TODAY’S MAZE

Good morning, MarketMaze readers! Ecommerce executives are bracing for a structural reckoning in 2026, driven by rising fulfillment costs and stricter import rules. The path to profitability now relies less on minor digital fixes and more on aggressive investments into industrial AI infrastructure.

In today’s MarketMaze focus:

AI & Tariffs Reshape E-commerce Logistics

Coupang data breach lawsuit

CFOs chase real-time liquidity

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Ecommerce executives anticipate a structural reckoning in 2026, where success depends less on incremental digital upgrades and more on aggressively funding industrial AI and rapidly adapting logistics networks to handle new tariff requirements.

Companies must ensure product data is structured for machines, otherwise content will not surface in conversational tools like Amazon’s Rufus, which expanded features throughout 2025, demanding consistent product attributes.

The formal end of the $800 de minimis exemption requires duties and customs entry for low-value imports and drives companies to revisit network design, prioritizing regional U.S. warehousing.

Warehouse automation startup Kargo.ai raised $42 million in Series B funding to scale its AI-powered dock operations platform amid chronic logistics labor shortages.

Why it matters: Fulfillment shifts from a cost center to a demand accelerator or suppressor, as marketplace algorithms directly factor delivery performance into search ranking.

FROM OUR PARTNERS

Easy setup, easy money

Making money from your content shouldn’t be complicated. With Google AdSense, it isn’t.

Automatic ad placement and optimization ensure the highest-paying, most relevant ads appear on your site. And it literally takes just seconds to set up.

That’s why WikiHow, the world’s most popular how-to site, keeps it simple with Google AdSense: “All you do is drop a little code on your website and Google AdSense immediately starts working.”

The TL;DR? You focus on creating. Google AdSense handles the rest.

Start earning the easy way with AdSense.

MAZE STORY

The Maze: New York-listed Coupang, often called the "Amazon of South Korea," faces a U.S. securities lawsuit alleging the company failed to timely inform investors about a massive data breach involving 33.7 million customer accounts, triggering intense legal and regulatory scrutiny over its disclosure practices.

The sprawling cyberattack, which compromised names, emails, and delivery addresses, began on June 24 but went undetected for five months until Coupang detected irregular activity in mid-November linked to a former employee who retained access credentials according to reports.

Share prices slumped sharply in early December, temporarily erasing billions in market value, as the suit alleges Coupang’s insufficient disclosures delayed investors’ understanding of material risks under U.S. securities rules.

The company announced a 1.69 trillion won ($1.18 billion USD) compensation package of vouchers for affected Korean users, a move that critics argue may be perceived as a marketing tactic rather than genuine restitution efforts.

Why it matters: This major incident raises the stakes for all publicly listed ecommerce platforms, forcing executive teams to prioritize insider threat detection and audit access revocation protocols aggressively. Leaders must now ensure their cybersecurity disclosures meet evolving investor expectations and strict new SEC reporting rules to mitigate legal and market volatility.

FROM OUR PARTNERS

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

MAZE STORY

The Maze: Chief Financial Officers are demanding that finance operations move from batch processing to continuous, real-time settlement to secure cash flow certainty while simultaneously deploying agentic AI systems that automate complex B2B procurement workflows. This push enables finance leaders to effectively eliminate reliance on excess working capital buffers and redeploy incoming funds the same day.

Surveys indicate that 68% of CFOs plan to adopt real-time payments within the next two years, significantly increasing adoption rates across enterprises.

Frameworks like the OpenAI and Stripe Agentic Commerce Protocol are emerging to let AI agents autonomously discover products and initiate payments on behalf of users.

Despite one procurement platform generating $6 billion in customer savings to date, a persistent trust gap means only 11% of enterprise CFOs are actively testing agentic AI for financial workflows.

Why it matters: Ecommerce and marketplace operators must integrate instant payment rails like FedNow and RTP to capture 24/7 liquidity and offer faster vendor payouts, which reduces short-term borrowing costs for partners. This shift forces platforms to build new trust layers and identity safeguards that authenticate autonomous AI agent actions rather than relying solely on traditional user KYC processes.

