TODAY’S MAZE

Happy Thursday! Meta is starting the year with a $2 billion acquisition of AI agent startup Manus. This move signals a massive push to turn social scrolling into a proactive, automated shopping experience.

This shift moves beyond simple bots to software that can execute complex tasks for businesses. Can autonomous agents successfully handle purchasing decisions for millions of users?

In today’s MarketMaze focus:

Meta acquires AI agents

Retailers add physical stores

eBay simplifies financial reporting

Amazon chases ultra-value market

Global grocery fulfillment models

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Meta pays over $2 billion to acquire Manus, a startup specializing in software that autonomously handles complex digital tasks. This move aims to turn social platforms into proactive commerce hubs where assistants manage everything from product discovery to marketing.

The Singapore-based startup reached $100 million in annual recurring revenue just eight months after launching its viral task-execution platform that performs data analysis and coding.

Meta plans to maintain the service as a standalone product while embedding its agent technology across the broader discovery and entertainment ecosystem for business users.

Founder Xiao Hong joins Meta as a vice president as the company severs all ties to the startup’s original Chinese operations to satisfy regulatory and data privacy requirements.

Why it matters: This acquisition signals a shift from passive social scrolling to active, agent-driven social commerce where software makes purchasing decisions for users. Providing autonomous assistants to millions of small businesses will likely lower the cost barrier for high-scale marketing and customer support, which enables brands to scale personalized operations without increasing headcount.

FROM OUR PARTNERS

Modernize your marketing with AdQuick

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

MAZE STORY

The Maze: Retailers like Uniqlo, Barnes & Noble, and Dollar General plan to open over 500 storefronts in 2026 as they pivot back to brick-and-mortar. This aggressive reinvestment signals a shift toward using physical storefronts as critical hubs for the modern omnichannel journey, prioritizing proximity to customers over purely digital reach.

Dollar General CEO Todd Vasos plans to open 450 locations this year, capitalizing on vacant real estate left by struggling competitors to capture budget-conscious shoppers.

Inditex-owned Bershka will enter the US market with two Miami stores following strong online performance, while Uniqlo adds 11 flagships in cities like Chicago and San Francisco.

Barnes & Noble leverages a decentralized strategy by handing control to local booksellers, a move that fueled enough growth for Elliott Management to consider a public offering.

Why it matters: The physical store acts as vital distribution infrastructure that lowers shipping costs for brands while increasing local brand awareness. Companies that master this balance will likely see higher customer lifetime value as they meet shoppers in any environment.

FROM OUR PARTNERS

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

MAZE STORY

The Maze: eBay is overhauling its financial reporting for US sellers by introducing standalone credit notes to track fee and tax reversals starting today. This long-awaited update finally aligns the marketplace with standard global accounting practices and helps professional marketplace sellers reconcile their digital accounts with significantly less manual effort during the busy tax season.

The platform will issue these official tax documents to explicitly confirm when a fee reversal or refund credits back to a seller's account.

Each credit note includes a direct reference to the original invoice to eliminate the guesswork often associated with matching reversals to specific transactions within a seller's billing cycle.

Sellers can easily access these new records in the same billing section where they currently retrieve their monthly tax invoices to simplify their complex end-of-year financial reporting tasks.

Why it matters: This shift reduces the heavy administrative burden on small businesses by providing a clean, automated audit trail for upcoming tax seasons. Better financial transparency across the platform strengthens long-term seller trust and helps professionalize operations for brands looking to scale their presence across the global marketplace ecosystem.

