Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

New look, same attitude. We’re rolling out our new format—hope you like it. If you’ve got comments or ideas, hit reply. The website’s next.

Today: Generations face off on Prime Day. Five giants eat half of e-commerce. Consumers are still spending, just not where you think. Plus, a Vinted CEO crash course in winning secondhand. Headlines you can’t ignore: Temu back in the US, TikTok Shop targets Japan, Shein in hot water, and Instacart doubling down on delivery.

🧠 INSIGHTS:

How Generations Will Shop Next Amazon Prime Day 📦

Big 5 Stores Own Half the Web’s Wallet 🏦

How Global Consumers Are Spending in 2024?

Inside Vinted: The CEO’s Playbook for Beating Shein and Amazon in Secondhand.

📖 NEWS:

🇺🇸 Temu Resumes Direct Sales to US After Trade Truce.

🇯🇵 TikTok Shop Launches in Japan to Challenge Amazon and Rakuten.

🇬🇧 Shein Sued for £5.8M in UK Tax Evasion.

🇨🇳 Shein's Emissions Surge 23% Amid IPO Plans.

🇺🇸 Costco and Kroger Boost Delivery with Instacart.

🇪🇺 Voi CEO Eyes Bolt’s Micromobility Business.

+ 15 other handpicked news from the last week you need to know 🔥

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

How Generations Will Shop Next Amazon Prime Day 📦

Amazon Prime Day is a generational showdown. Gen Z is ready to fill carts, while Boomers treat their wallets like fortresses. This year’s July Amazon Prime sale stretches four days. A recent report by Tinuiti shows just how much habits differ, from early deal hunting to AI use. If you want to win this Prime Day, you need to know how each generation plays.

