TODAY’S MAZE

Happy Thursday! France is hitting ultra-fast fashion with a plan for heavy import taxes. The goal is to reduce environmental waste and support domestic manufacturing.

The initiative also includes eco-vouchers to reward sustainable choices. Can these regulatory hurdles actually change consumer behavior across the EU?

In today’s MarketMaze focus:

France taxes fast fashion

Bauhaus launches DIY marketplace

Allegro Exits Mall South

Optimizing store credit refunds

Global talent shifts West

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: Clément Beaune, France's High Commissioner for Strategy and Planning, recently unveiled a strategic study to combat the massive influx of low-cost apparel through heavy import taxes. This initiative aims to revitalize French manufacturing while scaling textile recycling to protect the economy from further deindustrialization.

The proposed strategic report highlights that consumers wear ultra-fast fashion jeans seven times less than durable alternatives, which significantly increases the actual hidden expense of disposable fashion.

To support immediate purchasing power, the government suggests an eco-voucher system that enables providing tax-free income for buying sustainable clothing produced throughout the European Union.

France and eight other European nations recently petitioned the European Commission to address the systemic risks and environmental challenges created by the rapid growth of global e-commerce platforms.

Why it matters: This regulatory push marks a significant transition from price-driven retail to a value-based economy focused on garment longevity and ethical craftsmanship. Marketplace leaders should expect increased scrutiny on environmental impact as Europe attempts to end the era of disposable consumption and revitalize its own brands.

FROM OUR PARTNERS

ECDB shows what actually happens in online retail. Real transactions. Real rankings. Real market shares. No surveys. No vague estimates.

Know who’s winning and why.

Track online sales performance across retailers, marketplaces, and categories worldwide.Compare like-for-like across markets.

Standardized data makes cross-country and cross-category analysis finally possible.Turn data into decisions.

Used for market entry, competitive strategy, investor analysis, and growth planning.Enterprise-ready by design.

APIs, exports, and robust data coverage built for serious teams.

MAZE STORY

The Maze: German DIY retailer BAUHAUS is evolving its business model by launching its own online marketplace. The company teamed up with a technology partner to build this platform and modernize its digital footprint to better serve its regional customer base.

Partnering with commerce technology provider Mirakl enables scaling the new digital platform for the leading German DIY retailer while accelerating the company’s ongoing digital transformation efforts.

The launch of this specific online marketplace allows expanding the retailer's presence within the home improvement sector to reach more customers who are looking for diverse construction supplies online.

This strategic collaboration focuses on establishing a new digital marketplace that allows offering a wider variety of home improvement products to customers while strengthening the brand’s overall digital presence.

Why it matters: Legacy retailers are adopting marketplace models to defend their territory and stay competitive. This strategy helps brands like BAUHAUS modernize operations and meet the digital demands of customers who increasingly move their spending to specialized online platforms.

FROM OUR PARTNERS

Modernize your marketing with AdQuick

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

MAZE STORY

The Maze: Allegro is selling its Mall South operations in Slovenia and Croatia, along with selected technology and support teams in Czechia, to Mutares. The move is part of a broader effort to simplify the group and narrow its focus after an underwhelming international expansion.

The transaction will hit Allegro’s net result by PLN 235 million. About PLN 105 million comes from a non-cash write-down, while PLN 130 million is a cash impact, suggesting Allegro is effectively paying to exit and stabilize the assets before the handover.

This sale closes the chapter on the Mall Group acquisition from 2022, which never reached the scale needed to justify continued investment. Allegro has already paused further international expansion and is refocusing on profitability in its core markets.

Market reaction is likely mixed. Shedding a loss-making business helps margins over time, but the size of the exit cost highlights how expensive it can be to unwind cross-border marketplace bets.

Why it matters: Allegro is prioritizing discipline over ambition. The decision reinforces a hard lesson in marketplaces: expanding across borders without strong local scale can destroy value faster than it creates it, and fixing that mistake often comes with a painful upfront bill.