DATA TREASURE

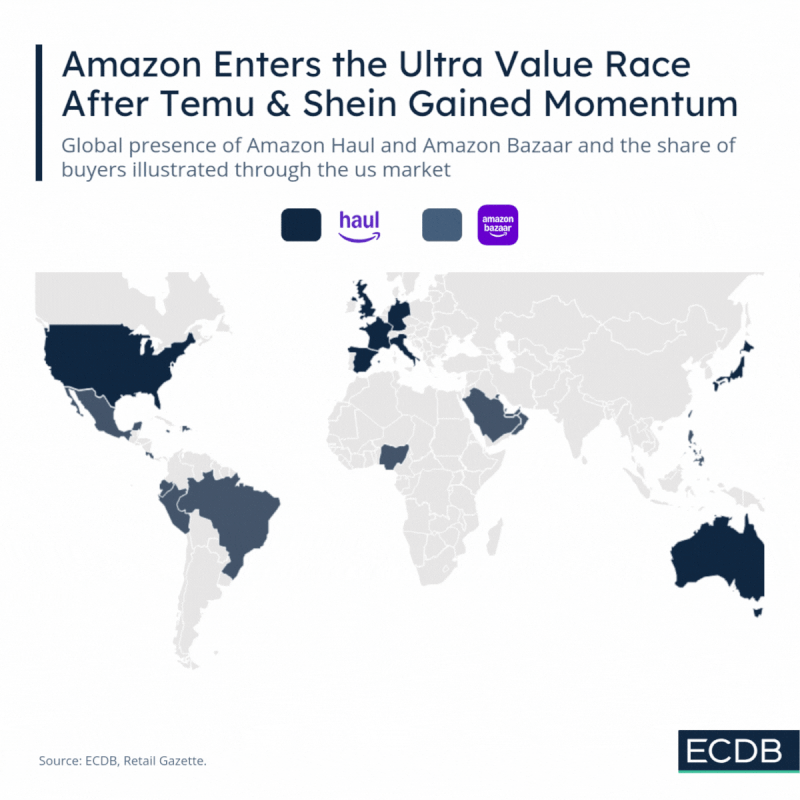

The Maze: Amazon is late to ultra value, but dangerous anyway. Haul and Bazaar are not about beating Temu on price. They are about inserting cheap shopping into an existing habit loop where trust, checkout, and delivery already work. Distribution, not novelty, is Amazon’s weapon.

By late 2024, Haul and Bazaar were live in 25 countries, split by market maturity and device behavior, showing Amazon is tailoring cheap shopping instead of copying one format.

In the US, Temu reached 28% buyer penetration and Shein 23%, while Amazon Haul sat at 16%, proving Amazon entered after habits formed.

Amazon’s advantage is not discovery but conversion, with Prime accounts, saved payments, and logistics lowering friction at scale.

Why it matters: Ultra value compresses prices across ecommerce. If Amazon normalizes cheap browsing, mid-tier sellers get squeezed. Platforms win by owning traffic, not by being cheapest.

DATA TREASURE

The Maze: Online grocery is not one market, it is many local systems. France, South Korea, the US, and the UK all buy food online, but in radically different ways driven by infrastructure, density, and habit. The winning model is the one that matches local economics, not global ambition.

France runs on pickup with over 90% of online grocery orders collected in store, shifting last-mile cost to consumers and protecting margins.

South Korea flips the model, with roughly 80% ship-to-home enabled by dense cities, fast logistics, and a culture built around speed.

The US and UK sit between, with mixed delivery and pickup as retailers experiment to balance convenience and cost.

Why it matters: Ecommerce grocery kills profits when the model is wrong. Global players cannot export one playbook. The future belongs to retailers who localize fulfillment, not branding.

BRIEFING

🏬 Everything else in Ecommerce

🇺🇸 Amazon granted remote work exceptions for employees stranded in India due to H-1B visa delays, a rare pivot from its five-day office mandate.

🇮🇳 Blinkit lost its CFO Vipin Kapooria, who is resigning after less than a year to return to marketplace rival Flipkart.

🌍 Gen Z is redefining drinking culture with ‘zebra striping’—alternating alcoholic drinks with non-alcoholic options—to maintain social habits while avoiding hangovers.

🇺🇸 Pinterest identified that Gen Z now represents 50% of its user base, with the demographic using the platform to discover multi-faceted ‘aesthetics’ for identity building.

🌍 News Publishers experienced a 23% drop in traffic after blocking AI crawlers, highlighting the significant audience reach trade-off involved in opting out of AI data scraping.

📉 Subscriptions faced the ‘Unsubscribe Olympics’ as consumers aggressively ‘zero out’ recurring payments in a seasonal test of retention for the ‘Resolution Economy.’

🇺🇸 Amazon received poor internal feedback from beta testers regarding the revamped Alexa+, which was described as ‘unbearably erratic’ with issues in volume control and command recognition.

🇺🇸 Tesla missed its 2025 Robotaxi delivery milestones, with the autonomous service remaining limited to a small, safety-monitored pilot program in Austin.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team