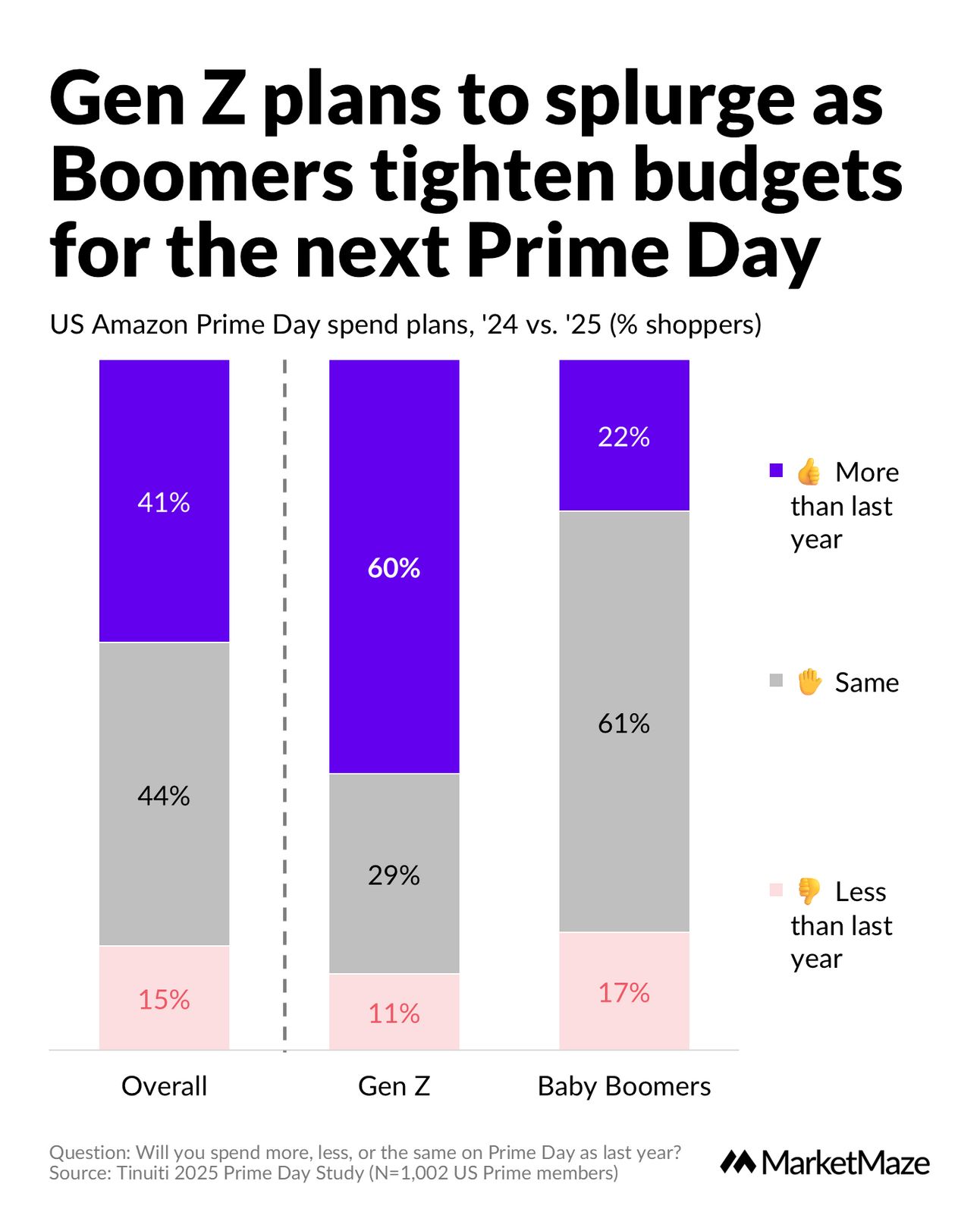

Gen Z Plans to Splurge, Boomers Play It Safe 💸

Gen Z is going big: 60% will spend more than last year. Only 22% of Boomers say the same. Just 11% of Gen Z will spend less, compared to 17% of Boomers pulling back. Forty-one percent overall are spending more, but the heat is with the youngest. Gen Z treats Prime Day as an event. Boomers? More like a careful checkout.

