TODAY’S MAZE

Happy Wednesday! The era of home shopping TV is facing a harsh reality check. QVC is reportedly in talks to restructure a massive $6.6 billion debt load.

With Francesca’s also filing for Chapter 11, the signal is clear: cutting costs won't save outdated models. Is reinvention even possible now?

In today’s MarketMaze focus:

QVC eyes bankruptcy restructuring

Estée Lauder sues Walmart

Amazon debuts bank payments

Amazon's ad profit engine

Young adults favor text

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: QVC Group is reportedly holding confidential talks to restructure its debt in bankruptcy, while fashion retailer Francesca’s officially files for Chapter 11 protection following a failed capital injection.

Weighing down the network is a crushing $6.6 billion debt load and a 61% plunge in operating income, forcing QVC CEO David Rawlinson to aggressively pivot toward social and streaming channels.

Francesca’s has already commenced liquidating its inventory across 400 locations after severe supply chain disruptions and a 2023 data breach derailed its attempts to secure essential funding.

Altar’d State is now overseeing the sale of Francesca’s intellectual property with bidding starting at just $7 million, a steep fall for a brand that once generated $500 million in annual sales.

Why it matters: Legacy retailers dependent on linear TV and mall traffic are hitting a liquidity wall, proving that cost-cutting cannot save outdated business models from the shift to digital. Survival now demands a fundamental reinvention rather than just financial restructuring.

What is the primary driver behind recent bankruptcies of retailers like QVC Group and Francesca’s in the US market?

- 📉 Debt Overhang (large legacy debt combined with declining operating income)

- 📺 Channel Obsolescence (reliance on cable TV or mall foot traffic instead of digital platforms)

- 🔐 Operational Disruption (supply chain shocks and data breaches limiting access to capital)

- 📲 Social Commerce Gap (failure to scale on TikTok, Instagram, YouTube, and live shopping platforms)

- 💰 Capital Drought (private equity and lenders unwilling to refinance mid-market retailers)

☝️ Vote to see results!

FROM OUR PARTNERS

How Marketers Are Scaling With AI in 2026

61% of marketers say this is the biggest marketing shift in decades.

Get the data and trends shaping growth in 2026 with this groundbreaking state of marketing report.

Inside you’ll discover:

Results from over 1,500 marketers centered around results, goals and priorities in the age of AI

Stand out content and growth trends in a world full of noise

How to scale with AI without losing humanity

Where to invest for the best return in 2026

Download your 2026 state of marketing report today.

Get Your Report

MAZE STORY

The Maze: Estée Lauder filed a federal lawsuit against Walmart, alleging the retail giant actively facilitates the sale of counterfeit beauty products on its third-party marketplace.

The beauty conglomerate purchased and tested products—including La Mer and Le Labo—from Walmart.com, confirming they were unauthorized fakes sold under its trademarks.

The complaint argues Walmart played an active role in the transactions, confusing shoppers into believing the retailer—not unvetted third parties—was the actual seller.

Walmart actively expands its marketplace to rival Amazon, recently hitting a $1 trillion market cap, though this strategy drastically increases exposure to liability for seller fraud.

Why it matters: Platforms historically shield themselves from liability for third-party listings, but successful active facilitation claims would force marketplaces to fundamentally overhaul how they vet sellers.

FROM OUR PARTNERS

With KeepCart or Without It — See the Margin Difference

Every checkout leak costs you. KeepCart shows exactly how coupon extensions quietly shrink your revenue — and how blocking them can recover hundreds per order. Your profit margin deserves a before-and-after moment.

Top brands like Bucketlisters and Quince have already seen the difference.

The Maze: Amazon UK launches a direct payment feature that allows shoppers to fund purchases straight from their bank accounts. This strategy bypasses traditional card networks to lower transaction costs while enhancing security.

The integration enables customers to transact directly without cards, effectively removing intermediaries to bypass card networks completely.

