TODAY’S MAZE

Happy Tuesday! FedEx is securing a physical foothold in Europe, leading a €7.8 billion consortium to take locker giant InPost private. It’s a strategic shift from simply renting capacity to owning the critical infrastructure of last-mile delivery.

With a major stake, FedEx gains immediate density to rival local networks, prioritizing resilience over raw volume. But can owning the hardware finally tip the scales in the global race for last-mile profitability?

In today’s MarketMaze focus:

FedEx buys InPost network

Uber acquires Getir unit

Eddie Bauer files bankruptcy

Amazon hits $800B GMV

Retailers form AI alliances

+Handpicked recent news you need to know

LET’S ENTER THE MAZE!

- Artur Stańczuk, MarketMaze Founder

MAZE STORY

The Maze: A consortium led by FedEx and Advent International is acquiring European parcel locker giant InPost for €7.8 billion ($9.2 billion), securing a dominant foothold in out-of-home delivery.

FedEx and Advent will each control a 37% stake, while founder Rafał Brzoska retains 16%, privatizing the firm below its 2021 IPO valuation.

CEO Raj Subramaniam aligns the move with FedEx's Network 2.0 overhaul, prioritizing data-driven resilience and B2C density over raw volume alone.

The agreement grants FedEx immediate access to InPost’s last-mile infrastructure, positioning it to better compete in the race to win the last mile.

Why it matters: Owning the locker network dramatically lowers last-mile costs while increasing density. FedEx shifts from renting access to controlling the critical infrastructure defining European ecommerce convenience.

After FedEx moved from renting parcel locker access to owning InPost, how should large logistics players approach last-mile infrastructure over the next five years?

- 🏗️ Full ownership (buy and control locker networks directly)

- 🤝 Long-term partnerships (exclusive contracts without acquisition)

- 🧩 Hybrid model (own core assets, partner for coverage gaps)

- 📉 Asset-light approach (rent capacity and focus on software and routing)

- 🏪 Marketplace model (open networks shared across carriers and retailers)

☝️ Vote to see results!

FROM OUR PARTNERS

Tech moves fast, but you're still playing catch-up?

That's exactly why 100K+ engineers working at Google, Meta, and Apple read The Code twice a week.

Here's what you get:

Curated tech news that shapes your career - Filtered from thousands of sources so you know what's coming 6 months early.

Practical resources you can use immediately - Real tutorials and tools that solve actual engineering problems.

Research papers and insights decoded - We break down complex tech so you understand what matters.

All delivered twice a week in just 2 short emails.

MAZE STORY

The Maze: Uber doubles down on the Turkish market by acquiring Getir’s food delivery business and taking a strategic stake in its grocery arm.

The ride-hailing giant pays $335 million upfront for the delivery unit and invests another $100 million for a 15% slice of Getir’s grocery and water business, according to SEC filings.

Operations will merge with Trendyol Go, a service Uber bought for $700 million last May, effectively cornering a market where Getir generated over $1 billion in 2025 bookings.

This transaction highlights the precipitous fall of a former unicorn, as documents filed reveal the company recently valued its group assets at $374 million, a fraction of its pandemic-era $12 billion peak.

Why it matters: Uber capitalizes on the quick-commerce crash to secure regional dominance for pennies on the dollar. This move accelerates consolidation, leaving the sector entirely in the hands of well-capitalized tech giants rather than pure-play delivery startups.

FROM OUR PARTNERS

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 2,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

MAZE STORY

The Maze: The operator of Eddie Bauer’s North American stores filed for bankruptcy today, initiating liquidation sales while simultaneously seeking a buyer to save the physical retail fleet.

Listing liabilities up to $10 billion, the retailer pursues a dual-path strategy that triggers immediate store closing events while actively soliciting a going-concern bid to preserve operations.

Key divisions like e-commerce and wholesale transitioned to licensee Outdoor 5 last month, ensuring digital operations continue uninterrupted separate from the physical store turmoil.

Management attributes the collapse to structural headwinds intensified by recent inflation, utilizing Chapter 11 to maximize stakeholder value without dragging down the parent company.

Why it matters: De-coupling high-margin digital assets from distressed brick-and-mortar operations allows the brand to survive even if the physical stores liquidate, setting a pragmatic precedent for heritage retail restructuring.

DATA TREASURE

The Maze: Amazon is no longer growing by expansion, but by efficiency. GMV passed $800B in 2025, with marketplace sellers driving most volume and profit pools shifting to fees and ads.