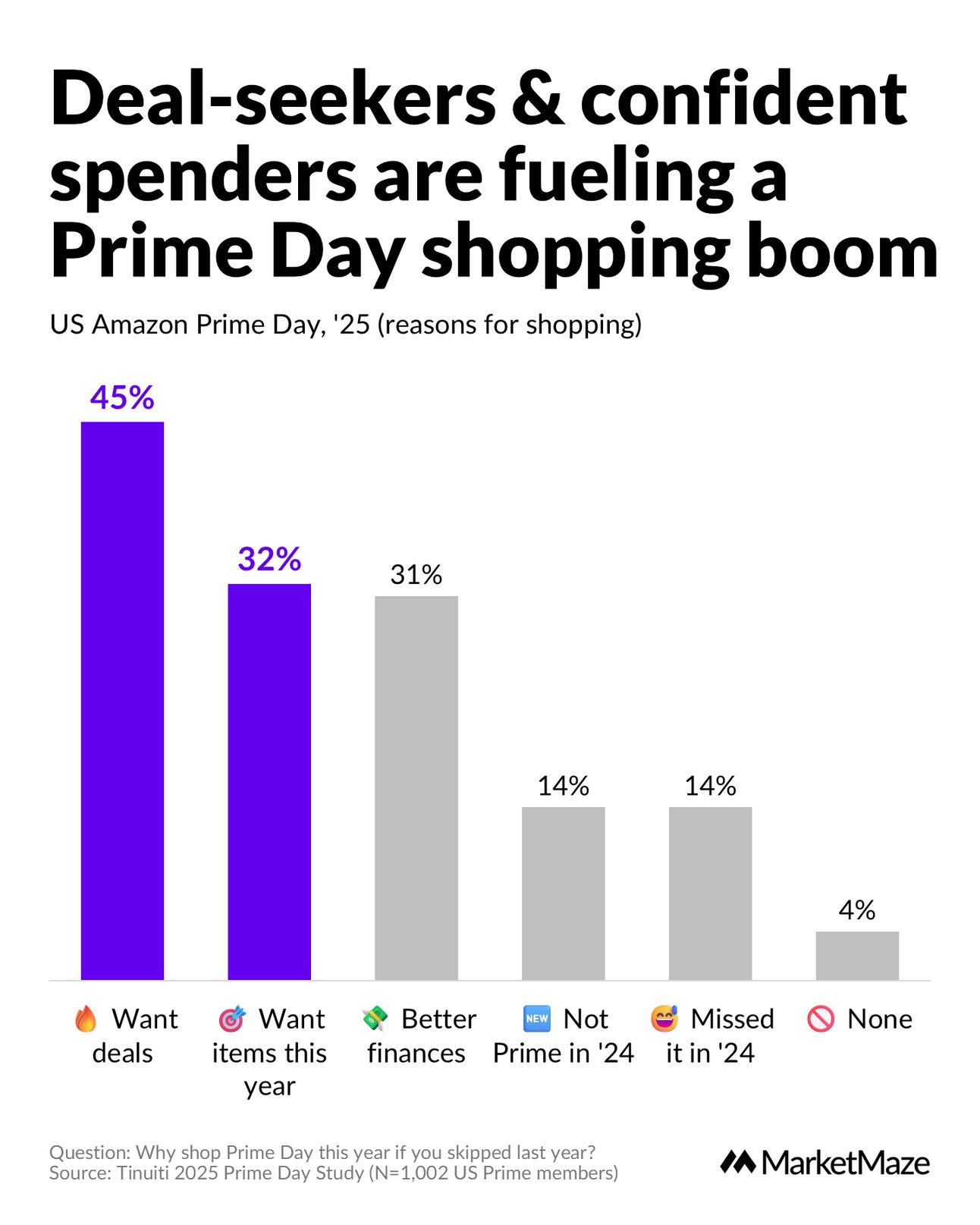

Deal Hunters and Confident Spenders Take the Lead 🔥

Deals and confidence are the name of the game. Forty-five percent are chasing better bargains, while 32% want specific products. 31% say they feel better about their finances in 2025. FOMO drives 14% back to the sale, and another 14% are new to Prime. It’s not just discounts… Prime Day is a quest for pride, planning, and bragging rights.

Early Research is the New Black Friday Line-Up 🕒

Prime Day shoppers aren’t waiting for the last minute. 43% start research 2–7 days ahead; 29% are at it more than a week early. Only 10% wait for the event, and 4% shop blind. It’s chess, not checkers. If you’re a brand, drop your deals early—everyone else is already in the game.

