Welcome to MarketMaze, the #1 newsletter for staying on top of the latest in Ecommerce & Marketplaces.

TODAY’S MAZE

Welcome to another round of MarketMaze, where Google’s latest algorithm tantrum is sending shockwaves through SEO teams—and e-commerce brands are watching their organic traffic vanish faster than your willpower at a buffet.

In this issue we dig into why “page one” isn’t what it used to be, how product widgets are eating everyone’s lunch, and why the best clicks now belong to the underdogs. Plus, Europe’s e-pharmacy scene is a street fight, and Amazon just ghosted Google’s ad business.

INSIGHTS🧠

💥 Google’s SEO Redo Just Began

💎 Europe’s e-Pharmacy Titans

🇺🇸 Tariffs vs. Shein’s $3 Tank Top

🛒 Walmart’s eGrocery Win Streak Continues

🧨 Amazon Just Ghosted Google Shopping Ads

🔥 Prime Day’s Ripple Effect Across Ecom

NEWS📖

🇺🇸 Google’s Ad Revenue Hits $54B in Q2 2025

🇮🇳 WhatsApp Tests Real-Time Voice Mode for Meta AI

🇺🇸 Klaviyo launches Conversational AI Agent

🇺🇸 Klarna and Poshmark partner for easy resale

🇺🇸 US and Japan strike $550B trade and tariff deal

🇩🇪 DHL adds 2,400 Ford Pro e-vans to delivery fleet

+ 15 other handpicked news from the last week you need to know 🔥

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

🌀 Maze Story

Google’s SEO Redo Just Began 💥

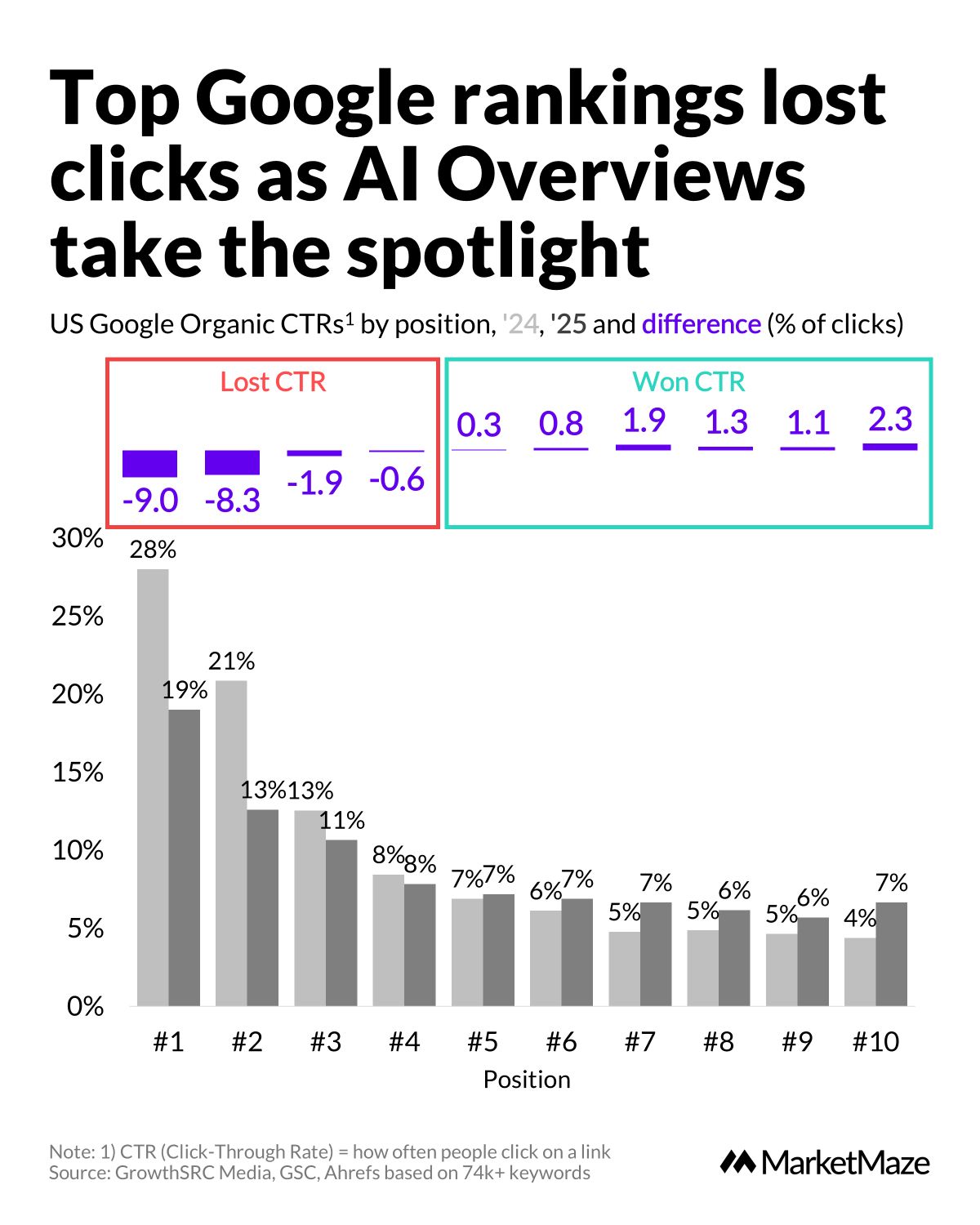

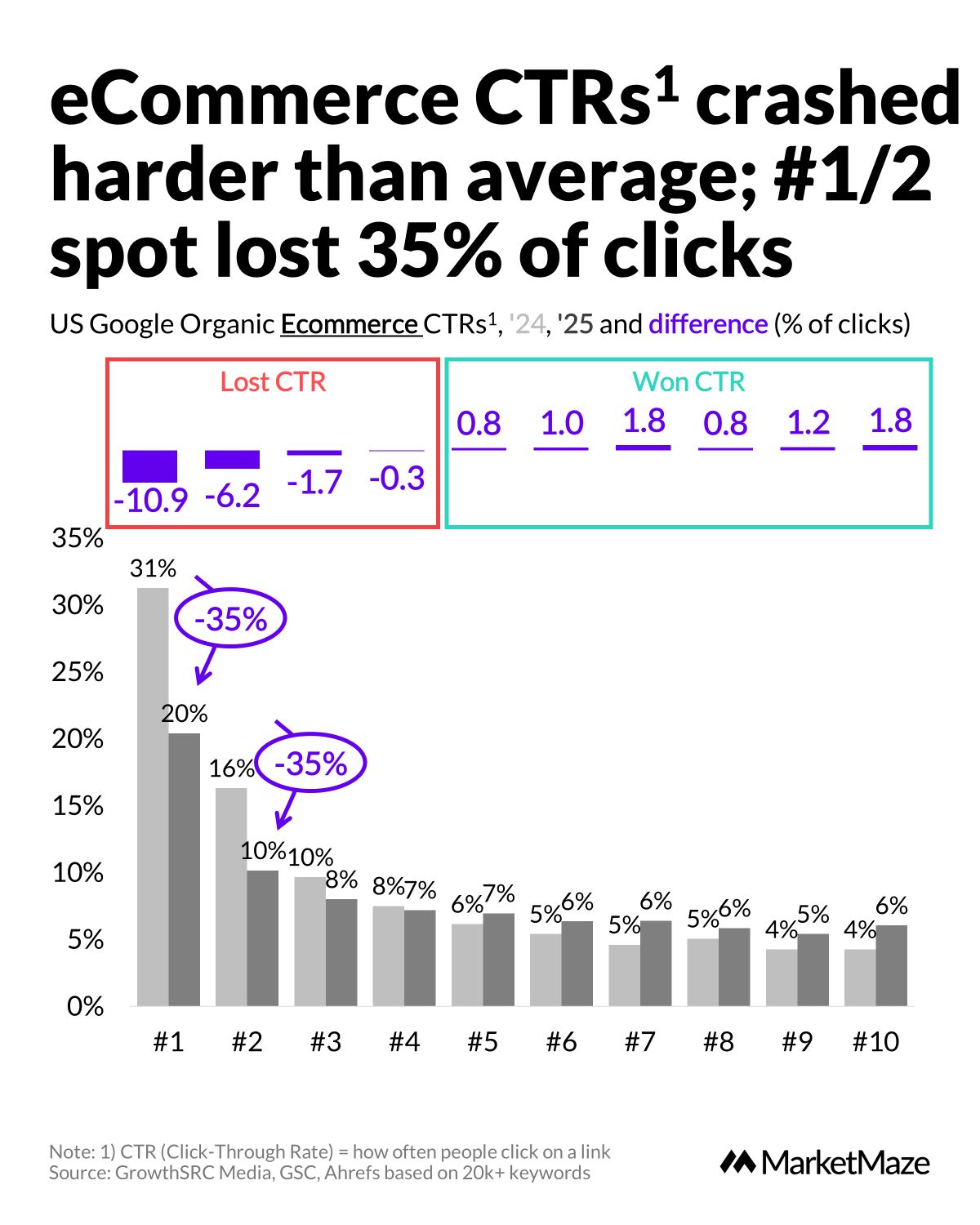

Google just flipped the search game. According to a new study by GrowthSRC Media using Google Search Console and Ahrefs data, AI Overviews and product widgets are crashing organic CTRs. They tracked 74K+ keywords across general and eCommerce queries, and the results are brutal: top spots are losing up to 35% of clicks, while lower positions are suddenly winning. Here's what the data says.

