TODAY’S MAZE

Happy Tuesday! OpenAI is testing ads inside ChatGPT as it enters the digital advertising market. This targets high-intent traffic currently dominated by Google.

With hardware coming in 2026, the company is building an AI ecosystem. Can conversational tools replace the keyword models brands rely on?

In today’s MarketMaze focus:

OpenAI tests ChatGPT ads

Amazon Now hits London

YouTube captures TV budgets

Marketplaces dominate ecommerce growth

Ad-free streaming costs rise

+Handpicked recent news you need to know

P.S. Check next poll below the first news & the last poll results at the end of the issue!

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: OpenAI prepares to disrupt the digital advertising landscape by testing ads within ChatGPT and projecting massive growth through 2030 as it scales its intelligence platform.

Evercore ISI analyst Mark Mahaney suggests the startup could generate $25B+ in annual ad revenue by 2030 by capturing high-intent commercial queries that currently drive Google Search.

The company recently expanded its $8-a-month ChatGPT Go tier to the United States and plans to begin testing ads for Free and Go users to monetize its massive global user base.

Chief global affairs officer Chris Lehane confirmed the firm remains on track to launch its first hardware device during the second half of 2026 to encourage deeper AI adoption.

Why it matters: This shift turns a productivity tool into a performance marketing powerhouse. Brands must rethink discovery strategies as conversational search begins to erode traditional search dominance.

Over the next three years, which advertising budget will be most disrupted by ads appearing inside AI chat tools like ChatGPT in the US and Europe?

- 🔎 Search ads (brand and performance spend on Google and Bing in the US and EU)

- 📱 Social ads (paid placements on Instagram, TikTok, and Facebook in the US and EU)

- 🛒 Marketplace ads (sponsored listings on Amazon, Allegro, and other marketplaces)

- 📺 Video ads (connected TV and online video ads bought by large advertisers)

- 🧪 Experimental spend (innovation budgets used by mid-market and enterprise teams)

- Other (write to us specifics by responding to this email)

P.S. Remember to click continue on the next screen after you click in the email for answer to be recorded

FROM OUR PARTNERS

Write like a founder, faster

When the calendar is full, fast, clear comms matter. Wispr Flow lets founders dictate high-quality investor notes, hiring messages, and daily rundowns and get paste-ready writing instantly. It keeps your voice and the nuance you rely on for strategic messages while removing filler and cleaning punctuation. Save repeated snippets to scale consistent leadership communications. Works across Mac, Windows, and iPhone. Try Wispr Flow for founders.

MAZE STORY

The Maze: Amazon just expanded its quick commerce reach by launching Amazon Now in London. This new service allows delivering thousands of grocery and everyday items to UK doorsteps in as fast as 30 minutes.

Using specialized smaller facilities like the Southwark site enables shipping products from locations situated closer to where customers live and work.

Operations Lead Salomon believes this launch allows scaling operations across the European Union by applying successful lessons learned from India and the UAE.

This rollout makes ordering essentials easier by integrating the service directly into the main website rather than using a standalone application.

Why it matters: Amazon is doubling down on physical proximity to counter rising competition in the convenience space. Mastering ultra-fast delivery turns the logistics network into a massive defensive moat that few retail competitors can match.

FROM OUR PARTNERS

Architecture of Sales gives you a fully managed, native sales team so you can reverse-engineer the Polish market without the overhead.

Instantly deploy local SDRs, validated prospect lists, and proven outreach sequences in one package.

Spend less time hiring and more time closing. Partner with us today and start generating meetings that actually convert.

MAZE STORY

The Maze: Advertising agencies are officially reclassifying YouTube from a social media platform to a connected TV powerhouse. This shift enables diverting billions from linear television into digital video inventory.

Global TV ad spending expects to hit $167.4B by 2026 per WPP Media, offering a massive pool of capital for YouTube to capture as it enters the living room.

Recent data from Tinuiti shows that 67% of US YouTube campaigns purchased in late 2025 ran on actual TV screens rather than mobile devices or laptops.

Legacy broadcasters face new pressure as YouTube secures premium content rights, including a deal to stream the Oscars starting in 2029 to challenge traditional networks.

Why it matters: As budgets shift, you must reconcile high-reach television tactics with granular digital targeting. You must now balance the scale of the living room with the specific conversion data that YouTube provides.

DATA TREASURE

The Maze: Marketplaces are quietly absorbing nearly all ecommerce growth. Brand-owned stores still grow, but platforms grow faster.

Marketplaces are projected to capture 87% of global B2C ecommerce revenue in 2026, up from 86% in 2025, leaving just 13% for standalone shops.

Consumers prioritize speed, price, and simplicity, defaulting to one app and one checkout, regardless of brand storytelling.

Emerging markets and everyday categories amplify the effect, pushing more volume into platforms even as strong DTC brands succeed.

Why it matters: DTC is no longer the growth engine. It is the margin and brand layer on top of marketplace-driven demand.