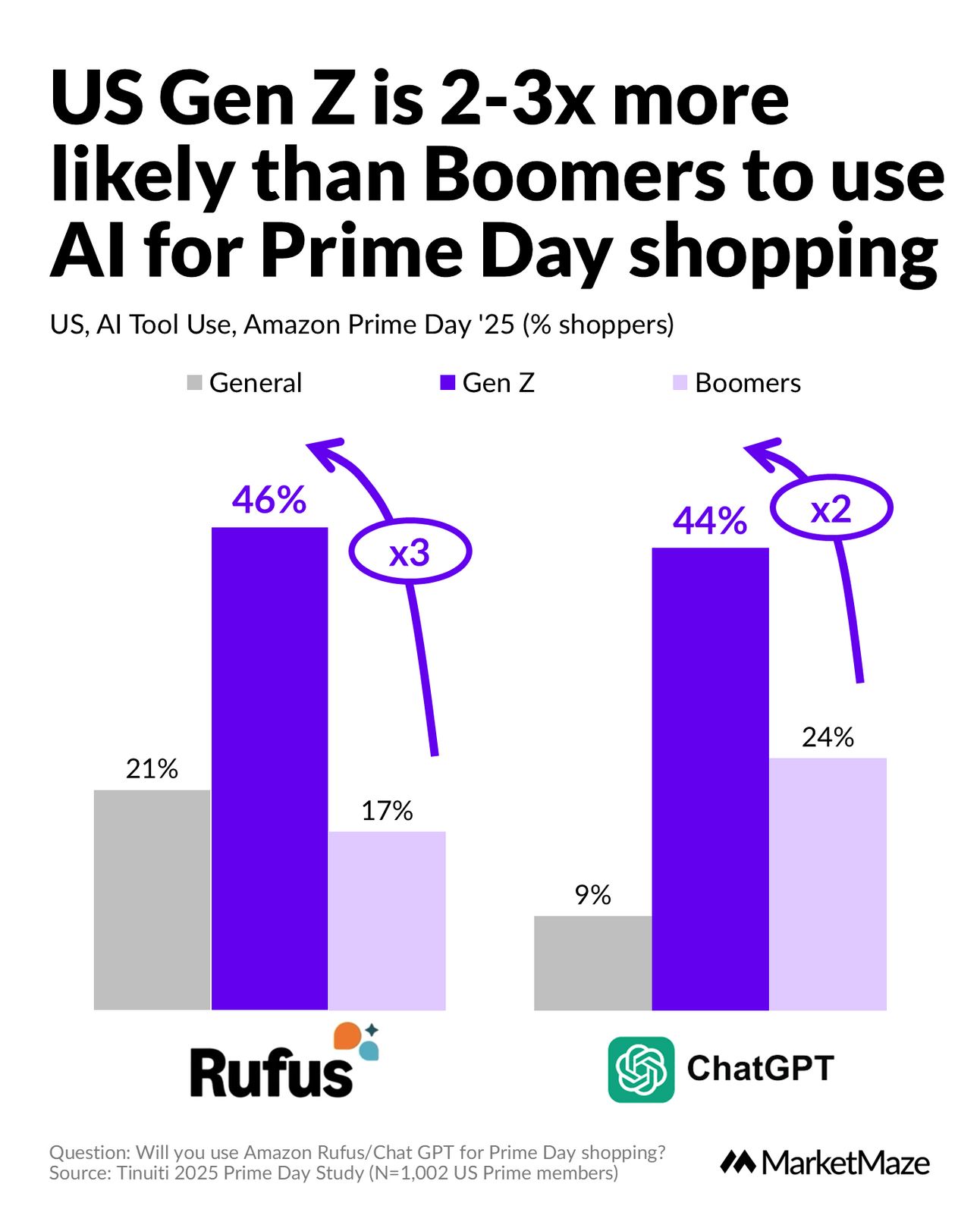

Gen Z Brings AI, Boomers Bring Caution 🤖

AI is the new shopping buddy for Gen Z: 46% will use Amazon’s Rufus, 44% will use ChatGPT. Boomers lag at 17% (Rufus) and 24% (ChatGPT). Gen Z is three times as likely to use AI for Prime Day. Want to win with young shoppers? Get smart with AI. For Boomers, tried-and-true methods still win.

From our partners

Outrank Your Competitors on Amazon—Fast!

Stack Influence automates micro-influencer collaborations to significantly boost external traffic and organic rankings on Amazon. Trusted by top brands like Magic Spoon and Unilever, it's your secret to dominating page one.

💎 Data Treasure

Big 5 Stores Own Half the Web’s Wallet 🏦

According to ECDB’s “Market Concentration in eCommerce: In North America, Large Companies Prevail,” the digital marketplace isn’t a democracy—it’s an oligarchy.

In 2024, the top 5 online stores dominated net sales in North America, leaving everyone else fighting for leftovers.

Canada: The top 5 grab 60% of all sales. Amazon and Walmart are basically the final boss level.

USA: Top 5 scoop up 55%, making it tough for any challenger to get noticed.

Mexico: Top 5 take 54%, with Coppel joining Amazon and Walmart at the top.

Europe gives smaller players more room, but the story still tilts toward the top.

Italy: Top 5 own 54% of net sales—practically North American levels.

Spain: 49% for the top 5. The grip loosens, but not by much.

UK & Germany: Each see the top 5 holding 46%.

France: Just 39%, as local heroes like Cdiscount keep the giants honest.

The Big 5 don’t just win—they set the rules. Amazon leads, Walmart is closing in, and Europe’s local champs are holding out—for now. As Amazon expands, expect market share to get even tighter. In eCommerce, the giants eat first, and everyone else gets what’s left.

From our partners

You found global talent. Deel’s here to help you onboard them

Deel’s simplified a whole planet’s worth of information. It’s time you got your hands on our international compliance handbook where you’ll learn about:

Attracting global talent

Labor laws to consider when hiring

Processing international payroll on time

Staying compliant with employment & tax laws abroad

With 150+ countries right at your fingertips, growing your team with Deel is easier than ever.