AI Overviews Stole the Spotlight 🤖

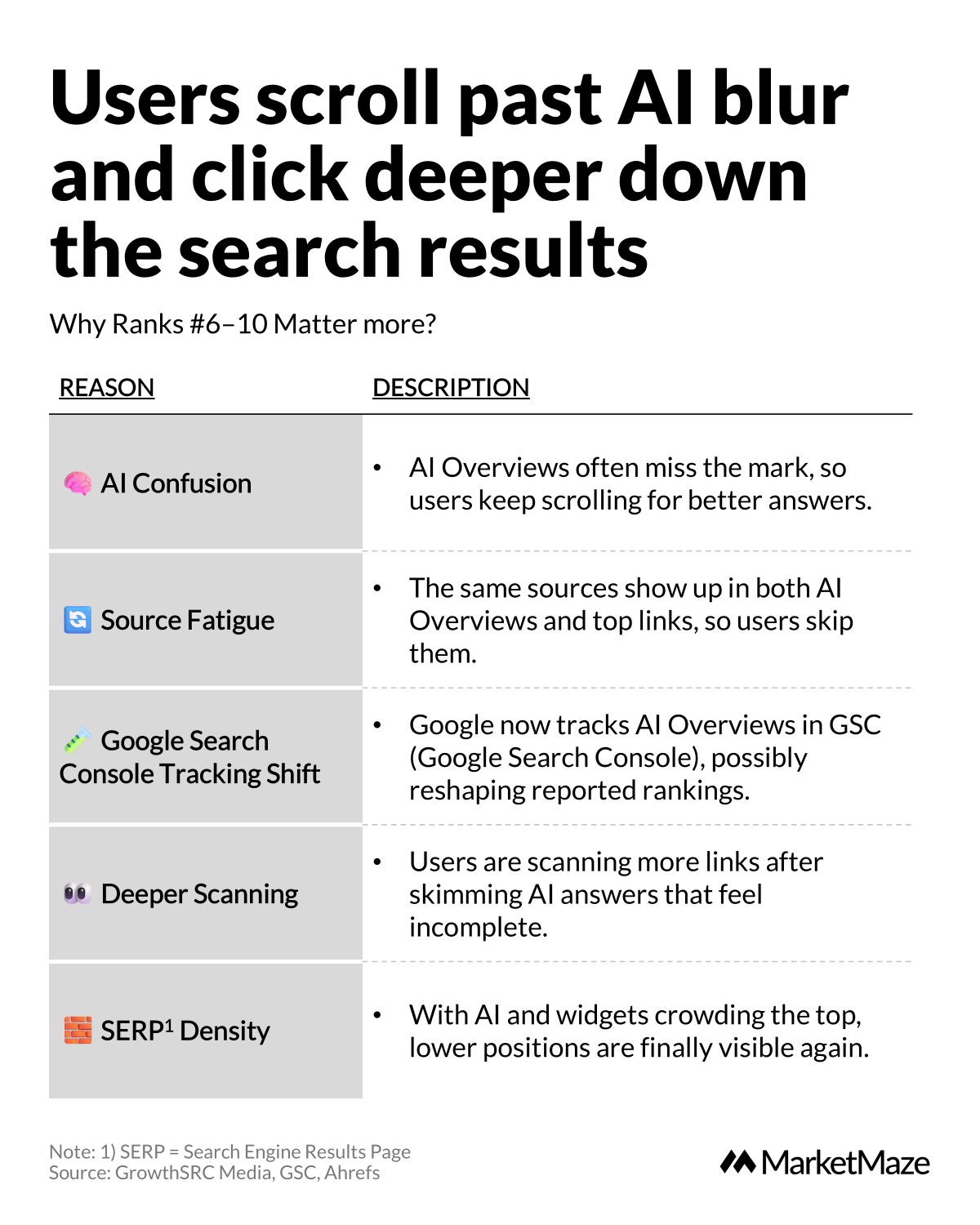

The #1 organic result in 2024 used to get 28% of clicks. In 2025, it's down to 19%. Positions #2–3 also dropped 8–9%. Blame Google's AI Overviews. They're swallowing attention at the top, while positions #6–10 are seeing small but steady click gains. Users are skipping the robotic answers and scrolling for the real stuff. It's not a Google search result anymore. It's Google’s opinion.

eCommerce Got Hit Even Harder 🛍️

If general search lost blood, eCommerce got gutted. The top 2 spots for shopping queries saw a 35% drop in clicks, with CTRs for #1 falling from 31% to 20%. This is worse than what we see across broader search, confirming that Google’s shopping SERP updates—especially product widgets—are choking organic traffic for online retailers. Paid or perish, folks.