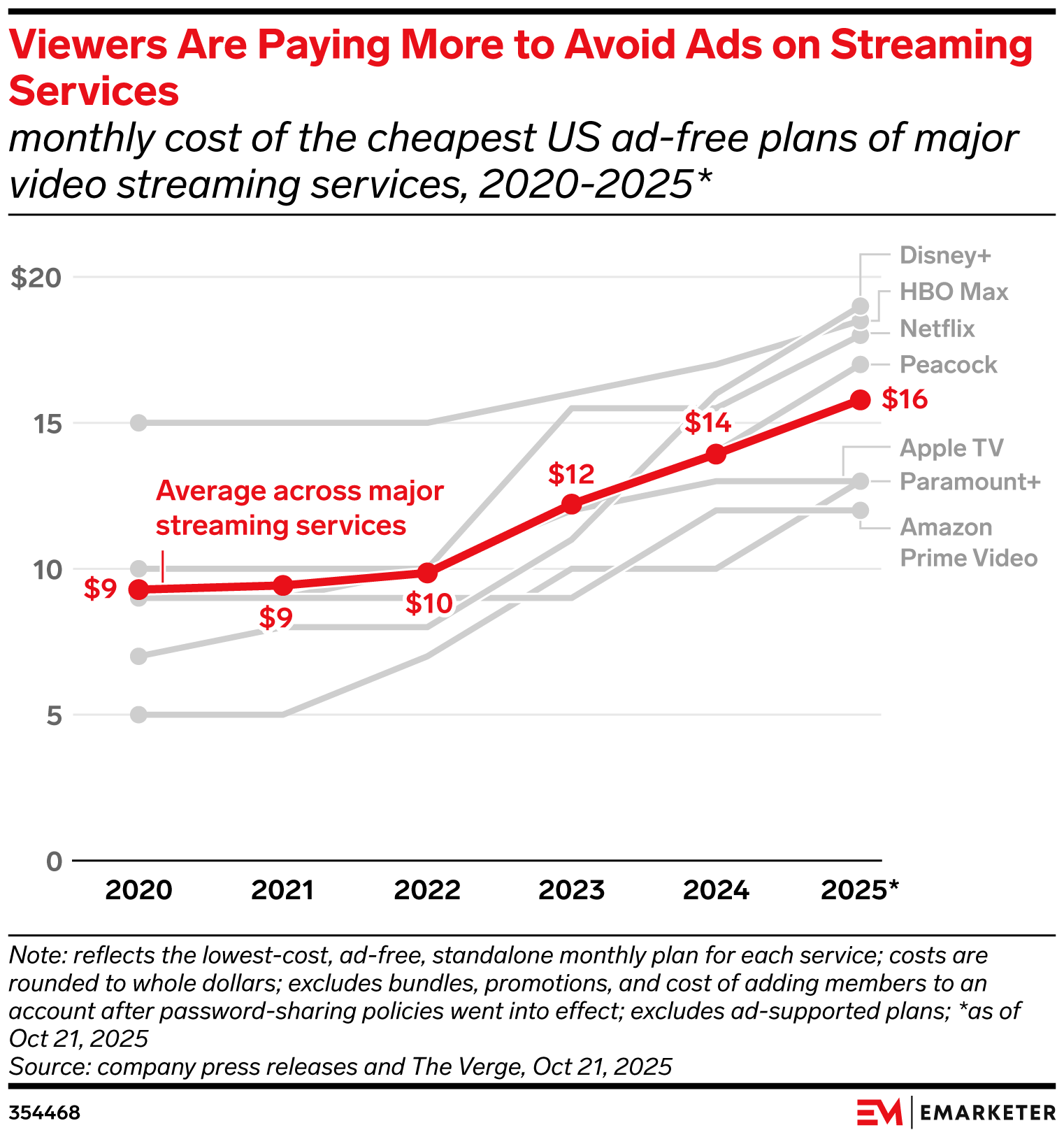

DATA TREASURE

The Maze: Ad-free streaming is turning into a luxury option. Prices rise, ads return, and the economics flip.

The average price of ad-free streaming climbed from $9 in 2020 to $16 in 2025, erasing much of the cord-cutting savings narrative.

Platforms increasingly add ads by default and charge extra to remove them, pushing users toward ad-supported tiers at scale.

Subscription cycling becomes rational behavior, while ad inventory expands across premium content environments.

Why it matters: Ads are back in force. For ecommerce, streaming is becoming a scalable performance and brand channel again.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🌍 PwC found in its global survey of 4,500 CEOs that 56% have yet to see tangible revenue or cost benefits from their AI investments, though confidence remains high for future gains.

🇺🇸 OpenAI confirmed that its annual recurring revenue tripled to $20 billion in 2025, supported by a significant expansion in enterprise adoption and compute infrastructure.

🇺🇸 FTC filed a legal motion against payment processor Cliq, alleging the firm failed to implement mandatory fraud prevention measures required by a previous 2015 legal order.

🇩🇪 Douglas reported squeezed profit margins despite sales growth, as European consumers increasingly prioritized value and promotional pricing during the holiday peak.

🇬🇧 Apparel Brands joined the race to acquire struggling footwear retailer Russell & Bromley after the legacy label saw a 9% drop in turnover during 2024.

