Geo: Europe

Area: Mass

Type: Market

Theme: Behavior

🌀 Key points

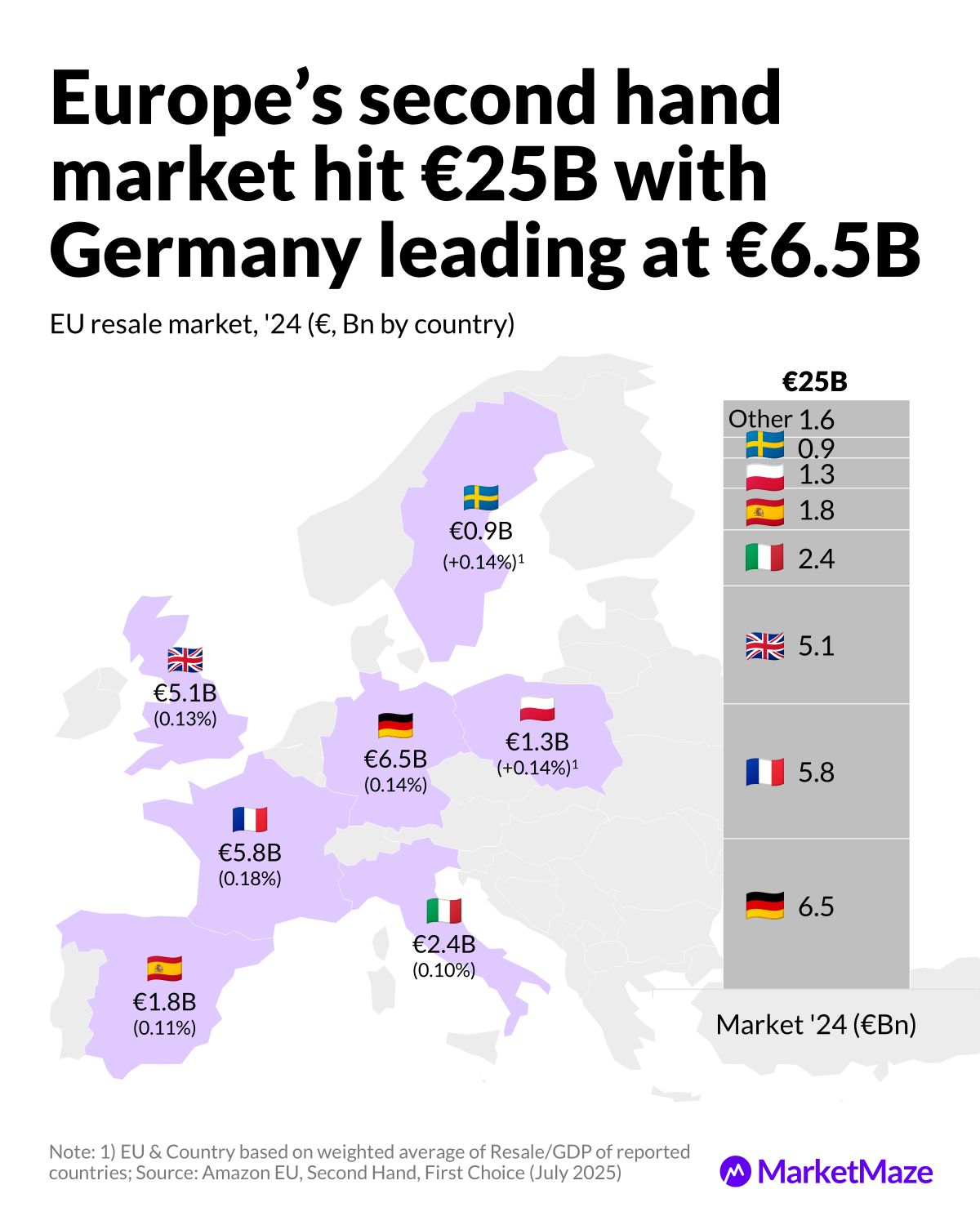

Germany leads resale with €6.5B in 2024

France and UK follow with €5.8B and €5.1B

Second-hand spending equals ~0.14% of GDP

💎 Data Gem

Second-hand is no longer second-rate. Europe's resale economy just hit €25 billion in 2024. And it's not Gen Z on Vinted — it’s everyone, everywhere, buying used.

🗺️ What’s the Maze?

The resale economy in Europe is officially big business. In 2024, it reached €25B, with Germany out in front at €6.5B — nearly the size of Croatia’s entire retail market. France (€5.8B) and the UK (€5.1B) round out the top 3. Even smaller markets like Poland (€1.3B), Italy (€2.4B), and Spain (€1.8B) are pulling their weight.

Here’s what the breakdown looks like:

🇩🇪 Germany: €6.5B, 0.14% of GDP

🇫🇷 France: €5.8B, 0.18% of GDP

🇬🇧 UK: €5.1B, 0.13% of GDP

🇮🇹 Italy: €2.4B, 0.10% of GDP

🇵🇱 Poland: €1.3B, 0.14% of GDP

🇪🇸 Spain: €1.8B, 0.11% of GDP

🇸🇪 Sweden: €0.9B, 0.14% of GDP

This growth isn’t just due to inflation-fatigued shoppers looking for bargains. It reflects a cultural shift: conscious consumption, digital thrift platforms, and circular economy mindsets.

Online platforms like Vinted, Vestiaire Collective, and eBay are becoming household names. And resale isn’t limited to fashion anymore. Furniture, tech, even toys are seeing second lives.

🏁 Why It Matters?

Resale is moving from the margins to the mainstream. For retailers and brands, that’s both a threat and an opportunity.

Here’s why this €25B market deserves boardroom attention:

New growth vertical: Vinted crossed €370M in revenue in 2023. Zalando is investing in pre-owned. Resale platforms are now category leaders.

Margin pressure: Every second-hand sale is a missed first-sale. Brands must adapt with take-back programs and re-commerce partnerships.

ESG goldmine: Circularity boosts sustainability KPIs. Investors love it, regulators are pushing it, and consumers demand it.

The resale wave is here to stay. From Germany’s structured used-goods logistics to Poland’s rapid growth, this market is both fragmented and accelerating. Expect more integrations, more regulation — and more billions on the line.e, many eco-conscious shoppers will stay stuck in the maze of good intentions.

🎓 Found this insightful?

📩 Get free weekly news and insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports with detailed sources and links

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

📖 Data Source

Name: Only for MarketMaze+ subscribers

Publish date: Only for MarketMaze+ subscribers

Region: Only for MarketMaze+ subscribers

Method: Only for MarketMaze+ subscribers

Link to source: Only for MarketMaze+ subscribers

See raw data from the chart below 👇 ((Only for MarketMaze+ subscribers)

Subscribe to MarketMaze+ to read the rest.

Become a paying subscriber to get access to all insights with sources and other subscriber-only content.

Try it now