DATA TREASURE

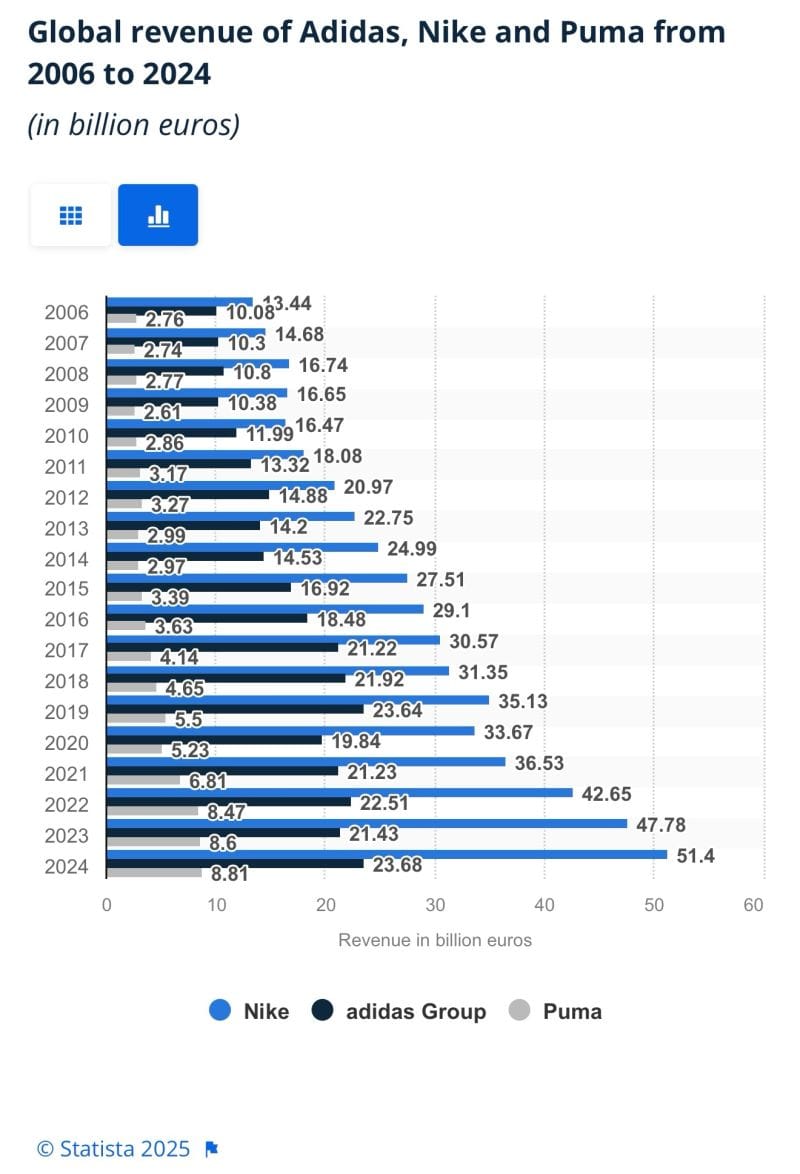

The Maze: Sportswear winners are not product companies anymore, they are demand engines. From 2006 to 2024, Nike, adidas and Puma turned brand equity into repeatable growth by scaling icons, direct channels, and cultural relevance. The real asset is not sneakers. It is the system that turns identity into revenue, year after year.

In 2006, the three brands made ~€26B combined, and by 2024 that number passed €83B, with Nike alone at ~€51B, showing how scale rewards brands that industrialize demand, not just design products.

Nike’s flywheel links Jordan, Air Force 1, SNKRS and direct sales into one loop where data improves drops, drops drive traffic, and traffic feeds the next launch.

adidas shows the risk side of scale, where Yeezy fueled growth but its collapse exposed how fast revenue falls when brand heat and operations drift apart.

Why it matters: Ecommerce amplifies brands with repeatable demand. Icon franchises convert better, return less, and discount later. In a crowded online shelf, identity beats performance specs every time.

DATA TREASURE

The Maze: UK ecommerce did not peak, it paused. After the pandemic surge, online share stalled, then quietly returned to its long-term growth path. That tells us online is not a COVID artifact. It is the default channel still taking share, just at a more sustainable pace.

Online retail moved from low single digits in 2008 to nearly 20% pre-2020, spiked during lockdowns, then stabilized before reaccelerating toward the same adoption slope.

The flat period reflected normalization, inflation pressure, and margin stress, not a consumer rejection of online shopping.

Recent acceleration signals that convenience layers like delivery reliability, returns, and hybrid store models keep pulling demand online.

Why it matters: Ecommerce growth is back, but cheap growth is not. Retailers must design online to make money, not just volume. Stores now exist to support ecommerce, not compete with it.

BRIEFING

🏬 Everything else in Ecommerce

🇺🇸 Discount retailers plan over 500 new US store openings in 2026, including Dollar General, Nordstrom Rack, and Uniqlo, signaling an accelerated physical retail comeback.

🇬🇧 Luxury brands are facing active consumer pushback after years of aggressive price hikes, signaling a potential break in the social contract with high-end buyers.

🇪🇸 Inditex’s Lefties is expanding its cross-vertical strategy by launching its own line of household appliances, following the successful diversification of sister brand Zara Home.

🇺🇸 Meta acquired Manus, a generative AI agent startup, for over $2 billion, signaling a major strategic push into autonomous conversational platforms and agent-led social commerce.

🇺🇸 Microsoft is reviving a classic platform strategy by embedding AI agents deep within the Windows OS, aiming to accelerate enterprise adoption and shift workflows away from traditional apps.

🇮🇳 India is unlikely to extend its duty-free regime for cotton imports beyond December 2025, forcing global textile and apparel supply chains to absorb an immediate 11% cost increase.

🌍 Major retailers extended holiday return deadlines while operational chaos hit eBay UK after DHL was dropped from the Simple Delivery service, disrupting options for sellers of bulky goods.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team