TODAY’S MAZE

Happy Thursday! Selling through AI carries a cost as Shopify introduces a 4% fee for ChatGPT orders. This signals a new era of platform taxes on autonomous shopping.

As brands adapt to automated sales, eBay is choosing to ban AI shopping agents. Will retail's future be bot-led or strictly reserved for humans?

In today’s MarketMaze focus:

Shopify AI sales fee

eBay blocks AI agents

IKEA expands in India

Marketplaces dominate retail growth

InPost’s parcel locker strategy

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Shopify merchants will pay OpenAI a 4% transaction fee for sales processed through ChatGPT, marking a significant move to monetize the agentic commerce ecosystem and establishing a new revenue model for AI-led distribution.

Brands must manually opt in to sell via ChatGPT starting January 26 while other platforms currently provide agentic features without forcing additional merchant transaction fees on the seller.

While OpenAI launches Instant Checkout for Shopify stores, Chinese giants Alibaba and ByteDance are already scaling autonomous food and travel bookings within their own super-app ecosystems.

President Harley Finkelstein reported that attributed orders from AI searches recently spiked 11x, proving that shoppers increasingly use LLMs to discover and purchase products at scale.

Why it matters: Agentic commerce shifts the consumer role from active operator to supervisor, forcing brands to optimize for algorithms rather than interfaces. This fee sets a precedent for AI platform taxes.

How do you expect seller fees for AI-driven checkouts on platforms like ChatGPT with Shopify to evolve over the next 12 months?

- 🌍 Global standard (4%+ fees become common across major AI shopping platforms worldwide)

- 🇺🇸 US-led first (fees normalize in the US before spreading to Europe)

- 🇪🇺 EU pushback (European regulation or merchant resistance limits fees)

- 🏢 Enterprise absorb (large, scaled brands accept fees as a new acquisition cost)

- 🧾 Seller bypass (brands push shoppers back to direct web checkout to avoid fees)

P.S. To see poll results please vote!

FROM OUR PARTNERS

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

MAZE STORY

The Maze: eBay updated its User Agreement to explicitly ban automated AI "buy-for-me" agents and LLM-driven scrapers from the platform. The policy takes effect February 20, 2026.

The new language prohibits any automated means that attempt to place orders without human review, effectively blocking tools that scrape data or manage purchasing flows.

This policy change follows Amazon’s agentic AI tests that enable displaying products from external merchant websites for sale directly through the Amazon shopping application.

eBay also updated legal requirements, moving its office after selling the Draper campus to consolidate its corporate footprint.

Why it matters: Marketplaces are building defensive moats against AI agents to protect their data and human-centric shopping models. This friction suggests a future where brands must navigate a complex landscape of allowed versus banned AI interactions.

FROM OUR PARTNERS

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

MAZE STORY

The Maze: IKEA plans to invest 2.22 billion euros in India over the next five years to scale its physical presence and digital operations. The giant aims to transform the region into one of its top global markets by quadrupling its current sales.

Since launching in Hyderabad in 2018, the retailer has grown its footprint to six locations and now looks to reach a total of thirty stores across the country.

Management reported that sales grew 6% to 18.61 billion rupees in the fiscal year ending August 2025 as the brand pushes to increase local purchasing and online fulfillment.

CEO Patrik Antoni emphasizes that India represents a top market opportunity for the furniture chain despite currently representing a relatively small portion of its global portfolio.

Why it matters: India’s massive middle class offers a crucial growth engine for global retailers facing stagnation in Western markets. IKEA’s heavy capital commitment signals a shift toward local supply chains and digital-first logistics in high-growth regions.

DATA TREASURE

The Maze: Marketplaces are no longer a channel. They have become the default operating system of e-commerce, absorbing almost all incremental growth while standalone stores slowly lose relevance.

By 2026, marketplaces capture 87% of business to consumer e-commerce spend, leaving only 13% for traditional online stores as shoppers prioritize speed and simplicity.

Scale compounds as platforms spread customer acquisition, logistics, and payments across millions of products, then monetize traffic through advertising and services.

Brands grow faster on marketplaces but trade margin and customer ownership for reach, turning growth into a control problem, not a demand problem.

Why it matters: The strategic choice is no longer presence versus absence. It is how much leverage you give platforms to stay visible where shopping starts.

DATA TREASURE

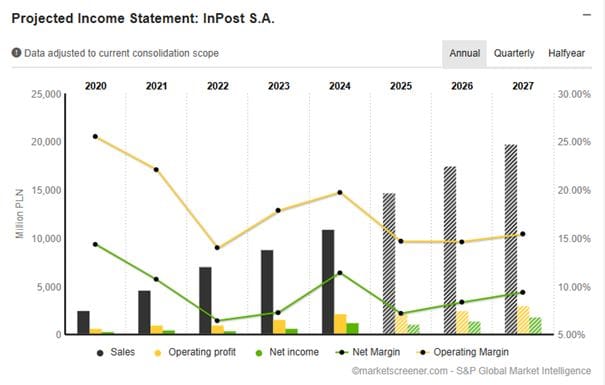

The Maze: InPost shows how logistics scale turns volatility into leverage. The image signals rising revenues with steady margins, while fresh operating data confirms that volume and density, not hype, drive the next phase of growth.

Sales rise steadily from 2020 to 2024 and are projected to keep climbing through 2027, while operating margin stabilizes around the mid teens, showing scale without margin collapse as the network matures.

Net income recovers after 2022, tracks revenue growth into 2024, and is projected to improve through 2026–2027, suggesting fixed costs are increasingly absorbed by higher parcel throughput.

In 2025, InPost delivered ~1.4B parcels, up 25% YoY, proving that demand keeps accelerating even as European ecommerce growth normalizes and competition in last mile intensifies.

The company added 14.2k new parcel locker machines in 2025, ending with 61k+ lockers and 94.5k out of home points, reinforcing density as the core growth engine rather than price cuts.

Why it matters: Ecommerce does not scale on marketing alone. When delivery infrastructure compounds, checkout reliability improves, costs fall, and platforms that control the last mile gain pricing power and loyalty.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Apple plans to transform Siri into a sophisticated AI chatbot using Google’s Gemini, integrating transactional capabilities across Mail, Music, and Photos later this year.

🇨🇳 Alibaba and ByteDance embrace 'agentic commerce,' rolling out AI chatbot features that enable users to book travel, order food, and complete payments within the chat interface.

🇺🇸 Nike shuffled its global leadership as EMEA VP Carl Grebert retires, appointing 25-year veteran César Garcia to helm the region and accelerate its 'Sport Offense' strategy.

🇬🇧 JD Sports maintained its full-year profit outlook as a 1.5% sales rebound in North America helped offset softened demand in the UK and European markets during Q4.

🇺🇸 Yelp acquired AI startup Hatch for $270 million, marking its largest AI investment to date to automate lead management and follow-ups for home services businesses.

🇺🇸 Amazon deployed native AI price-drop alerts, allowing users to leverage internal chatbots for automated shopping notifications and deal tracking.

🌍 The EU and India approached the final stages of a major free trade agreement, a development expected to provide a significant boost to the global textile and garment sectors.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team