🇬🇧 ElevenLabs pursued a new funding round that could double its valuation to $11 billion, potentially making the voice AI specialist the most valuable AI startup in the UK.

🇪🇺 European Union prepared to implement retaliatory tariffs on U.S. goods as early as February 7 following the expiration of a trade negotiation pause over Greenland.

MARKET PULSE

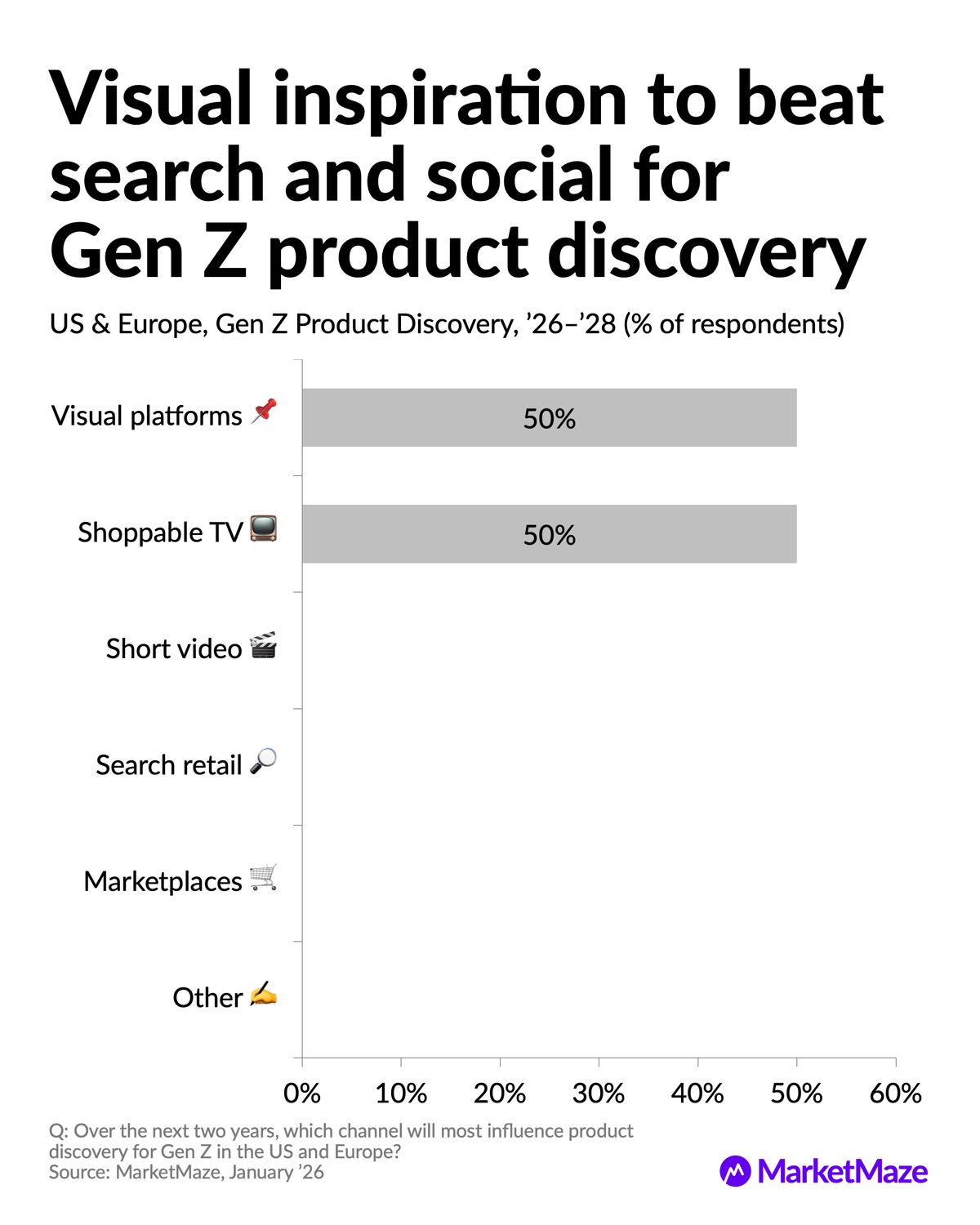

🎯 Discovery shifts upstream

The Maze: MarketMaze readers see product discovery moving away from search and feeds toward inspiration-first formats. Visual platforms and shoppable TV now define where Gen Z finds products, long before keywords or listings matter.

In a Jan ’26 MarketMaze survey, visual inspiration and shoppable TV tied at 50% each as the top Gen Z discovery drivers for ’26–’28.

Search, short video social, and marketplaces scored 0%, signaling fatigue with intent-only discovery models.

The bet is timing: discovery happens before demand exists, not when shoppers already know what to buy.

Why it matters: Ecommerce still optimizes for capture, not creation. If discovery shifts upstream, brands that win attention early will pay less later and control demand instead of renting it.

THAT’S IT FOR TODAY!

Your network thinks you’re as smart as the content you share. If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

Here is your unique referral link to share with friends:

and link to the hub to check your progress and rewards you can get!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team