👀 Outside the Maze

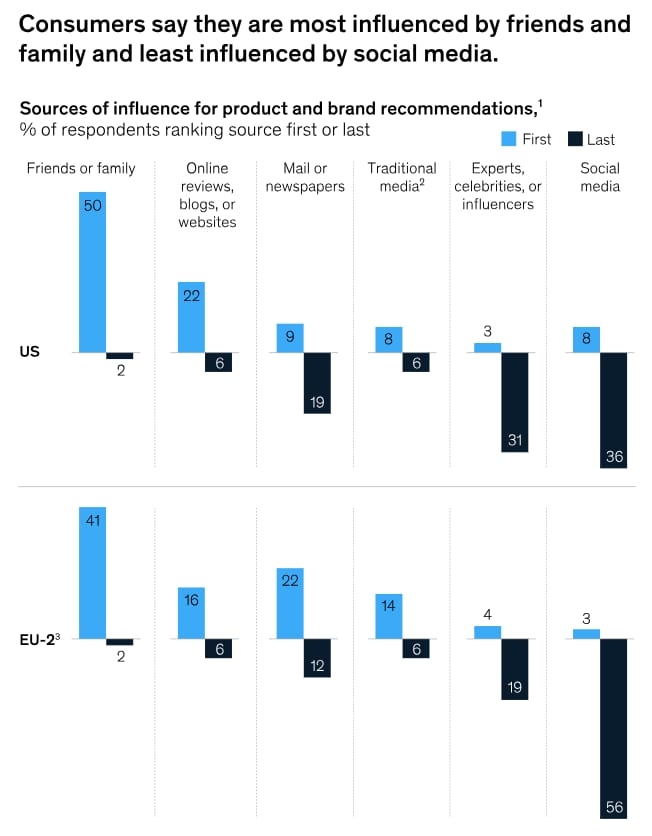

How Global Consumers Are Spending in 2024?

McKinsey dives deep into the post-pandemic wallet, mapping how consumer confidence and spending shift across markets, income groups, and categories. Over 40k people were surveyed—spoiler: shoppers are holding back on nice-to-haves but still splurging on travel and experiences. The piece breaks down where inflation bites hardest and who’s trading down vs. trading up. 👉 McKinsey

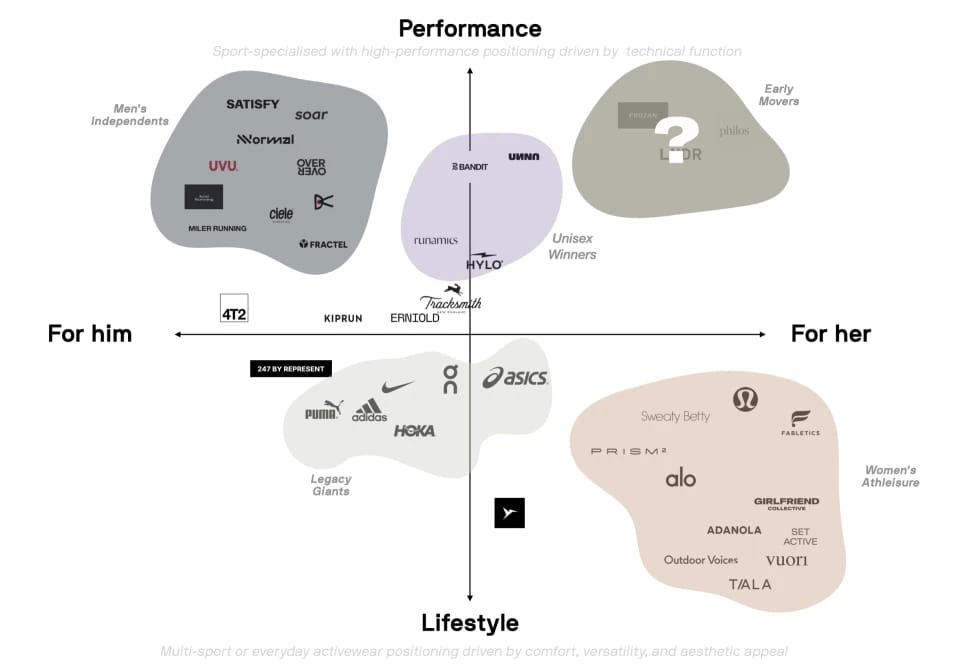

She Runs, Brands Walk?

If you think women’s sportswear is just pastel leggings and borrowed men’s tech, think again. Edition Partners dives into why the high-performance women’s sportswear market is still a white space—and why most brands keep missing the mark. The data is clear: women want more than resized shorts and a pink label. They want gear with teeth, culture, and credibility. Edition Partners scanned 44 brands to map where everyone stands and where the real opportunity is hiding. 👉 Edition Partners

Inside Vinted: The CEO’s Playbook for Beating Shein and Amazon in Secondhand.

