Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

Welcome back, gang. Q2’s ad auctions turned into a game of musical chairs—Temu, Shein, and Amazon all sat one out, and smaller brands finally grabbed a seat. Meanwhile, ecommerce search is still losing shoppers faster than a bad first date.

INSIGHTS🧠

🧊 Google Shopping Reshuffled

💎 Broken Search = Broken Sales

🧨 6 Retail Disruptions You Can’t Ignore

💥 China De Minimis Ends, Temu Crashes

🔻 Platforms Are Bleeding Sellers

NEWS📖

🇺🇸 Gmail pilots Demand Gen ads in Promotions tab

🇨🇳 TikTok Shop forces GMV Max ads on merchants

🇺🇸 Klaviyo drops 24/7 AI agent to lift DTC sales

🇫🇷 Criteo & Mirakl link up to tap $204B retail media

🇪🇺 EU scraps €150 duty waiver, adds €2 parcel fee

🇺🇸 FedEx hikes peak fees; Oversize now $108.50

+ 15 other handpicked news from the last week you need to know 🔥

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Google Shopping Reshuffled in Q2 🧊

Retail search made a comeback. But not because brands spent more—because some giants spent less. Based on Tinuiti’s Q2 2025 Digital Ads Benchmark (tracking $4B in ad spend), advertisers seized rare moments in Google Shopping as Temu, Shein, and Amazon pulled back. CPC inflation cooled, auctions opened up, and nimble brands clicked their way in.

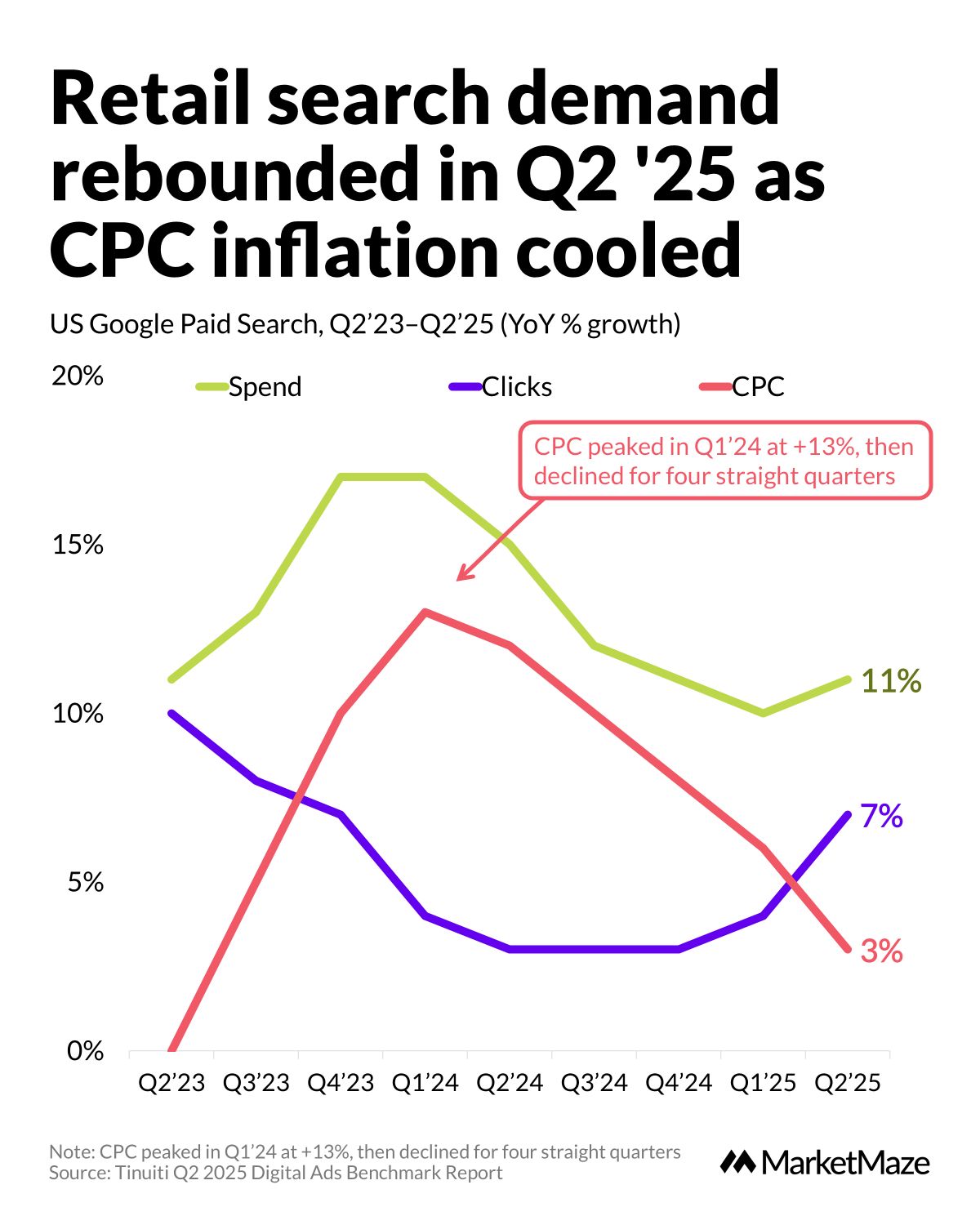

Retail demand rebounded as CPCs cooled 🧊

Google paid search clicks rose +7% YoY in Q2’25, the best growth in five quarters. CPC inflation finally eased, dropping to +3% after peaking at +13% in Q1’24. Spend still climbed +11%, showing that advertisers stayed active—but paid less per click. That’s a win. After four quarters of rising costs and flat engagement, retailers are finally seeing better ROI on search.

