TODAY’S MAZE

Happy Sunday! OpenAI is finally opening its doors to advertisers, but entry won't come cheap. The company is launching high-end ad inventory for ChatGPT users.

With Google also tweaking its feed for local discovery, the ad landscape is fracturing. Can brands afford the high price of conversational intent?

In today’s MarketMaze focus:

OpenAI debuts premium ads

Amazon ad revenue soars

3D visuals boost conversions

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: OpenAI has opened ChatGPT to premium advertising at ~$60 CPM, targeting the biggest global brands and positioning conversational search as scarce, intent rich inventory. At the same time, Google is reshaping Discover to boost local content, signaling a split between high cost AI intent and broad, localized discovery.

OpenAI began testing ads on Feb 6, placing sponsored results at the bottom of ChatGPT answers on Free and Go tiers, pricing them closer to NFL or premium streaming than Meta, despite offering only basic view and click metrics.

Brands were approached directly by OpenAI rather than agencies, and early outreach focused on household names, reinforcing that this is an exclusive channel built for budgets, not long tail experimentation.

Source: Market Pulse & The Information

The pricing mirrors a broader commerce reality where a low platform fee, around 4 percent for ChatGPT commerce, quickly rises toward ~7 percent plus paid discovery, shifting focus from access cost to demand cost.

Google’s Discover update leans the opposite way, prioritizing local and regional content to protect scale and legitimacy, while AI platforms move toward fewer impressions and higher priced intent moments.

Why it matters: Customer acquisition is getting more expensive and more fragmented. Brands must run two playbooks at once, optimizing for margin per interaction in AI driven conversations while still feeding localized discovery engines that trade scale for lower intent.

As conversational ads price near premium media levels, who will feel the pressure of higher customer acquisition costs first?

☝️ Vote to see results!

FROM OUR PARTNERS

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

MAZE STORY

The Maze: Amazon’s advertising unit generated $21.3 billion in revenue as the company solidifies its position in the digital media landscape.

The segment surged 23% year-over-year as brands increase investment in retail media networks.

Prime Video drove these results by commanding a global audience of 315 million viewers.

Disney simultaneously reported record success with streaming ad revenue hitting $5.3 billion.

Why it matters: Streaming platforms are successfully converting massive viewership into high-margin advertising businesses that now rival legacy media channels.

FROM OUR PARTNERS

Most E-Commerce Numbers Are Educated Guessing

Executives debate growth.

Analysts argue about market size.

Boards ask who’s winning.

And everyone pulls a different chart.

ECDB exists because e-commerce data is fragmented, delayed, and inconsistent.

So ECDB rebuilt it from the ground up.

Not surveys.

Not panels.

Not annual reports.

Transactions. At scale.

ECDB tracks real online sales activity across retailers, marketplaces, categories, and countries. Then it standardizes the data so comparisons actually make sense.

What teams use it for:

Market sizing without hand-waving

Competitive benchmarking without cherry-picking

Understanding marketplace vs direct models

Spotting inflection points before earnings calls

It’s not a dashboard for curiosity.

It’s a dataset for decisions.

MAZE STORY

The Maze: New industry data reveals that implementing immersive product visualizations offers retailers a dual benefit of accelerating sales velocity while significantly lowering operational logistics costs.

Merchants utilizing 3D assets are seeing conversion rates spike by up to 94% compared to standard static imagery.

The data indicates a corresponding 35% reduction in product returns, directly addressing a major profit leak for online sellers.

These findings underscore the financial impact of 3D product visualizations as they prove to be essential tools for modern online retailers.

Why it matters: Better visualization bridges the gap between digital browsing and physical reality, giving brands a powerful lever to simultaneously fix broken unit economics and improve shopper confidence.

DATA TREASURE

The Maze: Amazon is walking away from experimental grocery formats and doubling down on what already works. Stores still dominate grocery sales, but ecommerce is growing much faster, and Amazon is reallocating capital toward Whole Foods and same day delivery where scale and economics finally line up.

In 2020, ecommerce was ~12% of global grocery; by 2030 it reaches ~23%, while stores still hold ~77%, meaning growth flows online even as physical remains dominant and sets the pace for where new dollars matter most.

Amazon shut most Fresh and Go stores after admitting cashierless retail lacked a scalable profit model, while Whole Foods grew sales ~40% since 2017 and now anchors plans for 100+ new locations.

Same day grocery delivery became Amazon’s wedge, with perishables sales up ~40x since Jan 2025, signaling that speed, not format novelty, is what changes consumer behavior at scale.

Why it matters: Grocery innovation is not about more concepts, but better economics per trip. Omnichannel winners will use stores as inventory engines and ecommerce as the growth lever, capturing share where shoppers trade time for convenience.

DATA TREASURE

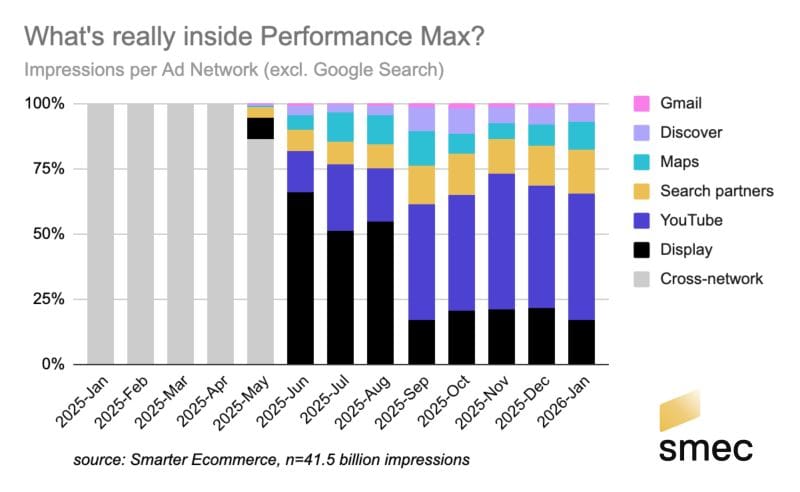

The Maze: Performance Max is no longer opaque. With channel level visibility unlocked, advertisers can finally see where impressions really land, revealing that PMax is closer to a video led reach engine than a pure shopping machine. This changes how you plan creatives, budgets, and expectations.

• From June 1, 2025, PMax impressions skew heavily to YouTube at ~49%, while Display and Search Partners each sit near 17%, proving that most exposure happens before high intent ever appears.

• Maps quietly takes ~11% of impressions for retailers with physical locations, turning PMax into a local discovery tool, not just an online sales lever.

• Gmail stays under 1% on average but spikes around Black Friday, acting like a seasonal promo channel rather than an always on performance surface.

Why it matters: Ecommerce teams can finally connect creative, channel, and outcome. This clarity exposes overlap, waste, and hidden reach, forcing brands to rethink how PMax fits alongside Shopping and Demand Gen.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇺🇸 Amazon reported that Rufus, its AI shopping assistant, generated $12 billion in incremental revenue in 2025, validating the ROI of its massive infrastructure bet.

🇺🇸 Amazon faces a self-help category saturated with AI-generated content—where 77% of success books are now AI-written—though human-authored titles still garner 5x more reviews.

🇺🇸 Amazon Ads revealed research with Publicis Media showing that adding interactive elements to video creatives boosts engagement by 79% compared to static formats.

🌍 The IAB projects that AI-driven measurement could reclaim $32 billion in lost value for advertisers as current attribution models continue to falter.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team