This structure offers a low-cost alternative to standard checkout flows, minimizing the processing overhead usually charged by external providers.

Shoppers utilizing this secure method keep their financial data private by paying through their own bank rather than sharing details.

Why it matters: Eliminating interchange fees unlocks significant margin retention for high-volume marketplaces. This move pressures legacy card networks to innovate as direct payments enter the mainstream consumer flow.

DATA TREASURE

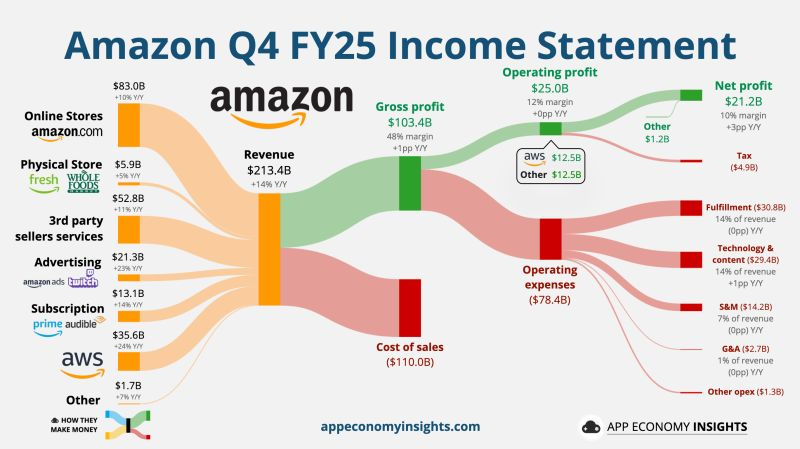

The Maze: Retail brings scale, ads and cloud bring profit. Amazon’s Q4 FY25 showed strong earnings, but also rising anxiety about how much AI investment the machine can absorb.

Q4 net sales hit $213B with net income over $21B, confirming strong core performance despite a noisy quarter.

Advertising grew over 20% year over year, reinforcing Amazon’s role as a full funnel media platform.

Massive AI capital spending plans unsettled investors, shifting focus from results to future cash burn.

Why it matters: Amazon monetizes attention better than anyone. Ecommerce players now compete not just with stores, but with platforms that fund growth through ads and infrastructure.

DATA TREASURE

The Maze: Young adults are not anti content, they are anti waste. Nearly half prefer reading news because text is faster, quieter, and easier to control than video.

In 2025, 45% of US adults aged 18 to 29 preferred reading news, compared with 31% who preferred watching it.

Reading skews digital and mobile, fitting short attention windows and multitasking habits.

Video still dominates older groups, proving preference is about context, not age alone.

Why it matters: Text converts when intent is high. For brands and ecommerce, written formats remain powerful for education, trust, and purchase decisions.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Toast & Instacart united forces to allow retailers to sync brick-and-mortar inventory with the marketplace, while Instacart Business becomes a procurement partner for Toast locations.

🇨🇳 Alibaba paused its AI assistant 'Qwen's' coupon-issuing function after an overwhelming customer response to a promotional campaign caused service interruptions.

🇩🇪 Mytheresa reported 8.8% sales growth to €242.7M and improved margins, successfully integrating YNAP assets while competitors like Kering face double-digit declines.

🇺🇸 CFDA launched an 'Innovation Hub' with OpenAI, pairing fashion brands with AI developers to create bespoke industry solutions and accelerate tech adoption.

🌎 Reddit reported $726 million in revenue with 70% growth driven by AI-powered ad formats, as daily users reach 121 million.

🌎 LinkedIn released a new framework replacing traditional SEO models and formed an AI Search Taskforce after suffering a 60% drop in B2B traffic.

🇬🇧 Square launched its conversational AI assistant for UK merchants, embedding generative tools directly into the dashboard to help SMBs analyse sales data.

🇺🇸 US Lawmakers introduced a new bill to modify the de minimis exemption, aiming to recreate a simplified system for low-value parcels without fully reinstating the loophole.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team