Total GMV reached about $830B in 2025, nearly 3x 2018 levels, confirming Amazon’s move into steady, mature growth.

Third party sellers generated roughly 69% of GMV, proving the marketplace is the core engine, not Amazon’s own retail.

The mix shift toward third party has slowed, signaling saturation and a new focus on monetization per transaction.

Why it matters: Growth now comes from take rate, not traffic. Sellers compete less on presence and more on efficiency, ads, and logistics discipline.

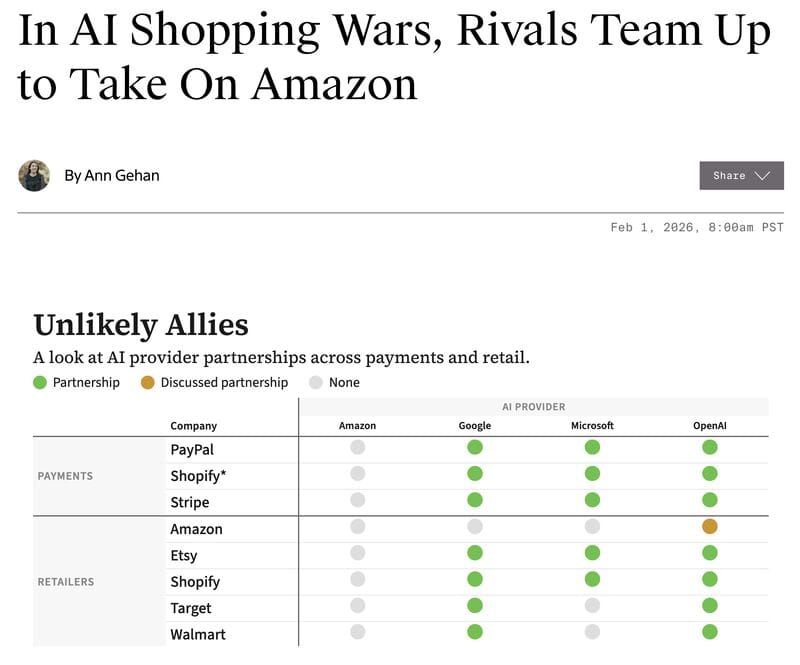

DATA TREASURE

The Maze: Everyone wants AI shopping, but nobody wants Amazon in control. Payments firms and retailers are forming unusual alliances to avoid losing the customer interface to one platform.

Retailers and payment players are partnering across multiple AI stacks at once, hedging against a single dominant gatekeeper.

Control of product data and checkout flows is the real prize, not the chatbot itself.

Liability, trust, and economics remain unresolved, slowing full scale rollouts despite heavy experimentation.

Why it matters: The next storefront may be an agent. Whoever controls discovery and checkout will control margins, data, and brand visibility.

BRIEFING

🏬 Everything else in Ecommerce & Big Tech

🇩🇪 OTTO opened up its marketplace to European partners for the first time, removing the requirement for a German VAT ID to compete more aggressively with Amazon.

🌍 TikTok Shop buyers expect response times four times faster than Amazon customers, highlighting the intense 'now' culture of social commerce according to new data.

🇺🇸 Kroger appointed Greg Foran, a veteran Walmart executive, as its new CEO, signalling a potential operational overhaul to better compete with retail giants.

🇺🇸 Target cut approximately 500 corporate roles to reinvest in frontline store staffing, aiming to resolve inventory issues and checkout delays hurting customer experience.

🇬🇧 Tesco acquired five former Amazon Fresh locations in London, repurposing the tech giant's retreated physical footprint to expand its own convenience network.

🇺🇸 OpenAI began displaying ads to free users, shifting from a pure subscription model to an ad-supported revenue stream that directly challenges Google's search dominance.

SHARE THE MAZE

Your network thinks you’re as smart as the content you share. Share smarter stuff and help us grow. Win–win. Here’s what you get when friends join the Maze:

Here is your unique referral link to share with friends:

and link to the hub to check your progress.

THAT’S IT FOR TODAY!

You’re the reason our team spends hundreds of hours every week researching and writing this email. Please let us know what you thought of today’s email to help us create better emails for you.

What do you think of this issue?

If you enjoyed it please share it with a friend, or share it on LinkedIn and tag me (Artur Stańczuk), I’d love to engage and amplify!

If this was forwarded by a friend you can subscribe below for $0 👇

See you next time in the maze!

MarketMaze team