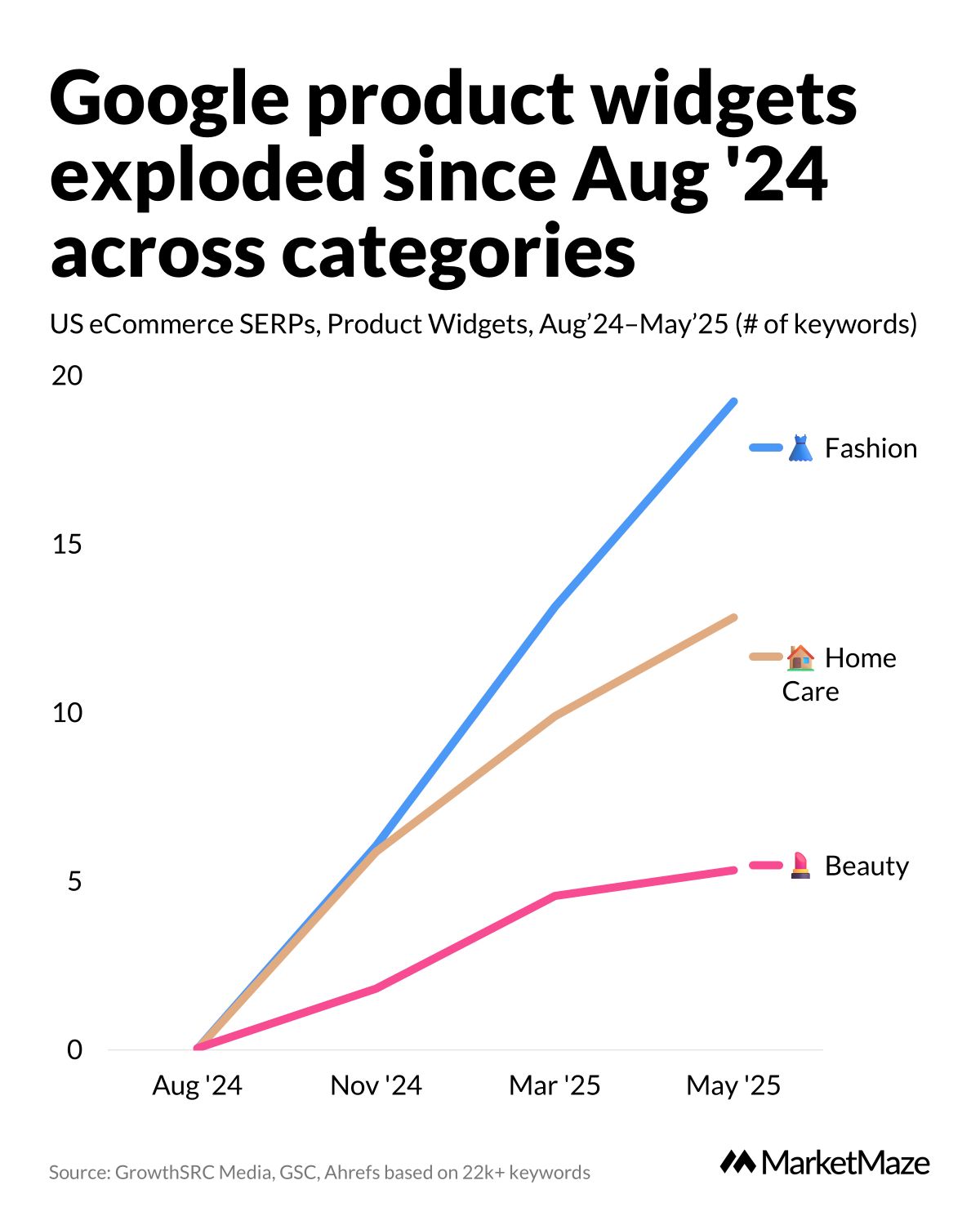

Product Widgets Took Over SERPs 🧱

Product widgets went from rare to everywhere. Since August '24, the number of eCommerce keywords showing these visual shopping blocks exploded. These widgets are drawing users in and keeping them in Google's garden. The takeaway: Google is not just a search engine—it's becoming a retail interface.

Lower Rankings Are Suddenly Cool 🕶️

There’s life after the fold. Positions #6–10 are seeing rising CTRs, partly because AI Overviews fail to satisfy intent, and partly due to repetition fatigue from the top results. Google’s shift in Search Console tracking may also be pushing more visibility to these lower ranks. With top SERP real estate cluttered by AI and widgets, the underdogs are finally getting their clicks.

From our partners

Inventory Software Made Easy—Now $499 Off

Looking for inventory software that’s actually easy to use?

inFlow helps you manage inventory, orders, and shipping—without the hassle.

It includes built-in barcode scanning to facilitate picking, packing, and stock counts. inFlow also integrates seamlessly with Shopify, Amazon, QuickBooks, UPS, and over 90 other apps you already use

93% of users say inFlow is easy to use—and now you can see for yourself.

Try it free and for a limited time, save $499 with code EASY499 when you upgrade.

Free up hours each week—so you can focus more on growing your business.