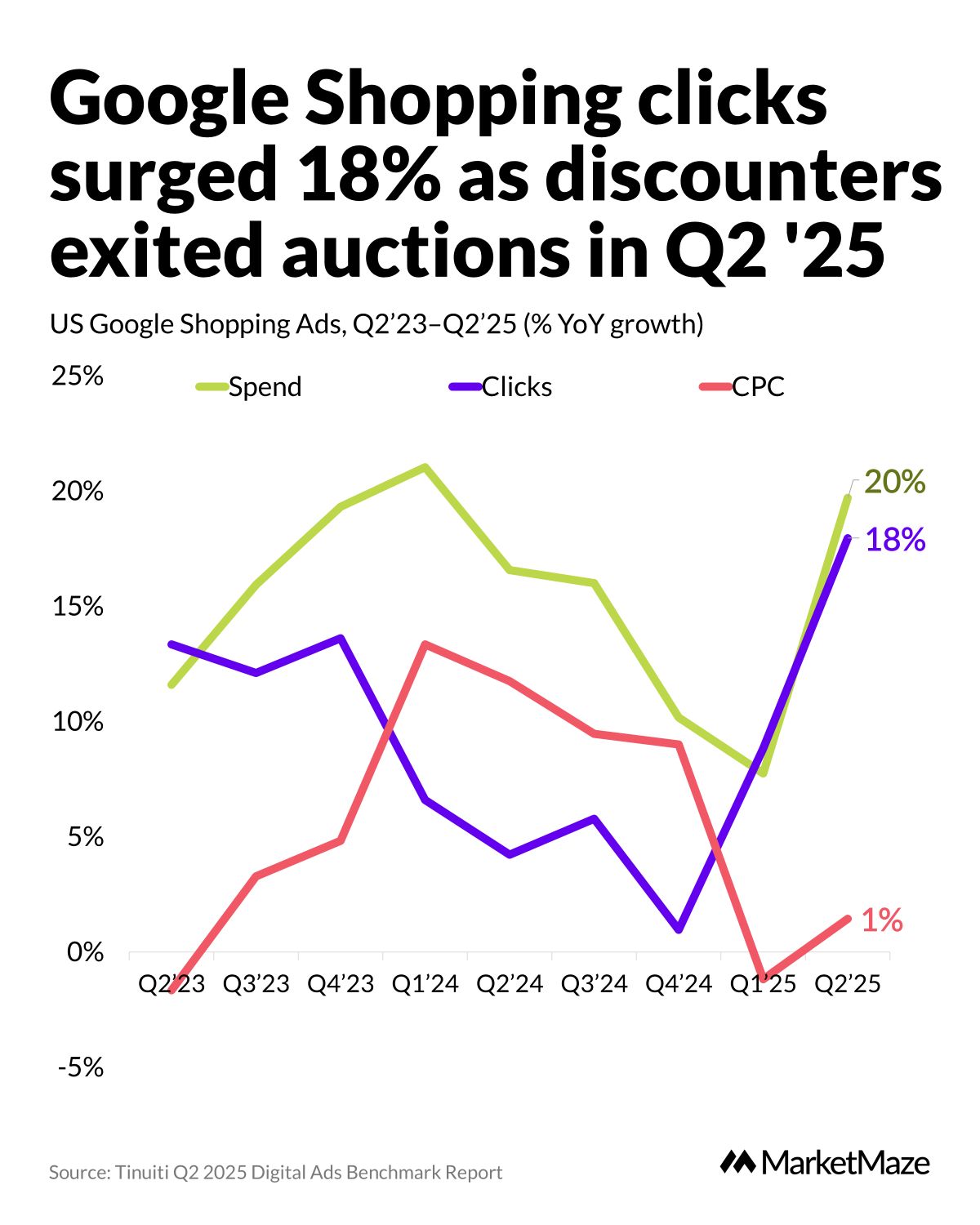

Shopping clicks surged after discounter exits 🚪

Google Shopping clicks jumped +18% YoY in Q2’25, nearly triple Q1’s growth. But it wasn’t just organic performance—it was competitive disappearance. CPCs stayed nearly flat (+1%) as Temu and Shein exited the auction in April. Amazon also slashed its Shopping presence in late May. With fewer whales in the pool, smaller brands started winning the clicks and conversions.

Temu vanished, Amazon blinked in May 👻

Temu’s Shopping ad share fell off a cliff in April, from 13% to 0%, following U.S. tariff hikes. Shein followed, briefly, before bouncing back to 22% in June. Amazon, meanwhile, saw its largest drop since March 2020—down 32 pts in two weeks. It rebounded in June, but the damage was done. This reshuffling opened up impression share across Google Shopping, and the auction got a whole lot more democratic.

