TODAY’S MAZE

Happy Monday! Google has fundamentally rebuilt its user experience, deploying the powerful Gemini 3 model to create dynamic, generative interfaces directly within Search. This massive update is strategically pushing content distribution away from traditional publishers and toward Google-owned properties like YouTube and AI Summaries.

The strategic move signals an acceleration of the decline in traditional organic web traffic. For ecommerce sellers, the urgent question is how to pivot metrics and content strategies away from rank tracking when visibility now depends entirely on feeding the model.

In today’s MarketMaze focus:

Google rolls out generative Search experience

Amazon integrates services into Business Prime

Retail tariffs settle near 15% floor

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Google fundamentally rebuilt its user experience, deploying the advanced Gemini 3 model to create dynamic, generative user interfaces in Search while simultaneously pushing content distribution away from publishers and into its own properties like YouTube and AI Summaries on Discover.

Data confirms 77% of U.S. AI Summary exits now default to inline YouTube plays, validating Vic Daniels’ characterization of Google’s destruction of the Open Web as content creators receive brand visibility without traffic.

The integration of Gemini 3 enables Generative UI, allowing the model to dynamically construct custom pages, generate interactive simulations, and power AI Mode shopping galleries that display images and live pricing, making it more fluid to get to AI.

The long tail of Google Discover, where 82.7% of positions past the 20th item contain AI Summaries, compresses publisher exposure just as Discover now accounts for two-thirds of Google referrals to news sites.

Why it matters: Ecommerce teams must pivot metrics away from rank tracking toward visibility and share-of-voice optimization within AI-constructed responses, demanding content that feeds the model rather than relying on direct click-throughs.

FROM OUR PARTNERS

Winning “Brewery of the Year” Was Just Step One

Coveting the crown’s one thing. Turning it into an empire’s another. So Westbound & Down didn’t blink after winning Brewery of the Year at the 2025 Great American Beer Festival. They began their next phase. Already Colorado’s most-awarded brewery, distribution’s grown 2,800% since 2019, including a Whole Foods retail partnership. And after this latest title, they’ll quadruple distribution by 2028. Become an early-stage investor today.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

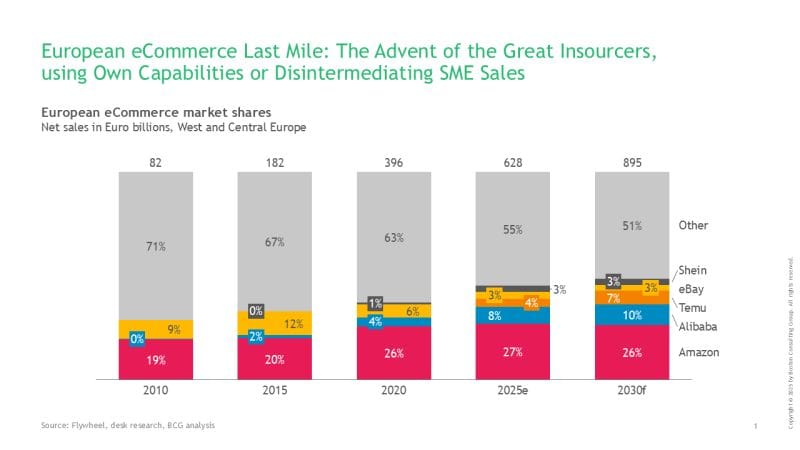

DATA TREASURE

The Maze: Last mile delivery is at an inflection point as platforms stop relying on carriers and start building their own networks. Ecommerce keeps growing at around 7% a year through 2028, but control over delivery is shifting fast. Platforms want certainty, speed, and margin, and they are willing to insource to get it.

• By 2025, large ecommerce platforms like Amazon and Walmart were already insourcing delivery in dense cities, with internal benchmarks showing up to 40% lower costs than third party rates while offering tighter delivery windows and peak season reliability.

• Platforms increasingly aim to insource 50–70% of deliveries in high density areas, keeping carriers for rural and low density routes, which removes the most profitable volume from traditional parcel networks.