✅ Hear from real users in our case studies

🚀 Compare plans on our pricing page

💎 Data Treasure

Europe’s e-Pharmacy Titans 💊

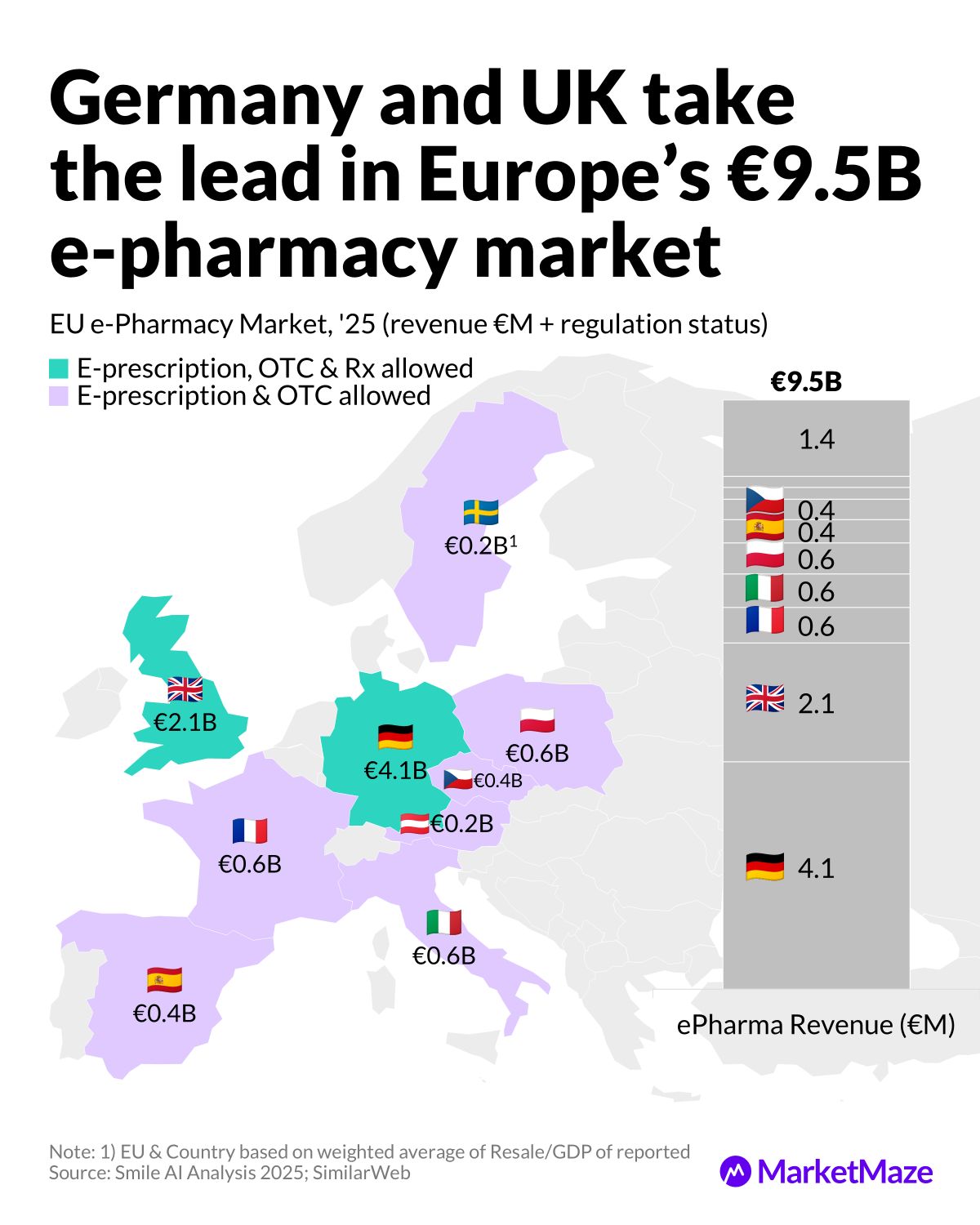

Europe’s e-pharmacy market is now worth €9.5B and the leaderboard just got interesting. Smile AI Report shows Germany and the UK sprinting ahead, but every country crowns its own digital hero. This is not Amazon’s world—every market is a turf war, and the winners are local giants.

Germany and UK Dominate e-Pharmacy Revenue 🚀

Germany is the undisputed e-pharmacy heavyweight, hauling in €4.1B, with the UK clocking €2.1B. Both allow e-prescription, OTC, and Rx sales—putting them miles ahead of France, Italy, and Poland at €600M each, who only allow e-prescription and OTC. Spain and Czechia trail at €400M. Only Berlin and London let you order everything from aspirin to antibiotics online. Regulatory bottlenecks mean the rest of Europe is still stuck in the waiting room.

No One-Size-Fits-All Pharmacy Hero 🦸♂️

Every country has its own e-pharmacy champion. The UK’s Pharmacy2U, France’s PharmaGDD, Italy’s Redcare, Poland’s DOZ.pl, and Spain’s PromoFarma all rule their home turf. Second-place finishers include Chemist4U, Atida, Dr.Max, Gemini.pl, and Atida Mifarma. But behind the scenes, pan-European titans like Redcare, DocMorris, and Atida are everywhere, shaping traffic and trust. There’s no Amazon effect here—only a fragmented digital pharmacy map ruled by local heroes with continental backers.

From our partners

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

👀 Outside the Maze

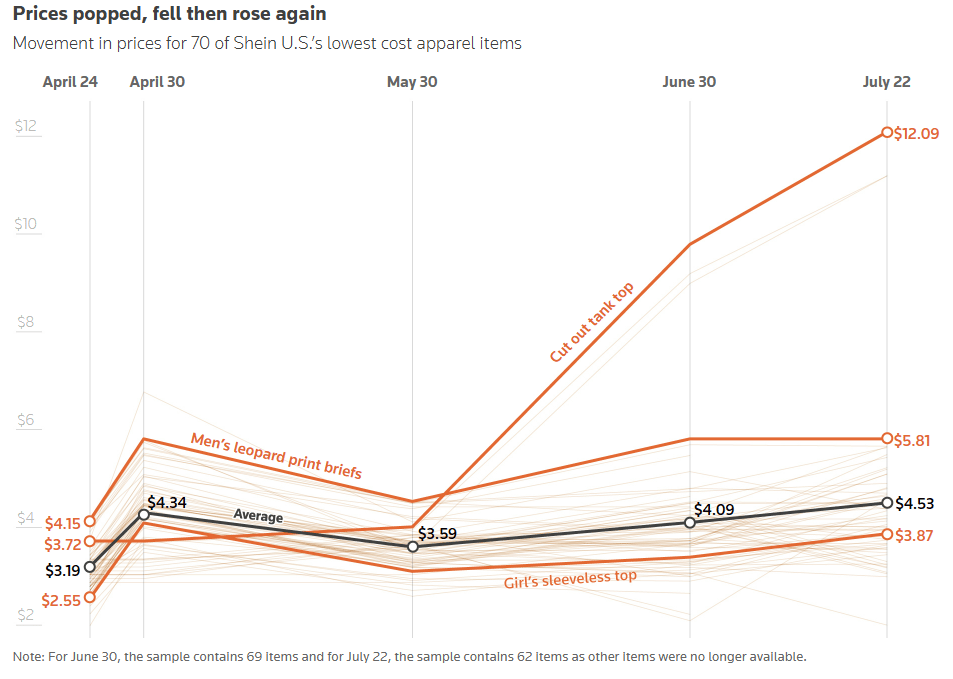

🇺🇸 Tariffs vs. Shein’s $3 Tank Top 💥

Reuters dives into how Trump-era tariffs are colliding with Shein’s ultra-low prices. The analysis shows that some $3 items would cost more to import than sell, calling into question Shein’s long-term viability under tightening rules. Add this to the geopolitical headwinds already threatening Temu. 👉 Reuters

