Geo: America

Area: Mass

Type: Market

Theme: Commercial

🌀 Key points

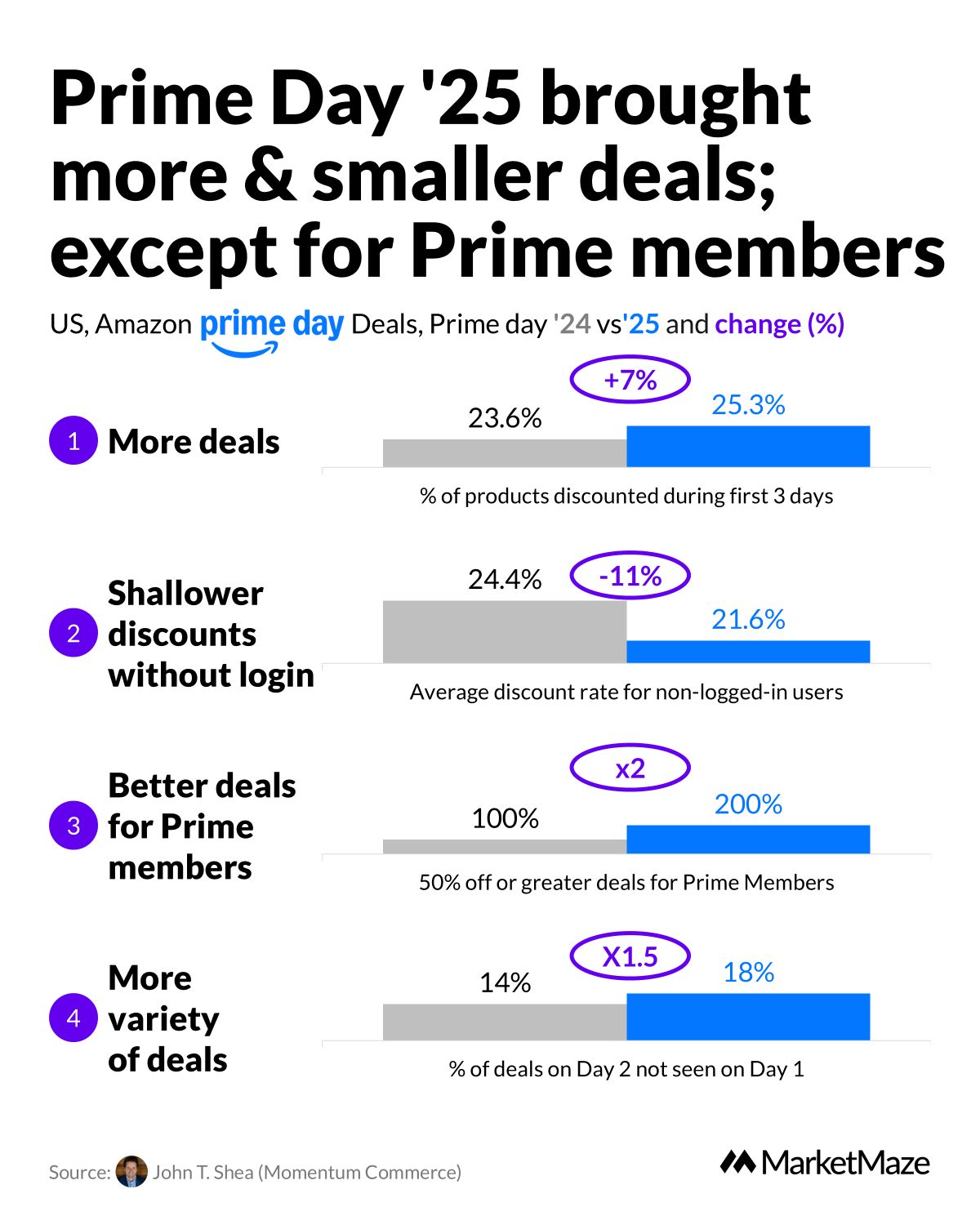

25.3% of products were discounted in 2025, up from 23.6%

Discounts dropped 11% for non-logged-in users

Prime Members got 2x more 50%+ deals than in 2024

💎 Data Gem

Amazon turned Prime Day into Prime Days—and it paid off, barely. In 2025, the deals came faster, lasted longer, and got smarter. But not necessarily deeper.

🗺️ What’s the Maze?

Prime Day 2025 wasn’t just a one-day bonanza. It stretched over four days, with each day telling a different story.

Here's what the data shows:

More deals: 25.3% of products were discounted during the first three days, up from 23.6% in 2024—a modest 7% increase

Shallower savings (if you're not logged in): The average discount dropped to 21.6% from 24.4%—that’s 11% less for anonymous browsers

Prime members won big: They saw 2x more 50%+ off deals compared to last year, including more 40%+ offers

Deal variety expanded: 18% of Day 2 deals were brand new (vs. 14% last year), showing Amazon’s push to keep carts filling across all four days

Momentum Commerce reported that Day 1 and Day 2 sales were 506% higher than average days—but still 35% below last year’s Prime performance. That changed on Day 3, which saw +165% YoY sales over “Prime Day 3” 2024, signaling a delayed but growing consumer response.

Amazon’s total U.S. sales in 1H 2025 crossed $250B, up 6% YoY—impressive in the face of tariff headwinds and inflation fatigue.

🏁 Why It Matters?

This year, Amazon didn’t just sell deals—it sold urgency and loyalty.

Logged-out shoppers got scraps: If you weren’t signed in, your deal quality took a hit. The 11% drop in average discount rate shows how Amazon is gating savings behind logins

Prime membership is the key: Prime members saw 2x more deep discounts. This isn't generosity—it's a growth hack to drive membership and stickiness

More deals ≠ better deals: Yes, there were more discounted products. But unless you were a loyal Prime member, those discounts weren’t as juicy

Smart pacing: By rotating 18% of deals daily, Amazon kept shoppers coming back instead of buying all at once

In short: Prime Day 2025 was less about blockbuster markdowns and more about behavioral engineering. Amazon used more deals, thinner margins, and exclusive offers to reward loyalty and stretch the shopping cycle across four days.

The takeaway? Prime Day has matured. It’s no longer just about deals—it’s a sophisticated machine for data harvesting, habit-building, and margin protection.

🎓 Found this insightful?

📩 Get free weekly news and insights, subscribe to the MarketMaze newsletter

📈 Join the MarketMaze+ Platform to access hundreds of insights like this, resources, and exclusive reports with detailed sources and links

📘 Understand retail media with our 60+ pg white paper or marketplace landscape with our 300+ Marketplace database

🔬 Ask for on-demand insight or report to make better decisions. Reach out here.

📖 Data Source

Name: Only for MarketMaze+ subscribers

Publish date: Only for MarketMaze+ subscribers

Region: Only for MarketMaze+ subscribers

Method: Only for MarketMaze+ subscribers

Link to source: Only for MarketMaze+ subscribers

See raw data from the chart below 👇 ((Only for MarketMaze+ subscribers)

Subscribe to MarketMaze+ to read the rest.

Become a paying subscriber to get access to all insights with sources and other subscriber-only content.

Try it now