From our partners

AI native CRM for the next generation of teams

Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

Join fast growing teams like Flatfile, Replicate, Modal, and more.

💎 Data Treasure

Broken Search = Broken Sales 🔍

The 2025 Commerce Relevance Report from Coveo (N=4,000 US/UK shoppers, Nov '24) delivers a brutal truth: ecommerce still fumbles the basics. Search is broken. Discovery is frustrating. And shoppers are out. The data shows that bad search is more than an inconvenience — it's a conversion killer. Here's the breakdown.

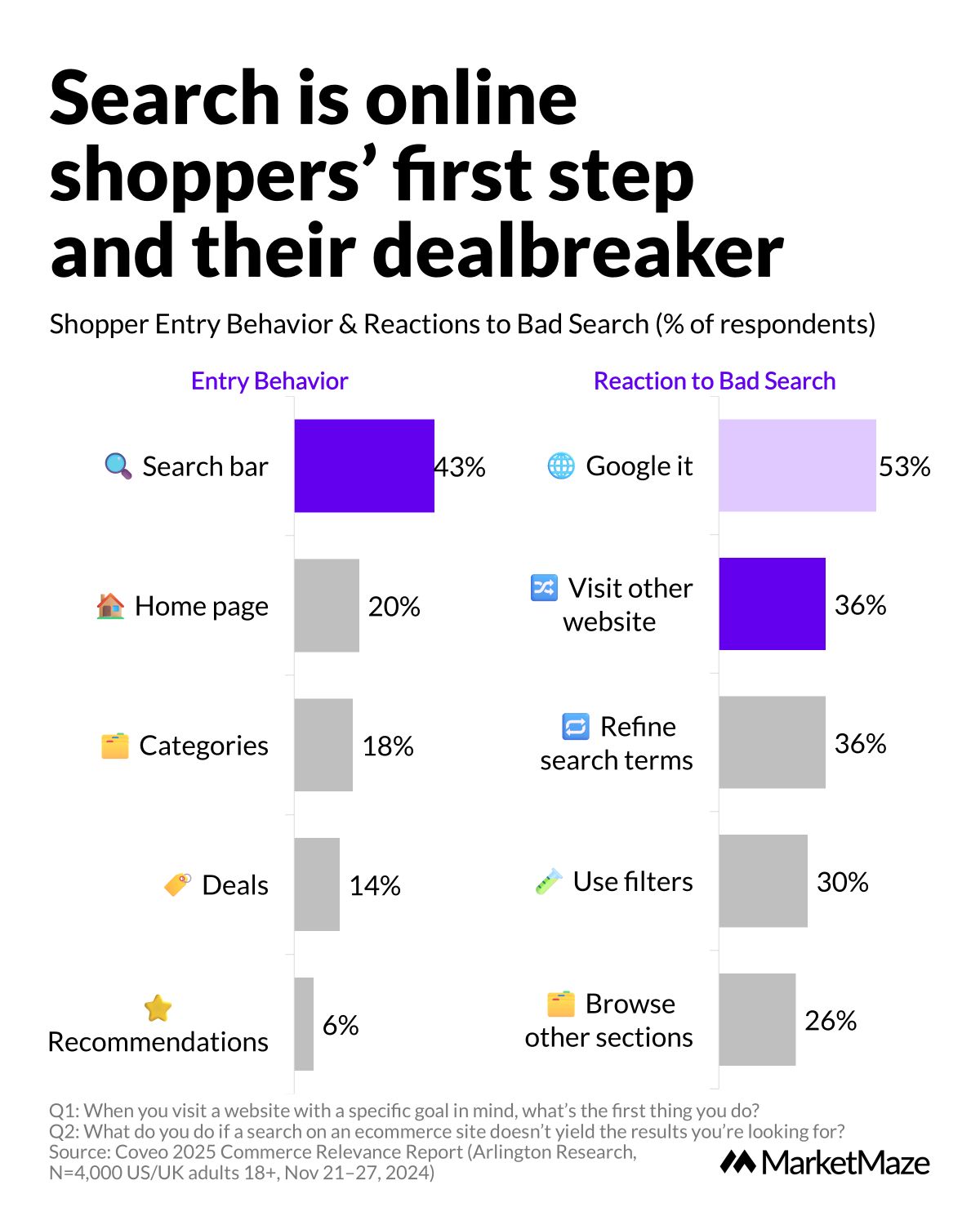

Search is the first click — or the last one 🧭

43% of online shoppers begin with the search bar. But if it doesn’t deliver, they’re gone. Over half (53%) bounce to Google, 36% jump straight to a competitor. Search isn’t just the entry point — it’s also the dealbreaker. Forget homepage sliders. Your search box is the homepage now. If it’s slow or off-target, shoppers leave faster than a bad Tinder date.

