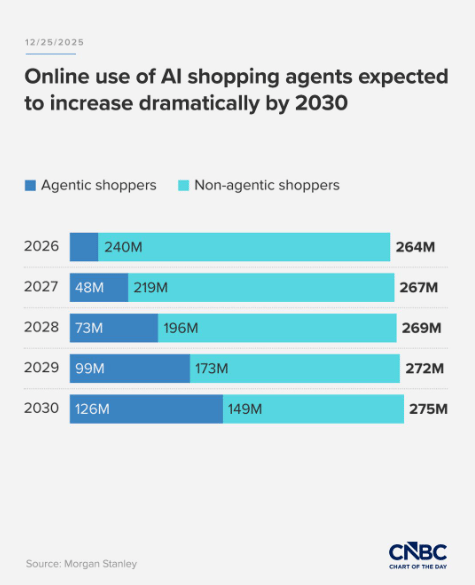

The Maze: AI shopping agents move from novelty to habit. Over the next decade, delegation replaces browsing as friction becomes the enemy. Choice compresses.

Agentic shoppers rise from about 24M in 2026 to 126M by 2030, nearing half of all online shoppers in some projections.

Adoption starts in repeat, low-emotion categories like household goods and care, where speed beats discovery.

Trust, not capability, becomes the adoption bottleneck as users weigh delegation risk.

Why it matters: Product data becomes destiny. Ecommerce success shifts from persuasion to eligibility. If an agent cannot read and compare your offer, you do not exist.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Etsy integrated its marketplace directly with Google’s AI Mode and Gemini app, allowing U.S. users to purchase specialized items via agentic commerce.

🇩🇪 Germany proposed a new textile disposal law forcing manufacturers to pay for the costs of used clothing to combat the waste crisis created by ultra-fast fashion.

🇺🇸 Amazon issued a March 31 deadline for dietary supplement sellers to correct misleading ingredient claims or face immediate deactivation of their listings.

🇨🇳 Alibaba introduced agentic AI features to its Qwen chatbot, enabling it to perform real-world tasks like booking travel and ordering food across the Alibaba ecosystem.

🇺🇸 Pinch AI debuted its platform to help ecommerce merchants identify and prevent return fraud and fulfillment scams that typically spike after peak sales periods.

🇩🇪 eBay expanded its SpeedPAK shipping service to Germany, offering sellers customs-cleared international shipping with pre-paid import duties.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team