• At the same time, SME shipping platforms now route millions of parcels per day, letting merchants switch carriers instantly, which weakens carrier loyalty and shifts pricing power to software layers.

Why it matters: Delivery is no longer a back office function. It is a competitive weapon that shapes cost, speed, and customer trust. In ecommerce, whoever controls the last mile controls the customer promise.

FROM OUR PARTNERS

AI in CX that grows loyalty and profitability

Efficiency in CX has often come at the cost of experience. Gladly AI breaks that trade-off. With $510M in verified savings and measurable loyalty gains, explore our Media Kit to see the awards, research, and data behind Gladly’s customer-centric approach.

MAZE STORY

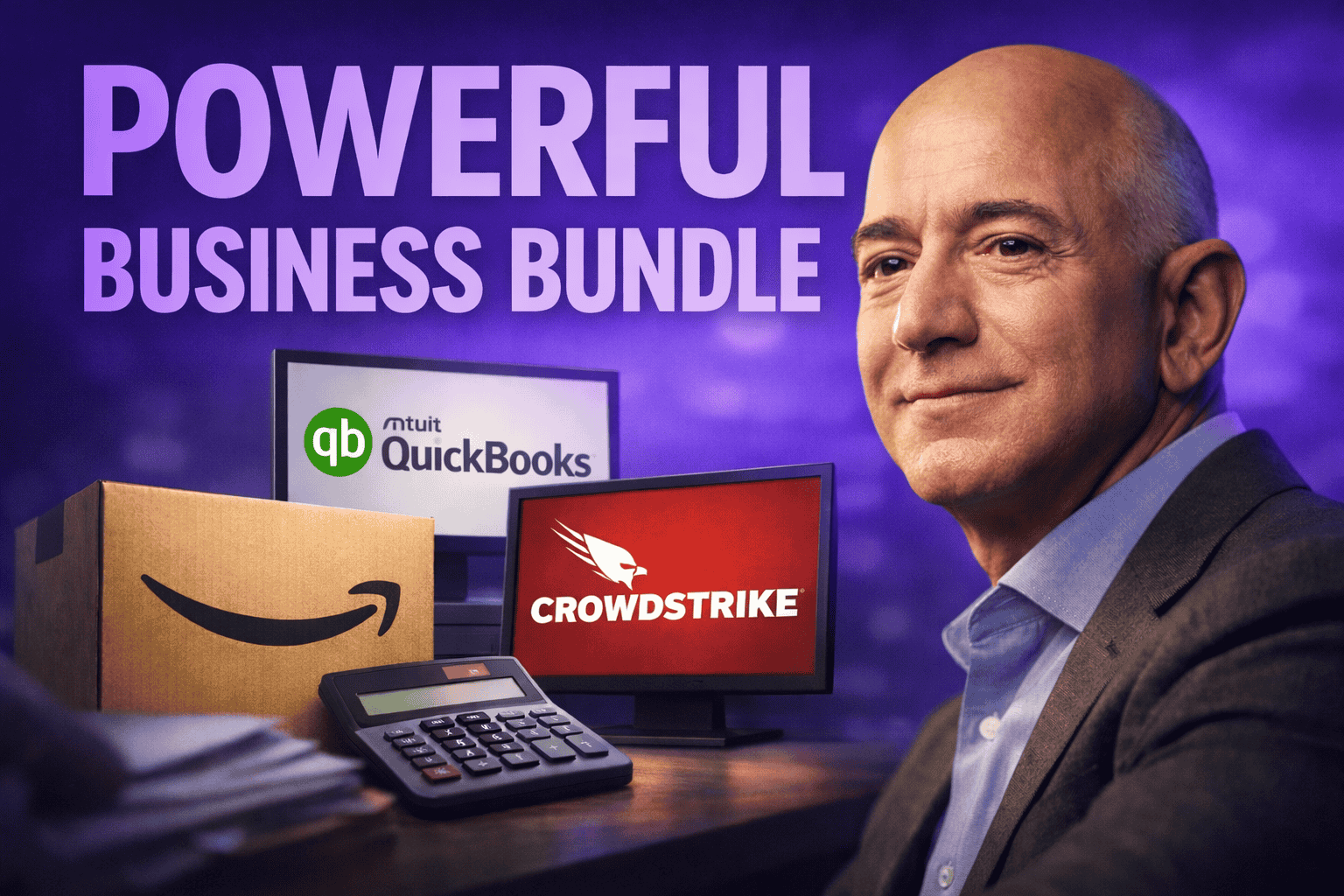

The Maze: Amazon Business deepened its engagement with small and midsize businesses by integrating crucial third-party services—financial, HR, and cybersecurity tools—into its Business Prime membership, positioning the platform as essential operational infrastructure, not just a procurement tool. This partnership strategy enables members to secure nearly $1,000 in annual savings by combining new software discounts with existing shipping advantages, according to the official Amazon Business announcement.

The bundling strategy leverages Amazon Business's scale, which already serves more than eight million organizations and generates $35 billion in annualized gross sales across 11 countries.

Qualifying members receive substantial financial management discounts, including 60% off the standard MSRP for Intuit QuickBooks Online Simple Start, with purchase reconciliation integrating systems starting in 2026.

Business Prime Essentials members and higher now receive the AI-native CrowdStrike Falcon Go cybersecurity platform at no additional cost, providing world-class prevention against ransomware and other modern cyberattacks for SMBs.

Why it matters: This strategic bundling dramatically increases customer lifetime value and raises the switching costs for organizations that rely on Amazon for procurement and now utilize integrated back-office software.

DATA TREASURE

The Maze: India looks early and late at the same time. Online retail crosses $255B by 2030 yet stays under 10% penetration. That gap is the opportunity.

Ecommerce grows at 14.2% CAGR through 2030, driven by everyday categories moving online.

Low penetration hides massive headroom across Tier 2 and Tier 3 cities. Total retail is heading toward $2T, meaning even small online share gains translate into enormous absolute growth.

Walmart owned Flipkart continues to widen its lead, setting standards for sellers, pricing, and logistics across the ecosystem.

Why it matters: India will not flip overnight like China did. Winners must operate online and offline at the same time. Patience and execution beat speed.