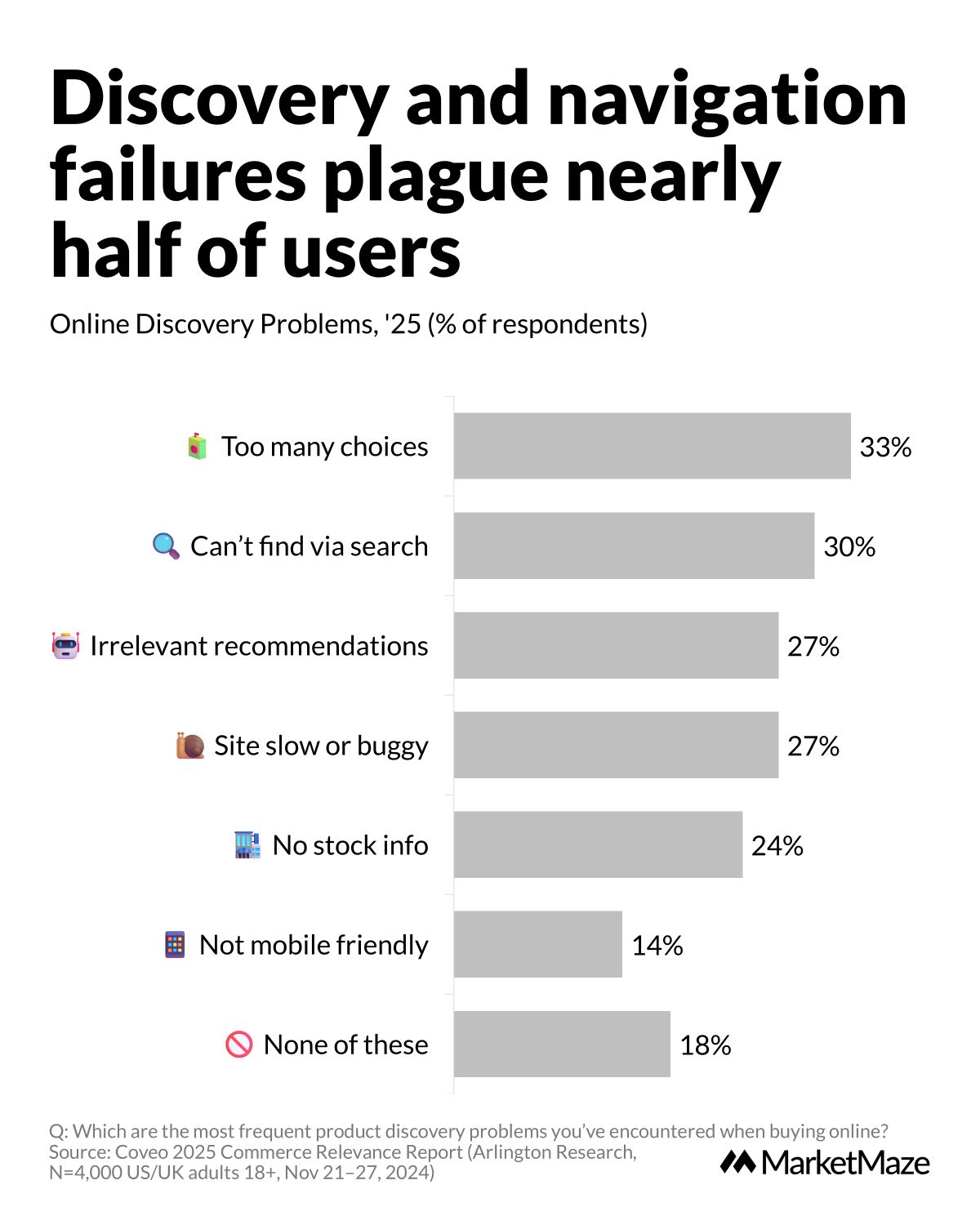

Most ecommerce sites still fail the basics 😵

Shoppers aren’t asking for much: relevant results, clear filters, and a glitch-free site. Yet 43% report issues with navigation or search. 1 in 3 feel overwhelmed by too many irrelevant choices. 30% can’t even find what they want. Add in slow pages, broken stock info, and irrelevant recommendations, and you’ve got a UX crime scene. That’s how you burn trust and lose carts.

