TODAY’S MAZE

Happy Sunday! Trade policy shifts as a 10% tariff looms over eight NATO allies. The administration is using these duties as leverage to negotiate for Greenland. How can it impact ecommerce?

In today’s MarketMaze focus:

Trump’s NATO tariff plan

Walmart’s new U.S. head

OpenAI tests ChatGPT ads

Amazon tests Google Shopping

Google Demand Gen economics

+Handpicked recent news you need to know

P.S. Check next poll below the first news & the last poll results at the end of the issue!

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: President Trump plans to impose a 10% tariff on eight NATO allies starting February 1, using trade leverage to pressure Denmark into selling Greenland. This aggressive move targets "any and all goods" from partners, as detailed in Trump Targets NATO Imports.

The proposed levies affect imports from eight NATO allies, with rates scheduled to climb to 25% by June 1 according to this specific Truth Social post released by the president this weekend.

Economic experts like Pete Mento suggest these threats remain theoretical until the administration issues an executive order to implement the duties as noted in this LinkedIn post Saturday regarding trade policy updates.

The administration justifies the move as a national security necessity to secure land for the Golden Dome missile defense shield designed to protect the entire nation and Canada from modern weaponry.

Why it matters: These tariffs threaten to disrupt established trade agreements and increase costs for D2C brands sourcing European goods.

How likely do you think broad US tariffs on NATO allies are to be fully implemented and sustained through 2026?

- 🟥 Very likely (tariffs enacted and remain in force long term)

- 🟧 Partly likely (introduced but reduced, delayed, or selectively applied)

- 🟨 Tactical threat (used mainly for negotiation leverage, not enforcement)

- 🟩 Unlikely outcome (political or legal pushback blocks implementation)

- 🟦 Short-lived move (implemented briefly, then reversed within months)

- Other (write to us specifics by responding to this email)

FROM OUR PARTNERS

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

MAZE STORY

The Maze: OpenAI is officially testing ads within free tiers and Go accounts, marking a departure from its previous subscription-only focus. This move aims to generate revenue as the organization faces mounting costs from scaling its global AI infrastructure.

Internal projections suggest the company could burn through $115 billion in cash by 2030 to maintain its competitive lead according to The Information.

CEO of applications Fidji Simo emphasizes that the new ad model will prioritize transparency and won't dictate the specific advice the model generates.

The new interface layout makes viewing ads secondary to the chat response to ensure the core utility remains intact for free users, as described in the company's official announcement.

Why it matters: This creates a massive new playground for marketplace sellers to capture high-intent traffic during the research phase of the buyer journey. It signals the end of the pure AI era, forcing brands to master a new set of visibility rules.

FROM OUR PARTNERS

Dashboards Aren’t Direction. You Still Make the Call.

Automation can generate reports, but sound financial leadership still requires human judgment.

The Future of Financial Leadership is a free guide that explores why BELAY Financial Solutions focus on human expertise to help leaders make confident, informed decisions.

MAZE STORY

The Maze: Walmart is installing David Guggina as the new head of its U.S. division to accelerate transitioning toward AI-driven commerce. Reorganizing the leadership bench now signals a massive bet on agentic shopping as the company integrates its digital and physical platforms.

David Guggina brings nearly eight years of experience in automation and supply chain at Walmart following a nearly decade-long tenure managing technical categories at Amazon.

Seth Dallaire moves into a global growth role to centralize platforms and enables focusing on customer needs by freeing up operating segments.

The leadership shift aligns with incoming CEO John Furner’s vision to use AI for reshaping how consumers interact with the retail giant.

Why it matters: Placing an e-commerce and supply chain specialist at the helm makes prioritizing technical efficiency easier than traditional merchandising. This move prepares the retailer to compete in an era where AI agents handle complex shopping tasks for consumers.