MAZE STORY

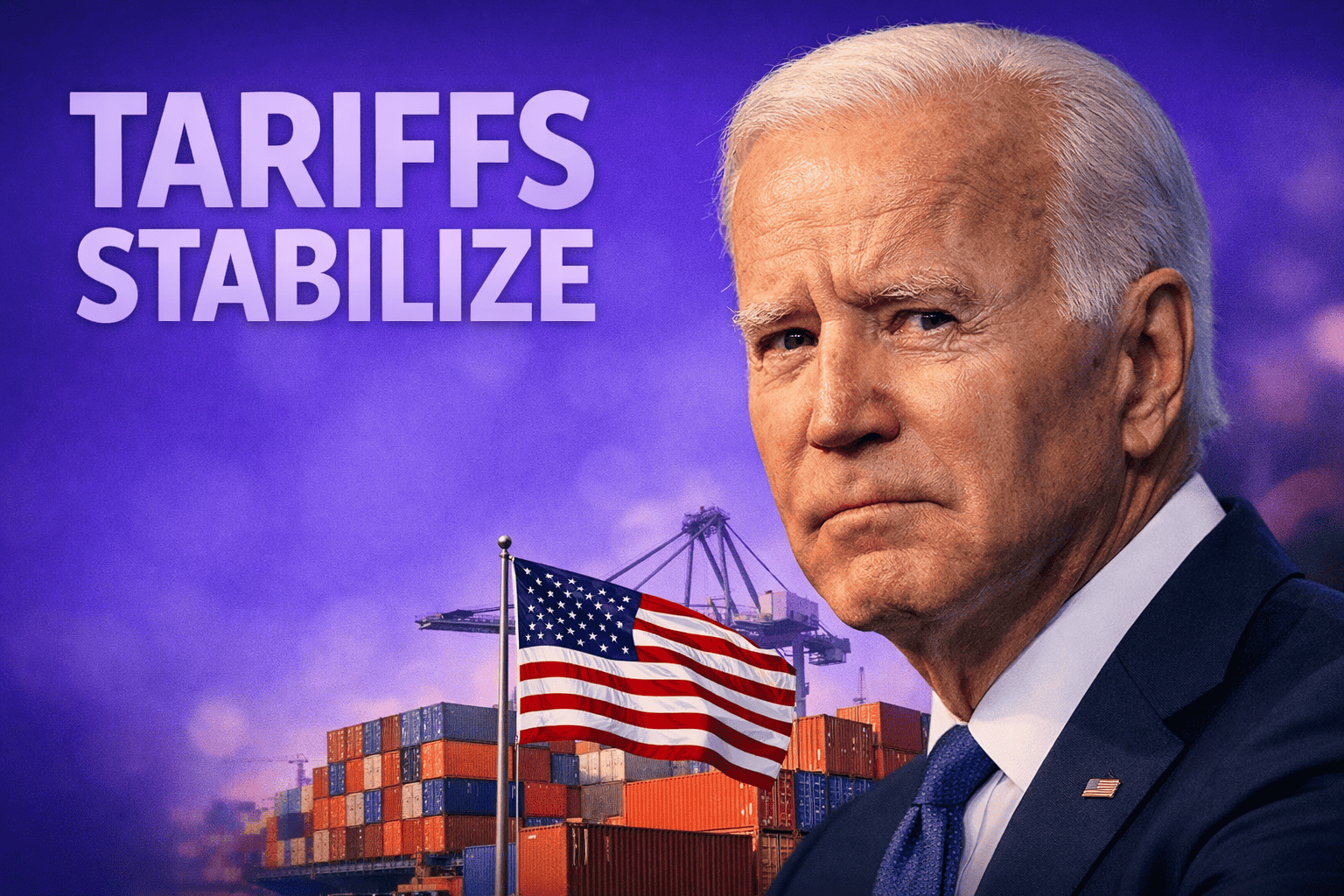

The Maze: After a chaotic year that saw the effective U.S. tariff rate spike above 17%, trade policy is reportedly de-escalating, settling around a 15% floor for most countries, which enables retailers to predict costs for the new year. This emerging predictability, affirmed by Bank of America's CEO, shifts the focus from navigating policy upheaval to managing the lasting supply chain and consumer price adjustments.

Resale platforms captured price-sensitive customers, enabling The RealReal to report 17% YoY growth in third-quarter revenue as shoppers sought luxury alternatives without added duty fees.

The end of the de minimis exemption crushed low-cost import platforms, causing Temu to slash prices on popular items by as much as 60% to recapture US market share after sales plunged.

Large import-reliant companies worked to mitigate high costs by sharing expenses with suppliers and reducing SKUs, though Under Armour expects tariffs to cut their annual profitability in half.

Why it matters: Ecommerce leaders must recognize that trade predictability around the 15% floor means the cost burden is now baked into the system, driving permanent shifts toward value-focused retail and domestic sourcing efforts. Businesses should solidify supplier diversification plans and budget for consumers who have lost an estimated $1,257 in annual purchasing power due to the tariff pass-throughs.

BRIEFING

🏬 Everything else in Ecommerce

🤖 Google Search has integrated the Gemini 3 frontier model, enabling dynamic interface generation and real-time simulations that fundamentally change information presentation for millions of users.

📦 New Fulfillment Models are lowering US market entry barriers for fashion brands through 'pay-as-you-sell' logistics, charging only for utilized capacity and aiding cross-border expansion.

🏨 Major Hotel Chains are swapping Online Travel Agents (OTAs) for AI agents to drive direct bookings and cut high commission fees, setting a precedent for marketplace disruption.

🏋️♀️ CPG and Snack Industries are seeing soaring demand for protein innovation driven by women seeking muscle gains, transforming niche functional foods into breakout retail hits.

🍫 Chocolatiers are innovating production and recipes—including using the whole cacao fruit—to maintain quality and margins while facing historically high cocoa prices.

📺 YouTube’s Home Feed has redirected 80% of available slots toward Shorts content, drastically reducing long-form video recommendations and forcing brands to immediately adapt their marketing strategies.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team