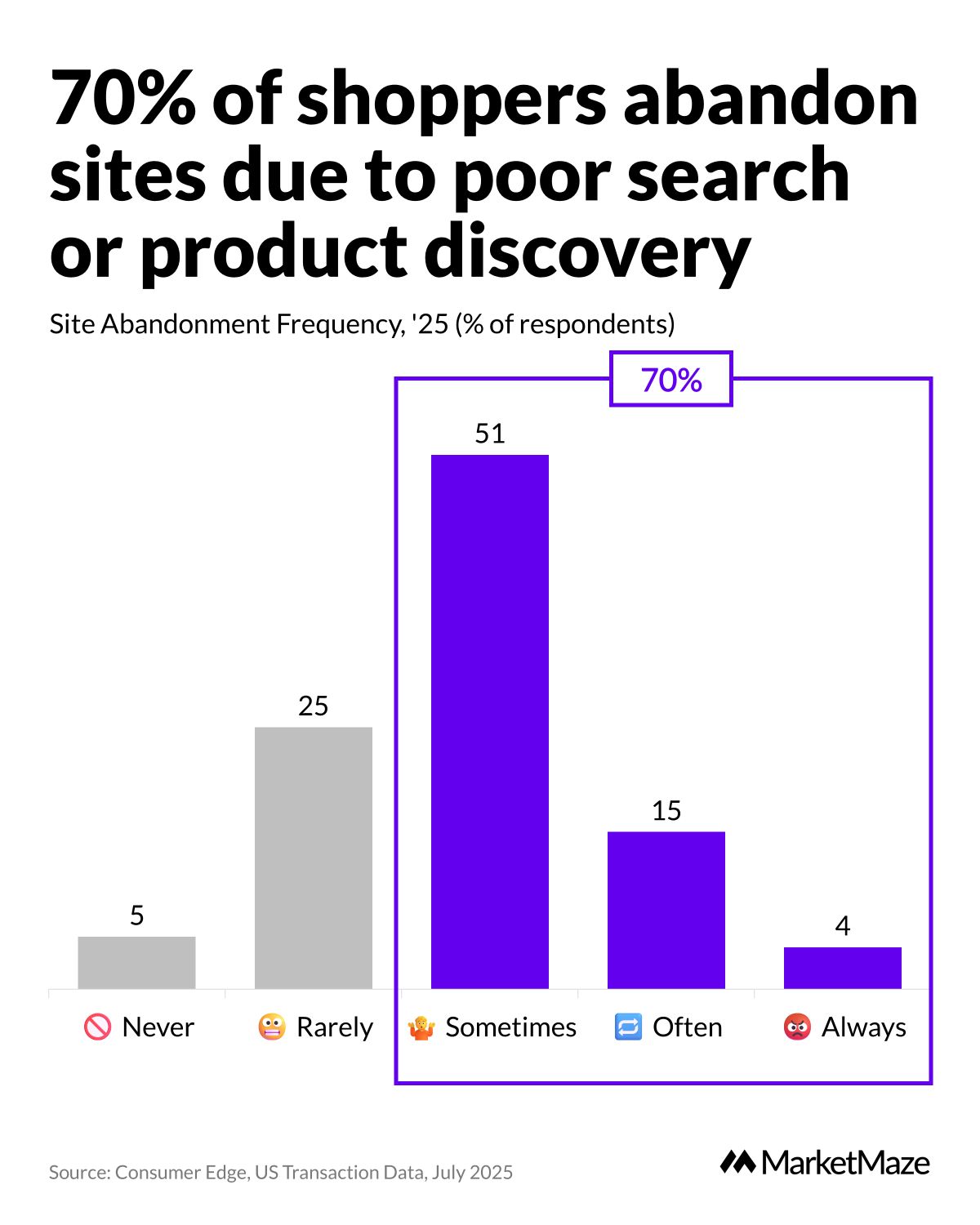

Frustrated users become ex-customers 🏃♀️

This isn’t just annoyance — it’s revenue walking out the door. 70% of shoppers say they’ve abandoned a site because of bad search or product discovery. Only 5% have never done it. Most abandon "sometimes" (51%) or "often" (15%). In a world of one-click options, poor UX isn’t a mistake — it’s a margin killer. If search and discovery don’t work together, your checkout page never sees daylight.

From our partners

Premium Marketing. 0% Effort, Real Results.

Tired of chasing leads or losing hours trying to stay relevant online? Lightpost hands you a custom-built A.I. that handles every part of your marketing—automatically. Here’s what you get:

New Leads, More Revenue: Watch your pipeline grow as Lightpost attracts customers for you.

Daily Content, Zero Effort: High-quality posts go out across all your social channels, every day.

Top Google Rankings: Your business rises up search results with smart, SEO-driven updates.

Tailored for Your Brand: Forget cookie-cutter. Everything is crafted just for you.

World-Class Presence: Look and sound elite online—no agency, no hiring, no stress.

Full Control, No Hassle: You approve what matters. The A.I. does the rest.

For busy teams and business owners who want real results (not another headache).

Try Lightpost free—see what zero-effort, premium marketing feels like.