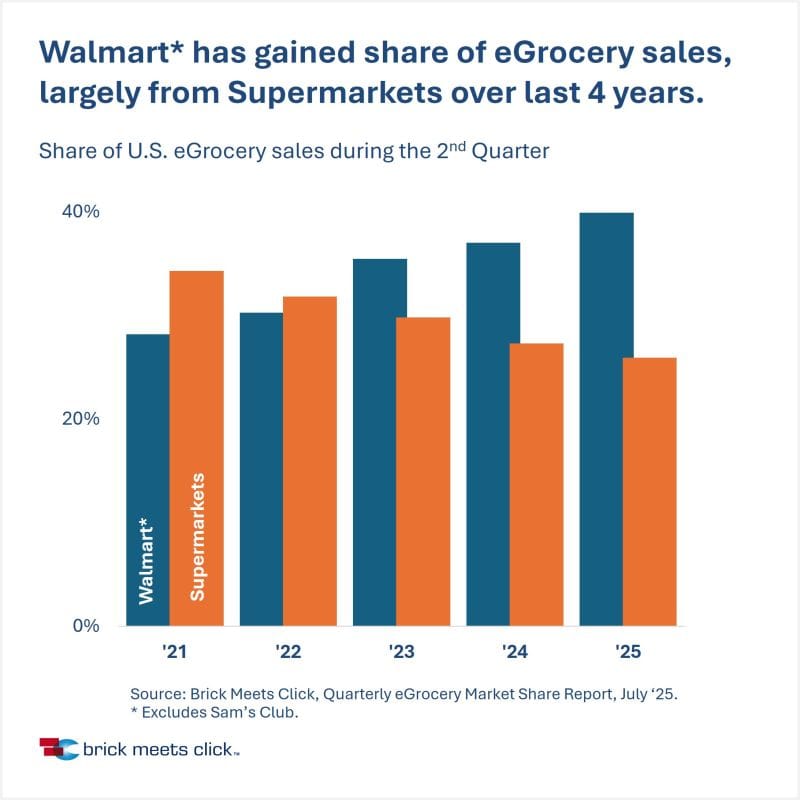

🛒 Walmart’s eGrocery Win Streak Continues 📈

Walmart has pulled ahead of U.S. supermarkets in eGrocery for four straight years, according to Brick Meets Click. Their Q2’25 data shows Walmart now owns the largest share, thanks to its infrastructure, pickup convenience, and ad network. A reminder: logistics still eat strategy for breakfast. 👉 LinkedIn

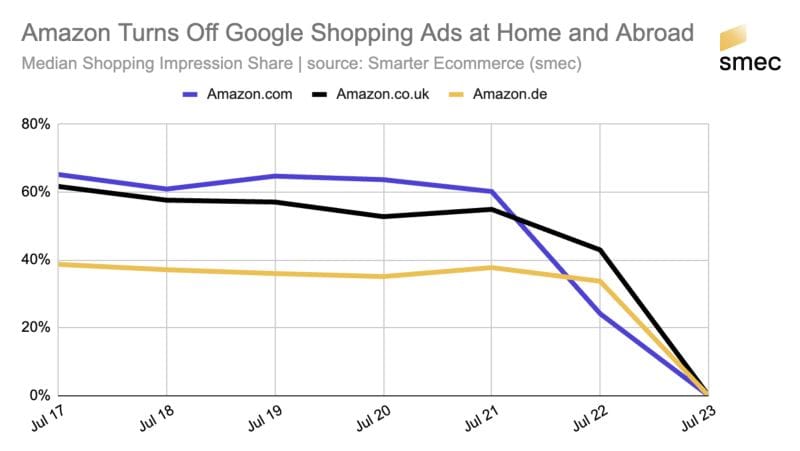

🧨 Amazon Just Ghosted Google Shopping Ads 😮

Amazon pulled the plug on Google Shopping ads across the U.S., UK, and Germany. Smec’s data shows impressions went from ~60% to 0% between July 21–23. It’s a $B question: Is Amazon done feeding the Google ad machine or just taking a pause before a new strategy? 👉 LinkedIn