DATA TREASURE

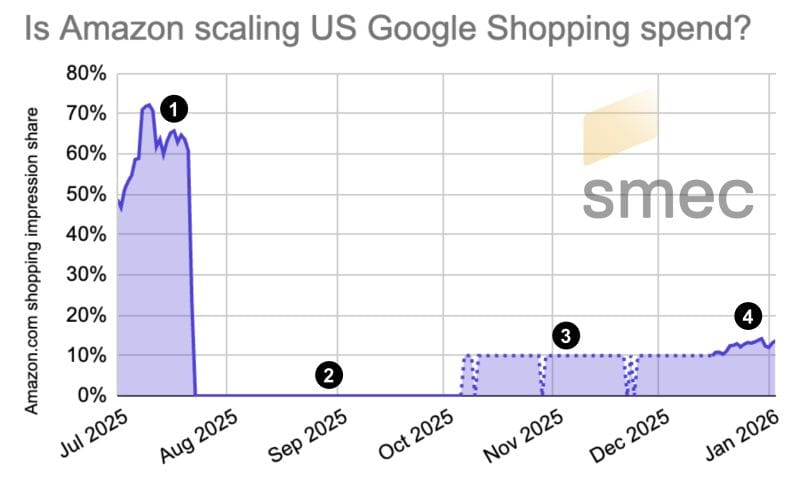

The Maze: Amazon never fully left Google Shopping, it just turned the volume way down. After a dramatic global shutdown, faint but persistent signals show Amazon quietly testing paid visibility again in selected US categories.

In late July 2025, Amazon held 60–70% shopping impression share in the US, then shut ads off almost overnight worldwide, with the pause lasting about 30 days everywhere except the US.

From early October 2025, Amazon reappeared below the 10% reporting threshold, meaning it was active but intentionally invisible in standard reporting.

Since mid December 2025, Amazon’s presence has steadily increased, continuing past holiday cutoffs, mainly in health and beauty, suggesting category-level testing, not seasonal panic.

Why it matters: Amazon treats paid media like a faucet, not a dependency. When it returns, it resets auctions fast, which makes category economics fragile for every other ecommerce player.

DATA TREASURE

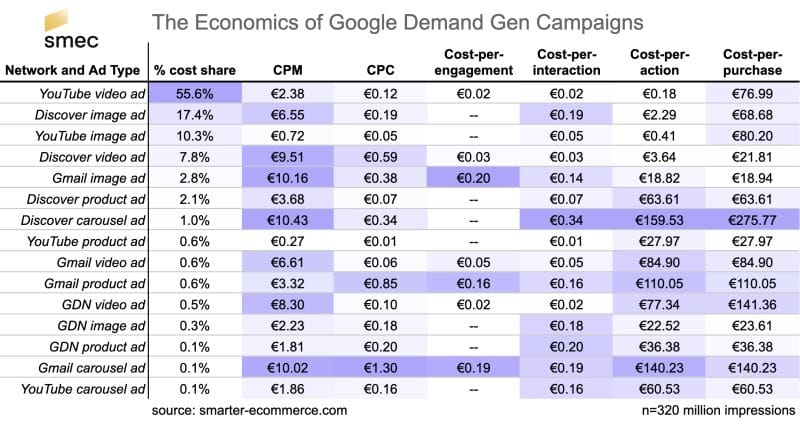

The Maze: Demand Gen looks unified, but the economics are anything but. Under one campaign name, Google sells very different products with very different costs.

Roughly two thirds of Demand Gen spend flows to YouTube, making video the engine that allows the format to scale where Discover alone previously stalled.

Discover placements command premium prices, and carousel formats can produce extremely high cost per purchase, signaling low conversion rates for what is effectively mid-funnel inventory.

Gmail placements bill on “clicks” that are often just ad expansions, creating engagement priced like traffic, while Google Display adds risk of accidental remarketing.

Why it matters: Demand Gen works only if advertisers control where money goes. Without guardrails, automation optimizes spend, not outcomes, and ecommerce margins pay the price.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇬🇧 Amazon launched Prime Air drone delivery operations in Darlington, marking its first official UK hub for aerial logistics two centuries after the town hosted the first steam train.

🇮🇹 The Italian government introduced a mandatory €2 customs administration fee for all parcels arriving from outside the EU with a value under €150, impacting low-value cross-border Ecommerce.

🇺🇸 Google filed a formal notice of appeal against the DOJ’s search monopoly ruling, requesting a stay on court-mandated remedies that would require the tech giant to share its proprietary search data with competitors.

🌍 The Atlantic sued Google for antitrust violations, accusing the company of monopolizing the ad tech market through rigged auctions that allegedly cost publishers billions in lost revenue.

🌍 Google explained its current strategy for keeping Gemini ad-free, focusing on user experience while continuing to monetize AI features through its Search Overviews and AI Mode.

🇺🇸 Elon Musk seeks $134 billion in damages from OpenAI and Microsoft, claiming he was defrauded of seed money that has now ballooned into a massive stake in the company's $500 billion valuation.