👀 Outside the Maze

🧨 6 Retail Disruptions You Can’t Ignore 🔮

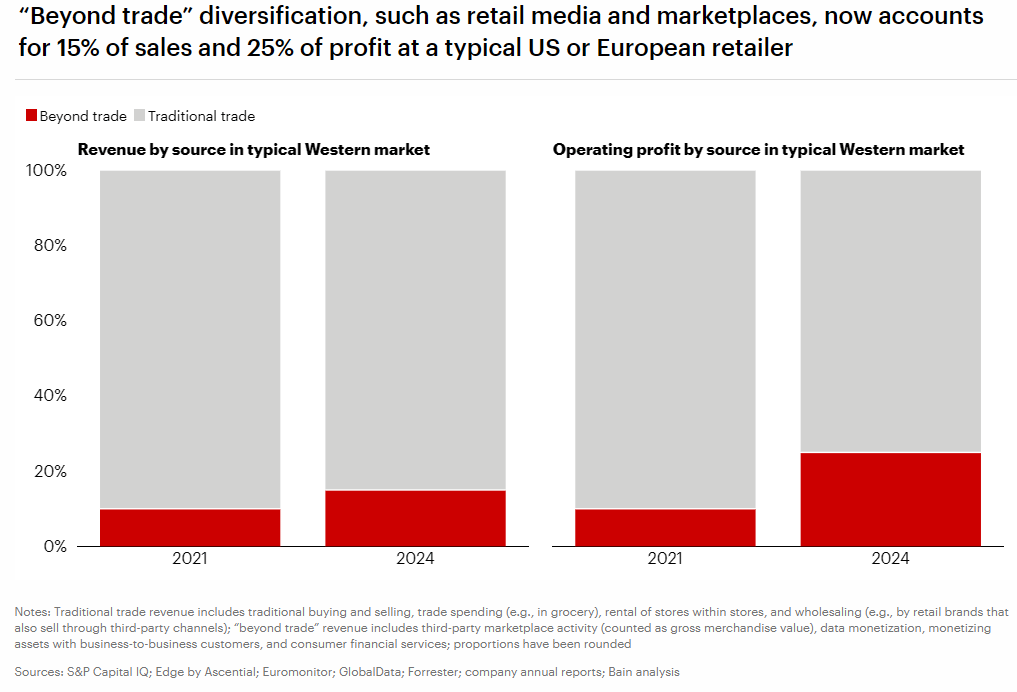

Bain & Company outlines six forces shaping retail’s next decade. From AI copilots and automation to private-label wars, beyond-trade profits, and sustainability regulation. One stat jumps out: “Beyond trade” (like retail media, marketplaces) now drives 25% of profits for Western retailers. Traditional trade is no longer the profit engine.

👉 Bain & Company

📉 China De Minimis Ends, Temu Crashes 💥

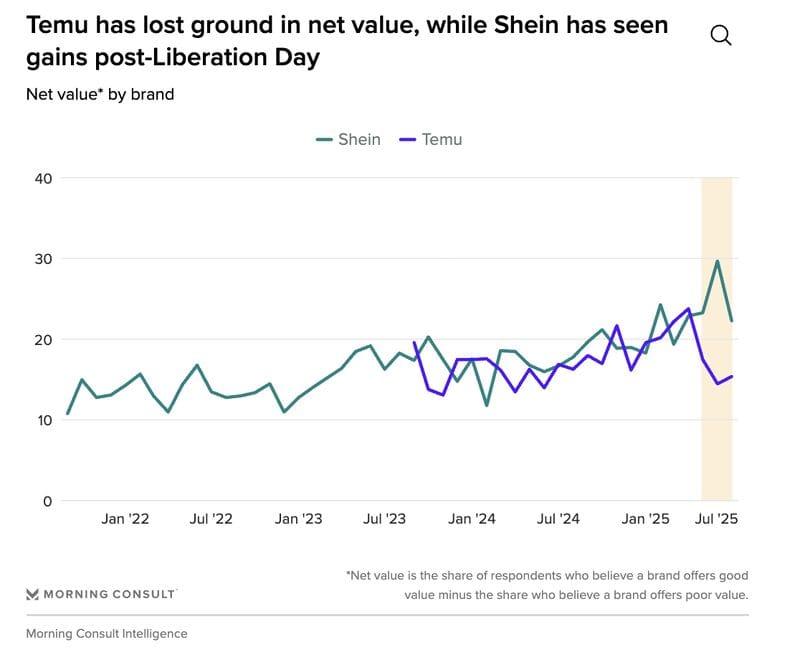

Sonnet Frisbie and Claire Tassin unpack the collapse of Temu and Shein usage after the U.S. canceled tariff exemptions (de minimis) for China on May 2. Temu’s user drop was steep, though both brands saw a bounce in June. The bigger story? By 2027, all countries lose access. Trump’s new OBBBA bill just rewired the import game.

👉 Sonnet Frisbie on LinkedIn

🇩🇪 German Shoppers Flock to Temu 🧧

According to Statista, Temu went from 0% to 27% market penetration in Germany in just two years. Meanwhile, Amazon, eBay, and Otto are slowly bleeding share. Chinese platforms are no longer fringe—they’re mainstream in the EU’s biggest economy. AliExpress hit 14%, up from 10% in 2023.

👉 Statista Consumer Insights

🌍 Expand to Europe or Get Left Behind ✈️

Only 1% of U.S. Amazon sellers are on Amazon Europe. Yet Amazon Germany + UK hit nearly $80B in 2024, up from $70B in 2023. 1.5B monthly visits. Hellotax offers a free expansion blueprint and $3K+ in perks to enter the EU market. 99% of your competition is sleeping on this.