DATA TREASURE

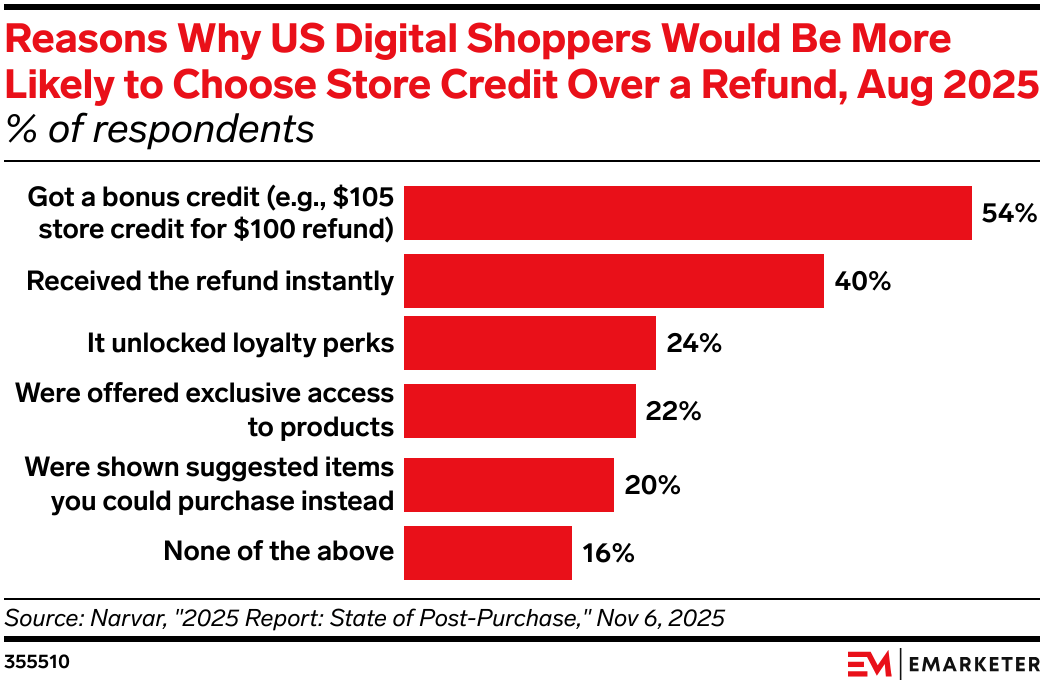

The Maze: Returns are no longer a cost, they are a lever. Most shoppers will trade cash refunds for store credit if the deal feels fair and fast. Small incentives keep money inside the ecosystem.

In Aug 2025, 54% of US shoppers preferred store credit when offered a small bonus like $105 for $100.

40% chose store credit for instant access, valuing speed over cash.

Loyalty perks and exclusive access mattered more than brand affection.

Why it matters: Post-purchase is now a profit battleground. Smart credit offers protect margin, boost repeat purchases, and reduce logistics pain. Badly designed ones train abuse.

DATA TREASURE

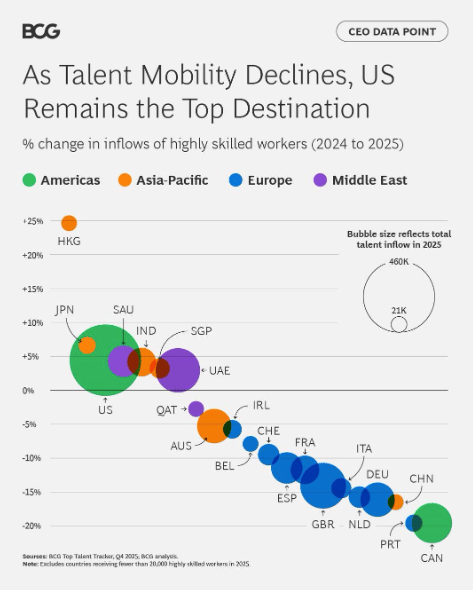

The Maze: Global talent is moving less, but moving with intent. The US remains the top destination, while the Middle East is rising fast for technical roles. Policy and opportunity now outweigh lifestyle.

After 2020, mobility slowed for the first time, yet the US kept the largest share of high-skill inflows.

The UAE climbed rapidly for STEM and AI talent, passing Canada and the UK.

Tighter migration rules in Europe reduced inflows despite strong consumer markets.

Why it matters: Talent concentration shapes innovation. Where engineers and operators go, platforms follow. E-commerce ecosystems will mirror these talent flows over the next decade.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🌍 AI Assistants surpassed Google as the starting point for product discovery for 37% of consumers, as search frustrations drive shoppers toward conversational tools.

🇺🇸 Google deployed ALF, a new multimodal AI foundation model, to enhance its ability to identify and combat fraudulent advertisers in real-time.

🇺🇸 Anthropic released Claude Code, an AI agent gaining rapid adoption among retailers for its ability to automate complex debugging and commerce operational tasks.

🇨🇦 FreshBooks integrated AI-automated bookkeeping via a partnership with Kick, streamlining financial management for independent sellers and small businesses.

🇺🇸 Swap raised $100 million in Series C funding to accelerate the expansion of its logistics and operations infrastructure across the United States.

🇮🇩 Indonesia imposed three-year safeguard duties on cotton woven fabrics to protect its domestic textile sector from a surge in low-cost imports.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team