MARKET PULSE

🧨 Power Shifts Multiply

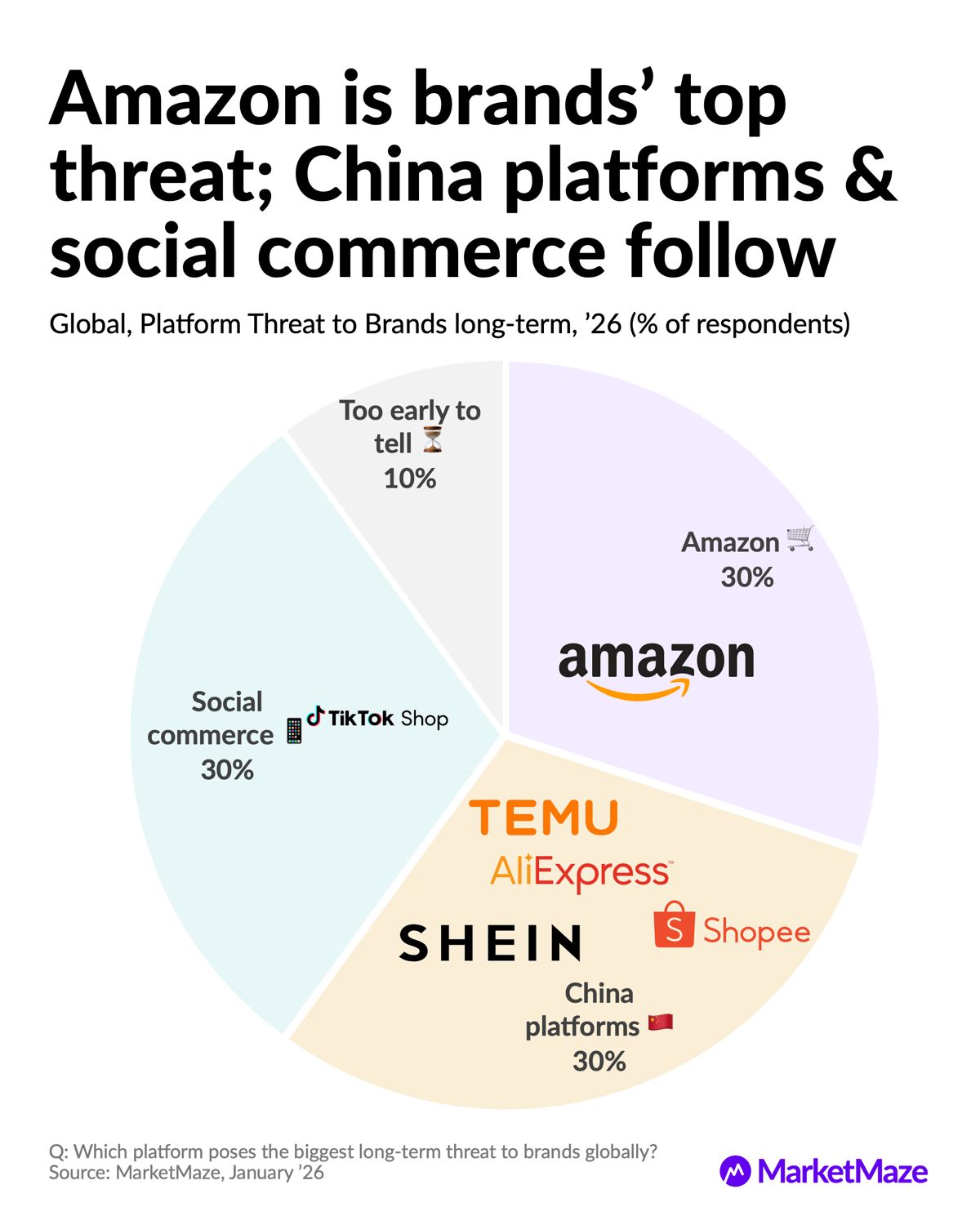

The Maze: Brands no longer face one enemy. Fear is split evenly between Amazon, China platforms, and social commerce, which signals a market where control of demand is fragmenting fast and brand power is being diluted across three different systems at once.

In Jan ‘26, only 30% of industry respondents named Amazon as the top long term threat, while an equal 30% pointed to China platforms like Temu and Shein, showing price disruption now rivals platform dominance in brand anxiety.

Social commerce reached parity at 30% as TikTok Shop scaled from zero to multi-billion GMV in under two years, proving discovery driven buying can bypass brands, sites, and even marketplaces.

Just 10% said it is too early to tell, meaning 9 in 10 brands already believe platform power will grow faster than brand power through 2026.

Why it matters: Ecommerce used to be about picking the right channel. Now it is about surviving three at once. Brands that do not control price, discovery, and fulfillment simultaneously will rent growth from platforms that control all three.

THAT’S IT FOR TODAY!

Your network thinks you’re as smart as the content you share. If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

Here is your unique referral link to share with friends:

and link to the hub to check your progress and rewards you can get!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team