👉 Hellotax on LinkedIn

📉 Platforms Are Bleeding Sellers 🔻

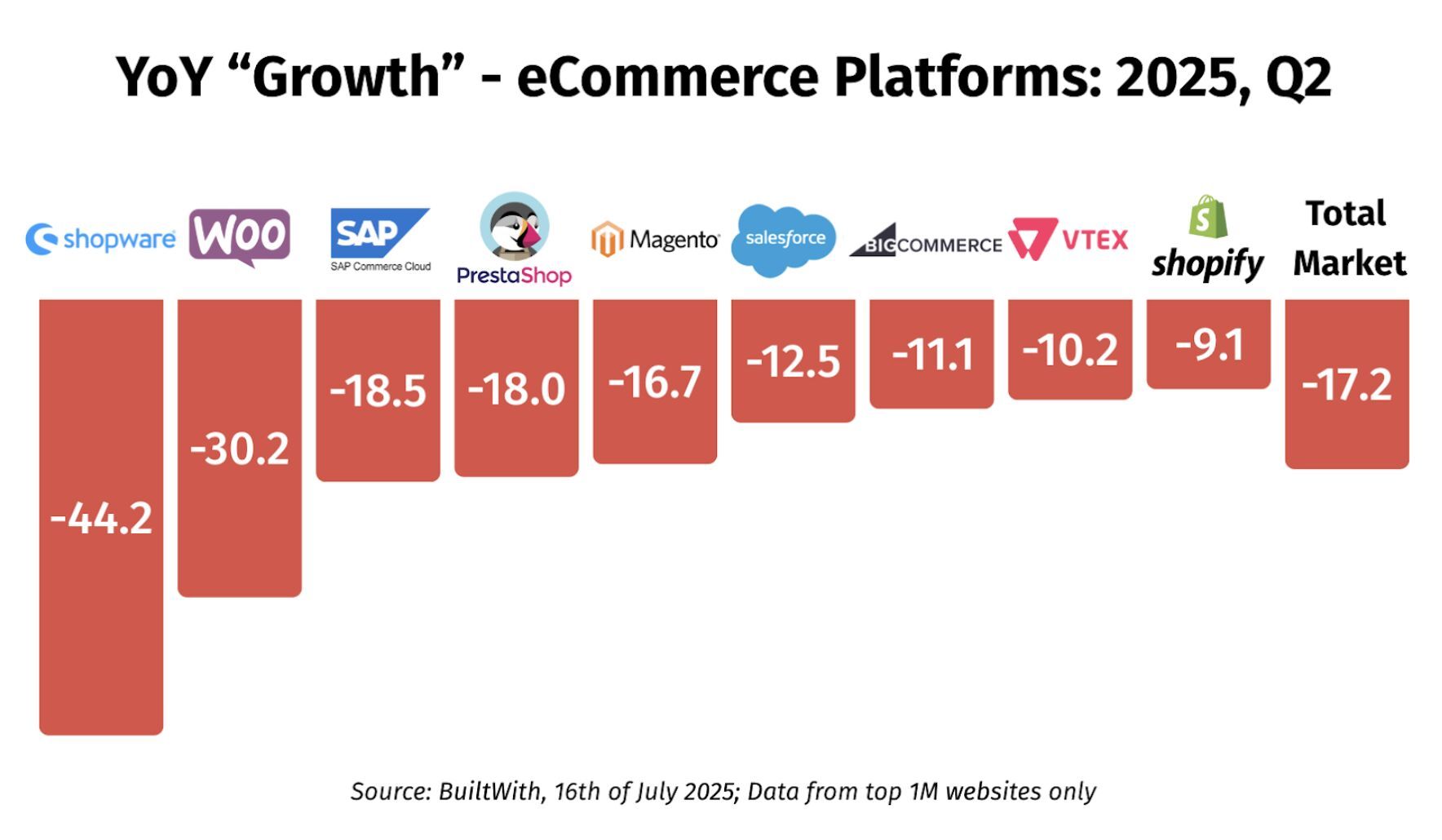

According to BuiltWith (July 2025), nearly every major eCom platform saw a drop in usage among top 1M websites. Shopware is down 44%, WooCommerce -30%, SAP -18%. Even Shopify dropped -9%. Total market down -17%. Only the fastest and most data-native survive.

👉 Valentin Radu on LinkedIn

📰 Maze Briefing

📣Ecommerce Marketing

🇺🇸 Gmail pilots Demand Gen ads in Promotions tab now. Google began a July 15 test placing Demand Gen e-commerce ads in Gmail's Promotions tab. Units expand to a carousel with price, rating and shipping tags, giving brands a fresh conversion touchpoint inside inboxes and feeding AI bidding data. 👉 Search Engine Land

🇮🇳 Flipkart launches credit ads to aid small sellers. On Jul 17 Flipkart let 1.4 M sellers run ads now, pay next month. The credit line has no fees and already signed 24 000 merchants, aiming to boost ad reach before the marketplace’s expected 2025 IPO. 👉 Storyboard18

🇺🇸 Google Ads gets AI Max search-URL audit view live. Google on Jul 17 rolled out a new AI Max report showing the exact search terms and landing pages its automation pairs. Advertisers can prune poor matches, compare assets and tighten bidding before brand-safety controls arrive later this quarter. 👉 Search Engine Land

🇨🇳 TikTok Shop forces GMV Max ads on merchants world. TikTok told merchants that from Jul 15 all Live, Product and Video Shopping ads auto-migrate to GMV Max, its algorithm that maximises total checkout value. Early users lifted ROI to 2.6 and GMV by 30 % but lose granular control and must upload fresh creatives daily. 👉 Kr-Asia