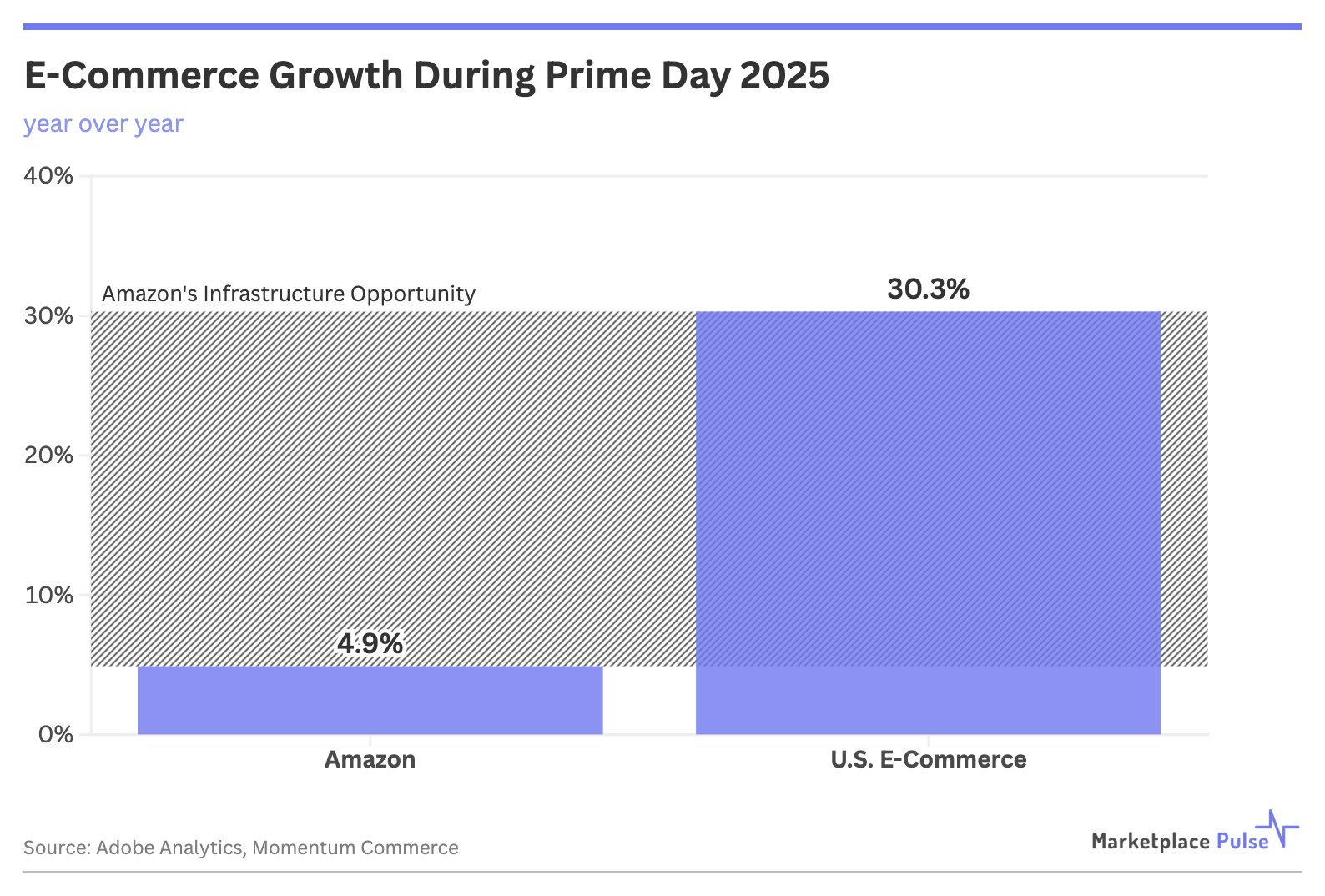

🔥 Prime Day’s Ripple Effect Across Ecom 🌊

Marketplace Pulse highlights how Prime Day is now a rising tide lifting all eCommerce boats. While U.S. eCom grew 30.3% YoY, Amazon itself only grew 4.9% during the event. Infrastructure envy? Or proof Amazon has become a utility for everyone else to ride? 👉 Marketplace Pulse

📰 Maze Briefing

📣Ecommerce Marketing

🇺🇸 Google’s Ad Revenue Hits $54B in Q2 2025. Alphabet’s Q2 results show Google’s core Ads business pulled in $54.2B, up 11%. Over 2M advertisers now use Google’s generative AI ad tools, a 50% jump year-on-year. YouTube’s sports content drove growth. CFO Anat Ashkenazi highlighted strong retail and finance verticals. 👉 Marketing Dive

🇮🇳 WhatsApp Tests Real-Time Voice Mode for Meta AI. WhatsApp is rolling out a real-time voice chat feature for Meta AI in its Android beta. Select users can now speak to the chatbot via a waveform icon, enabling faster, spoken interactions. Full public launch date is unknown. 👉 Indian Express

🇺🇸 Canva and Meta Team Up on New Video Ad Era. Canva and Meta hosted a joint webinar to help brands master Reels ads. Canva’s new creative tools and Meta integrations promise easier, faster video campaigns for marketers. The partnership targets businesses needing high-performing, platform-specific ads. 👉 Technology Magazine

🇺🇸 DoorDash Buys Symbiosys, Launches AI Ad Suite. DoorDash acquired ad-tech firm Symbiosys for $175M to expand ads beyond its app. New AI-powered tools let restaurants and brands target customers across channels. DoorDash’s ad revenue hit $1B in the last year, signaling its big move into retail media. 👉 DoorDash IR

