TODAY’S MAZE

Happy Friday! Shopify crushed expectations this quarter, posting a massive revenue surge driven by high-volume wholesale wins. It’s a strong signal that the platform’s big bet on business-to-business sales is paying off.

But the real story is the infrastructure being built for AI shopping agents. Is Shopify becoming the operating system for the autonomous economy?

In today’s MarketMaze focus:

Shopify’s B2B revenue surge

Amazon accelerates European growth

Instacart’s new platform pivot

Retail’s shift to agents

TikTok’s halo effect revealed

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Shopify shattered expectations with $3.67 billion in Q4 revenue, signaling a successful strategic pivot toward high-volume B2B transactions and new infrastructure for agentic commerce.

Wholesale volume is skyrocketing as B2B GMV jumped 84% in Q4, significantly outpacing the consumer segment thanks to major enterprise wins like Sonepar.

The company is effectively building the rails for AI shopping by co-developing the Universal Commerce Protocol with Google, enabling bots to transact directly while merchants retain control.

Executives project this momentum will continue through Q1 2026 with growth remaining in the low-30% range, driven by these investments in non-traditional revenue streams seen here.

Why it matters: This performance validates the aggressive expansion beyond simple D2C storefronts, positioning the platform as the invisible operating system for both industrial wholesale and the emerging wave of autonomous AI buying.

How significant will AI shopping agents enabled by Shopify and Google become for online transactions in the US and Europe by 2028?

- 🤖 Niche Tool (used mainly by tech-savvy consumers and early-stage startups)

- 📈 SME Booster (adopted by small and mid-sized US and EU merchants first)

- 🏢 Enterprise Standard (rolled out mainly by large US and EU enterprises)

- 🌍 Cross-Border Driver (accelerates international trade for export-focused sellers)

- 🛍️ Consumer Default (becomes a common checkout method for mainstream buyers)

☝️ Vote to see results!

FROM OUR PARTNERS

How 2M+ Professionals Stay Ahead on AI

AI is moving fast and most people are falling behind.

The Rundown AI is a free newsletter that keeps you ahead of the curve.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses — tailored to your needs.

MAZE STORY

The Maze: Amazon significantly increased revenue in its two largest European markets, outpacing US growth rates according to its latest annual financial report. The retail giant is cementing its dominance abroad while facing new antitrust orders in Germany.

Germany and the UK generated a combined $89.1 billion, marking a sharp acceleration compared to the single-digit growth rates recorded in 2024.

The 'Rest of World' segment surged 14.5% to surpass the $100 billion milestone, highlighting a shift where international markets are now growing faster than domestic operations.

Regulatory friction continues as the Bundeskartellamt ordered a 59 million euro repayment and mandated changes to the Buy Box algorithm.

Why it matters: International diversification is paying off as US maturity sets in, but scaling in Europe now requires navigating increasingly aggressive local competition authorities.

FROM OUR PARTNERS

Your Boss Will Think You’re an Ecom Genius

Optimizing for growth? Go-to-Millions is Ari Murray’s ecommerce newsletter packed with proven tactics, creative that converts, and real operator insights—from product strategy to paid media. No mushy strategy. Just what’s working. Subscribe free for weekly ideas that drive revenue.

The Maze: Instacart is evolving beyond delivery, leveraging AI and partnerships to build a full-stack embedded commerce platform for grocers after posting strong Q4 growth.

The company is embedding commerce capabilities into third-party platforms, becoming the first grocery partner to launch native checkout directly inside ChatGPT.

Management is positioning the business as a technology enablement layer for retailers, powering over 380 grocer ecommerce sites and integrating with Toast to capture restaurant procurement.

While aggressive on internal efficiency, the company recently halted an algorithmic pricing test following criticism, highlighting the governance challenges of deploying automated optimization.

Why it matters: Instacart is successfully transitioning from a gig-economy delivery app into the underlying operating system for the grocery industry. This pivot reduces reliance on low-margin fulfillment while deepening moats against competitors.