Sifted’s podcast with Thomas Plantenga, Vinted’s CEO, is a crash course in European marketplace strategy. Plantenga breaks down why Vinted’s frictionless shipping and no-seller-fee model beats the usual secondhand slog, sharing data on growth, GMV (gross merchandise value), and where the next battlegrounds are. Expect real numbers, not fluff. 👉 Sifted

📰 Maze Briefing

🛒 Mass merchant platforms

🇺🇸 Temu Resumes Direct Sales to US After Trade Truce. Temu, owned by China’s PDD Holdings, is back selling directly to the US after a Washington-Beijing trade truce in May 2025. The South China Morning Post says this could juice up cross-border shopping big time. 👉 South China Morning Post

🇯🇵 TikTok Shop Launches in Japan to Challenge Amazon and Rakuten. TikTok’s e-commerce arm is hitting Japan, taking on Amazon Japan and Rakuten after wins in the US and Philippines. Tik Tok hgis partnering with local businesses to sell everything from clothes to gadgets. 👉 The Japan Times

🇺🇸 Walmart Launches AI Shopping Assistant Sparky. Walmart rolled out Sparky, an AI that sums up product reviews and helps plan buys. It’s their latest trick to make shopping easier and keep up with the tech wave. 👉 Retail Dive

🇺🇸 Amazon Announces Prime Day 2025 Dates. Amazon set Prime Day 2025 for July 8 to July 12, its longest yet with up to 50% off, says The Verge. They’re pushing discounts to hook new subscribers, especially young adults. 👉 The Verge

🇪🇺 Amazon Offers Prime Discount to Young Adults in Europe. Amazon’s giving 18-22-year-olds in Europe Prime for 4.50 euros a month, Heise Online notes, expanding beyond students. It’s a play to grab young shoppers despite gripes about more ads on Prime Video. 👉 Heise Online

🇪🇺 AliExpress Pledges Transparency Under EU's DSA. AliExpress, with 400 million monthly users, promised the EU better transparency under the Digital Services Act, per EU News. The European Commission still flagged new issues, hinting at fines if they don’t shape up. 👉 EU News

🇪🇺 AliExpress Launches Local+ for Faster European Shipping. AliExpress started Local+, using warehouses in the UK, Spain, and Germany for 7-day delivery in Europe, says Ecommerce News. It’s matching moves by Shein and Temu, who kicked off local storage in December 2024. 👉 Ecommerce News

🇦🇪 AliExpress Starts Selling Cars in UAE. AliExpress is now selling Chinese electric and fuel cars in the UAE, a first for big cross-border platforms, per PromosSale. With China exporting 6.41 million vehicles in 2024, this could shake up online car sales. 👉 PromosSale

🇮🇱 eBay Advises Sellers to Cancel Orders to Israel. eBay told US sellers on June 18, 2025, to cancel Israel-bound orders due to shipping chaos from geopolitical tensions, Ecommerce Bytes reports. USPS and Royal Mail have paused services there, gumming up logistics. 👉 Ecommerce Bytes

👗 Fashion, Home & Beauty Ecommerce

🇬🇧 Shein Sued for £5.8M in UK Tax Evasion. Shein, the fast-fashion king, got slapped with a £5.8M lawsuit by customs agents IT Way Transgroup Clearance and Orange Transgroup for dodging UK taxes from 2021 to 2024. With £250M in yearly UK sales, Shein’s denying it, but this mess could trip up its big IPO dreams. 👉 Modaes

🇨🇳 Shein's Emissions Surge 23% Amid IPO Plans. Shein’s 2024 report shows CO2 emissions jumped 23%, hitting 8.52M metric tons, even though it cut direct emissions by 4.4%. They’ve ballooned 176% since 2021, and while Shein’s aiming for a 25% drop by 2030, critics say its fast-fashion game makes that a long shot. 👉 Vogue Business

🇺🇸 ASOS Opens First US Pop-Up Store in NYC. ASOS, with 20M customers globally, popped up its first US store in NYC’s SoHo, selling spring/summer 2025 gear from $10 to $300. It’s pushing its new premium brand Arrange and testing the waters for more brick-and-mortar moves. 👉 Chain Store Age

🇺🇸 Tariffs Hit Secondhand Shopping Platforms. Trump’s new tariffs—like a 10% global minimum and axing the $800 de minimis rule—are jacking up prices on secondhand sites like eBay, where 40% of sales are used goods. Green groups want exemptions, but enforcement headaches mean that’s a tough sell. 👉 WIRED