🇺🇸 Google Drops ‘Sponsored’ Label on Related Ads. Google removed the “Sponsored” tag from its “Find Related Products & Services” block in search results. The update makes ads less obvious to users and raises transparency questions. The change is part of Google Ads UI updates, with no official statement released. 👉 PPC News Feed

🇺🇸 Google Ads Upgrades Lookalike Targeting Tools. Google Ads now lets brands use Android device IDs, YouTube audiences, and Google Analytics data for lookalike targeting. Advertisers can mix up to 10 seed lists and adjust reach settings. These upgrades help brands expand without relying only on first-party data. 👉 PPC News Feed

🌏 Google Partners Flipkart, Shopee on AI Retail Ads. Google is ramping up retail media by partnering with Flipkart and Shopee. Brands can now use AI-powered ads across Search, YouTube, and Display, uploading catalogs for Performance Max campaigns. The new Commerce Media suite offers full-funnel measurement and smart creative tools. 👉 Storyboard18

🛠️Ecommerce Software

🇺🇸 Klaviyo launches Conversational AI Agent. Klaviyo rolled out a new AI tool that lets any online store offer 24/7 product support and recommendations through webchat, pulling info from catalogs and FAQs without coding. Grant Deken says it brings big-brand shopping help to smaller retailers. 👉 ecommercenews.eu

🇺🇸 Klarna and Poshmark partner for easy resale. Klarna and Poshmark now let U.S. shoppers instantly list old Klarna purchases on Poshmark with a click, pre-filling details and images. First-timers get $10 credit, and the move targets the booming $521B secondhand fashion market. 👉 PYMNTS

🇺🇸 PayPal unveils World for global wallets. PayPal launched “PayPal World” to connect 2B+ users, integrating wallets like UPI, Tenpay, and Mercado Pago for seamless cross-border payments. CEO Alex Chriss says open APIs will make shopping and remittances easier worldwide. 👉 TechCrunch

🇫🇷 Criteo & Mirakl launch retail media integration. Criteo and Mirakl Ads joined forces to boost marketplace ad revenue, offering one workflow for self-serve ads and campaign automation to thousands of sellers. The goal: unlock more retail media dollars for every marketplace. 👉 Criteo

🇳🇬 RedCloud partners with Paystack for digital trade. RedCloud kicked off its new payments strategy by adding Paystack in Nigeria, letting businesses use bank transfers and wallets to cut checkout friction. The plan aims to close a $2T inventory gap in African trade. 👉 GlobeNewswire

🇪🇺 Vivid and Adyen launch instant pay for SMBs. Vivid and Adyen now offer instant payouts to European SMBs—no more waiting days for card sales to clear. Over half of merchants say cards boost customer spending, while 41% report a 6–15% rise in sales from digital payments. 👉 Fintech Review

🇺🇸 Cimulate debuts CommerceGPT AI engine. Cimulate launched CommerceGPT, an AI-native platform that creates synthetic transactional data to help brands build product discovery agents. CEO John calls it a new era for agent-led shopping and faster conversion. 👉 PR Newswire

🇺🇸 BigCommerce launches B2B Quick Start Accelerator. BigCommerce rolled out fixed-price B2B e-commerce launch packages ($15K, $30K, $50K) with setup, ERP integration, and training—all live in 90 days or less. It targets mid-sized firms wanting a fast digital storefront launch. 👉 GlobeNewswire

🚚Ecommerce Logistics

🇺🇸 US and Japan strike $550B trade and tariff deal. Japan will invest $550B in US energy, chip, pharma, and shipbuilding, lowering US import tariffs on Japanese autos to 15%. The deal boosts US rice and aircraft sales to Japan, but US carmakers warn it gives Japanese firms an edge. 👉 Supply Chain Dive

🇩🇪 DHL adds 2,400 Ford Pro e-vans to delivery fleet. DHL Germany is growing its electric fleet to 4,900 Ford Pro e-vans, with a total of about 35,000 electric delivery vehicles. Most new E-Transit and E-Transit Custom vans are already in use, aiming to cut carbon emissions in last-mile delivery. 👉 DHL Group

🇫🇷 InPost rides Tour de France for brand boost. InPost and Mondial Relay partnered as official Tour de France sponsors, raising brand awareness across France. The sponsorship helped push InPost’s cross-border profile, but no new 2025 announcement was found for this event. 👉 Trans.info

🌏 Cainiao expands to 10 APAC markets with 99.9% fulfilment. Cainiao, Alibaba’s logistics arm, now runs over 20 warehouses in 10 Asia-Pacific countries. The upgrade means 99.9% of orders ship same day, supporting cross-border e-commerce growth in the region. 👉 Antara News

🇩🇪 GLS adds Black Week surcharge for business clients. GLS will charge a Black Week fee for business customers from Nov 24 to Dec 5, 2025, to manage peak season delivery costs. The surcharge follows DHL’s lead, applies only to business accounts, and ends two days before DHL’s own extra fees. 👉 Onlinehaendler News

🇨🇳 CEVA Logistics opens 4,300 m² TIR hub in China. CEVA launched a new bonded TIR center at Alashankou, linking 30 cities across 15 countries on the Belt and Road. The site offers fast customs clearance, duty-free storage, and boosts cross-border e-commerce from China to Europe. 👉 Caasint

That's it for today! Before you go we’d love to know what you thought of today's maze to help us improve!

What do you think of this issue?

See you next time in the maze!

MarketMaze team