🇺🇸 Xnurta adds Amazon ad support in five new markets. On Jul 14 Bellevue-based Xnurta added Sponsored Products, Brands, Display and DSP tools to Poland, Belgium, Sweden, Egypt and South Africa, reaching 84.8 M new monthly visitors. Its AI Copilot now steers 2 M bids daily as headcount rises 42 % ahead of a hinted IPO. 👉 BusinessWire

🛠️Ecommerce Software

🇳🇱 Mollie enters CEE with three payment markets, now. Dutch PSP Mollie went live in Hungary, Slovenia and Czechia on 15 Jul 2025, adding Apple Pay, Google Pay and Klarna for 250 000+ merchants through one fraud-protected dashboard. CEO Koen Köppen says the move is “a key step” toward border-free commerce. 👉Ecommerce News

🇺🇸 Klaviyo drops 24/7 AI agent to lift DTC sales now. Klaviyo opened beta of a Conversational AI agent on 15 Jul 2025; it sits in Klaviyo Service and pulls from 7 bn profiles to answer questions, track orders and suggest products 24/7. Pilot brand ThirdLove booked $200 k in four months as Klaviyo preps returns and WhatsApp support. 👉ChannelX

🇵🇹 Worten adopts Mirakl Ads to juice marketplace rev. On 14 Jul 2025 Portugal’s Worten activated a Mirakl Ads platform, turning 180 m annual visits into CPC slots for 3 000+ sellers. Pilot lifted seller sales penetration by 40 pts, which Digital Chief Marta Sousa calls a win-win-win. 👉Mirakl

🇫🇷 Criteo & Mirakl link up to tap $204B retail media. Criteo fused its 225-retailer commerce-media stack with Mirakl’s 450 marketplaces and 100 000 sellers on 17 Jul 2025 to chase the $204 bn retail-media pool forecast for 2027. Criteo’s Melanie Zimmermann says it “unlocks long-tail ad spend,” Mirakl’s Octavie Gosselin sees untapped power. 👉PPC Land

🇨🇦 Clearco rolls out Rolling Funding for ecom brands. Clearco debuted Rolling Funding on 10 Jul 2025, a line that refills dollar for dollar as weekly repayments land, ending re-applications and showing live capacity in its dashboard. Millions have been approved since May; COO Olivier Grinda says it puts capital on autopilot. 👉Business Wire

🇺🇸 Ordoro turns tracking clicks into branded loyalty. Ordoro released Branded Tracking Pages on 10 Jul 2025 for Shipping Premium users, swapping carrier links for logo-rich pages with FAQs, promos and socials. Buyers check tracking up to four times, turning each visit into a free upsell moment. 👉PR Web

🇺🇸 New Gen adds AI stores with builtin Visa checkout. New Gen revealed AI-native storefronts on 10 Jul 2025, hosting catalog data on sub-domains that surface to chat or voice agents and finalize payments via Visa. Gen-AI traffic to US retail sites rose 1 200 % year-on-year; backers include South Park Commons, Matrix and ex-Stripe execs. 👉PR Newswire

🚚Ecommerce Logistics

🇪🇺 EU scraps €150 duty waiver, considers €2 parcel fee. The European Parliament voted 530-48 to axe the de-minimis break and slap a €2 handling charge on about 12 m low-value parcels a day, many from Temu and Shein. Rapporteur Liesje Schreinemacher says AI-driven checks start rolling out in 2028. 👉 Ecommerce News

🇺🇸 FedEx hikes peak fees; Oversize now $108.50. From 29 Sep 2025 the carrier adds three surcharge waves, topping out at $10.90 for Handling, $108.50 for Oversize and $545 for Ground-Unauthorized, plus a residential tier peaking at $8.75. EVP Brie Carere cites 24 m Cyber-Monday parcels as the stress test. 👉 Supply Chain Dive

🇮🇪 DHL unveils 265k-sq-ft life-science hub in Dublin. The €50 m warehouse packs 33 k pallet slots, chilled docks and a digital control tower for pharma and tech clients. Solar roofs, biomethane trucks and rain-harvesting earn BREEAM “Excellent” and create 110 jobs in DHL’s £550 m UK-Ireland build-out. 👉 Trans.INFO

🇮🇳 Blip, India’s 30-minute fashion app, closes shop. Co-founder Ansh Agarwal shut the Bengaluru startup on 12 Jul 2025 after GMV froze near ₹3 cr, far off a ₹100 cr target as CAC and delivery costs soared. With only $18 m sector funding in H1 2025 versus $942 m for grocery q-commerce, Blip is quick-fashion’s first bust. 👉 Apparel Resources

🇷🇺 Wildberries pilots 60-min meals in Moscow, StP. The $28 bn e-commerce giant links its app to Dostaevsky kitchens, offering 450 dishes in an hour via Delivery-by-Seller couriers. The move taps a food-delivery market up 30 % in 2024 and readies a rollout to 135 hubs ahead of a 2026 IPO. 👉 Vietnam Investment Review

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team