🇩🇪 ABOUT YOU Revamps Marketplace for Small Brands. ABOUT YOU’s Seller Center hooks up small brands with 12M shoppers across 28 European markets, tossing in up to €50K in ad cash and no onboarding fees. It’s built for quick setup and easy shipping, aiming to turbocharge startup growth. 👉 FashionUnited

🇨🇿 Decathlon Pilots Smart Lockers for Free Sports Rentals. Decathlon’s testing smart lockers in Prague and Brno, letting folks rent sports gear like balls for free for 90 minutes via an app. It’s a slick move to get more people playing and cut waste, syncing with eco-friendly vibes. 👉 Reason Why

🇩🇪 Platform Group Enters Optician Market with Acquisitions. The Platform Group snagged two German optician firms with 30 stores for a hefty double-digit million-euro deal, folding them into its MyGlasses site. They’re eyeing more EU buys by 2026 to beef up their healthcare lineup. 👉 EQS News

🇰🇷 AliExpress Bets on K-Fashion Influencers. AliExpress is tapping Korean influencers for its Celeb Shop to push Dongdaemun fashion to teens and 20-somethings in the US, Japan, France, and Spain. The beta kicks off soon, riding the K-fashion wave to pump up sales. 👉 Korea Times

🍔 eGrocery & Food Delivery

🇺🇸 Costco and Kroger Boost Delivery with Instacart. Costco offers 30-minute Priority Delivery and No-Rush Delivery for savings via sameday.costco.com, while Kroger’s Express Delivery hits 30 minutes too, using Instacart’s Storefront Pro tech. Retailers like Harmons and Woodman’s also use it, and Instacart’s Pinterest ads enable shoppable 30-minute delivery. 👉 Pymnts

🇪🇺 Voi CEO Eyes Bolt’s Micromobility Business. Voi’s Fredrik Hjelm considers acquiring Bolt’s e-scooter and e-bike operations, as Bolt focuses on ride-hailing; Bird’s Michael Washinushi critiques Bolt’s low pricing. In 2024, Bird hit $19M EBITDA, Voi $17.9M, while Bolt’s $2.11B revenue came with a $108M loss in 2023. 👉 TechCrunch

🇬🇧 Bolt Launches E-Bikes in London. Bolt’s August 2025 e-bike launch in London integrates with its ride-hailing app, targeting short trips under 3km, with 60% of users switching when scooters are nearby. Distance-based pricing could cut speeds by 9% and collisions by 90%, serving Bolt’s 200M+ global customers. 👉 Zag Daily

🇪🇸 Just Eat-Glovo €295M Trial Ends. Just Eat claims Glovo’s freelance couriers gave an unfair edge, seeking €295M; Glovo says 80% of riders are now salaried, raising delivery costs from €4.50 to €6. Just Eat criticizes Glovo’s 24-hour service and exclusivity deals, with the Barcelona court’s ruling still pending. 👉 Catalan News

🇪🇸 Glovo Redesigns App with AI Gifting. Glovo’s app update includes AI-powered gifting via chatbot, Flash Deals for food discounts, and user profiles with favorite dishes, rolling out in 23 countries and 1,800+ cities. Daniel Alonso and Connie Kwok highlight personalized experiences to boost engagement and restaurant support. 👉 Retail Tech

🇺🇸 Uber Eats Tested Drones in 2019. Uber Eats trialed drone deliveries with McDonald’s in San Diego, using Elevate Cloud Systems for drop-offs, with drivers finishing the job, as Luke Fischer emphasized FAA safety. Amazon’s 2019 drone plans pushed competition, with Uber eyeing vehicle-landing drone tech. 👉 Pymnts

🇮🇳 Swiggy’s Crew App Targets Luxury. Swiggy’s Crew app, launched as an invite-only pilot, offers premium services like travel bookings and gifts, following Rare Life’s debut. Available on Apple and Google Play, it joins Pyng and Assure in Swiggy’s “house of brands” strategy, competing with Zepto Cafe. 👉 YourStory

🇬🇧 Boots Expands Late-Night Delivery. Boots’ trial in 10 London stores offers 10K products via Uber Eats and Deliveroo, some in 20 minutes, serving 2M+ customers until midnight. Top items include cold remedies and gifts, building on partnerships since 2021 and 2023. 👉 Retail Gazette

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team