DATA TREASURE

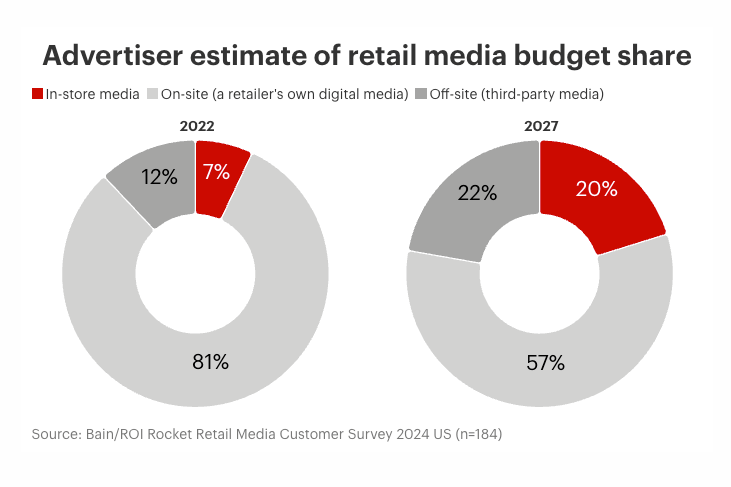

The Maze: Retail is becoming data plus distribution. AI agents and retail media are converging on one goal: owning the moment of decision.

AI driven purchasing could reach up to 25% of US ecommerce by 2030, changing how discovery works.

In store retail media is projected to triple share by 2027, turning physical space into ad inventory.

Slower retail growth makes monetization of data and attention essential, not optional.

Why it matters: Margins move upstream. Retailers who control data, media, and decision moments can grow profits even when sales growth slows.

DATA TREASURE

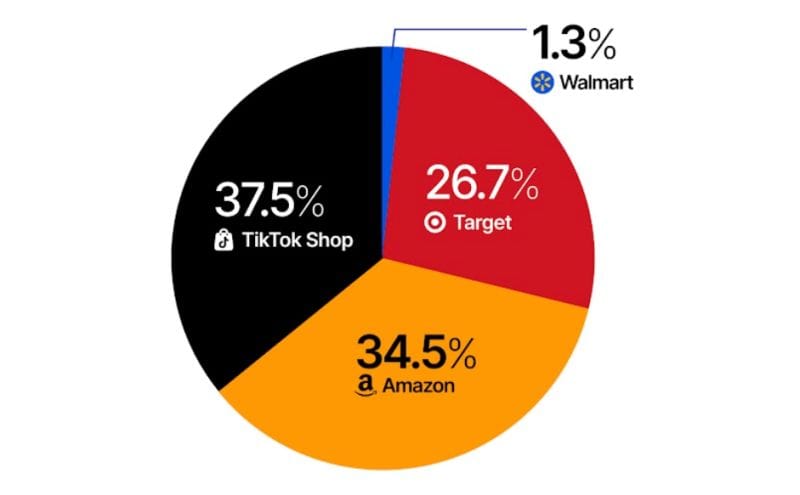

The Maze: TikTok Shop is a discovery engine that drives most sales off its platform. When you include off-platform impact in measurement, TikTok turns from a marginal channel into a core driver of total revenue and efficiency.

In cross-channel tests with Amazon, Walmart, and Target, 62.5% of TikTok’s incremental impact happened outside TikTok, proving last-click misses most value.

Once halo effects were included, true iROAS jumped 166% and iCPA fell 68%, flipping performance metrics in favor of TikTok.

When spend was scaled, total sales rose 64% in 30 days and iROAS still improved 24%, showing TikTok scales without collapsing efficiency.

Why it matters: Discovery has moved upstream and measurement must evolve. Brands that treat TikTok as a demand layer, not just a checkout app, unlock much higher return.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Major Retailers confirmed that 2025 tariff hikes have now been fully absorbed into pricing models, with giants like Costco and Wayfair adjusting supply chains to stabilize margins for the 2026 fiscal year.

🇺🇸 Saks Global announced the closure of nine US stores following its bankruptcy filing, aiming to streamline operations and focus on profitable luxury corridors.

🇳🇱 Bol reported trading volume hitting €6.3 billion, with growth primarily fueled by third-party international sales partners rather than first-party inventory.

🌍 Mailchimp launched with Intuit new features allowing merchants to sync data for omnichannel campaigns, claiming the new AI-driven flow can drive up to 30x ROI.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team